Aptos is becoming one of the best places in DeFi for yield farmers.

• @hyperion_xyz is Aptos' primary CLAMM currently offering ~240% APR on its APT–USDC pool and ~28% APR on its USDC–USDT stablecoin pool

• @ThalaLabs has an APT–USDT pool that can reach up to 49% APR for veTHL holders

• @EchelonMarket is paying ~16% APR on sUSDe with extra yield from staking Thala LP tokens

• @AmnisFinance offers ~7% APR on stAPT, allowing stakers to keep APT liquid for DeFi use

• @kofi_finance delivers ~9% APR on stkAPT, boosted by MEV revenue sharing

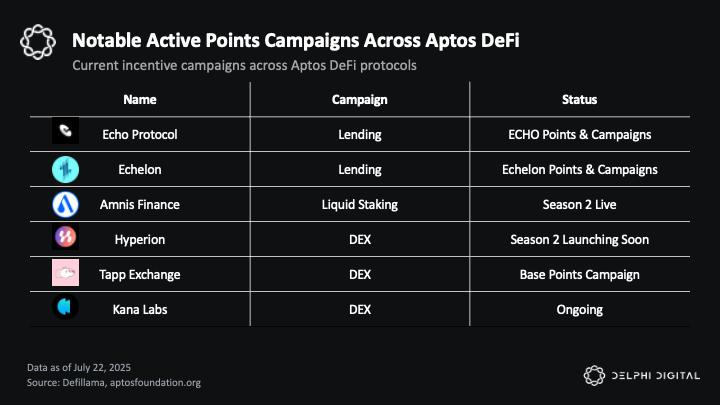

Points Programs & More

Many Aptos protocols are also running active points campaigns that reward usage, adding another layer of upside for yield farmers that could translate into future token allocations or boosted rewards.

On top of this, many major protocols on Aptos are still tokenless and could reward early users if they decide to launch a token.

While yields are attractive, these strategies do carry risks such as liquidation if the market moves against you, compounded smart contract exposure from using multiple protocols, and APRs that can drop quickly if volume or liquidity dries up.

For yield farmers, Aptos is one of the most rewarding places to be right now.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。