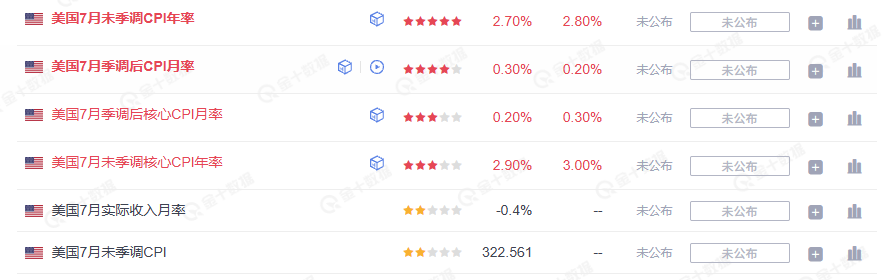

The weekend homework is easier to write, recently Trump seems to have been slacking off, and has been much quieter. Today, a friend asked if the CPI data will be released next week, and whether the market is panicking. I think it might have some short-term impact on the market, as inflation expectations are currently rising. However, the CPI data is also released by the Bureau of Labor Statistics, which makes it interesting.

Of course, this is a joke. My focus has shifted away from macro data because, regardless of the data, interest rate cuts are a priority for Trump. That's why he has added his people to the Federal Reserve and has been cozying up to Waller, essentially hoping to influence the Fed's decisions and quickly enter a rate-cutting cycle.

So as long as the CPI data isn't ridiculously bad, it won't have a significant impact on the game between Trump and the Fed. In the short term, the ultimate influence on the outcome will depend on Trump's influence within the Fed. If we look purely at the data, inflation has already risen even before tariffs were fully implemented, and Powell is unlikely to choose to cut rates in September. Moreover, the inflation data for August is expected to be unfavorable.

This is also what Trump does not want to see. Today, another member of Trump's camp, Fed Governor Bowman, publicly expressed support for three rate cuts in 2025 and for starting rate cuts in September, believing that high interest rates have already begun to affect the labor market. This is what Trump wants.

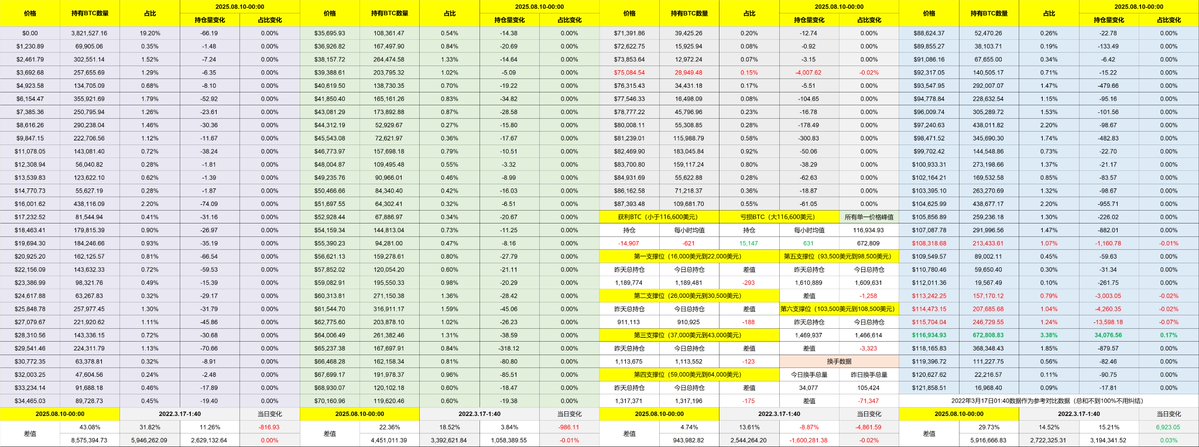

Looking at Bitcoin's data, after entering the weekend, the turnover rate has significantly decreased, returning to the stage where there is little interest in buying or selling. However, in the last two days, although the US stock market and $ETH have risen well, the rise of $BTC has lagged behind. I am indeed considering whether ETH is draining BTC.

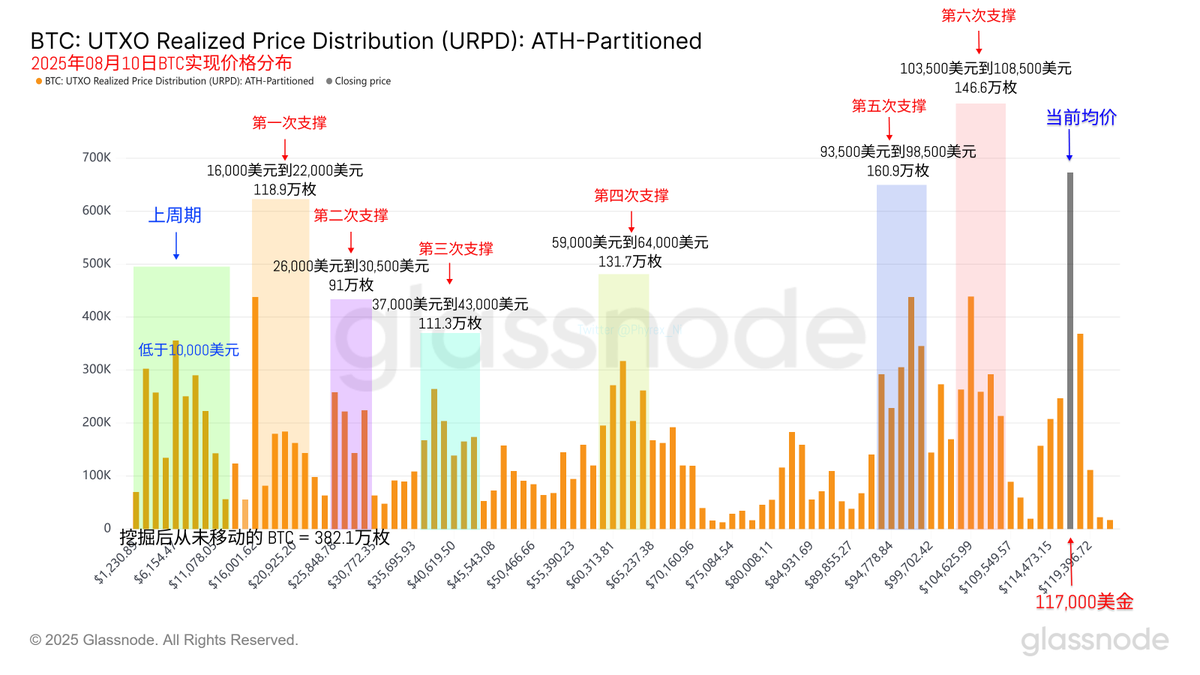

But from the trading volume of the ETHBTC trading pair, although the three major exchanges, Binance, OKX, and Coinbase, have all seen increases, there hasn't been an exaggerated situation of converting BTC to ETH. However, from the chip structure, it is clear that holders at the $117,000 level have been accumulating, and currently, there are over 670,000 BTC at this level.

In previous assignments, we also emphasized that the more chips accumulate at a single price, the greater the demand for directional choices from investors. Moreover, the more inventory at a single price, the greater the resistance to upward price movement. Considering the uncertainty of next week's macro data, I may close my long position before Tuesday, as I am currently making a small profit.

Support remains solid, and as long as there is no systemic risk, there is no need to consider it for now.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。