Original | Odaily Planet Daily (@OdailyChina)

Author|Azuma (@azuma_eth)

The leading player in the liquid staking sector, Lido (LDO), has recently made a significant comeback. According to OKX market data, as of 10:00 AM Beijing time on August 11, LDO is priced at 1.52 USDT, with a 24-hour increase of 14.21%, and a staggering 64.5% increase over the past week.

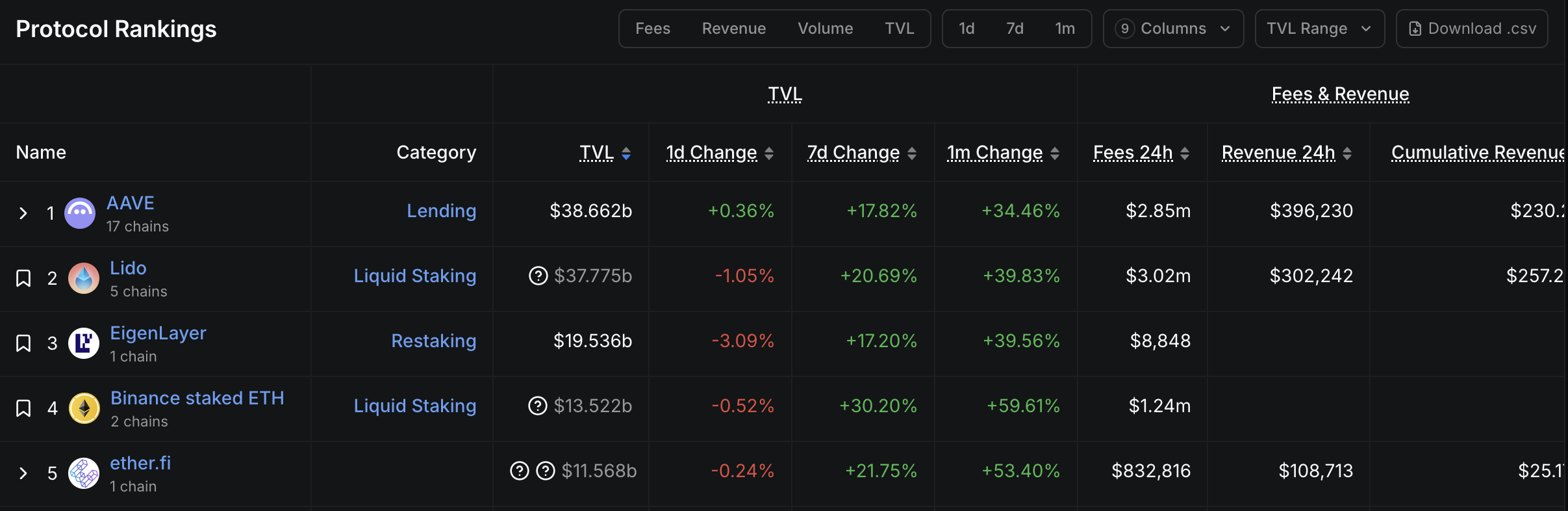

As the largest liquid staking protocol in the Ethereum ecosystem, Lido has long dominated the total value locked (TVL) rankings in the Ethereum ecosystem and even the entire on-chain ecosystem. Although it has recently been surpassed by Aave, which has rapidly grown due to the borrowing of USDe assets, Lido remains one of the most influential protocols in the Ethereum ecosystem.

The recent rise of LDO can be attributed to both macro and micro factors.

Macro: Clear Regulatory Attributes, Progress on Staking ETFs

First, on the macro level, on August 6, the U.S. Securities and Exchange Commission (SEC) officially released a statement regarding liquid staking activities titled "Statement on Certain Liquid Staking Activities," which clearly states: "Liquid staking activities related to protocol staking do not involve the issuance and sale of securities, unless the deposited crypto assets are part of an investment contract or are subject to an investment contract. Participants in liquid staking activities are not required to register transactions with the SEC under the Securities Act, nor do they need to comply with the registration exemption provisions of the Securities Act regarding these liquid staking activities."

In June 2024, when Gary Gensler was still at the helm of the SEC, the agency had accused Lido and Rocket Pool of being securities, causing LDO to drop over 10% on that day and remain in a downturn for a considerable time afterward. Just a year later, the new SEC's statement clarified that its business model does not involve securities, effectively easing regulatory constraints for the subsequent operation and development of such projects.

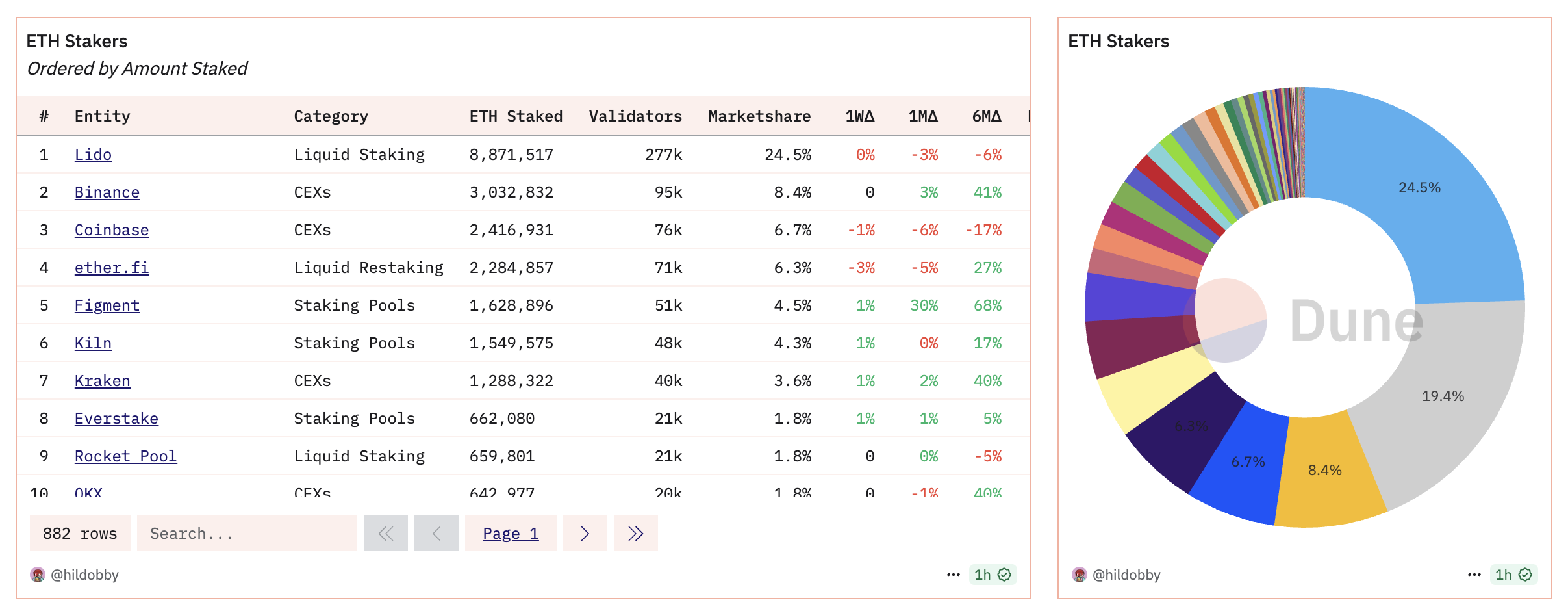

In addition to the regulatory shift, another key development in the staking sector is that BlackRock has submitted an application to the SEC to introduce a staking mechanism in its spot Ethereum ETF. Although this application is still under review, the SEC's attitude suggests that approval is not expected to be too difficult. The market generally anticipates that with the approval of staking ETFs, Lido, which currently holds nearly 25% of the Ethereum staking share, is likely to receive a boost in business and capital inflow.

Micro: LDO Buyback Plan Finally on the Table

Compared to the indirect effects on the macro level, the recent discussions about the LDO buyback plan may be the direct factor influencing the price movement in the short term.

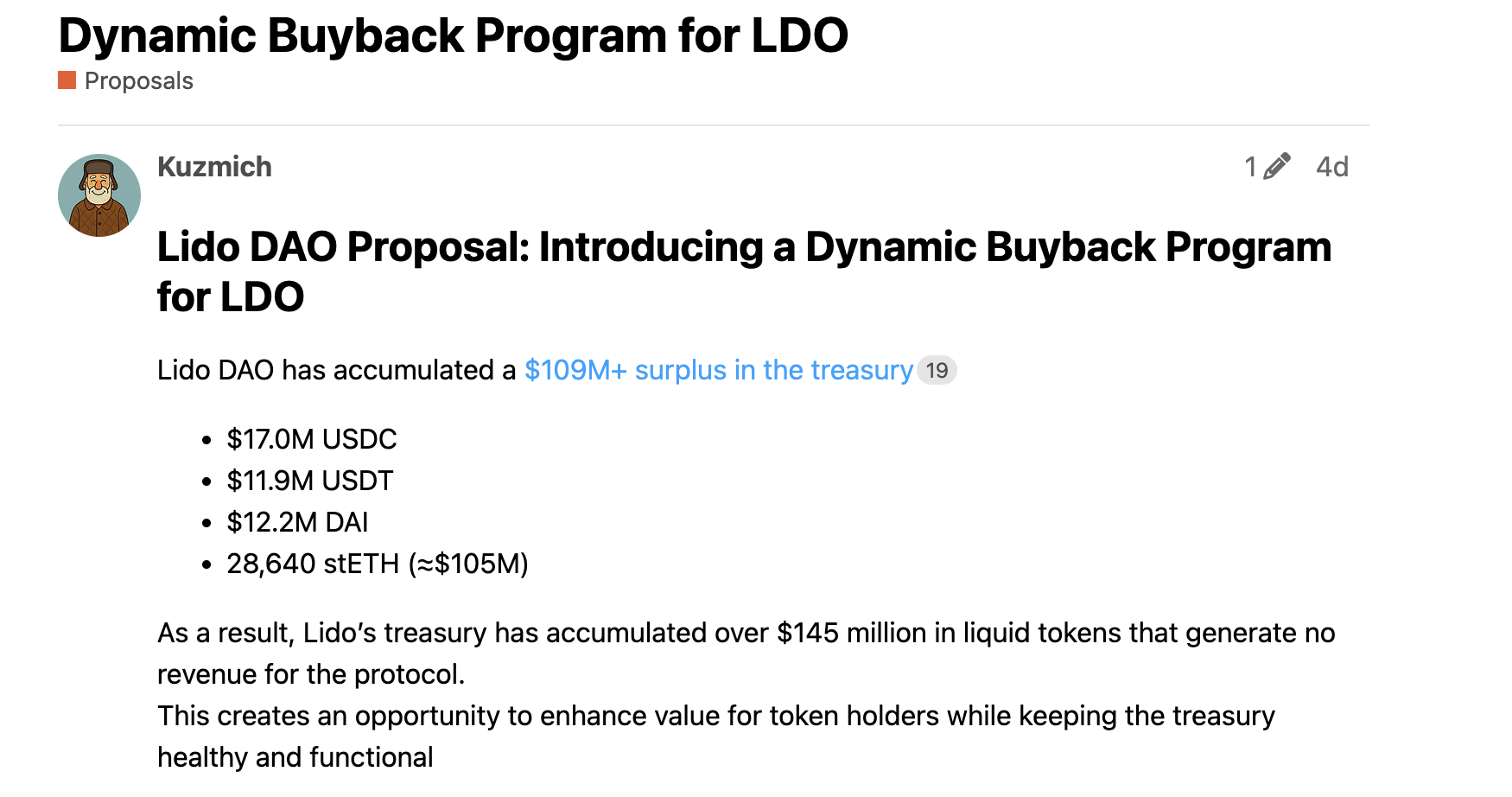

On August 7, Lido community member Kuzmich submitted a draft regarding the "LDO Buyback Plan" draft on the governance forum. The draft mentions that Lido's treasury currently holds liquidity assets worth $145 million (17 million USDC, 11.9 million USDT, 1.22 million DAI, 28,640 stETH), but these assets are not generating revenue for the protocol.

The draft suggests that Lido should dynamically execute LDO buybacks based on treasury balances to improve the protocol's capital utilization, boost LDO prices, and restore market confidence in LDO's value. Specifically, the draft proposes that under the current treasury reserve scale, 70% of liquidity assets should be used for regular LDO buybacks, while 30% should be retained for operational and strategic needs; when treasury liquidity assets decrease to between $50 million and $85 million, the ratio will adjust to 50% buyback / 50% retention; when treasury liquidity assets fall below $50 million, the ratio will adjust to 0% buyback / 100% retention (suspending buybacks until the threshold is restored).

According to the planning of the Lido governance forum, if all goes smoothly, the draft will collect community feedback from August 7 to 14; then it will be discussed in the Lido token holders' conference on August 14; afterward, from August 15 to 24, the proposal will be revised based on feedback; finally, it will be submitted for a Snapshot vote on August 25.

Although there are some opposing voices within the community forum, most users' concerns focus on the specific details of the plan, such as the lack of clarity on whether the tokens will be burned after the buyback, and the methods and execution of the buyback still being insufficiently defined, among other issues.

Considering that the draft is still in its early stages, it is expected that further modifications will be made after the conference discussions. Coupled with the recent strong upward movement in LDO prices, there is an optimistic expectation that this draft or other buyback plans derived from it will receive a certain level of community support.

Is the "Prince" of ETH Finally Going to Discover Its Value?

As a widely recognized Beta of ETH, LDO's performance over a long period has been quite unsatisfactory.

While AAVE surged rapidly above $300 due to buybacks; ENA skyrocketed due to its business flywheel and treasury plans (see "Nearly 50% Increase in a Week, Could ENA Be the Biggest Beta of ETH?"); and PENDLE opened new imaginative spaces with Boros (see "Funding Rates Finally Become Tradable Assets, How Does Pendle's Sub-Platform Boros Disrupt the Arbitrage Market?"), LDO has long remained in a relatively weak state, even though the expectation of a "staking ETF" has been voiced for a long time, it has not been able to drive LDO's price performance over a relatively long period.

With the dual stimulation of current macro and micro factors, LDO finally shows some signs of trend reversal. Could this be the beginning of price discovery for this ETH "Prince"? It may be too early to make a judgment, but there is certainly some hope.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。