In the third quarter of 2025, the cryptocurrency market enters a critical turning point under the interplay of volatility, innovation, and clearer regulations. Mainstream cryptocurrencies are experiencing strong increases, compliance boundaries are gradually becoming clearer, and security risks are frequent, driving a dramatic reshaping of the industry landscape, giving birth to new life amid the turmoil.

In this round of transformation, LBank stands out with its unique advantages in the discovery of hundredfold coins, strengthening its leading position in the high-potential asset field, and is reshaping the key role of exchanges in the popularization of cryptocurrency. To delve deeper into its strategic layout and judgment on the future of the industry, Odaily specially interviewed Czhang, head of LBank Labs and partner at LBank.

Question 1: Can you introduce your role at LBank and briefly explain what achievements LBank has made in this competitive market?

Czhang: I currently serve as the head of LBank Labs and am also a partner at LBank, focusing mainly on the overall investment strategy of the platform, project incubation system, and the construction of innovative directions. Today, LBank is no longer just a platform for trading early-stage crypto projects; it has gradually evolved into a key driver in the discovery and growth of quality projects.

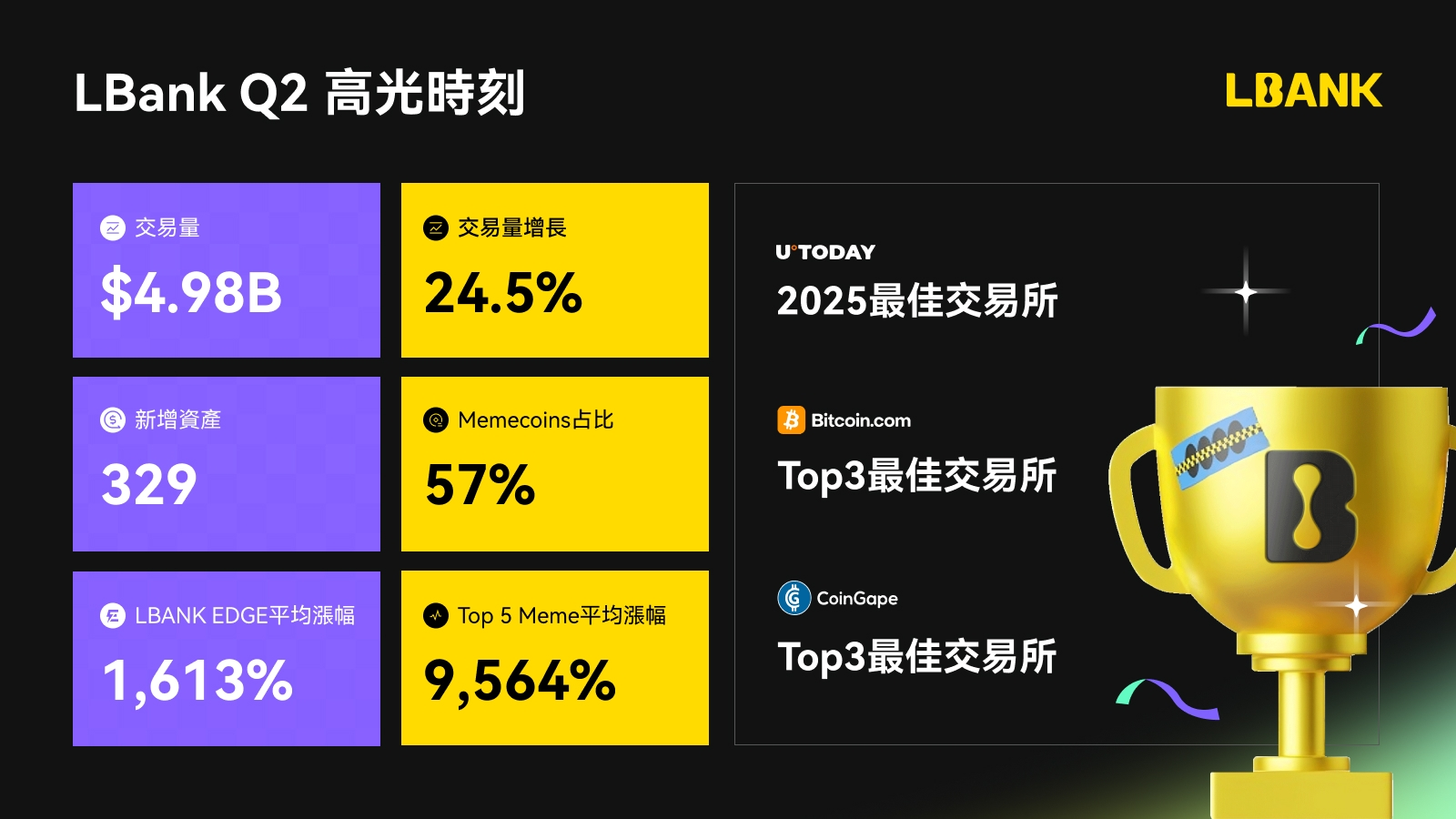

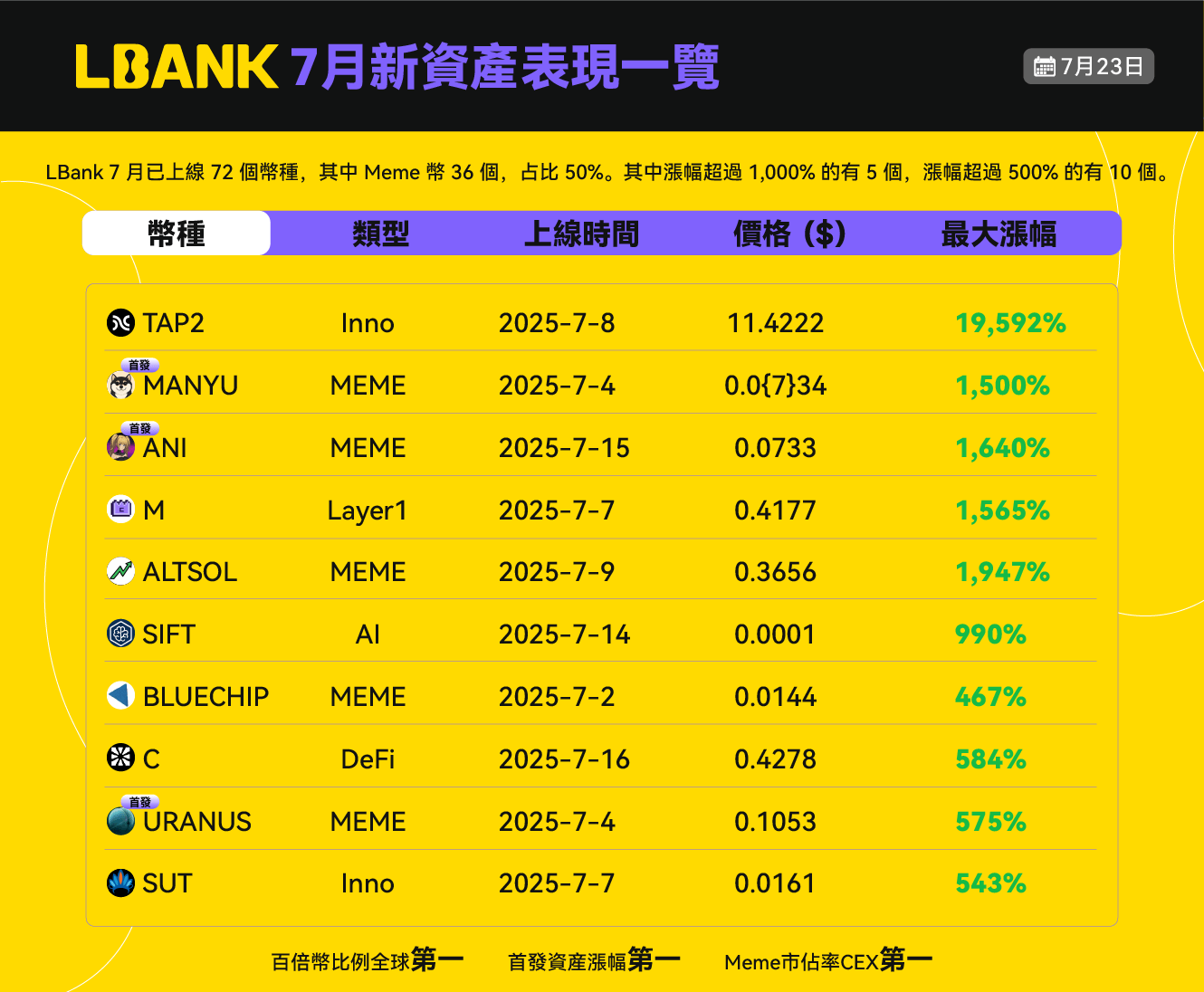

Currently, LBank's user base has surpassed 15 million, with a daily trading volume reaching $4.98 billion (a 24.5% quarter-on-quarter increase in Q2 2025), gradually becoming an important gathering place for hundredfold coin projects. This achievement is inseparable from our "fast listing mechanism" and the project discovery logic oriented towards retail user needs. LBank's positioning has never been that of a "follower," but rather that of the one who takes the lead before the next wave arrives.

Question 2: In the current competitive landscape of centralized exchanges (CEX), what are LBank's differentiated advantages?

Czhang: In this "slow exit" market, LBank's core advantages lie in speed and the ability to discover hundredfold coins.

First, we launched the "LBANK EDGE" section, focusing on high-risk, high-return assets, such as USELESS (with a rise of +7,485%) and LAUNCHCOIN (with a rise of +15,194%), which often achieve priority listings before the market is aware, seizing the opportunity. At the same time, we have also integrated and launched "xStock"—a groundbreaking innovative platform that supports trading of coin-stock linked assets like $MSTRX and $CRCLX, successfully tapping into the growth dividends of the U.S. stock market.

In terms of user growth and retention, LBank has restructured its user incentive mechanism through the launch of a "90-day points loyalty program," closely linking platform rewards with user activity, further enhancing user stickiness and flexibly responding to the ongoing changes in the CEX industry landscape.

On the security front, we adhere to a "zero tolerance" principle and have established a long-term strategic partnership with CertiK to comprehensively enhance the platform's response and defense capabilities against external security threats.

It can be said that speed, innovation, and trust constitute LBank's three core moats in the fast-paced competition of CEX.

Question 3: As the head of LBank Labs, what core elements do you prioritize when evaluating investment projects?

Czhang: We are very cautious in project evaluation, focusing on three core dimensions:

- Sustainable economic model: Projects must have a clear long-term value creation path, not just short-term speculative increases;

- Disruptive innovation: We support teams that build infrastructure or reshape user experiences in DeFi, RWA, or other emerging sectors;

- Strong execution capability: Whether the founding team possesses professional skills and the ability to advance projects under high-pressure environments is a non-negotiable important standard in our evaluation.

In addition, we also comprehensively consider the project's token economic design, community enthusiasm, and compliance adaptability to ensure its resilience and flexibility for long-term development. For us, the goal of investment is not to blindly chase short-term trends, but to empower those who truly have the ability to build the future of Web 3.

Question 4: The U.S. recently passed two landmark cryptocurrency bills. How do you think they will affect the future direction of the industry?

Czhang: The introduction of these bills marks a milestone transition for the cryptocurrency industry from a "regulatory vacuum" to a "support for innovation" institutional framework. They are not only policy tools but also send a clear signal to the world—cryptocurrency is gradually moving from a fringe industry to a core position in the global financial system.

This regulatory clarity significantly lowers the barriers for institutional participation, especially promoting the compliance process and trading activity of the stablecoin sector. In the past, regulation was seen as a major obstacle to crypto development; now, it is becoming an accelerator for industry maturity, paving the way for blockchain technology to participate in reshaping global financial infrastructure.

Question 5: July 30, 2025, marks the 10th anniversary of Ethereum. What are the driving forces behind ETH's rebound? What are your views on its future development?

Czhang: Bitcoin is the "digital gold," symbolizing value storage; Ethereum, on the other hand, is becoming the core of global financial infrastructure and settlement layer.

The current recovery of ETH is the result of both institutional adoption and structural upgrades at the foundational level. On one hand, the Ethereum Foundation's reforms in governance mechanisms have reshaped market confidence; on the other hand, the continuous inflow of funds from spot ETFs and the increasing number of enterprises incorporating ETH into their financial reserves further solidify its market positioning as an "institutional asset."

At the same time, the optimization of the staking mechanism effectively compresses the market circulation supply of ETH, enhancing its price resilience. Currently, ETH has stabilized above its MA 7 (7-day moving average), with both technical trends and fundamental performance showing strong momentum.

Looking ahead, Ethereum will continue to serve as the core underlying infrastructure for Web 3, providing solid support for DeFi, asset tokenization (RWA), and scalable ecosystems—it is not only the bearer of innovations over the past decade but will also be a foundational force for cryptocurrency transformation in the next decade.

Question 6: Large traditional financial institutions like JPMorgan and Citigroup are accelerating their layout in stablecoins and RWA (real-world asset tokenization). What are the driving factors behind this institutional "influx"?

Czhang: This is not just a trend; it represents a deep restructuring of the global financial landscape.

The implementation of the GENIUS Act provides a clear compliance path for institutional funds entering the cryptocurrency market and releases a positive signal of regulatory embrace of innovation. Currently, the total market value of stablecoins has surpassed $265 billion, demonstrating unprecedented efficiency and certainty in cross-border payments and on-chain liquidity.

The competition for dominance over RWA (real-world assets) and the underlying infrastructure of digital currencies has fully unfolded. Whether traditional financial giants or agile crypto-native forces, whoever can complete their strategic layout first is likely to gain core discourse power over the future global asset flow and value transfer.

Question 7: MicroStrategy's Bitcoin reserve strategy has sparked a wave of imitation among companies like Japan's Metaplanet. Is this model suitable for broader corporate adoption?

Czhang: MicroStrategy's strategy is a classic example of Bitcoin allocation—it amplifies Bitcoin's gains through the leverage mechanism of capital markets, forming a positive cycle of "buy Bitcoin—boost stock price—refinance—continue buying." The self-reinforcing effect is very significant. However, this is not a universal model suitable for all companies. Its success heavily relies on several preconditions: favorable market cycles, a cheap financing environment, and the company's strong capacity to endure high-volatility assets and firm belief.

For most companies, this strategy also implies higher liquidity risks, greater regulatory uncertainty, and potential market pullback pressures. Therefore, it is more like an "anomalous paradigm" suitable for specific types of companies (such as those with strong balance sheets and extremely high risk tolerance in tech or crypto sectors) rather than a widely replicable leverage template.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。