Shanzhai Season vs. Small-Cap Stocks

Tonight, I saw a news article from Bloomberg stating that the short positions of U.S. stock traders in small-cap stocks have reached their highest level since 2022.

This indicates that institutions and traders may believe that an economic slowdown, high interest rates, or financing costs will have a greater impact on small-cap stocks, as they typically rely more on the credit environment. Once liquidity tightens, price fluctuations become more severe. Currently, we are indeed in a period of tight liquidity.

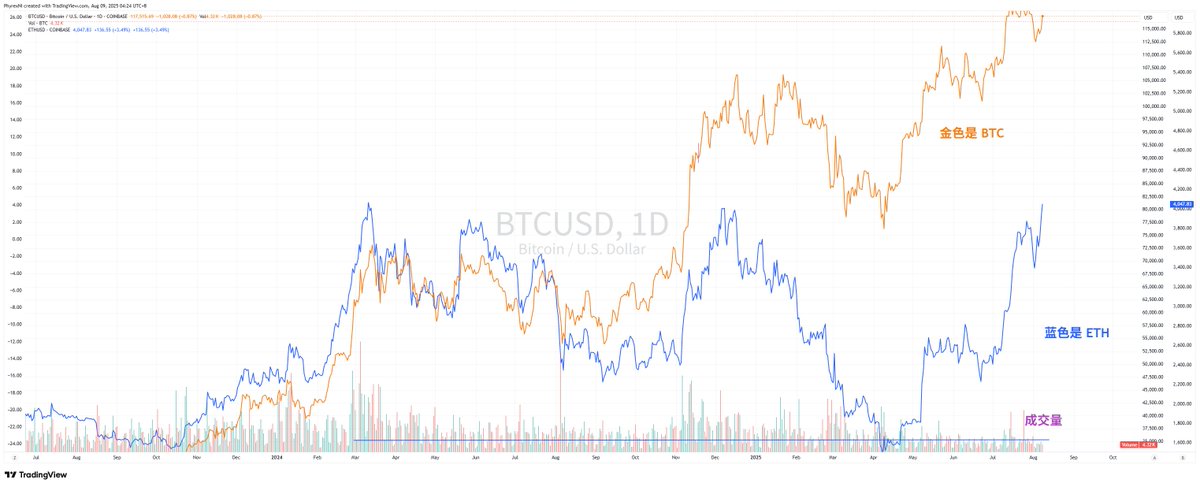

So, what does this have to do with Shanzhai Season? I have previously discussed with friends that the price movements of $ETH have a strong correlation with the Russell 2000, which represents small-cap stocks in the U.S. market. ETH is often considered the leader of altcoins, and I have even stated before that the arrival of Shanzhai Season is closely tied to the rise of ETH. After all, only when ETH rises and attracts more overflow funds is it possible to bring about Shanzhai Season.

Now that ETH has surpassed $4,000, rising over 3.6% today and even exhibiting a "bloodsucking" effect on $BTC, does this mean Shanzhai Season is about to arrive?

I maintain a pessimistic view because this rise in ETH is different from the comprehensive bull market that started in 2021 or even earlier. I have spent a lot of time explaining that this rise in ETH is largely driven by spot ETFs, while the purchasing power for ETH in the native cryptocurrency space has not significantly increased.

Under the leadership of $ETHA, the secondary market trading volume of ETH spot ETFs has surged, surpassing the trading volume of the ETHUSD pair on Coinbase over the past month. Moreover, the purchasing power in the primary market for ETFs has become comparable to that of $BTC, whereas in the best case over the past year, it could only reach 30% of BTC's trading volume.

More importantly, this wave of increase has little to do with ETH itself. ETH is still the same ETH that was hovering around $2,000 when BTC broke through $100,000; fundamentally, nothing has changed, and the narrative has not changed either. Although many friends are talking about "changing the main player," I prefer to think of it as BlackRock and Wall Street positioning themselves for "on-chain brokers."

In March 2024, when Bitcoin broke its historical high and entered the $70,000 range, ETH also soared to $4,100 under ETF expectations, which was $100 higher than now. Everyone was looking forward to the arrival of Shanzhai Season, but what happened? Although it did rise for more than a month, compared to the Shanzhai Season of 2021, it ended before it even officially started.

This is because there is not enough overflow capital. The investors in BTC spot ETFs are mostly long-term investors, and even if they made profits, they did not fully exit. Even if some investors did exit, they showed no interest in altcoins. Therefore, while BTC may continue to have a chance to surge to $100,000, ETH has fallen behind, let alone altcoins.

A similar historical occurrence happened at the end of 2024 when Trump won the election, which was also the second time ETH surged to $4,100 in 2024. Many altcoins reached their historical highs in 2024 and 2025, either in March 2024 or during the end of 2024 and early 2025, and this time the duration was even shorter.

Again, the rise of BTC did not truly bring about a recovery in liquidity; it was mainly due to Trump's policies, leading more investors to want to invest in BTC, while more BTC holders were reluctant to sell their BTC.

Let’s think differently: the "Seven Sisters" have driven the S&P and Nasdaq to continuously break new highs, but aside from the "Seven Sisters," many of the top 100 listed companies globally have poor stock price trends, such as CMCSA and ON, not to mention Nike. This indicates that new highs in the S&P do not necessarily lead to an increase in all stocks. The current liquidity is indeed not good, and assets prefer to invest in high-growth, high-discussion, and defensive stocks, mainly in AI and robotics.

Thus, overflow capital will not invest like it did during periods of monetary easing; investors' risk appetite remains relatively tight, especially since U.S. Treasury yields are quite attractive.

Therefore, when monetary policy has not fully shifted, more U.S. stock investors are shorting small-cap stocks, as the rise of small-cap stocks may just be a flash in the pan.

In the cryptocurrency space, altcoins may see more investors betting on sector rotation due to the rise of ETH, but this portion of capital may not be able to support a large-scale Shanzhai Season.

Of course, I may not be right, and I do not recommend shorting; I personally will not short.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。