Today's homework is a bit simpler. Although the weekend has low liquidity, investor sentiment is good, driving the rise of $BTC and $ETH. I also closed my long position during this time, finally confirming that my recent trend judgment was not wrong. Next week, we will start a new short-term competition again. As mentioned yesterday, several macro data points will be released together starting next week, including CPI and retail data—one related to inflation and the other to the economy.

Although I personally believe that investors should be temporarily desensitized to the data, human nature is complex, so I dare not make any predictions. I will just watch patiently. However, I believe Trump still has cards to play, so if the market does drop due to the data, I might open a long position, but this time the margin for error will need to be a bit higher.

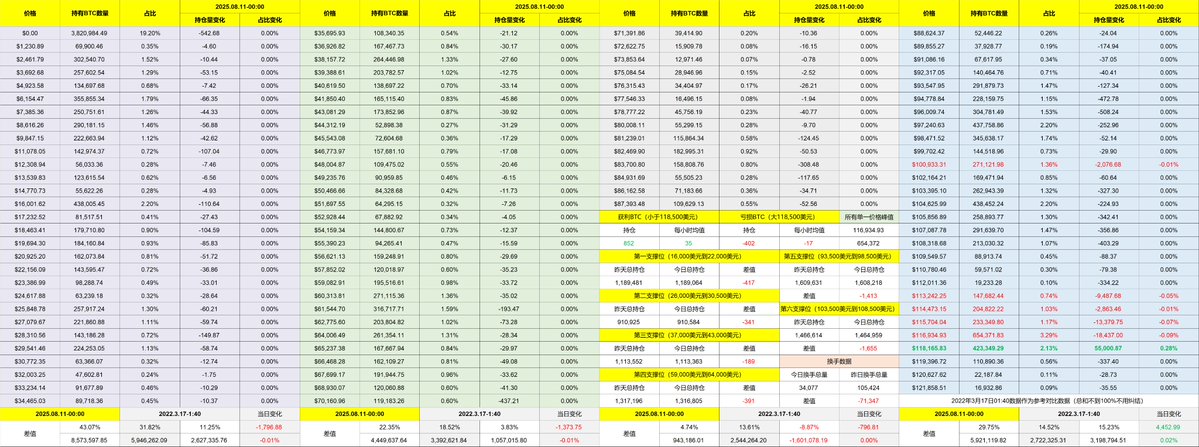

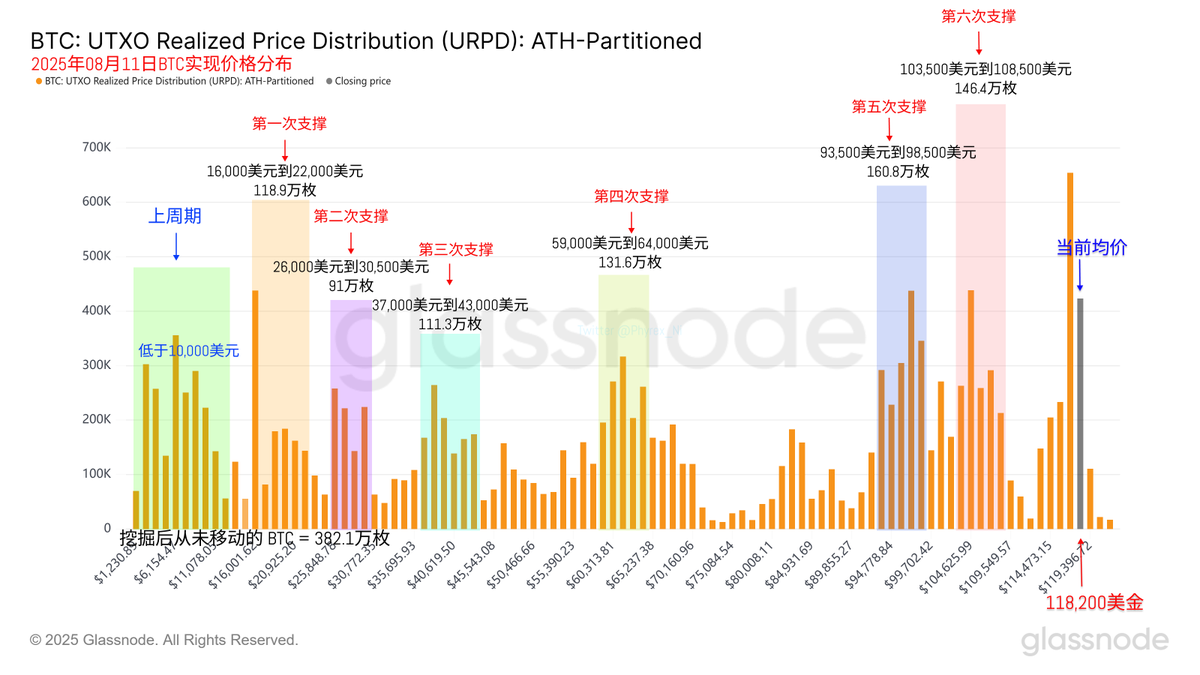

Looking back at Bitcoin's data, the turnover rate increased slightly over the weekend due to the price rise, but the increase is not significant. Only investors who bought the dip in the last two days show clear signs of exiting, while most other investors remain indifferent. However, it might be hard to say what will happen on Monday, especially with CPI data coming out on Tuesday. I wonder if there will be some risk-averse sentiment, as market expectations are not very good.

A decrease in turnover naturally has no impact on support levels. The investors at the two support levels are also very steady, and it feels like the seventh support level is gradually emerging. This situation resembles the first, second, and third support levels, and if it happens again, it is likely to lead to significant volatility.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。