Aug 4–Aug 10, 2025 #LookonchainWeeklyReport

🟢 Onchain Overview

Stablecoin inflows, strategic whale positioning, and fresh institutional demand point to rising confidence in the ongoing rally.

The market was already rebounding last week and whales were buying back cryptocurrencies.

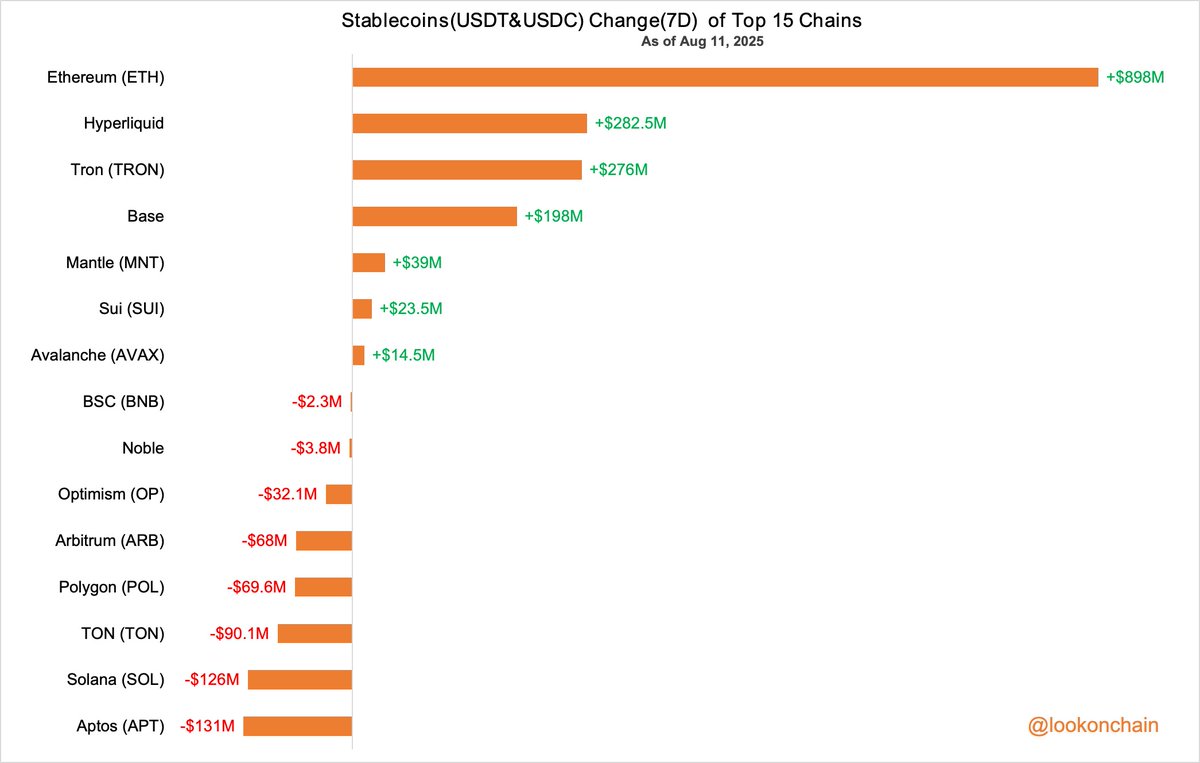

🟢 Stablecoin Market

The total stablecoin market cap increased by $2.376B. Stablecoins(USDT&USDC) on #Ethereum increased by $898M and on #Aptos decreased by $131M.

🟢 Spot & Perps Trading Volume on DEXs

The DEX spot trading volume reached $95.978B last week, down 6.95% from the previous week.

Breakdown:

Uniswap: $28.232B (WoW +10.35%)

PancakeSwap: $11.756B (WoW -14.35%)

Raydium: $6.082B (WoW -16.27%)

Meanwhile, DEX perps trading volume totaled $110.794B, a 8.54% decrease week-over-week.

Breakdown:

Hyperliquid: $68.453B (WoW -11.29%)

edgeX: $8.287B (WoW +38.23%)

Jupiter: $4.113B (WoW -17.11%)

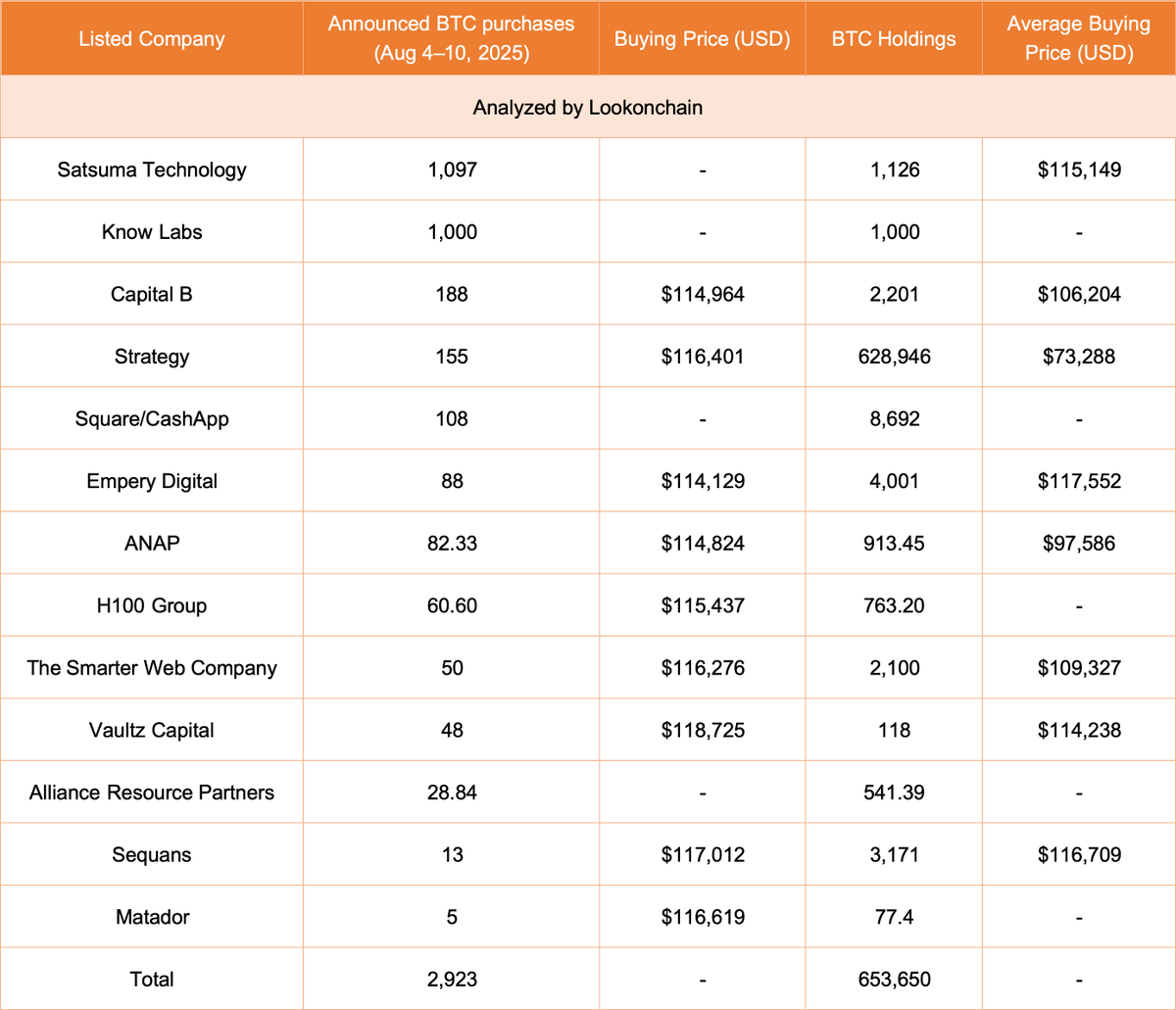

🟢 Announced BTC purchases

13 listed companies purchased 2,923 $BTC($352M) last week.

🟢 Institutional/Whale Activity

A mysterious institution created 6 new wallets and accumulated 221,166 $ETH($946.6M) from #FalconX, #GalaxyDigital, and #BitGo.

https://x.com/lookonchain/status/1954702379905089804

Many whales, including Arthur Hayes, are buying back the $ETH they previously sold — at even higher prices.

https://x.com/lookonchain/status/1954132632423588028

https://x.com/lookonchain/status/1954022044670341132

https://x.com/lookonchain/status/1953672575172968628

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。