Yesterday, I discussed this with Kitty in a more data-driven manner. First, we see the BTCUSD trading pair on Coinbase, where it is evident that the trading volume over the past two to three months is still significantly lower compared to the end of 2024 and the beginning of 2025. This indicates that American investors, who have already reached their investment ceiling, have not increased their investment efforts during the spot phase.

Next, looking at the trading volume of BlackRock's $BTC spot ETF, $IBIT, although the trading volume over the past two months is around the average, it has not shown a significant increase compared to the end of 2024 and the beginning of 2025. This means that even the highest purchasing power investors from BlackRock have not increased their trading volume in the secondary market for ETFs.

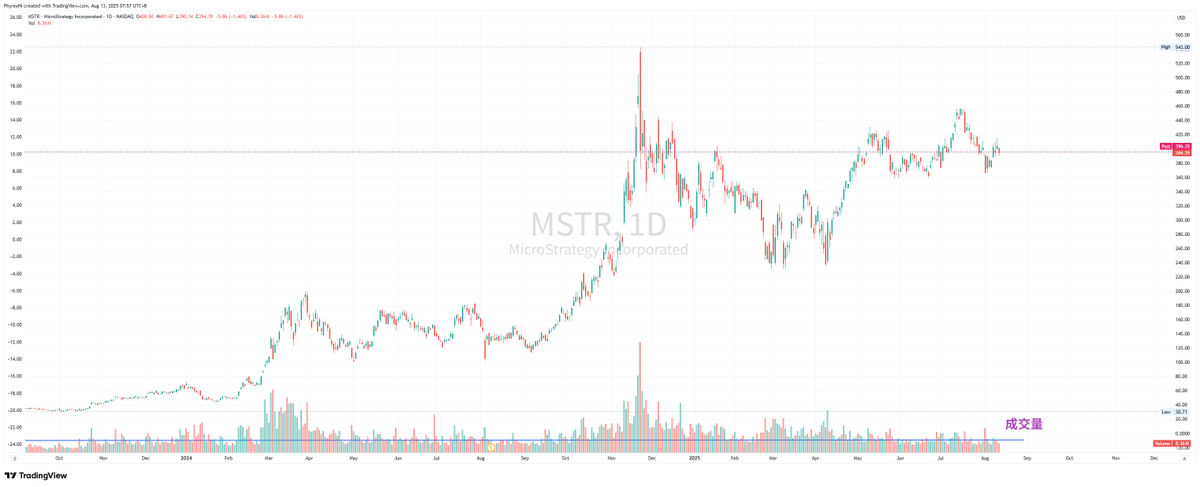

Then we have the leading cryptocurrency stock, $MSTR, where the difference in trading volume compared to the end of 2024 is even more pronounced. Although there is significant buying of Bitcoin in the primary market, the overall FOMO sentiment for BTC has not shown any clear signs.

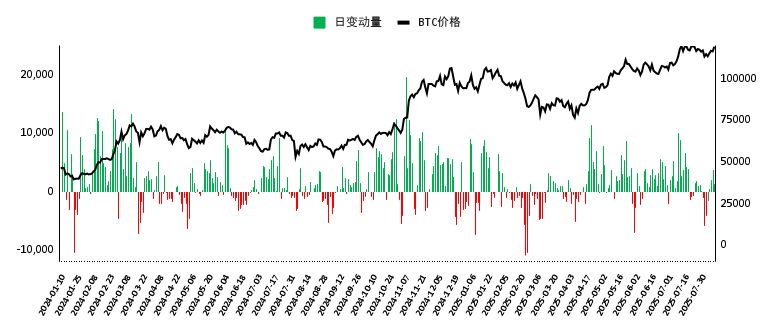

Finally, regarding the primary market data for the BTC spot ETF, while the purchases over the past six months have been decent, it is clear that in the last two months, as prices have risen, purchasing power has declined, and it is still far behind compared to the end of 2024 and the beginning of 2025.

In summary, the reasons and structure behind the current rise of BTC and $ETH are completely different. The strength of BTC lies in the growing expectations for its future, with fewer investors willing to sell their holdings. BTC is gradually becoming a collectible, while ETH resembles BTC from March 2024, driven entirely by accumulated purchasing power.

Although this purchasing includes both spot transactions on exchanges and on-chain, as well as the primary and secondary markets for spot ETFs, it is clear that traditional investors and the market's purchasing power for ETH exceeds that of the spot market. Therefore, on one hand, there is very little overflow of funds, and on the other hand, more investors are shifting towards long-term holding.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。