Original Title: "Trump's TMTG: Q2 Loss of $20 Million, Transforms into the Sixth Largest BTC Holding Giant"

Original Source: Dingdong, Odaily Planet Daily

Trump Media & Technology Group (TMTG) recently released its Q2 2025 financial report, showing a net loss of $20 million, of which approximately $15 million was related to legal fees associated with its merger with a special purpose acquisition company (SPAC). As a result, the company's stock price fell by 3.8%.

However, behind this seemingly pressured financial report lies a hidden agenda: TMTG is quietly pushing for a critical strategic transformation—from a social media platform to a high-risk, high-leverage crypto fintech company, with Bitcoin and crypto financial services as its core weapons.

Starting from a Social Platform: TMTG's Political DNA and Traffic Origins

TMTG was founded by U.S. President Donald Trump in February 2021, headquartered in Sarasota, Florida, positioning itself as a "free expression" platform to counter content censorship by large tech companies. Its core product, Truth Social, was born in the context of Trump's bans from Facebook and Twitter following the January 6, 2021, Capitol incident, targeting conservative users as its main audience, attempting to create an alternative public opinion platform outside mainstream platforms. Previously, Trump had attempted to launch a personal website, but it was closed after just one month.

In October 2021, TMTG went public through a merger with the SPAC Digital World Acquisition Corp (DWAC), with the stock code DJT. Trump is the largest shareholder of TMTG, and in December 2024, he transferred approximately 115 million shares (valued at about $4 billion) to a trust fund controlled by his eldest son, Donald J. Trump Jr., without selling the shares or receiving any compensation, referred to as a "gift." This equity arrangement further strengthened the binding of TMTG with the "Trump brand." Trump has also stated that he will not leave Truth Social and will not sell his shares in Trump Media Group.

However, TMTG has not stopped at being a social network. Backed by Trump's political capital and media presence, the company is gradually building a diverse ecosystem around content, finance, and technology. From the streaming platform Truth+ (focusing on family-friendly and Christian content) to planned crypto payment and utility token mechanisms, and the financial technology and asset management business driven by Truth.Fi, this startup media company is attempting to blur the lines between "media" and "tech finance," telling a higher multiple growth story to the capital markets.

TMTG's diversified layout is closely tied to the political influence of its founder, Trump. Truth Social is not just a social platform but also an extension of the Trump brand effect. However, its user base is relatively niche, and its profit model is not yet mature, making its growth strategy reliant on Trump's personal reputation uncertain. The layout in crypto and streaming aims to break through in high-growth areas.

Q2 Financial Report Interpretation: Bitcoin Strategy Drives Asset Surge

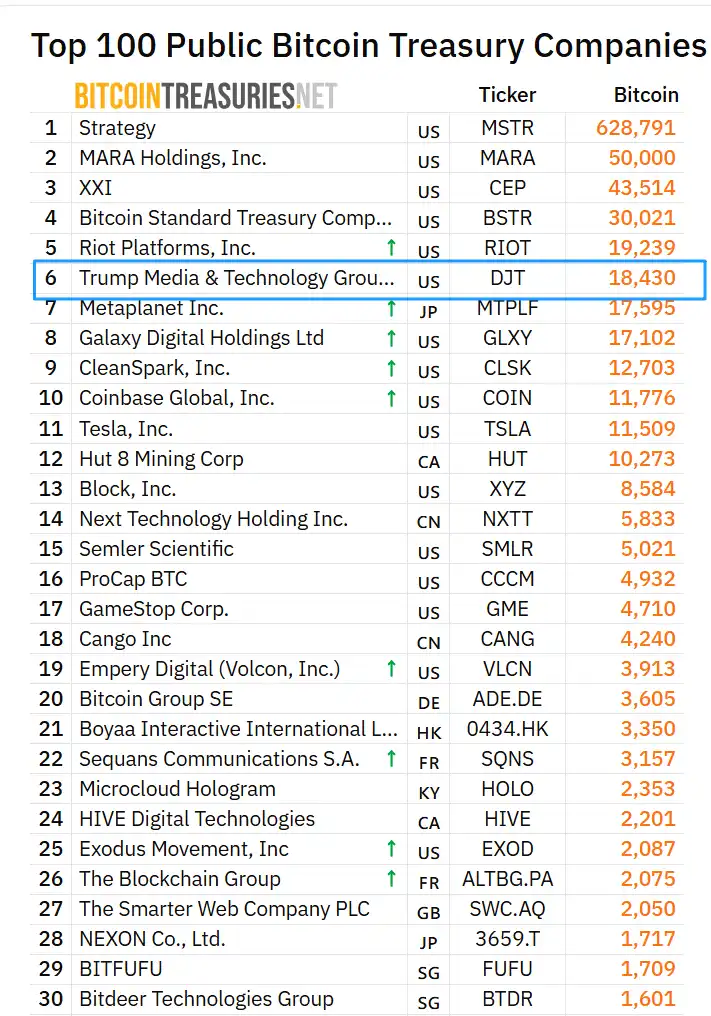

Despite significant losses, one data point in the Q2 financial report stands out: as of June 30, 2025, TMTG's financial assets have surged to $3.1 billion, with an annual growth rate of nearly 800%. The main reason for this is the comprehensive advancement of its Bitcoin strategy. The company raised $2.4 billion in special funds for crypto asset allocation and held approximately $2 billion in Bitcoin assets in July, ranking it among the world's sixth largest publicly traded Bitcoin holders.

It is noteworthy that despite the rapid growth in assets, TMTG's core revenue has remained weak. According to public data:

- In 2023, the company's revenue was $4.1 million, with a loss of $325 million;

- In 2024, annual revenue fell to $3.6 million, with losses widening to $400.9 million.

The massive losses over these two years reflect significant challenges for TMTG in terms of business model, user growth, and monetization capabilities. Although it has traffic attraction due to Trump's personal brand, in terms of advertising revenue, TMTG lags far behind mature social platforms like X (formerly Twitter), making it difficult to attract stable advertisers and long-term investors.

To some extent, TMTG is attempting to use the high volatility of crypto assets as a "financial engine" to compensate for the sluggish growth of its core business.

In June 2025, TMTG submitted a registration to the U.S. Securities and Exchange Commission (SEC) to issue over 84.65 million shares of common stock, with a valuation of up to $12 billion, demonstrating strong ambitions for capital operations. According to the Financial Times, TMTG had planned to raise $3 billion through the issuance of stocks and convertible bonds to increase its crypto allocation, although this was officially denied. However, the $2.44 billion financing and ETF registration that took place at the end of May have provided a realistic footnote for this strategy.

Currently, TMTG has submitted registration documents for several ETF products to the SEC, including the Truth Social Crypto Blue Chip ETF, Truth Social Bitcoin and Ethereum ETF, and Truth Social Bitcoin ETF, indicating that a financial productization offensive led by political figures is about to unfold.

Market Valuation: Cautious Premium and Market Differentiation

As the valuation logic of "Bitcoin treasury companies" like MicroStrategy and Semler Scientific is gradually accepted by the market, TMTG's valuation as a "political crypto hybrid" has also drawn attention. NYDIG's global research director Greg Cipolaro pointed out in a report on June 6 that TMTG (DJT) and Semler Scientific (SMLR) have the lowest "equity premium to net asset value (NAV)," at -16% and -10%, respectively. When Bitcoin prices rose to $108,500 in June, MicroStrategy's stock price increased by nearly 5%, while TMTG and SMLR's stock prices remained almost unchanged.

The market clearly has not yet formed sufficient confidence in TMTG's crypto strategy, which is due to concerns about its early exploratory phase and a sentiment of avoiding its political risk exposure. In the current highly financialized crypto market, whether participants like TMTG, which are highly politicized, can break free from the shadow of "Trump concept stocks" and gain value recognition based on financial and asset metrics remains a significant question.

The Offensive and Defensive Ends of the Crypto Field: Comprehensive Penetration from ETFs to Mergers

In addition to the Bitcoin treasury strategy, TMTG's offensive in the crypto ecosystem is increasingly multi-faceted. The company recently signed a non-binding agreement with Crypto.com to launch a series of ETFs covering digital assets and securities in the U.S., with the first products expected to cover mainstream assets like BTC, ETH, SOL, and XRP, and plans to expand to European and Asian markets in the future, with Crypto.com providing underlying infrastructure and custody services.

At the same time, TMTG is in talks to acquire the crypto trading platform Bakkt. Bakkt was incubated by the Intercontinental Exchange, and its former CEO Kelly Loeffler is now co-chair of Trump's inauguration committee, giving this potential deal a strong political flavor. After the news of the deal broke, Bakkt's stock price surged over 162% in a single day, and TMTG's stock price also rose significantly.

Additionally, TMTG's executive team has established a new SPAC company, Renatus Tactical Acquisition Corp I, planning to raise $179 million through IPO and private placements for acquisitions in the fields of cryptocurrency, blockchain, secure computing, and dual-use technologies. Its CEO is Eric Swider, a member of TMTG's board, while the board chair is Devin Nunes, TMTG's current CEO, and COO Alexander Cano also has a TMTG background. The leadership of Renatus Tactical is highly overlapping with TMTG, which may provide certain strategic synergies. It is worth noting that appointments made by the Trump administration to regulatory bodies like the SEC and the Department of Justice may affect the review of such merger transactions.

Currently, TMTG is attempting to break away from the single trajectory of traditional media companies, no longer satisfied with relying on social platform traffic monetization, but rather trying to transform the political momentum carried by the "Trump" brand into capital leverage in the crypto financial market. By increasing Bitcoin holdings, launching ETF products, and venturing into blockchain and asset management, TMTG is deeply embedding itself in the high-volatility intersection of technology and finance. As the narrative in crypto becomes increasingly "institutionalized" and "formalized," this highly politicized hybrid is also vying for its own share of the dividend zone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。