I. Introduction

In 2025, global cryptocurrency regulation is reaching a historic turning point. The once gray area of crypto assets is gradually being intervened and reshaped by the "invisible hand" of government. From the introduction and deliberation of a series of landmark crypto bills in the United States to the formal implementation of the "Stablecoin Regulation" in Hong Kong, major economies around the world are almost simultaneously shifting from a vague, wait-and-see, or even suppressive attitude to actively constructing clear regulatory frameworks. This global policy shift marks the end of the wild growth era for the crypto industry, moving towards a new stage characterized by compliance and accelerated integration with traditional finance.

This article aims to comprehensively review and deeply analyze the significant progress in global crypto policies since 2025 and to anticipate their profound impact on the future market landscape. We will first focus on the United States, dissecting its series of legislative, administrative, and regulatory measures; then, we will broaden our perspective to the global stage, overviewing policy dynamics in key jurisdictions such as the European Union, Hong Kong, Singapore, and the United Arab Emirates; we will then reveal the interaction between policy and market through the analysis of market prices, institutional movements, and on-chain data; finally, we will distill several core trends in future global crypto policies to provide forward-looking references and insights for investors navigating this transformative landscape filled with opportunities and challenges.

II. The Interaction Effect Between Crypto Policies and the Market

The crypto market in 2025 exhibits a clear policy interaction effect, repeatedly demonstrating a "buy the expectation, sell the fact" trend, as the hand of policy brings regulation and guidance to the crypto industry while reshaping the market's operational logic.

1. The Interaction Between Crypto Policies and Market Prices

At the beginning of 2025, Bitcoin continued its upward trend from the end of the previous year, briefly breaking historical highs and surpassing the $100,000 mark in early January. This surge largely reflected expectations of a "crypto-friendly" policy following Trump's election victory. However, market sentiment also experienced fluctuations: due to the delay in specific policy details in mid-January, Bitcoin's price saw a significant correction in February, dropping from the early January high (around $105,000) to about $70,000, with a monthly decline exceeding 17%. This volatility reflects investors' sensitivity to policy fulfillment—expectations drive up prices, while delays trigger corrections. In early March, when Trump hinted at establishing a national strategic crypto reserve on social media, the market was reignited: following the weekend announcement, Bitcoin surged by 20%, and altcoins like XRP skyrocketed by 25% within two days. However, the subsequent formal executive order did not include a plan for the government to directly purchase Bitcoin, leading the market to feel that "good news had been fully priced in," and Bitcoin fell about 6% after a brief spike.

As July approached with the "Crypto Week" in the U.S., legislative benefits gradually materialized, leading to a short squeeze in the market. In mid-July, Bitcoin broke previous highs and continuously set new records, surpassing $120,000 on July 14. During this phase, multiple positive factors converged: a series of bills (GENIUS, CLARITY, etc.) expected to pass in the House of Representatives were seen as milestones for the industry's future, prompting investors to position themselves early; simultaneously, the SEC's change in attitude accelerated the approval of spot Bitcoin and Ethereum ETFs, resulting in sustained and strong capital inflows into Bitcoin spot ETFs, driving prices to new highs. Crypto-related stocks also rose accordingly, with the share prices of U.S.-listed mining companies and major holders strengthening. Digital asset investment funds recorded net inflows of up to $3.7 billion in a single week, pushing the industry's managed asset scale to a historic high of $211 billion. Among these, Bitcoin-related products attracted $2.7 billion, dominating the market, while Ethereum also received considerable incremental funds. It can be said that policy dividends drove capital to "run into the market," directly boosting the significant rise in the market.

2. Exchange Liquidity and Institutional Movements

The improvement in the regulatory environment in 2025 is also reflected in the structure of trading markets. First, the liquidity of compliant exchanges in the U.S. has significantly rebounded. With clearer U.S. regulations and institutional participation, the order depth for Bitcoin on several licensed exchanges (such as Coinbase) has greatly increased, allowing the U.S. market to regain dominance in global Bitcoin 1% depth liquidity. The clear and professional execution environment creates positive feedback: deeper liquidity attracts more capital into the market, further deepening market thickness. Additionally, the behavior of institutional investors has changed significantly—beyond ETF capital inflows, U.S. listed companies and traditional institutions are once again enthusiastic about investing in Bitcoin. Strategy has repeatedly increased its Bitcoin holdings in 2025, reaching 628,791 BTC by July, accounting for 2.994% of the total Bitcoin supply. Several Wall Street asset management firms have also taken advantage of favorable policies to issue new crypto trusts and fund products, providing compliant exposure to clients. According to a report by CoinShares, digital asset investment products saw cumulative net inflows exceeding $10 billion in the first seven months of 2025, far surpassing the total for 2024. Even in traditional hedge funds, crypto assets are beginning to be viewed as a compliant component of investment portfolios.

Source: https://bitbo.io/treasuries/microstrategy

3. On-Chain Data and Liquidity

Long-term holders are becoming the absolute majority of Bitcoin supply. A Coinbase research report states that as of August 2025, approximately 85% of Bitcoin supply is held in long-term wallets, with the proportion available for trading at a historical low. A large amount of Bitcoin has not returned to exchanges after the early surge but continues to be stored in cold wallets. Correspondingly, the Bitcoin balance on exchanges has shown a continuous downward trend, indicating that investors prefer to hold Bitcoin long-term rather than engage in frequent trading.

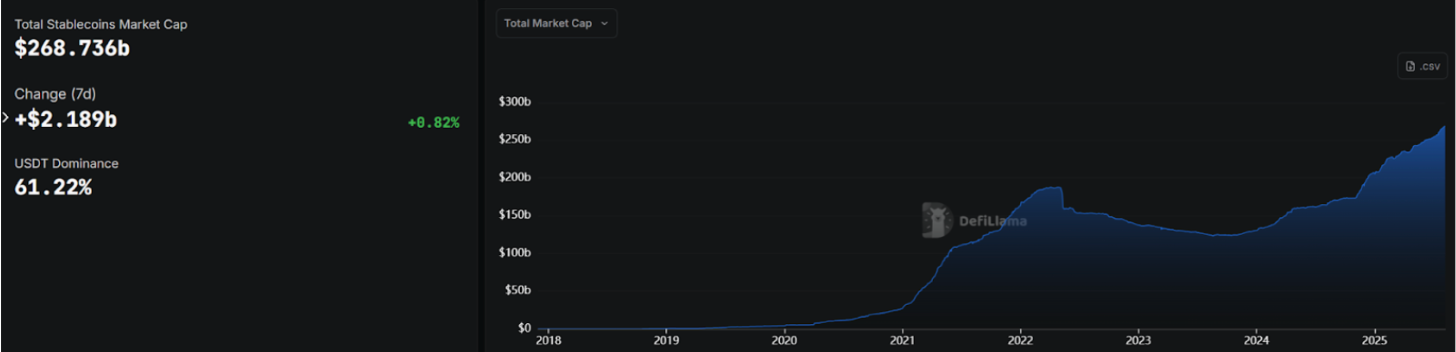

The supply of stablecoins and on-chain liquidity has rebounded significantly. After stagnation in 2022-2023, compliant stablecoins began to grow again in 2025, indicating that capital is seeking entry channels. The increase in stablecoin issuance is seen as a leading indicator of restored risk appetite. Especially against the backdrop of clear U.S. regulatory support for dollar stablecoins, the market capitalization of compliant stablecoins like USDC has rebounded, with monthly increases reaching several billion dollars. These stablecoins provide new liquidity to the market. On-chain data shows that the daily trading volume of dollar stablecoins grew by 28% year-on-year in mid-2025, with the total on-chain payment transaction volume for the year even surpassing that of Visa and Mastercard combined. This highlights the increasingly important role of stablecoins in global capital flows and reflects how regulation is pushing them from the gray area into mainstream payment networks.

Source: https://defillama.com/stablecoins

In summary, the market response in 2025 can be summarized as follows: the clarification of policies has led to a dual increase in incremental capital and holding willingness. Bitcoin, with its trust and liquidity, has become the biggest beneficiary, not only repeatedly setting new price highs but also increasing its market dominance to near peak levels in recent years. Ethereum closely follows, solidifying its position as "digital silver." Meanwhile, most competing coins have lagged or even been marginalized due to regulatory pressure or a lack of new narratives. On-chain, mainstream assets are accelerating their concentration among long-term investors, and trading behavior is becoming more rational. All of this indicates that the crypto market is gradually moving away from the wild era and towards a mature and stable period.

III. Progress of U.S. Crypto Policies

1. Breakthroughs in Crypto Legislation

In 2025, the U.S. achieved a milestone breakthrough in crypto legislation. In addition to the recently passed GENIUS Act and CLARITY Act, several other important legislative proposals related to cryptocurrencies are in progress, covering key areas such as CBDC prohibition, Bitcoin strategic reserves, consumer protection, mining, and taxation.

GENIUS Act: On July 18, Trump signed the GENIUS Act, marking the first comprehensive cryptocurrency legislation passed by the U.S. Congress, focusing on stablecoin regulation and prohibiting interest payments on them. This signifies an important step for the U.S. in digital asset policy. The GENIUS Act stipulates that only federally insured financial institutions (banks, credit unions, and specially approved compliant institutions) can issue payment stablecoins; issuers must maintain a 1:1 backing with fiat currency or high-quality reserve assets and undergo monthly reserve disclosures and regular audits; all stablecoin issuers must also comply with the Bank Secrecy Act, implementing anti-money laundering and anti-terrorism financing measures. The act aims to provide clear regulatory safeguards for the stablecoin industry and is seen as a "banking license" system for stablecoins.

CLARITY Act: Following this, the U.S. House of Representatives reviewed another significant bill, the CLARITY Act. This act aims to clarify the definition standards for whether digital assets are securities or commodities, delineating the regulatory responsibilities of the SEC and CFTC regarding cryptocurrencies. The CLARITY Act proposes to grant the Commodity Futures Trading Commission (CFTC) broader regulatory authority over non-security crypto assets while establishing a pathway for certain tokens that meet decentralization and functionality standards to transition from securities to commodities, thereby ending the previous "regulatory gray area." The CLARITY Act has passed the House and is awaiting Senate review.

CBDC Prohibition Act: Concurrently with the GENIUS and CLARITY Acts, measures have been proposed to prevent the issuance of a U.S. Central Bank Digital Currency (CBDC), which has passed the House and is awaiting presidential signature or Senate cooperation. This act aims to protect financial privacy and limit the Federal Reserve's expansion of intervention in the digital currency space.

BITCOIN Act: Proposed by Senator Cynthia Lummis on March 11, 2025, with bipartisan support. The act aims to consolidate Bitcoin obtained by the federal government through confiscation into a "strategic Bitcoin reserve" and requires the development of a purchasing plan, such as proposing to buy 1 million BTC over five years. It has been submitted to the Senate Banking Committee for review and has not yet entered the voting stage.

DCCPA: Jointly initiated by several senators, this act attempts to classify most crypto assets as "commodities" under CFTC regulation while strengthening consumer protection measures. This act was initiated in 2022 and is still under review.

FIT21 Act: Passed by the House in May 2024, it has not yet been voted on in the Senate. The goals of this act are similar to those of the CLARITY Act, clarifying the regulatory responsibilities of the CFTC and SEC, defining standards for decentralized blockchain industries, and providing exemptions for small-scale issuances, while also incorporating stablecoins into the regulatory framework and clarifying anti-fraud enforcement authority.

In addition, some states, such as Texas, passed state-level "Bitcoin Strategic Reserve" legislation in June 2025, allowing the government to invest in digital assets with a market value of at least $500 billion (such as Bitcoin). The White House Digital Asset Working Group released a comprehensive 160-page report recommending policies to accelerate updates to the tax code (such as redefining income from mining, staking, etc.), establish regulatory sandboxes, and simplify banking access systems, which align with several drafts (CLARITY, GENIUS, Anti-CBDC).

2. Administrative Measures and Regulatory Agency Shift

While legislation is advancing, administrative authorities and regulatory agencies have also taken a series of significant measures to reverse the uncertainty towards the crypto industry seen in recent years, beginning to coordinate various regulatory agencies from the top down to formulate a "unified" strategy for digital assets.

In January 2025, the newly appointed Trump administration issued a presidential executive order titled "Strengthening America's Leadership in Digital Financial Technology," explicitly prohibiting the development or use of any U.S. Central Bank Digital Currency (CBDC). This executive order reversed the previous administration's support for exploring CBDCs, citing the protection of financial privacy and monetary independence as reasons, directly halting the Federal Reserve's potential issuance of a digital dollar, and instead emphasizing support for dollar-backed stablecoins to maintain the dollar's dominance in the digital age. This order also stressed the protection of citizens' rights to participate in blockchain networks (including mining, node validation, and self-custody), requiring that no legal policies improperly restrict these activities. More importantly, the executive order rescinded the Biden administration's 2022 cryptocurrency executive order and the related framework from the Treasury Department, establishing the White House Digital Asset Market Working Group, led by the newly appointed "crypto czar"—former PayPal executive David Sacks. This working group brings together senior officials from the Treasury Department, the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Department of Justice, and other agencies, requiring each agency to submit a unified digital asset regulatory framework report within 120 days to eliminate regulatory overlap and vacuums. On August 7, Trump signed an executive order allowing alternative assets such as private equity, real estate, and cryptocurrencies to enter 401(k) retirement savings plans, opening the door to approximately $12.5 trillion in retirement account funds.

At the SEC, with the change in ruling party, there was a significant policy shift in 2025. Paul Atkins, the SEC chairman nominated by Trump, made establishing a digital asset regulatory framework a top priority upon taking office. He adopted a relatively lenient regulatory stance, actively promoting the easing of cryptocurrency regulations, including the approval of ETFs, regulatory guidance, and litigation settlements. On July 31, Atkins launched a program called "Project Crypto," aimed at comprehensively updating U.S. securities regulations to adapt to the blockchain and digital asset markets. He instructed SEC staff to develop clear guidelines to determine which crypto tokens qualify as securities and to draft disclosure and exemption plans to lower compliance thresholds. He also requested that the SEC collaborate with companies wishing to issue tokenized securities to promote pilot projects for traditional financial assets on the blockchain.

3. Financial and Accounting Policies

In terms of financial management and accounting standards, the U.S. also introduced supporting measures in 2025 to integrate crypto assets with the traditional financial system. In January 2025, the SEC released SAB 122, rescinding the controversial crypto custody accounting guidance SAB 121 from 2022. Previously, SAB 121 required banks and other institutions to account for customer-held crypto assets as both liabilities and equivalent assets on their balance sheets, a rule criticized by the banking industry for excessively occupying capital and hindering banks from providing digital asset custody services. Congress attempted to overturn SAB 121 in 2023, but it was vetoed by Biden.

Now, the SEC has withdrawn this requirement, allowing banks and other custodial institutions to avoid making high provisions on their books for holding customer crypto assets. The American Bankers Association (ABA) welcomed this, stating that it would "allow banks to act as custodians of digital assets with greater peace of mind." This indicates that the U.S. is removing barriers for traditional finance to participate in the crypto space at the accounting standard level, promoting the entry of compliant funds.

4. Strategic Reserves and Macroeconomic Policies

The Trump administration has also incorporated digital assets like Bitcoin into the national strategic vision. In March 2025, the White House issued an executive order to establish a "Strategic Bitcoin Reserve" and a "Digital Asset Reserve Account." According to this order, the federal government will concentrate Bitcoin obtained from law enforcement seizures into the strategic reserve, ceasing to sell or liquidate it, and authorizing the Treasury and Commerce Departments to study budget-neutral plans to increase holdings without increasing taxpayer burdens. Additionally, government agencies are required to report their holdings of all crypto assets to the Treasury and the President's Digital Asset Working Group to achieve centralized management of state-owned crypto assets.

The Trump administration emphasized that this initiative aims to make the U.S. one of the "first countries to establish an official Bitcoin reserve" to leverage Bitcoin's strategic value as "digital gold." U.S. officials estimate that the previous scattered disposal of seized Bitcoin has cost taxpayers over $17 billion in potential value. The new policy attempts to correct this by "locking up" these assets for national needs. The U.S. government's initiative to reserve crypto assets is unprecedented globally, reflecting a significant shift in U.S. policy from past high-pressure regulation to viewing crypto assets as strategic resources.

In summary, since 2025, the U.S. has launched a series of measures across legislative, administrative, and regulatory levels, referred to in the industry as the "spring of regulation." Under the leadership of the Trump administration, the U.S. is attempting to position itself as the "global crypto capital," reversing previous vague and suppressive policies through stablecoin legislation, clear market structure bills, and executive orders. These measures have had an immediate impact on the market: investor sentiment has significantly improved, and new funds are beginning to flow into the compliant U.S. market.

IV. Progress of Crypto Policies in Other Countries

Apart from the United States, many countries and regions around the world are also accelerating the improvement of their cryptocurrency regulatory frameworks in 2025, focusing primarily on stablecoins, anti-money laundering, and market regulations.

European Union: The EU's Markets in Crypto-Assets Regulation (MiCA) officially came into full effect at the end of 2024, providing a unified regulatory blueprint for member states regarding crypto assets. MiCA brings the issuance and services of crypto assets under EU financial regulation, establishing strict rules for stablecoins: only entities with an electronic money institution license or credit institution qualification can issue stablecoins pegged to a single fiat currency (EMT), while tokens backed by a basket of assets (ART) must be established in the EU and authorized by regulators. Stablecoin issuers must meet capital requirements, and reserve assets must be of high quality and liquid, with regular disclosures to regulators regarding reserve composition and audit reports. The implementation of MiCA makes the EU the first major economy to establish comprehensive crypto legislation. In the first half of 2025, regulatory agencies in member states (such as the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA)) were busy drafting technical standards to support MiCA, and crypto service providers such as exchanges and custodians began applying for cross-EU licenses. This unified regulation brings a certain attractiveness to the EU market, with expectations that by the end of 2025, a number of compliant trading platforms and stablecoin issuers will emerge in Europe.

United Kingdom and Australia: The UK passed the Financial Services and Markets Act in 2023, which includes provisions to regulate stablecoins and other crypto assets. This law grants the Treasury and the Financial Conduct Authority (FCA) the power to classify the issuance and services of crypto assets as regulated financial activities. From 2024 to 2025, the UK government will conduct consultations on specific rules, with the expectation of establishing detailed regulations for stablecoin issuance and crypto trading platform operations by the end of 2025, aligning them with the regulation of traditional financial institutions. The UK has a generally positive attitude, hoping to attract crypto businesses back to London through improved legislation. Meanwhile, Australia also took action in 2025: following the release of the "Token Mapping" report in 2022, the Australian government announced that it would propose draft regulations for crypto asset custody and exchange licensing in 2025, as well as improve tax guidelines for digital assets.

Hong Kong: Hong Kong is actively exploring becoming a testing ground for China's cryptocurrency policies, looking to open up exchange operations and public chain technology development, and establish a sandbox environment for technological regulation to provide a reference for mainland China's cryptocurrency policies. Hong Kong is committed to building an Asian compliant crypto center. The Hong Kong Securities and Futures Commission (SFC) implemented a licensing system for virtual asset trading platforms as early as June 2023. In 2025, Hong Kong regulators further expressed support for the development of compliant stablecoins and tokenized securities. The Stablecoin Ordinance, which came into effect on August 1, explicitly requires any issuer of stablecoins pegged to the Hong Kong dollar to obtain a license in Hong Kong; otherwise, it would be considered illegal. Reserve assets must be high liquidity, high-quality assets, and their value must be equivalent to the nominal value of the circulating stablecoins, subject to regulation and auditing by the Monetary Authority. These measures indicate that Hong Kong aims to strike a balance between investor protection and innovative development to attract global compliant crypto businesses. Currently, several large exchanges and crypto funds have chosen to establish offices or seek licenses in Hong Kong, and market liquidity has also rebounded.

Singapore: Singapore adopted an open attitude towards the crypto industry in its early years, attracting a large number of industry enterprises and talents. However, the collapse of the FTX exchange in 2022 caused significant losses for Singapore's sovereign funds like Temasek, and the failures of well-known crypto exchanges such as Three Arrows Capital and Terraform Labs damaged Singapore's reputation as a financial hub in Asia. Starting in 2023, the Monetary Authority of Singapore (MAS) gradually tightened relevant regulatory measures, requiring recognized stablecoins to meet standards for value stability, reserve custody, and capital adequacy, with issuers needing to obtain corresponding licenses. This led to exchanges like Binance, Bybit, and Huobi failing to obtain licenses and subsequently exiting the Singapore market by the end of 2023. In 2025, MAS continued to tighten regulations on cryptocurrency trading, stating that after June 30, only digital token service providers serving overseas clients must obtain a license from the authority to continue operating in Singapore; otherwise, they must shut down their trading platforms to curb financial crimes such as money laundering using cryptocurrencies. In terms of investment and innovation, Singapore launched sandbox programs like "Project Guardian" to explore decentralized finance for institutions. Overall, Singapore's attitude towards the crypto industry is "encouraging innovation, prudent regulation."

United Arab Emirates: The UAE has actively positioned itself as a crypto-friendly jurisdiction in recent years, with the Central Bank of the UAE launching the "Regulation of Payment Token Services" rules at the end of 2024. This set of rules defines fiat-backed stablecoins as "payment tokens" and adopts a tiered access policy: locally issued dirham (AED) pegged stablecoins can apply to become qualified payment tokens for domestic payment settlements, while foreign-issued stablecoins (such as USDT, USDC) cannot be used as payment means within the country and can only be used for investment trading purposes. The UAE encourages local banks or institutions to issue AED stablecoins and explores government-supported multi-asset reserve stablecoins (such as those pegged to government bonds or gold). The regulations also prohibit the issuance or use of algorithmic stablecoins and anonymous privacy coins within the country to prevent systemic risks and money laundering concerns. Additionally, the Dubai Virtual Assets Regulatory Authority (VARA) has gradually released rules on token issuance, marketing, and promotion from 2023 to 2025, requiring crypto companies operating in Dubai to be licensed and comply with a series of regulations regarding advertising disclosure and investor protection. Overall, the UAE is establishing a multi-tiered crypto regulatory system, aiming to make it one of the most attractive crypto hubs in the Middle East while ensuring financial security.

Thailand: In 2025, Thailand implemented a series of supportive and regulatory measures. On one hand, the Thai government announced that starting from January 1, 2025, capital gains tax would be exempted for digital asset transactions conducted through licensed crypto trading platforms for five years, encouraging the development of compliant trading. This effectively provides tax incentives for investors to participate in crypto investments within a regulated environment, likely enhancing the attractiveness of the Thai market. On the other hand, the Thai Securities and Exchange Commission revised regulations in April 2025, requiring foreign crypto service providers (exchanges, brokers) offering services to Thai citizens to register and obtain licenses in Thailand; otherwise, they would be considered illegal operations. At the same time, the Thai SEC strengthened its regulation of crypto advertising and investor suitability.

Pakistan: Pakistan has shifted from a previously vague or even prohibitive stance on crypto to embracing virtual assets to promote financial modernization. In July, the Pakistani government officially approved the "2025 Virtual Assets Bill," establishing the Pakistan Virtual Assets Regulatory Authority (PVARA) as an independent regulatory body responsible for licensing and supervising cryptocurrency and virtual asset service providers nationwide. This framework is similar to Dubai's VARA model, aiming to introduce licensed operations and risk control to the domestic crypto industry. Jameel Ahmad, the Governor of the State Bank of Pakistan, stated that a digital rupee (CBDC) pilot is about to launch, and legislation will establish the licensing and regulatory foundation for virtual assets. Pakistan has also formed a Crypto Committee (PCC) to promote innovative projects such as blockchain and Bitcoin mining, even inviting Zhao Changpeng, the founder of the world's largest exchange, as an advisor, and plans to establish a national Bitcoin reserve. Overall, Pakistan is attempting to shift from strict suppression to active regulation, hoping to gain a share in the emerging digital finance sector.

Turkey: As an emerging market country with a large crypto user base, Turkey implemented strict new regulations in 2025 to combat illegal activities and maintain financial stability. The Ministry of Finance's Financial Crimes Investigation Board has begun to implement a series of anti-money laundering regulations for crypto: all crypto transactions require mandatory real-name authentication, and transactions exceeding 15,000 lira must be reported for review; all transactions are subject to a delayed settlement mechanism—ordinary transfers take 48 hours to complete, and the first withdrawal must wait 72 hours. Additionally, the new regulations impose a cap on the circulation of stablecoins: individual daily stablecoin transaction amounts cannot exceed the equivalent of $3,000, and the monthly total cannot exceed $50,000. Finance Minister Mehmet Simsek stated that this move is intended to "prevent the laundering of illegal gambling and fraud funds through cryptocurrencies." With an estimated one-fifth of Turkey's population having participated in crypto investments and the country ranking third globally in trading volume, the regulatory new rules have a wide-ranging impact on the market. In the short term, the new regulations may reduce on-market liquidity, but in the long run, they are expected to help clean up illegal fund flows and enhance the legitimacy and transparency of Turkey's crypto ecosystem.

India: The Indian government's attitude towards cryptocurrencies remains cautious and conservative, but there are signs of some softening. Since 2022, India has imposed a heavy tax of 30% on crypto trading profits and a 1% tax deducted at source (TDS), leading to a sharp decline in domestic trading volume. However, during its G20 presidency in 2023, India promoted the development of a joint framework for global crypto asset regulation by the IMF and FSB, indicating a tendency to act in unison under international rules. As of 2025, India has not yet introduced specific crypto legislation, and domestic crypto exchanges continue to operate under difficult conditions. However, government officials have repeatedly stated that they will not impose a blanket ban on crypto but will wait for international consensus. Regarding CBDCs, the Reserve Bank of India is gradually expanding the pilot scope for the digital rupee. In the future, India may choose to adjust its domestic policies after global standards become clearer.

Russia: Russia has implemented a "differentiated" crypto regulatory strategy. Domestically, the use of cryptocurrencies as a means of payment remains strictly prohibited, while the promotion of the digital ruble (CBDC) is accelerating to strengthen state control over the monetary system. However, at the international level, to circumvent Western financial sanctions, Russia's attitude towards cryptocurrencies has become noticeably open. In early 2025, the "Law on the Use of Digital Financial Assets in International Settlements" officially came into effect, providing a legal framework for Russian importers and exporters to use cryptocurrencies for trade settlements with friendly countries. This law authorizes specific enterprises to use mainstream cryptocurrencies such as Bitcoin and Ethereum, as well as stablecoins, in foreign transactions to bypass the SWIFT system. Additionally, the Russian government is actively promoting the regulation and taxation of the cryptocurrency mining industry, hoping to convert the country's abundant energy advantages into national fiscal revenue and foreign exchange reserves, achieving the strategic goal of "nationalizing crypto mining."

In addition to major economies, some small countries are also exploring crypto pathways. Bhutan, as a small country in South Asia, continued to deepen its "green mining" strategy in 2025, combining Bitcoin mining with its abundant hydropower resources to support national fiscal revenue and economic development. The Bhutanese government announced in April 2025 that it would collaborate with international enterprises to build multiple sustainable mining centers, aiming to become Asia's "green crypto mining center." On the other hand, El Salvador continues and expands its national Bitcoin strategy, having made Bitcoin legal tender in 2021, and in 2025 announced the establishment of a "Bitcoin National Wealth Fund" to strengthen the country's Bitcoin reserve scale. Additionally, the El Salvador government has launched a dedicated Bitcoin bond issuance project, planning to use the raised funds to build "Bitcoin City," further reinforcing Bitcoin's strategic support for the national economy.

Overall, in 2025, various countries' policies have been implemented, reflecting both convergence and divergence: developed economies emphasize establishing comprehensive regulatory frameworks, while emerging markets focus more on preventing financial crimes and leveraging crypto opportunities. Regulation of stablecoins is a common focal point, with Europe, the U.S., and Hong Kong having established rules to ensure stablecoins have sufficient reserves and controlled issuance. Regulation of exchanges and anti-money laundering measures are also high-frequency themes, with countries beginning to apply KYC/AML standards similar to those in traditional finance to crypto trading activities. It is foreseeable that the legal status and regulatory requirements for cryptocurrencies in major global jurisdictions will gradually become clearer.

Global Crypto Policy Trends and Outlook

Looking ahead to the remainder of 2025 and beyond, cryptocurrency policies may exhibit the following trends, which could have a profound impact on the global market landscape:

1. Accelerated Global Regulatory Convergence: The policy direction of the United States may drive major global economies toward similar regulatory frameworks. On one hand, the GENIUS Act sets a benchmark for stablecoin regulation, with its requirements for compliant reserves and licensing potentially serving as a reference for other countries. For example, regulatory agencies in countries like Japan and South Korea are reportedly assessing the implications of the new U.S. regulations for their own stablecoin policies, while the EU will observe how the U.S. implements this act to adjust its own regulatory details. On the other hand, the challenges of distinguishing between securities and commodities, which the CLARITY Act seeks to address, are also common challenges faced by many countries. If the U.S. successfully classifies tokens with a certain market capitalization and level of decentralization as non-securities, this could provide regulatory insights for jurisdictions like the UK and Singapore that wish to develop crypto finance, reducing the "legal vacuum." At the same time, cross-border regulatory cooperation will strengthen. Under the G20 framework, the IMF and the Financial Stability Board (FSB) proposed high-level guiding principles for crypto asset regulation in 2023, and it is expected that by the end of 2025, countries will formulate their own regulations based on these principles and engage in information sharing.

2. More Institutionalized and Commoditized Market Structure: The shift in U.S. regulation is expected to bring traditional finance into the crypto space significantly, a trend likely to continue. By the end of 2025, the CFTC may introduce a regulatory framework for on-chain commodity trading, guiding more commodities and indices to be traded on-chain in token form and subject to compliance oversight. This will further commoditize and financialize the crypto market, deeply integrating the digital asset market with traditional commodity markets. Additionally, more types of crypto ETFs and investment products will emerge. Following Bitcoin and Ethereum ETFs, regulators may approve a basket of crypto index ETFs, options ETFs, etc., facilitating institutional allocations. Some large Wall Street institutions are already preparing to issue actively managed crypto funds and pension fund crypto portfolios when policies allow. Bitcoin may gradually exhibit macro sensitivity similar to gold or the Nasdaq index, becoming an "alternative asset" in institutional asset allocation.

3. Competition and Division of Regional Compliance Centers: In Asia and the Middle East, regions like Hong Kong, Singapore, and Dubai are competing to build regional crypto hubs. Hong Kong, backed by mainland China and its robust financial infrastructure, along with the intensive introduction of exchange and stablecoin regulatory systems from 2023 to 2025, has attracted many well-known trading platforms and projects. Singapore continues to be a breeding ground for blockchain startups due to its sound legal system, tax advantages, and business-friendly environment. The collaboration between these two regions is expected to establish Asia's significant position in the global crypto landscape. The UAE (Dubai) and Saudi Arabia in the Middle East are also not falling behind, attracting pressured crypto businesses from Europe and the U.S. through relaxed tax systems and open regulations. In the coming years, we may see a multi-center pattern: North America with crypto financial centers like New York and Miami, Europe with cities like Switzerland and Paris actively embracing regulation, Asia shining with the dual stars of Hong Kong and Singapore, and the Middle East using Dubai as a stronghold. These compliance highlands will dominate the flow of compliant funds and projects.

4. New Opportunities in the Integration of Technology and Compliance: Clear policies will unleash new momentum for industrial innovation. Once it is clear which behaviors are prohibited, companies can boldly invest in permitted directions. For example, while the U.S. prohibits CBDCs, it supports private stablecoins, which may lead to a surge in bank-issued USD stablecoins, with traditional banks and fintech companies collaborating to launch various compliant stablecoins to fill payment gaps, representing a huge market potential. The issuance of security tokens is expected to heat up, with on-chain stocks and bonds listed on compliant exchanges. Blockchain technology will see more applications in traditional areas such as supply chain finance and trade settlement. Even Web3 technologies like decentralized identity (DID) and zero-knowledge proofs may find applications in privacy compliance and digital identity verification, achieving innovations in compliance technology.

5. Evolution of Investor Behavior: The evolution of policies will also profoundly impact investor sentiment. After experiencing regulatory pressure in 2022-2023, global investors have shown a stronger awareness of compliance and risk management in their rebound in 2025. In the near future, we may see U.S. pension plans officially allowing allocations to Bitcoin ETFs, and some countries' sovereign wealth funds publicly announcing allocations to digital assets as a long-term strategy. These developments will further strengthen the market's fundamentals and reduce excessive speculation. Of course, under the new policy environment, the market may also exhibit new volatility patterns— for instance, due to the participation of institutional algorithmic trading, short-term market fluctuations may closely follow macro news and liquidity changes, requiring investors to adapt to the rhythm of an institutionalized market, which differs from the emotional ups and downs driven purely by retail investors in the past.

Conclusion

The cryptocurrency world in 2025 is undergoing a profound transformation from disorder to order. Compliance has become the main theme, with major global economies extending a "visible hand" to this emerging field from their respective perspectives, either by formulating laws or issuing guidelines to bring crypto assets into the financial system's proper track. In the long run, this policy evolution will profoundly shape the infrastructure and investment environment of the crypto industry. Clearer rules will drive out bad money and retain good money, allowing the industry to bid farewell to its barbaric growth phase and enter a new stage of compliant and orderly development. For ordinary investors, this means that crypto investment is no longer an adventure adrift in a gray area but is expected to gradually become a legally protected, transparent, and sustainable asset allocation choice.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Every week, our researchers will also engage with you through live broadcasts to interpret hot topics and predict trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors invest based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

[Mail: labs@hotcoin.com](mailto:Mail: labs@hotcoin.com)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。