Written by: Dr.404

The focus of this article is on structure and logic, without delving into detailed legal provisions. Neither of us are lawyers, and debating legal details is pointless, akin to chickens pecking at each other. I can make mistakes, so feel free to point them out. The content is based on my research and inferences, and may not be 100% aligned with the project's compliance framework design; everyone can make their own judgments.

After reading Mr. Ni's article, I feel that mixing different elements together may mislead everyone, so I would like to share my perspective.

First, I will mention a few points from Mr. Ni's original text that I disagree with:

The focus should not be on the assumption of MyStonks "if it wants to operate publicly in the U.S. with securities-type tokens," because it is currently not open to U.S. residents, only for non-U.S. sales, so discussing Broker and ATS qualifications is meaningless.

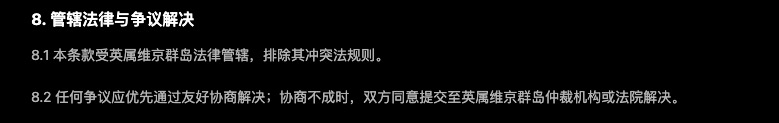

"FinCEN (MSB registration) also failed to directly locate the entry on the public search page," indicating a misunderstanding of MyStonks' current structural design and misidentifying the company.

Comprehensive Analysis of MyStonks' Compliance Structure Design

1. Two Main Entities and Their Responsibilities

The first is MyStonks Holding Limited, registered in the BVI (British Virgin Islands).

Responsibilities: It is the issuer of the U.S. stock tokens that can currently be traded on the MyStonks exchange, utilizing the Reg S exemption. Under U.S. securities law, U.S. stock tokens represent equity in U.S. stocks and essentially fall under the definition of securities. The Reg S model was pioneered by the early U.S. tokenization company Dinari, so it is not a precedent.

The second is MyStonks Holding LLC, registered in Delaware, USA.

Responsibilities: Based on industry norms, it is the entity that can issue securities to U.S. users in the future. I believe we do not need to overly focus on this Reg D; it is more like an exercise to explore the U.S. market, which could lead to an STO for compliant investors later. Consider if a new startup were to conduct an on-chain IPO; thus, Mr. Ni's Reg D filing has no relation to MyStonks' current issuance and trading of U.S. stock tokens.

Currently, the issuance of U.S. stock tokens is completed through the BVI company MyStonks Holding Limited, relying on the Reg S exemption, which is a completely different compliance pathway.

2. Reg S Exemption

MyStonks Holding Limited issues and sells U.S. stock tokens offshore, targeting non-U.S. investors, and can rely on the Reg S exemption, which does not require registration or filing with the SEC. The main requirements (only listing the two most important points) are:

1) Offshore Transactions

- Securities offers and sales must occur outside the U.S.

- The purchaser must be located outside the U.S. when placing an order

- Or the issuer has reasonable grounds to believe the purchaser is outside the U.S.

How MyStonks does this:

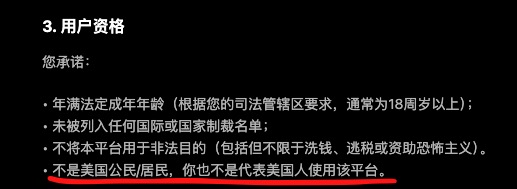

GeoBlocking + KYC before purchase (verifying non-U.S. identity) + agreeing that you are not a U.S. citizen/resident when purchasing U.S. stocks.

The exchange's user terms also state this.

2) No direct sales activities in the U.S.: No advertising, roadshows, investment seminars, etc., aimed at promoting securities can occur in the U.S.

3. MSB (Money Services Business) Registration

What Mr. Ni couldn't find, I can help him locate, because the MSB registration is not for MyStonks Holding LLC but for MyStonks Holding Limited, which can be downloaded from the FinCEN website.

Why is MSB registration necessary?

Reg S only addresses the compliance exemption for U.S. stock tokens and does not cover money transmission and exchange activities.

Although MyStonks issues U.S. stock tokens to non-U.S. investors through the BVI company MyStonks Holding Limited (Reg S), it is generally understood that the transaction process involves funds clearing through the U.S. The stablecoins (USDC) paid by users need to be exchanged into USD through a U.S. financial institution (Circle), and these USD are then used to purchase corresponding U.S. stocks in the U.S. market.

This step, accepting customer funds → exchanging → transferring to the securities market, falls under money transmission within the U.S. regulatory framework and must register with FinCEN as an MSB.

Purpose of MSB registration:

- Anti-Money Laundering Compliance (AML/KYC): FinCEN requires the collection and verification of customer identities, prohibiting transactions from high-risk or sanctioned areas.

- Suspicious Activity Reporting (SAR): Reporting suspicious fund flows to prevent money laundering, terrorist financing, etc. For example, in yesterday's incident, it would typically be automatically detected by a Transaction Monitoring System, and if confirmed suspicious, an SAR would be submitted to FinCEN.

- Cross-Border Business Recognition: Holding an MSB license makes it easier to collaborate with U.S. banks, payment institutions, and market makers, reducing the risk of chargebacks or frozen funds.

Thus, the offshore BVI company MyStonks Holding Limited is responsible for the issuance and trading of U.S. stock tokens.

Here’s more evidence: user declarations indicate they are in the BVI.

Reg S addresses the compliance issues of U.S. stock token issuance, while MSB addresses anti-money laundering and fund flow issues. These two functions are entirely different but are both associated with MyStonks Holding Limited.

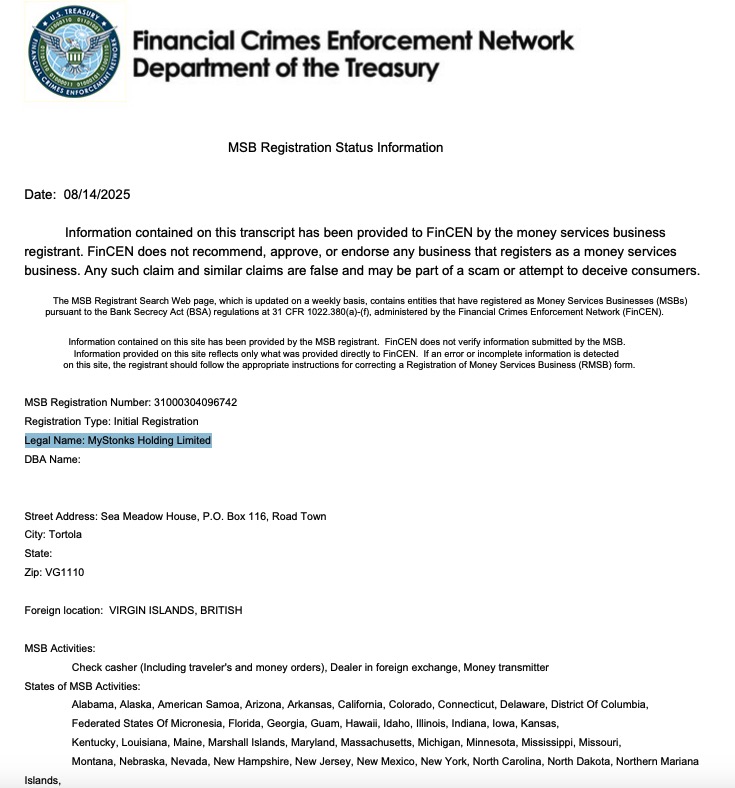

Including previous proof of Fidelity's custodial stocks also points to MyStonks Holding Limited.

It is now very clear that MyStonks Holding Limited is the entity responsible for the issuance and trading of U.S. stock tokens!

Final Summary

The compliance of MyStonks in selling U.S. stock tokens in different countries is actually a multi-layered protective structure, and it is not about obtaining licenses from each jurisdiction one by one.

1) Issuance Layer Compliance (Reg S Exemption): Obtaining an exemption for securities issuance under U.S. law, without needing to register or file with the SEC.

2) Trading and Fund Flow Compliance (MSB / AML): Handling fund clearing and anti-money laundering issues, especially regarding cross-border dollar flows.

3) Risk Avoidance in Different Countries: Different countries have vastly different definitions and licensing requirements for security tokens; some countries have no specific regulations at all, making it a gray area. However, MyStonks is not the only one facing this challenge; others like Dinari, Xstocks, and SHIFT also have similar experiences.

What I have observed is:

A. In the user terms, it clearly states unsupported users:

- Not listed on any international or national sanctions list.

- Not using this platform for illegal purposes (including but not limited to money laundering, tax evasion, or financing terrorism).

- Not a U.S. citizen/resident, nor using the platform on behalf of a U.S. person.

B. MyStonks actively implements GeoBlocking + KYC to restrict access.

C. At the same time, MyStonks is actively applying for licenses in various jurisdictions here.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。