By Francisco Rodrigues (All times ET unless indicated otherwise)

The cryptocurrency market is still enjoying a rally on the back of Tuesday's higher-than-expected core inflation reading that boosted chances of a Federal Reserve interest-rate cut next month. Some traders are even calling for a 50 bps cut.

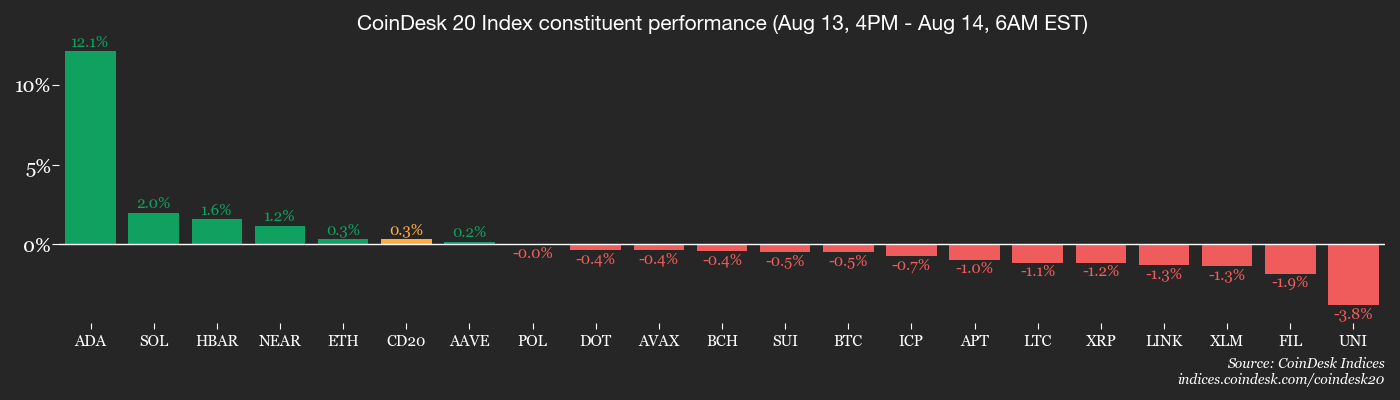

The euphoria has lifted the CoinDesk 20 (CD20) index of largest cryptocurrencies more than 1% in the last 24 hours, and sent bitcoin (BTC) to a record high over $124,000 and ether (ETH) 2.2% higher to $4,750, just below its record.

Headline inflation data for July came in cooler than expected, but rising core inflation fed into rate-cut expectations. On Polymarket, traders now weigh an 80% chance of a 25 basis-point cut in September, while chances of a 50 bps cut rose to 8.3%. The CME FedWatch tool shows a 97.8% chance of a 25 bps cut, and a 2.2% chance of a 50 bps cut.

In the geopolitical front, President Donald Trump is expected to meet Russian President Vladimir Putin this Friday in Alaska. The meeting comes as the U.S. president ramps up pressure for a ceasefire in Ukraine. A follow-up meeting with Ukraine’s President Volodymyr Zelenskyy may also be on the cards. Deescalation measures, including a potential air truce, are currently on the table.

Institutional demand has made this the best week for spot ether ETFs net inflows, with $2.27 billion coming in according to SoSoValue data. Meanwhile, corporate accumulation led by BitMine has seen ETH treasures accumulate over 3.5 million ETH.

“Bitmine’s capital raise to build its ETH treasury has drawn attention, with the market noting that any allocation to ETH has an outsized impact compared with BTC, given ETH’s smaller market cap and marginally thinner liquidity,” analysts at QCP Capital wrote. ”We expect the current momentum in ETH to persist as long as fresh flows continue into ETH DATs.”

Bitcoin treasuries, including ETFs, have grown their holdings by around 3.36% in the past 30 days to 3.64 million BTC. That’s more than 17% of the cryptocurrency’s total supply.

Put together, the cryptocurrency market is benefiting from four key tailwinds. These are the anticipated rate cuts, a friendlier regulatory climate, easing geopolitical tensions and rising institutional and corporate interest.

Looking ahead, investors will be closely monitoring today’s Producer Price Index (PPI) data for further clues on what the Fed might do in September. Stay alert!

What to Watch

- Crypto

- Aug. 15: Record date for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution requirements.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Aug. 20: Qubic (QUBIC), the fastest blockchain ever recorded, will undergo its first yearly halving event as part of a controlled emission model. Although gross emissions remain fixed at one trillion QUBIC tokens per week, the adaptive burn rate will increase substantially — burning some 28.75 trillion tokens and reducing net effective emissions to about 21.25 trillion tokens.

- Macro

- Aug. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July producer price inflation data.

- Core PPI MoM Est. 0.2% vs. Prev. 0.0%

- Core PPI YoY Est. 2.9% vs. Prev. 2.6%

- PPI MoM Est. 0.2% vs. Prev. 0%

- PPI YoY Est. 2.5% vs. Prev. 2.3%

- Aug. 14, 7 p.m.: Peru's central bank announces its monetary policy decision.

- Reference Interest Rate Est. 4.5% vs. Prev. 4.5%

- Aug. 14, 10 p.m.: El Salvador's Statistics and Census Office, which is part of the Central Reserve Bank of El Salvador, releases July consumer price inflation data.

- Inflation Rate MoM Prev. 0.32%

- Inflation Rate YoY Prev. -0.17%

- Aug. 15: U.S. President Donald Trump and Russian President Vladimir Putin will meet in Alaska to discuss potential peace terms for the war in Ukraine.

- Aug. 15, 12 p.m.: Colombia's National Administrative Department of Statistics (DANE) releases Q2 GDP growth data.

- GDP Growth Rate QoQ Prev. 0.8%

- GDP Growth Rate YoY Est. 2.6% vs. Prev. 2.7%

- Aug. 15, 4 p.m.: Peru’s National Institute of Statistics and Informatics releases June GDP YoY growth data.

- GDP Growth Rate YoY Est. 4.7 vs. Prev. 2.67%

- Aug. 18, 6 p.m.: The Central Reserve Bank of El Salvador releases July producer price inflation data.

- PPI YoY Prev. 1.29%

- Aug. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July producer price inflation data.

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- SoSoValue DAO is voting to allocate 5,000,000 SOSO tokens for a Researcher Ecosystem Fund, aimed at boosting top-tier crypto research through competitions and incentives, improving content quality, transparency and SOSO’s utility. Voting ends Aug. 18.

- Uniswap DAO is voting to allocate $540K in UNI over six months to as many as 15 top delegates, with up to $6K/month based on voting activity, community engagement, proposal authorship and holding 1,000+ UNI. Votings ends Aug. 18

- Aavegotchi DAO is voting on a Bitcoin Ben’s Crypto Club Las Vegas sponsorship: a $1,000/month corporate membership (logo on sponsor wall, team access, newsletter feature, one branded meetup/month) or a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Aug. 14, 10 a.m.: Lido to host a tokenholder update call.

- Aug. 14, 10 a.m.: Stacks to host a townhall meeting.

- Unlocks

- Aug. 15: Avalanche (AVAX) to unlock 0.33% of its circulating supply worth $41.84 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating supply worth $18.12 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating supply worth $18.94 million.

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating supply worth $49.95 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating supply worth $91.6 million.

- Aug. 20: LayerZero (ZRO) to unlock 8.53% of its circulating supply worth $57.59 million.

- Aug. 20: Kaito (KAITO) to unlock 8.82% of its circulating supply worth $27.55 million.

- Token Launches

- Aug. 14: Useless Coin (Useless) to be listed on Binance.US.

- Aug. 14: Cherry AI (AIBOT) to be listed on Binance Alpha, MEXC, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Day 3 of 3: AIBB 2025 (Istanbul)

- Day 3 of 7: Ethereum NYC (New York)

- Day 1 of 2: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 15: Bitcoin Educators Unconference (Vancouver)

- Aug. 17-21: Crypto 2025 (Santa Barbara, California)

- Aug. 18-21: Wyoming Blockchain Symposium 2025 (Jackson Hole)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

Token Talk

By Shaurya Malwa

- SHIB’s burn rate exploded 48,244% in the past 24 hours, with nearly 88 million tokens permanently removed from supply.

- “Burning” means sending coins to a wallet no one can access, taking them out of circulation forever.

- The biggest single burn was 69,420 tokens in one hour, part of a series of transactions tracked by Shibburn, a community-run monitoring site.

- Prices are holding firm above the $0.000010 support level, which traders see as a key floor for keeping bullish momentum intact.

- If buying pressure continues, analysts say SHIB could attempt a move toward $0.000020, double the current price.

- Activity on Shibarium, SHIB’s layer-2 blockchain, remains robust, clocking 1.51 billion total transactions and about 4.69 million daily.

- Burn-driven supply cuts can, in theory, make each remaining token more valuable, but sustained price gains depend on demand matching or outpacing the shrinking supply.

Derivatives Positioning

- ADA and SOL have seen the largest increases in futures open interest among the top 10 tokens in the past 24 hours.

- Even though BTC rose to record highs above $124K, positioning in futures remains relatively light. Open interest is currently at 687K BTC, well below the July peak of 742K BTC.

- Meanwhile, on the CME, the three-month annualized premium in BTC futures remains below 10%.

- The 24-hour open interest-adjusted cumulative volume delta for most tokens except TRX is negative, implying seller dominance. This raises a question over the sustainability of price gains.

- The markets for FART and FLR appear overheated, with annualized perpetual funding rates exceeding 100%, a sign of overcrowding in bullish long bets. Such a scenario can lead to a long squeeze, resulting in a sharp price slide.

- On Deribit, August and September expiry BTC options are exhibiting only a slight call bias. That's likely due to persistent OTM call selling by long-term holders and indicates that the rally has yet to trigger a speculative frenzy. Meanwhile, call bias is more pronounced in ether options across all time frames.

- Flows over the OTC network Paradigm featured demand for BTC calls and short call spreads in ETH December expiry options.

Market Movements

- BTC is down 0.98% from 4 p.m. ET Wednesday at $121,693.52 (24hrs: +0.88%)

- ETH is up 0.92% at $4,760.09 (24hrs: +1.2%)

- CoinDesk 20 is up 0.53% at 4,417.7 (24hrs: +0.86%)

- Ether CESR Composite Staking Rate is up 7 bps at 3.04%

- BTC funding rate is at 0.0127% (13.9065% annualized) on Binance

- DXY is unchanged at 97.84

- Gold futures are down 0.11% at $3,404.50

- Silver futures are down 0.55% at $38.39

- Nikkei 225 closed down 1.45% at 42,649.26

- Hang Seng closed down 0.37% at 25,519.32

- FTSE is unchanged at 9,165.62

- Euro Stoxx 50 is up 0.28% at 5,403.07

- DJIA closed on Wednesday up 1.04% at 44,922.27

- S&P 500 closed up 0.32% at 6,466.58

- Nasdaq Composite closed up 0.14% at 21,713.14

- S&P/TSX Composite closed up 0.26% at 27,993.43

- S&P 40 Latin America closed down 0.45% at 2,684.56

- U.S. 10-Year Treasury rate is down 3.1 bps at 4.209%

- E-mini S&P 500 futures are unchanged at 6,488.25

- E-mini Nasdaq-100 futures are unchanged at 23,932.75

- E-mini Dow Jones Industrial Average Index are unchanged at 45,057.00

Bitcoin Stats

- BTC Dominance: 59.32 (-0.57%)

- Ether to bitcoin ratio: 0.03906 (1.4%)

- Hashrate (seven-day moving average): 906 EH/s

- Hashprice (spot): $59.75

- Total Fees: 4.39 BTC / $532,696

- CME Futures Open Interest: 142,140 BTC

- BTC priced in gold: 36.3 oz

- BTC vs gold market cap: 10.26%

Technical Analysis

- The cardano-bitcoin (ADA/BTC) ratio has risen 11% today, confirming an inverse head-and-shoulders breakout on the daily chart.

- The pattern indicates a bullish trend change, indicating ADA outperformance ahead.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $389.90 (-1.14%), -0.58% at $387.65 in pre-market

- Coinbase Global (COIN): closed at $327.01 (+1.36%), +0.71% at $329.32

- Circle (CRCL): closed at $153.16 (-6.16%), -0.48% at $152.43

- Galaxy Digital (GLXY): closed at $28.34 (+1.58%), +1.09% at $28.65

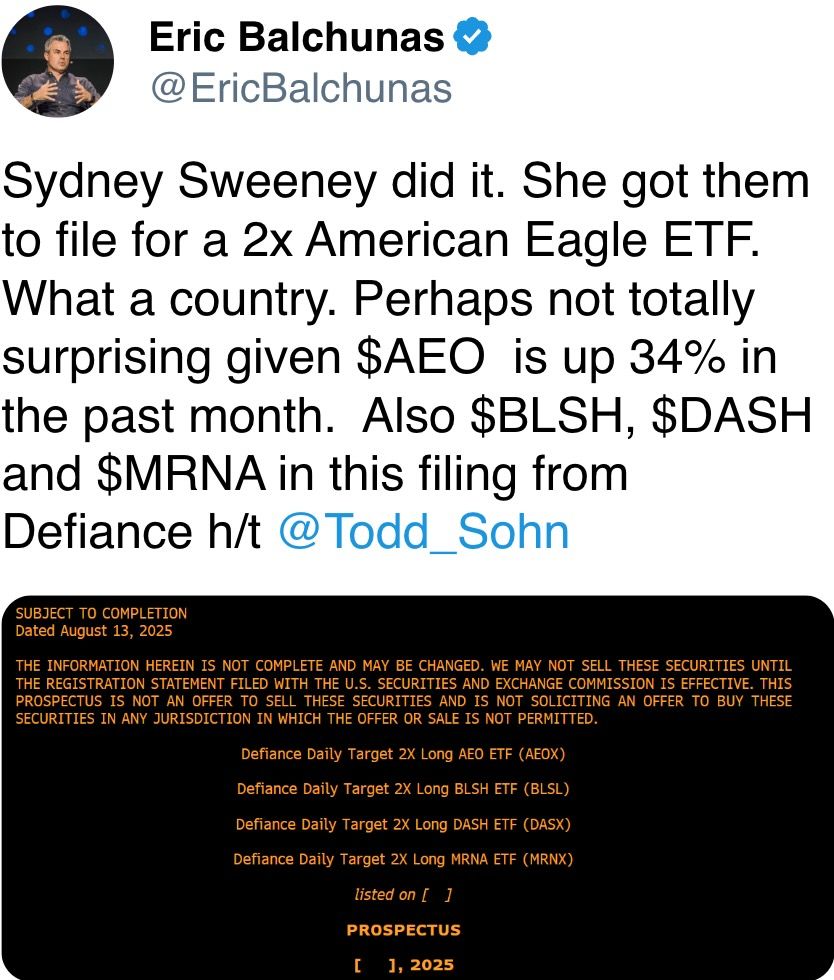

- Bullish (BLSH): closed at $68.00 (+83.8%), +15.7% at $78.70

- MARA Holdings (MARA): closed at $15.86 (+0.89%), -0.63% at $15.76

- Riot Platforms (RIOT): closed at $11.59 (+1.31%), -0.52% at $11.53

- Core Scientific (CORZ): closed at $13.85 (-8.34%)

- CleanSpark (CLSK): closed at $9.97 (+0.5%), -0.5% at $9.92

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.50 (+0.35%)

- Semler Scientific (SMLR): closed at $35.57 (+2.98%), -0.34% at $35.45

- Exodus Movement (EXOD): closed at $27.34 (-1.87%), +3.04% at $28.17

- SharpLink Gaming (SBET): closed at $23.52 (+4.67%), -0.13% at $23.49

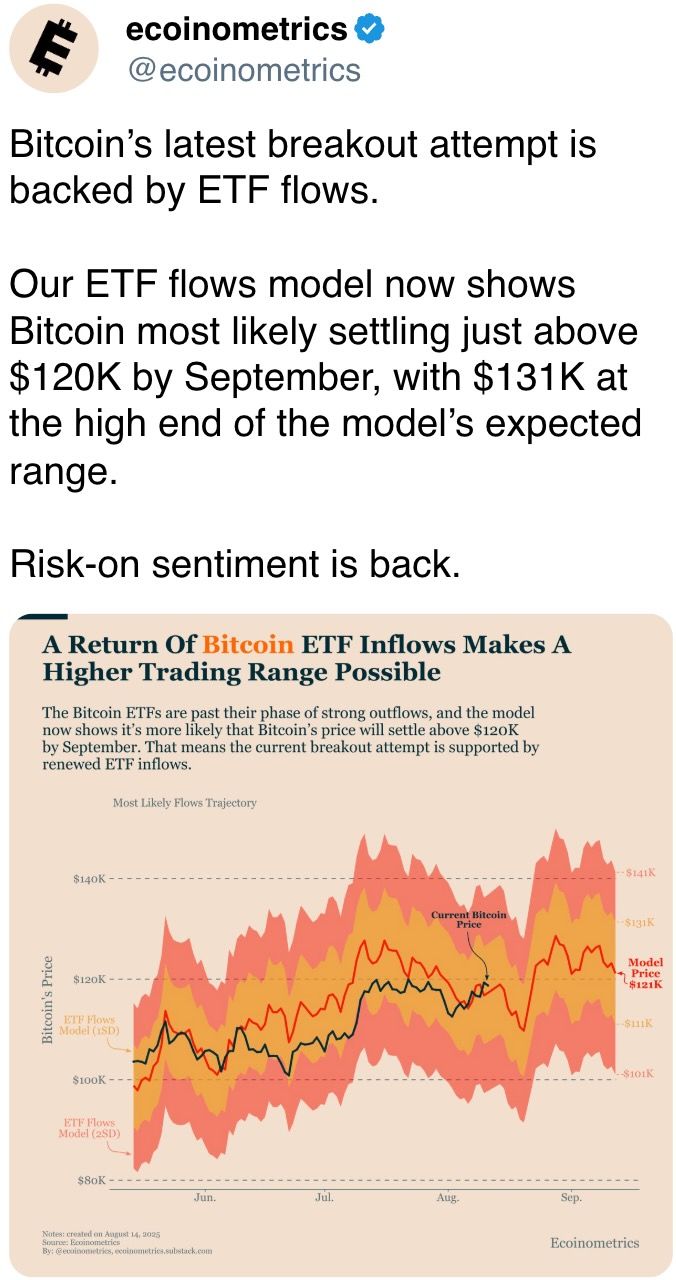

ETF Flows

Spot BTC ETFs

- Daily net flows: $86.9 million

- Cumulative net flows: $54.74 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily net flows: $729.1 million

- Cumulative net flows: $12.11 billion

- Total ETH holdings ~6.12 million

Source: Farside Investors

Chart of the Day

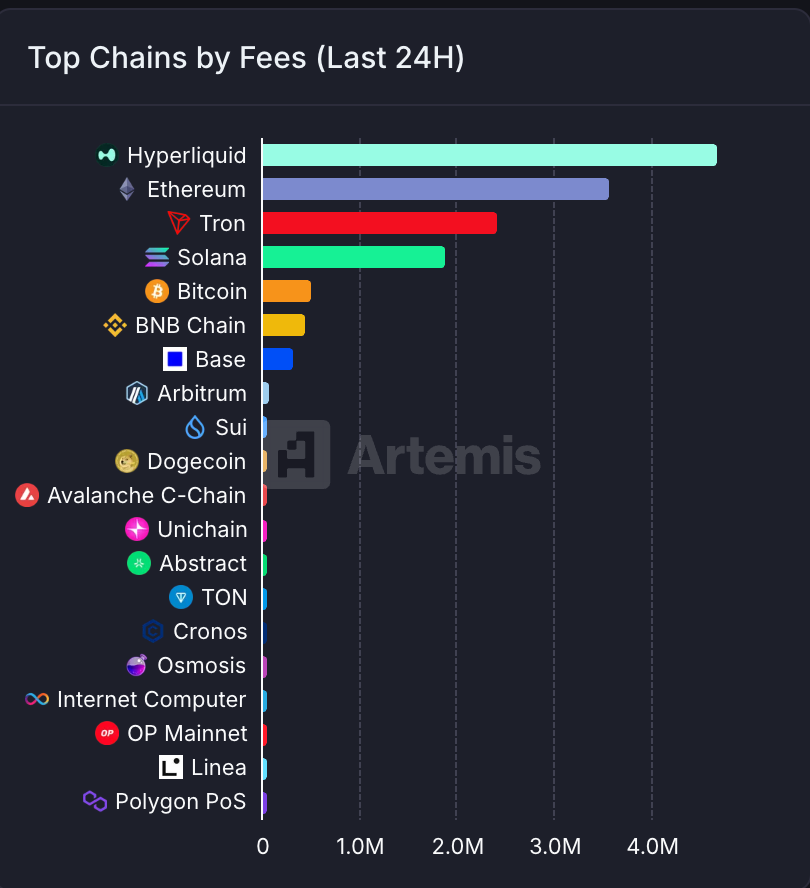

- Hyperliquid, the layer 1 blockchain and decentralized exchange (DEX) focused on perpetual futures trading, has earned more than $4 million in fees in the past 24 hours, outpacing Ethereum, the world's largest smart-contract blockchain.

- Hyperliquid has consistently generated more fee revenue than Ethereum since early July, a sign that single-purpose blockchains are gaining traction by offering specialized, efficient solutions that attract high user engagement and liquidity.

While You Were Sleeping

- Bitcoin Hits Fresh Record as Fed Easing Bets Add to Tailwinds (Reuters): Bitcoin rose above $124,000, driven by expectations of U.S. rate cuts, strong institutional demand and regulatory momentum. IG’s Tony Sycamore says a sustained break over $125,000 could pave the way to $150,000.

- Bitcoin Crosses Google to Become Fifth-Largest Asset as Fed Rate-Cut Bets Rise (CoinDesk): The milestone caps a year of growing optimism for crypto, driven by a more supportive regulatory climate in the U.S. and surging corporate interest in the bitcoin treasury strategy.

- Scott Bessent Says Japan Is ‘Behind the Curve’ on Interest Rates (Financial Times): The U.S. Treasury Secretary said the Bank of Japan should lift its benchmark rate to curb inflation. Mizuho strategist Shoki Omori sees markets pricing in narrower U.S.-Japan short-term rate gaps.

- Bitcoin Realized Price Breaks Above 200WMA, Signaling More Room to Run (CoinDesk): Bitcoin’s price has moved above a key long-term technical indicator, a milestone that in previous cycles has preceded extended rallies, according to historical on-chain data from Glassnode.

- Chinese Imports Fell During Trump’s First Term. It’s Happening Again. (The Wall Street Journal): China now makes up around 12% of U.S. goods imports, compared with 22% in 2018, according to Census data. The goods trade deficit with China is roughly $280 billion.

- Pound Extends Recent Winning Streak as UK Growth Beats Estimates (Bloomberg): Sterling has outperformed G10 rivals over the past week and is heading for a six-day advance against the euro. Money markets expect 15 basis points of BOE rate cuts this year.

In the Ether

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。