Selected News

CMB International launches the first on-chain public fund on Solana

a16z proposes regulatory safe harbor for DeFi project websites and apps to the SEC

Pump.fun officially repurchased 175.3 million PUMP from the market in the past 24 hours

Ethereum withdrawals accelerate, with a net outflow of 182,400 ETH from CEX in the past 24 hours

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

[XMR]

Today's discussion about XMR mainly focuses on reports of the Qubic mining pool launching a 51% attack on the Monero network. It is claimed that this mining pool has controlled most of Monero's hash power, raising concerns about potential chain reorganization, double-spending attacks, and transaction censorship. There are differing opinions in the community regarding the sustainability and economic feasibility of this attack, with some claiming daily costs could reach $75 million, while others believe it could be as low as $7,000–$10,000 per day. Despite the attack, some believe Monero will emerge stronger, while others emphasize the vulnerabilities in its network.

[SUI]

SUI is gaining significant attention due to Grayscale's launch of investment trusts for the Sui protocol, DeepBook, and Walrus, which is expected to drive demand for SUI-related tokens. The Sui ecosystem is rapidly expanding through new products and collaborations, including integration with Dfns to provide secure wallet infrastructure and the launch of the native crypto payment product Sui Pay. Additionally, SUI user growth is rapid, with 2 million new accounts added in just one day. With scalability and efficiency, Sui is being viewed as a potential leader in the blockchain space.

[SURF]

SURF gained considerable attention on Twitter today, primarily due to its association with the AI Agent—Surf Copilot, a tool recognized for its utility in crypto research and market analysis. Tweets highlighted Surf Copilot's capabilities in providing in-depth insights and strategies, making it a valuable tool for investors and researchers. Furthermore, the recent price increase of the $CYBER token associated with Surf Copilot has further fueled market discussions, with users showing interest in its future growth potential.

[WAL]

Today's main discussions around WAL focus on Grayscale's announcement of the Walrus Trust, which is built on the Sui network and aims to provide scalable decentralized data management. This news has heightened market interest and recognition of the Walrus Protocol ecosystem, with the community speculating on its potential listing on Kaito and the impact of community reward mechanisms. The Walrus Trust and DeepBook Trust are seen as significant steps in bringing institutional funds into the Sui data and liquidity layer, further enhancing the credibility and adoption of the Sui ecosystem.

[PEPE]

Today's discussions about PEPE center on its significant market volatility and community activity. Notably, PEPE's price has surged recently, with some users reporting returns as high as 76 times. The community is actively discussing its potential for further growth, especially in comparison to other meme coins like DOGE and TROLL. Additionally, there are speculations about the influence of creator Matt Furie and discussions on the broader significance of meme coins in the crypto market. The discussions also emphasize the role of platforms like BagsApp in monetizing meme content and PEPE's strategic positioning within the meme coin ecosystem.

Featured Articles

The DeFi market is experiencing a long-awaited "revival of the veterans." As of now, the total locked value (TVL) in the DeFi market has risen to $197 billion, just a step away from its historical high of $206 billion. More importantly, the leaders of this rebound are not newly emerged projects but a group of "veterans" that once shone brightly during DeFi Summer. From the early speculative demand to the current "old trees reviving," the collective growth of the DeFi market is driven by accelerated institutional capital entry (RWA, compliant lending, 401k crypto investments), a resurgence in retail demand for on-chain yields during the bull market, and new use cases brought by technological iterations. The return of veterans reflects market confidence and heralds a new round of competition in DeFi. BlockBeats has compiled the main reasons for the recent surges in the prices and TVL of DeFi "veteran players" such as Aave, Uniswap, Euler, Pendle, Fluid, and Spark in this article.

On the first earnings report night after going public, Circle delivered a complex answer of "paper losses, operational growth": total revenue and reserve income for the second quarter reached $658 million, a year-on-year increase of 53%, with adjusted EBITDA of $126 million, a year-on-year increase of 52%. Meanwhile, USDC continues to expand on the circulation side, with an outstanding circulation of $61.3 billion and a stablecoin market share of 28%. However, due to two non-cash factors triggered by the IPO, including large stock compensation and changes in the fair value of convertible bonds totaling $591 million, the company recorded a net loss of $482 million. Outside of the earnings report day, the competitive landscape of the industry has been rapidly rewritten this summer. The "GENIUS Act" has officially landed, putting the boundaries between "bank-issued stablecoins" and "licensed non-bank issuers" on the table. Circle's Chief Strategy Officer Dante Disparte stated in a recent interview: the real competition has just begun, and it remains to be seen whether banks will hastily issue coins. Circle's partnership landscape is also expanding.

On-chain Data

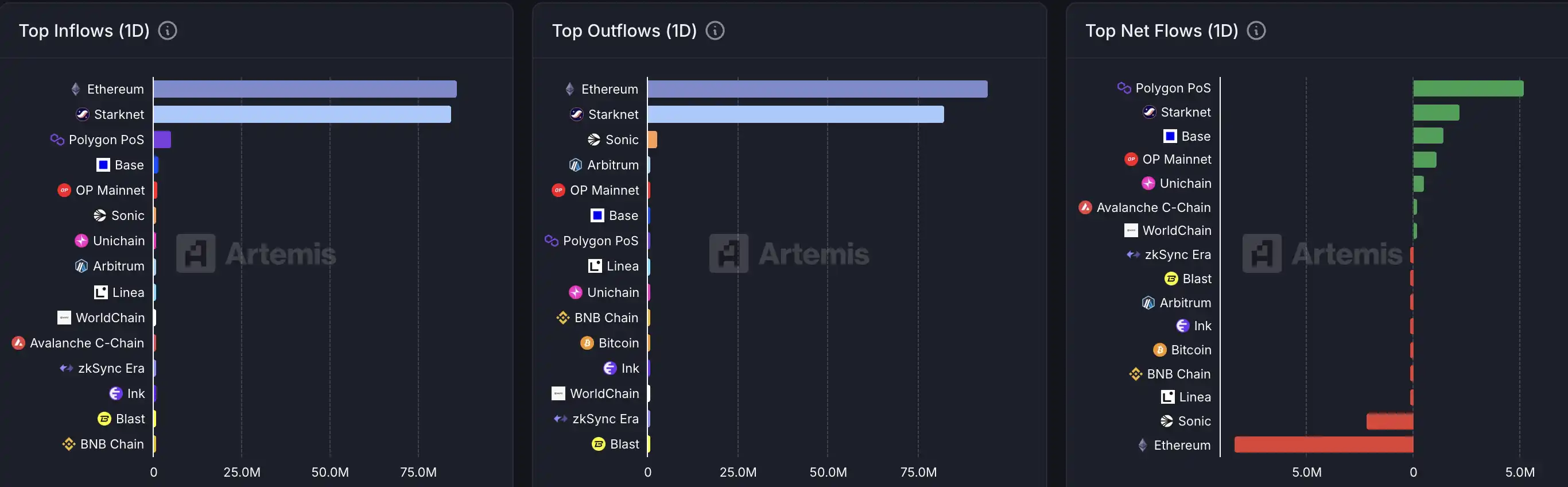

On-chain capital flow situation for the week of August 13th

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。