Today's homework is a bit complicated. Although the price of $ETH has surpassed $4,000, it doesn't feel like the friends in the crypto circle have entered into FOMO. Even after the announcement of 401K entering the cryptocurrency industry, the FOMO sentiment among investors has not manifested. Although the price of $BTC is gradually stabilizing, purchasing power has not shown a significant increase.

From the data of Bitcoin, there has been no increase in trading volume in the last 24 hours due to the favorable news of 401K. Not only in exchanges, but even the trading volume of $IBIT has not shown significant signs of increase; overall purchasing power remains at a normal level.

This aligns with what we have been saying: the current rise in BTC prices is not due to an increase in purchasing power, but rather a significant correlation with reduced selling pressure. However, unlike BTC, after the announcement of 401K, the trading volume of ETH has shown a noticeable increase.

Not only has the trading volume of ETH on exchanges increased, but the trading volume of the spot ETF $ETHA has also risen. This situation is quite different from BTC, and it feels like funds are starting to gravitate towards ETH, especially with traditional ETF funds driving the trading volume in both primary and secondary markets.

Today's performance of the US stock market is also good. The Nasdaq has once again broken new highs, completely emerging from the shadow of last Friday's decline. Although the S&P 500 hasn't reached a new high, it has risen nearly 0.8%, and the gap from the historical peak is now very small. If this trend continues, creating new highs next week shouldn't be a problem, and for Bitcoin, which is highly correlated with the US stock market, it shouldn't be too bad either.

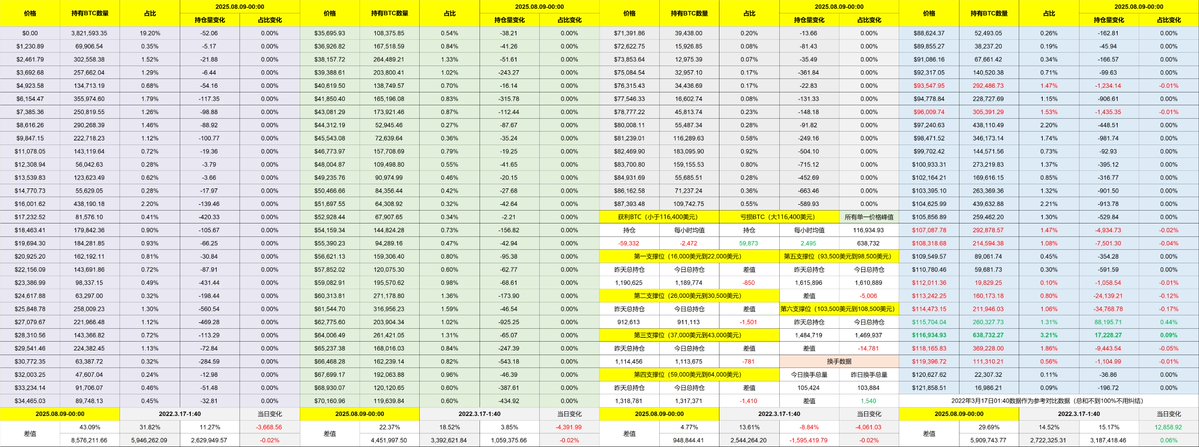

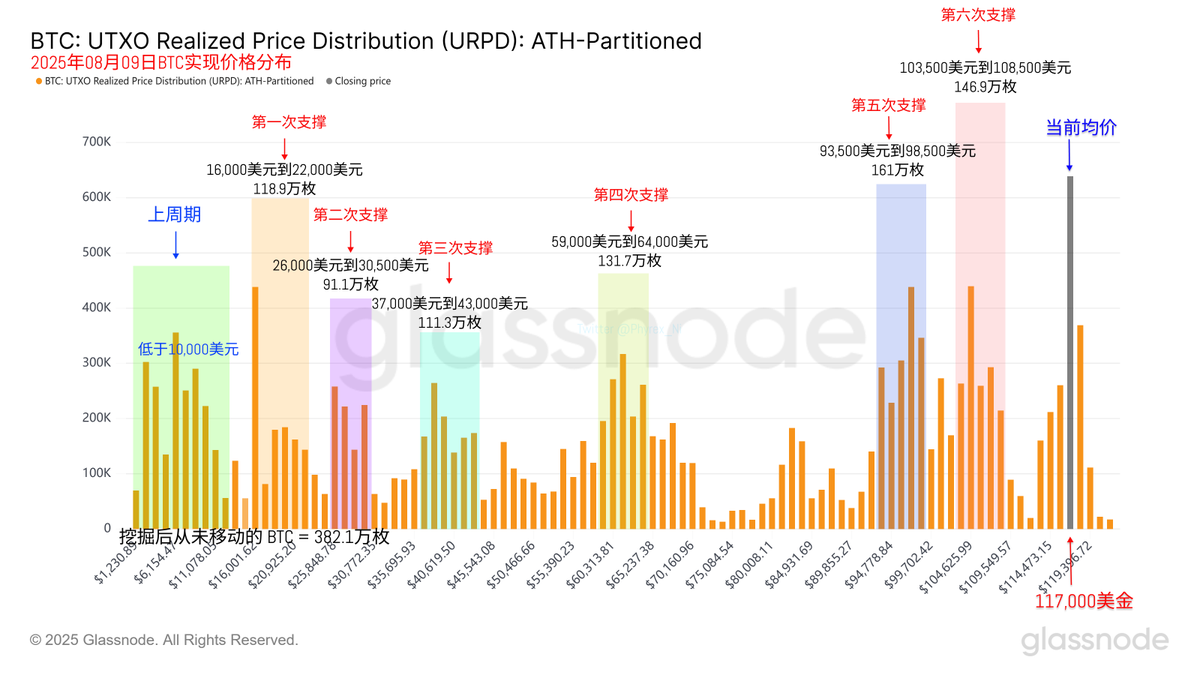

From the current data of Bitcoin, the turnover rate has slightly increased but remains within a relatively normal range. Short-term investors with a holding cost exceeding $107,000 are currently the main force in turnover. Although the $117,000 level doesn't feel stable, it has dropped below that many times today, but the accumulated BTC is nearly 640,000 coins, suggesting that a directional choice is imminent.

Other data looks good; the current support remains unchanged, and there has been little reduction in holdings from investors in the two main support areas. The stability of these two positions is also improving. Even last week, despite poor sentiment, it did not drop below $110,000. It seems that as long as there is no systemic risk, the support should be very solid.

We have now entered the weekend market. I am still holding my long position and not in a hurry. Let's see how investor sentiment reacts to liquidity over the weekend; it feels like this weekend shouldn't be too bad.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。