Today's homework isn't too difficult. Although there are some price fluctuations, the overall sentiment among investors is quite good. Tomorrow is the day for the CPI announcement. I've noticed that the reactions in the U.S. stock market and $BTC are quite similar, both showing slight oscillations, which is normal. The recent CPI and retail data have seen some risk-averse sentiment, which is to be expected, as the market's anticipated data isn't optimistic.

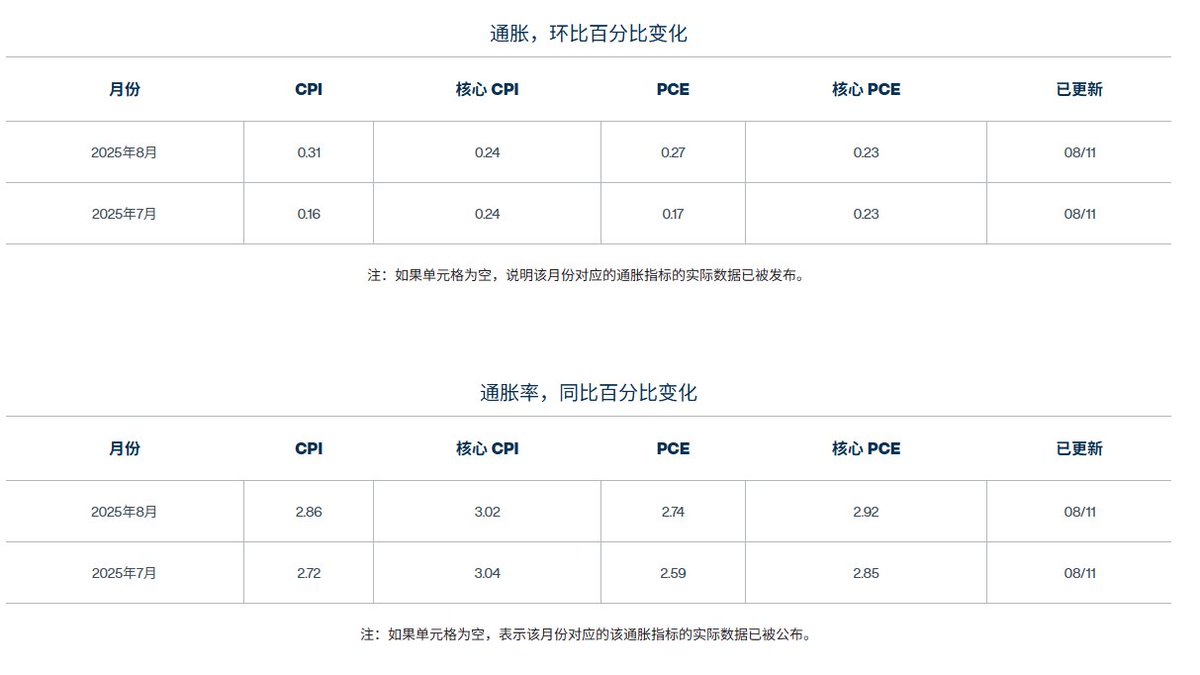

Data shows that last month's broad CPI was 2.7%, while the market expectation was 2.8%. The Cleveland Fed's prediction was 2.72%. Although there is a slight discrepancy, it also suggests that if there are no issues, the broad CPI is likely within expectations or slightly below, with the CPI value probably between 2.7 and 2.8.

Of course, since this is data from the Bureau of Labor Statistics, if it does come in below 2.7%, it would be favorable for the market. Additionally, the market expectations for the month-on-month CPI and the Cleveland Fed's predicted data are both below the previous value, indicating that the transmission pressure of inflation isn't very significant.

The core CPI data is also greater than or equal to last month's data, so overall, the situation isn't very optimistic. If we follow market expectations, U.S. inflation is likely to continue rising, but this inflation only includes basic tariffs and does not account for formal tariffs. While a slight increase is normal, it also shows that U.S. inflation is still temporarily affected by tariffs.

However, I believe that current investors have begun to desensitize to tariffs, as the main contention is no longer solely dictated by the Federal Reserve, but rather the struggle between the radical faction representing Trump and the conservative faction of the Federal Reserve. The Trump faction will likely advocate for interest rate cuts as long as the data isn't too exaggerated, while the conservatives may hold onto interest rates until they see data indicating a drop in inflation to demonstrate their integrity.

Therefore, if the data is good, it will be a win-win situation, allowing everyone to save face. If the data is bad, it doesn't necessarily mean there will be a pessimistic outlook, especially since the expectation for a rate cut in September is quite high. I used to say that since the rate hikes in 2022, the market has never won a single round against the Federal Reserve, but this time, I really don't know.

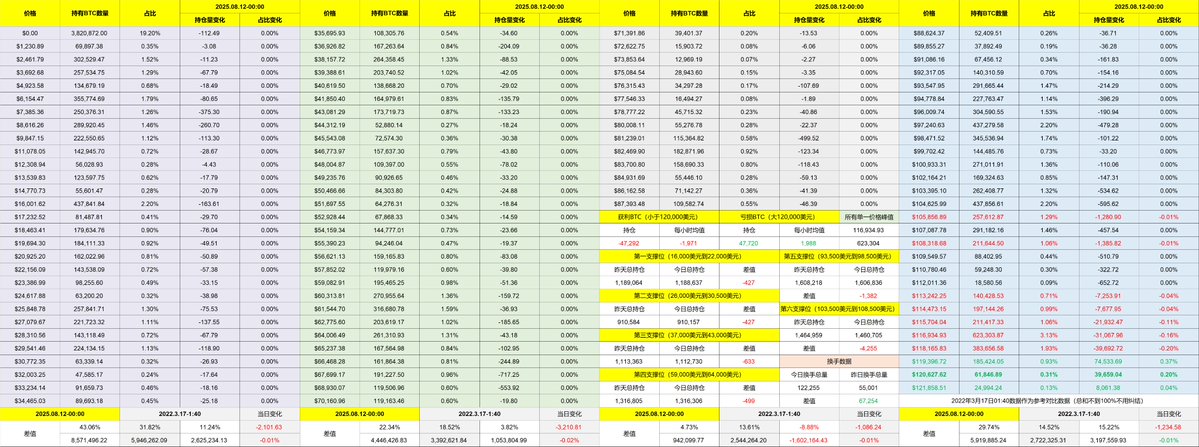

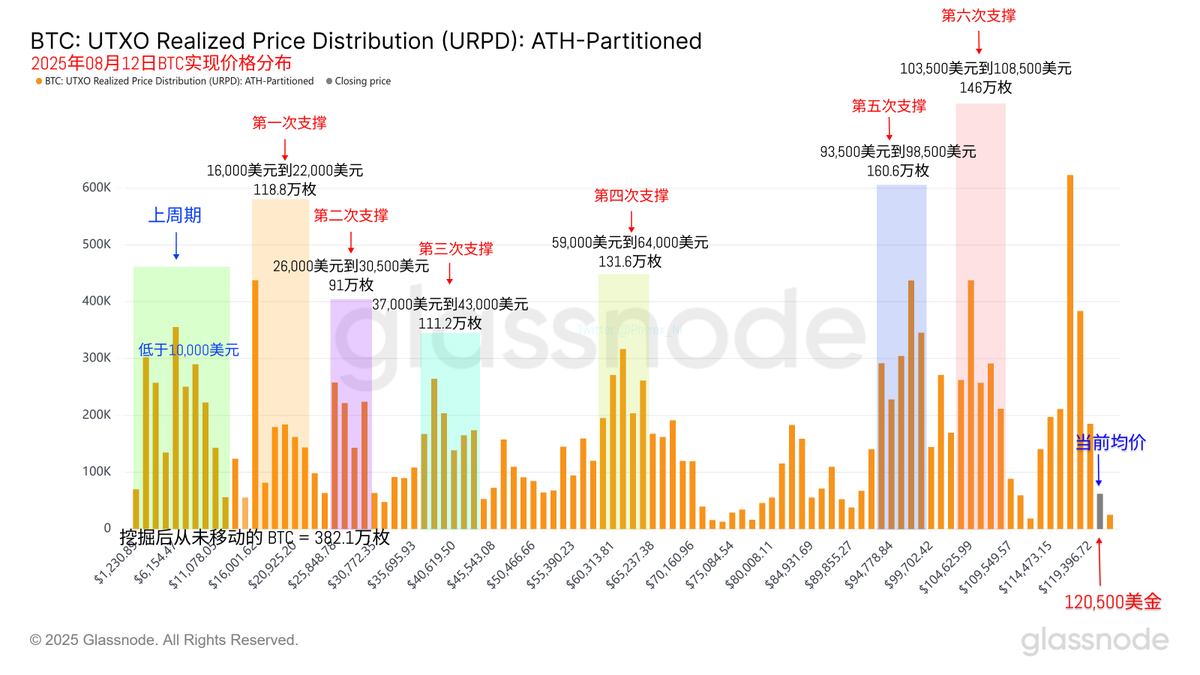

Looking back at Bitcoin's data, the turnover rate began to rise on Monday, which was expected, as BTC's price increased nicely over the weekend, prompting many short-term investors to trade. The data clearly shows that short-term investors are currently the main force in trading, while earlier investors are still taking a wait-and-see approach, not panicking or exiting just because BTC's price returned to $120,000.

Although there has been a lot of trading, the changes in chips at the two support levels are still quite minimal, with no significant exits occurring. This indicates that investors at these two positions are gradually transitioning into long-term investors. The seventh support zone, as I mentioned yesterday, is gradually taking shape. Whether it can solidify is another matter that requires further observation.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。