Written by: Will A-Wang

Currently, the field of anti-money laundering (AML) in cryptocurrency is primarily dominated by Blockchain Analytics Tools (BATs), such as Chainalysis and Elliptic. Although these tools have strong on-chain capabilities, how can we ensure compliance with AML requirements in real-world scenarios—such as stablecoin payments—while safeguarding the security of on-chain funds/wallets? This is a key concern for the expansion of stablecoin payments in real-world scenarios and a question that AML compliance must address.

While cryptocurrency exchanges can use blockchain analytics tools (BATs) and bind strong KYC information of users on their platforms—KYA wallets + KYT assets + KYC user information—to implement relatively compliant AML measures and risk monitoring, there are still vulnerabilities in stablecoin payments for consumer scenarios, especially in the current social entertainment context of stablecoin retail payments.

A recent study by Singapore licensed digital asset service provider MetaComp has exposed the "fig leaf" of industry risk control. The report tracked over 7,000 real on-chain transactions and found that if only 1-2 KYT (Know Your Transaction) tools are relied upon for screening, approximately 25% of high-risk transactions would be misclassified as "safe" and allowed to proceed. In other words, a quarter of potential threats slip away right under our noses—this is no longer a "blind spot" in risk control, but a "black hole" that consumes risk.

Therefore, on-chain AML compliance cannot merely rely on the cognitive blind spots of using a single blockchain analytics tool (BATs): it must also be combined with off-chain fiat anti-money laundering (AML) transaction monitoring solutions. Thus, we have compiled the article "Deloitte: Conquering Crypto Crime" to explore a solution that combines blockchain analysis with real-time transaction monitoring, believing that this solution will promote the further implementation of stablecoin payment scenarios.

Introduction

Blockchain technology and cryptocurrencies have garnered significant attention in recent years. However, their pseudo-anonymity—sometimes even complete anonymity—makes these technologies susceptible to misuse for money laundering activities. Blockchain Analytics Tools (BATs) are currently at the forefront of combating money laundering threats in the crypto industry. Companies like Chainalysis, Elliptic, and Scorechain collect risk data on pseudo-anonymous and anonymous blockchain addresses and conduct clustering analysis to integrate insights.

For example, if a blockchain analytics tool (BAT) identifies a blockchain address associated with a ransomware attack, it will absorb and store that address along with its associated risk information. However, despite the effectiveness of these tools, current methods and tools still have several limitations:

End-to-End Fiat and Crypto Asset Monitoring: BATs often lack the ability to track the flow of exchanges between fiat and cryptocurrencies, which is a critical link in the money laundering chain.

Pattern Analysis: BATs typically can only identify suspicious transactions or behavioral patterns based on simple rules, making it difficult to detect more complex anomalies, which does not meet regulatory requirements and limits the depth of money laundering detection.

Indirect Risk Scoring: Since only a few blockchain addresses are directly linked to confirmed criminal activities, BATs often can only provide indirect risk scores. For addresses with such indirect scores, analysts often face significant subjective judgment when deciding whether to submit a Suspicious Activity Report (SAR).

In addition to the low detection rate (which increases the risk of being used for money laundering), these limitations may also lead to technical deficiencies in complying with existing anti-money laundering laws and regulations. Regulatory agencies typically require compliance with known typologies published by financial intelligence units (FIUs) and/or law enforcement agencies (LEAs), either directly or indirectly. The typological cases published by various countries' financial intelligence units and the Financial Action Task Force (FATF) often cover mixed transactions between fiat and cryptocurrencies as well as more complex behavioral patterns, which cannot be comprehensively covered by blockchain analytics tools (BATs) alone.

Moreover, these shortcomings can lead to inefficient alert handling. Addresses that have indirect associations with tainted addresses and are in the medium-risk range often trigger a large number of alerts but provide limited additional risk information. These alerts are usually ultimately classified as false positives, forcing operators to spend a lot of time dealing with ambiguous alerts—efforts that often prove futile.

1. Supplementing Blockchain Analysis with Real-Time Transaction Monitoring

The aforementioned limitations highlight the necessity of complementing blockchain analytics tools (BATs) with anti-money laundering (AML) transaction monitoring systems that are widely applied in the fiat currency domain. These systems are designed specifically to handle fiat transactions and can analyze based on complex scenario models. The combination of BATs with AML transaction monitoring systems "adapted for crypto assets" can jointly overcome each other's shortcomings.

1.1 Connecting Fiat and Crypto Asset Transactions

To achieve effective risk management, monitoring systems should link fiat and crypto asset transactions to present a comprehensive view of customer behavior, such as integrating through customer numbers or account IDs. This approach is particularly revealing in cryptocurrency exchanges that have both types of transaction data, as it can uncover insights that cannot be discovered through a single dimension (either crypto or fiat alone). Key typologies focus on the complete crypto customer journey: from depositing fiat, trading various crypto assets, to ultimately withdrawing fiat to another bank account.

1.2 Analyzing Complex Transaction Patterns

To achieve efficient and effective money laundering detection, it is essential to identify known (but undetected) complex money laundering behavior patterns. While modern BATs allow for rule creation, they are often limited to simple and often one-dimensional standards (such as amount thresholds). More complex rule sets, even AI-based models—as adopted by many modern AML transaction monitoring systems—can help operators detect common and complex suspicious behaviors such as "money muling" and "account passthrough."

1.3 Incorporating Customer Risk Data

Although the traditional fiat sector has not fully integrated static "Know Your Customer" (KYC) data with dynamic transaction data, modern AML transaction monitoring systems support this integrated view, enabling operators to utilize all available customer data for optimal risk detection. In the crypto space, due to the pseudo-anonymity of blockchain transactions, the correlation between customer data and transaction data is particularly critical. To achieve comprehensive risk detection and cover all typological scenarios published by regulators, it is essential to integrate static customer data, dynamic transaction data, and risk information provided by BATs.

2. What Kind of Compliance System Do We Need?

Blockchain analytics tools (BATs) are fundamental to reducing money laundering risks associated with cryptocurrencies, but they also require the complementary functionalities provided by modern transaction monitoring systems. Integrating crypto market tools with modern monitoring systems is the future roadmap for achieving efficient and effective AML compliance. Utilizing AI-based models to identify known and unknown patterns and to reorder risks initially identified by BATs is not only meaningful but may also be a trend. We advocate for the coordinated and comprehensive use of both BATs and modern traditional fiat monitoring tools to achieve efficient and effective anti-money laundering compliance, ultimately curbing the misuse of blockchain technology and cryptocurrency transactions.

Specifically, we recommend the following ways to integrate BATs with modern financial crime technology systems:

2.1 Unified User Interface

An integrated user interface allows operators to seamlessly access and present all information required for analysis and verification of transactions on a single, synchronized platform, rather than switching back and forth between multiple independent applications. Centralizing customer data, fiat and crypto transactions, complex behavioral patterns, and risk priority models can significantly enhance processing efficiency.

2.2 Joint Presentation of Fiat and Crypto Fund Flows

This core recommendation stems from the value of presenting both types of transactions in a unified format. Criminals often attempt to reintegrate illegal proceeds into the legitimate financial system, so effective monitoring must associate and analyze fiat and crypto transactions together. When operators can view this complete link, they can better identify and mitigate complex money laundering patterns.

2.3 AI Models for Detection and Result Reordering

AI models can enhance efficiency and accuracy through anomaly detection and alert prioritization based on comparative risk analysis. Additionally, these models can dynamically reorder the initial findings from BATs based on multi-dimensional risk indicators; in crypto transactions, funds often pass through multiple consecutive transfers, and risk scores frequently fall into a "gray area," making AI sorting particularly important. It is worth emphasizing that the models used should possess transparency and interpretability; especially for regulatory purposes, AI-generated decisions must come with human-readable explanations.

Complex transaction patterns and customer risk data can hinder the effectiveness of AML compliance related to cryptocurrencies. However, by integrating user interfaces, jointly presenting fiat and crypto fund flows, and utilizing AI models for result reordering, the efficiency and quality of monitoring processes can be significantly improved. Therefore, integrating blockchain analysis systems with traditional AML systems is the best way to enhance the efficiency and effectiveness of anti-money laundering compliance in the crypto space.

3. Deloitte Case Study—From Independent Assessment to Integrated Support

Before transforming any transaction monitoring system, we first conduct an independent assessment of the transaction monitoring landscape for both crypto and non-crypto clients. The scope of the assessment can be flexibly adjusted by module, covering various regulatory focus areas, such as analyzing underlying policies and processes, data handling, coverage, and data lineage.

In this case study, we focused on examining the coverage of relevant risks and typologies and assessing the effectiveness and efficiency of existing rules and parameters in detecting these risks. In addition to analyzing internal documents (such as risk assessment reports), we also specifically measured the implementation level of publicly available crypto-related typologies (from various countries' financial intelligence units and FATF) across the entire transaction landscape.

Based on a priority list containing over 50 applicable typological scenarios, we found that some scenarios were completely uncovered, while most were covered but relied on highly manual and decentralized methods. Almost all key information (crypto and fiat transactions, other customer data) already exists but is scattered across different systems, making it nearly impossible for alert handlers to "connect the dots." Further analysis of the alert clearing process and alert statistics showed that operators spent most of their time laboriously investigating false positives, while significant suspicious behaviors proactively identified by the transaction monitoring system were almost nonexistent. Coupled with feedback from law enforcement and other regulatory requests, we know that there are indeed suspicious behaviors within the known customer base, further confirming the urgent need to adjust detection logic and alert prioritization.

After completing the independent assessment, we assisted the client in formulating a rectification plan: first, we mapped out the Target Operating Model, based on which we evaluated the feasible options of "in-house" or "outsourced." During the evaluation phase, we helped the client break down and refine requirements based on all dimensions of the assessment framework.

Ultimately, the client independently completed the vendor selection. Subsequently, we intervened in the integration project in various roles as needed: the primary task was to decompose the relevant fiat-crypto typologies into actionable rules and model configurations, ensuring through testing that they met expectations in terms of effectiveness and efficiency; secondly, we provided support from both business and technical sides: on the business side, assisting in mapping existing interfaces to the new vendor's interfaces; on the technical side, assisting in configuring APIs and building necessary connectors.

In the end, we helped the client achieve:

Clearly define (regulatory) issues based on facts;

Select the optimal solution in the market;

Complete the integration within a minimized time window without overly consuming the client's already strained resources.

4. Hawk Case: Integrated Monitoring of Fiat & Crypto

Hawk has developed a cryptocurrency asset monitoring solution that deeply integrates its own AML transaction monitoring technology with the capabilities of blockchain analytics tools (BATs), providing modules for customer risk rating, customer screening, payment screening, and more.

4.1 Connecting Fiat and Crypto

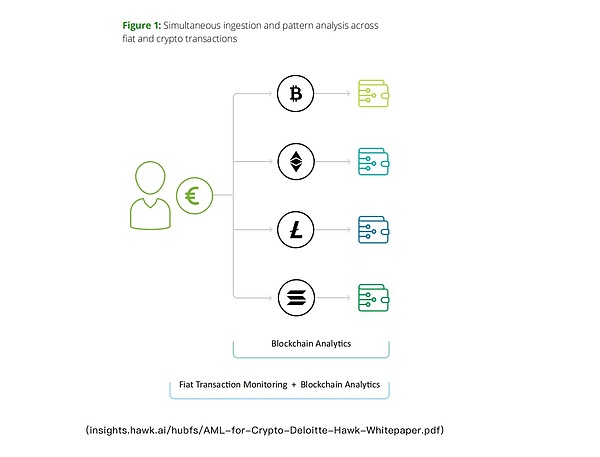

The Hawk platform can read various transaction data—covering standard fiat transaction protocols such as SWIFT and SEPA, as well as cryptocurrency transaction data. The system can simultaneously ingest fiat and crypto transactions, allowing it to identify overall patterns across data sources.

For example, a new customer at a cryptocurrency exchange makes a large fiat deposit, which is then quickly exchanged for various cryptocurrencies; shortly thereafter, the split-up smaller amounts of crypto assets are transferred to multiple external addresses. Since BATs can only track on-chain cryptocurrency flows, they cannot capture this classic "layering" technique—often used by money launderers in cryptocurrency exchanges. Hawk can fully identify the entire money laundering chain by synchronously monitoring fiat and crypto transactions.

4.2 Integrating Blockchain Analysis with KYC Customer Risk Information

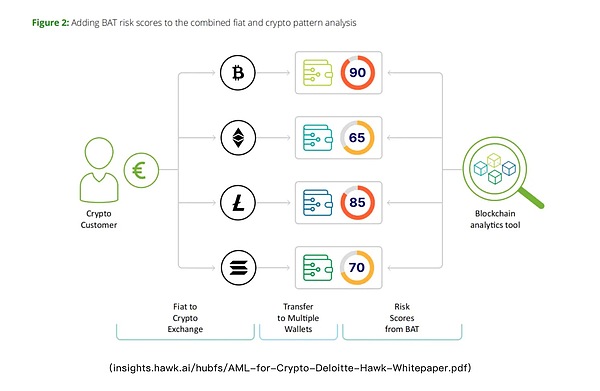

In addition to simultaneously processing fiat and crypto transactions, Hawk has established standardized interfaces with BAT vendors, embedding BAT risk scores into its rules and models to provide additional insights for anti-money laundering.

Using the previous example, applying the BAT wallet risk score to identified money laundering schemes can provide further clues about the external wallets used for fund withdrawals. These wallets may be directly or indirectly linked to addresses marked for illegal activities, such as ransomware proceeds receiving addresses. As a result, alerts will gain richer contextual information, helping operators more accurately determine whether the behavior is illegal.

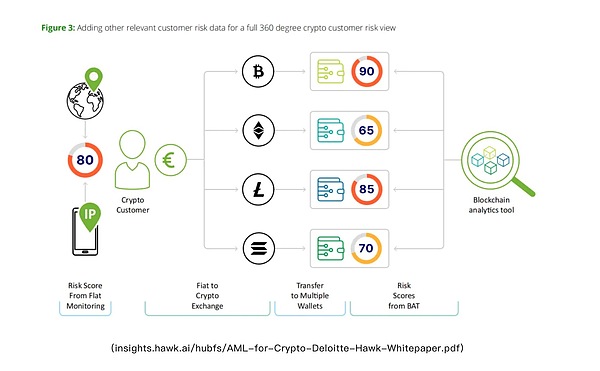

The out-of-the-box Hawk solution will also automatically inject other relevant customer risk information (KYC) into alerts. When the system detects suspicious activity, it synchronously adds background information (such as geographical location, occupational information, watchlist, and negative media search results). In the previous example, if the customer registered in Germany but logged in using a device from a Vietnamese IP address, these details would provide valuable context for the investigation.

Ultimately, all information is consolidated into a unified case management system, presenting transaction and customer-related information in a complete manner at once. This system also supports maximizing the automation of subsequent processes, such as automatically generating and submitting Suspicious Activity Reports (SARs).

4.3 Overlaying AI, Entering a New Era of Crypto Transaction Monitoring

A core task of Hawk is to overlay transparent and interpretable AI on all relevant data to further enhance transaction monitoring effectiveness. Hawk's AI model specifically incorporates crypto signals into detection and false positive reduction models, fully utilizing transaction data, customer information, and risk data provided by BATs.

This approach not only allows the model to accurately identify illegal money laundering schemes but also addresses a core challenge in current crypto transaction monitoring: many results provided by BATs fall into a "gray area," making it difficult for analysts to determine whether they are truly suspicious. Hawk's crypto model integrates the latest data analysis techniques and utilizes all transaction and customer data, enabling operators to accurately triage these "gray" alerts, avoiding the waste of significant manpower.

5. Conclusion

We discussed the limitations faced when relying solely on blockchain analytics tools (BATs) such as Chainalysis, Scorechain, or Elliptic for anti-money laundering (AML) efforts. While these tools are powerful, they are still insufficient for comprehensive money laundering detection: they cannot handle fiat transactions and struggle to identify suspicious transactions or behavioral patterns; their risk scoring methods are mostly indirect, leading to inefficiencies in the alert clearing process.

To break through the bottleneck of BATs, we recommend supplementing them with traditional AML transaction monitoring systems, enabling the linkage of fiat and crypto transactions and supporting complex transaction pattern analysis. Additionally, customer risk data should be taken into account. Specifically, we advocate for a deep integration of BATs with modern financial crime technology systems: seamlessly displaying and accessing transaction analysis data through a unified user interface; presenting fiat and crypto fund flows in a single format; and utilizing AI models to detect anomalies and intelligently prioritize results.

We also demonstrated a feasible path through case studies: Deloitte assisted clients in comprehensively assessing their transaction monitoring systems; Hawk integrated its self-developed AI enhancement solutions with BAT capabilities, significantly improving monitoring effectiveness.

In summary, we advocate for the collaborative use of BATs and traditional fiat monitoring tools to achieve efficient and effective anti-money laundering compliance in the crypto space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。