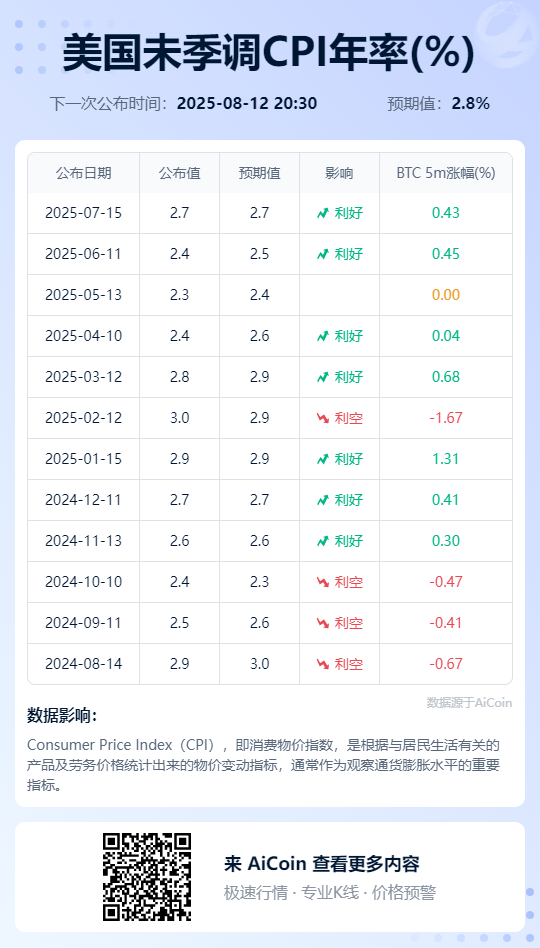

Tonight at 20:30 (UTC+8), the U.S. Bureau of Labor Statistics will release the July CPI data. It is expected to record 2.8%, slightly higher than the previous value of 2.7%. If it meets expectations, this will mark the second consecutive increase in inflation indicators this year, highlighting the potential upward pressure on prices from tariff policies.

Data shows that the overall CPI for July is expected to rise by 2.8% year-on-year, while the core CPI (excluding food and energy) is expected to rise to 3.0% year-on-year. Economists generally believe that concerns about data quality are increasing, but the price pressure from imported goods due to tariffs has begun to manifest. Compared to June, the increase in core categories (such as imported goods affected by tariffs) has accelerated, leading to a slight rebound in overall inflation.

Tariffs "bite," Fed in a dilemma

If the July data meets the expected 2.8%, it will reflect the initial impact of the recent tariff increases by the Trump administration. These tariffs target imported goods from multiple countries, including China and the EU, covering electronics, steel, and consumer goods, directly raising domestic price levels. Tariff pressures have led to an accelerated increase in core goods prices, pushing the CPI up slightly from 2.7% in June. Analysis shows that if the month-on-month core CPI reaches 0.3%, it will further confirm the stubbornness of inflation, and the Fed may be forced to maintain a high-interest-rate environment. IDNFinancials emphasizes that tariffs "are starting to bite," and are expected to push inflation higher in the coming months.

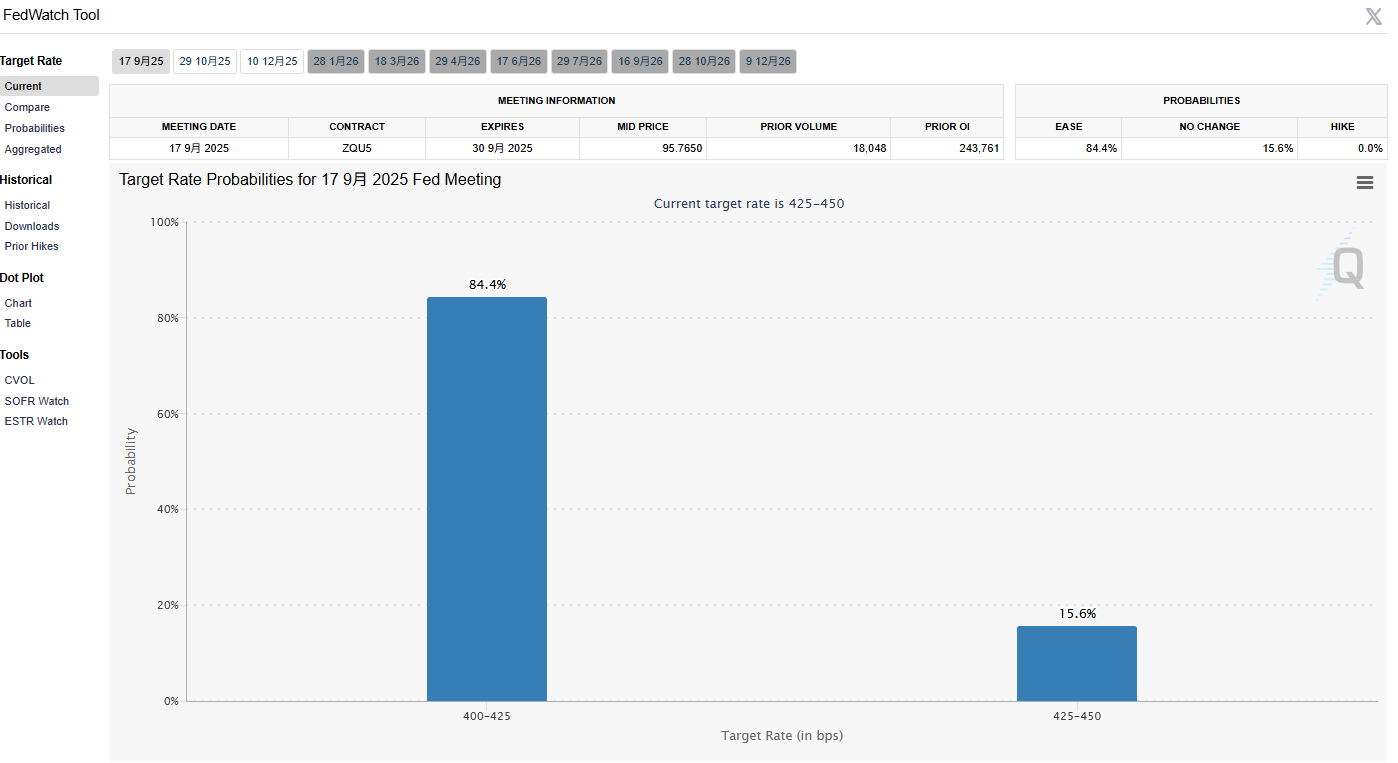

The Fed's stance is crucial. Currently, market pricing shows an 84.4% probability of a rate cut in September, but this depends on a moderate decline in CPI. Morningstar points out that if the July CPI exceeds expectations (such as 2.9%), it will create the largest increase of the year, forcing the Fed to reassess the pace of rate cuts. TheStreet warns that this data could overturn the Fed's rate cut path; if inflation accelerates, maintaining high rates will impact risk assets.

How CPI results reshape the crypto market

If the CPI exceeds expectations (reaching 2.9% or higher), inflation pressures will highlight the impact of tariffs, and rate cut expectations will quickly cool. Reports indicate that BTC traders have begun seeking downside protection, fearing that high CPI will boost the dollar and yields, putting pressure on risk assets. A high CPI will raise interest rate expectations, diminishing BTC's appeal as "digital gold," potentially leading to a short-term pullback.

If the CPI meets expectations (2.8%), inflation will maintain a moderate decline trajectory. The market will turn to a detailed analysis of the Fed's subsequent statements, looking for "dovish signals." The crypto market may experience limited volatility but could see a mild rebound.

If the CPI is below expectations (2.7% or lower), expectations for a rate cut in September will significantly increase, and the crypto market may experience a rally. CoinDesk reports that traders have bet on BTC reaching $135,000 and ETH reaching $4,800.

Concerns and opportunities in the crypto market

The crypto market's sensitivity to CPI stems from its close linkage to macro liquidity. Reuters points out that if the core CPI reaches 3%, it will boost the dollar, impacting assets like BTC.

Tariff factors exacerbate uncertainty. Trump's tariffs have already raised prices, and the July CPI may show broader inflationary pressures.

Advice: Volatility is a double-edged sword. High data may delay the Fed's rate cuts, leading to a drop in BTC; low data could drive a rebound.

This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。