Author: Level

Translation: AididiaoJP, Foresight News

Stablecoins are reshaping the underlying architecture of the global financial system. As a new type of digital asset, their core value is reflected in three dimensions: the programmability at the technical level allows them to be embedded in smart contracts for automatic execution; the borderless nature at the geographical level breaks down the regional barriers of traditional finance; and the high speed at the efficiency level reduces settlement times from the traditional T+1 or even T+3 to nearly real-time.

However, beyond their payment functions, stablecoins are quietly enhancing the velocity of money circulation: changing the frequency of use, flow direction, and stimulating economic activity of every dollar. The impact of stablecoins on the velocity of money circulation presents a unique "double helix" effect: on one hand, the automatic clearing achieved through smart contracts releases idle settlement margins from traditional finance; on the other hand, the 24/7 uninterrupted global liquidity pool significantly improves capital turnover efficiency, a phenomenon particularly evident in cross-border B2B transactions.

This phenomenon is reminiscent of the transformation brought about by the internet to early forms of currency and value circulation two decades ago, where electronic payments primarily optimized payment efficiency, while stablecoins, on the basis of efficiency improvement, have restructured the complete closed loop of value storage, transfer, and creation. To understand the current role of stablecoins, we need to return to the basic concepts.

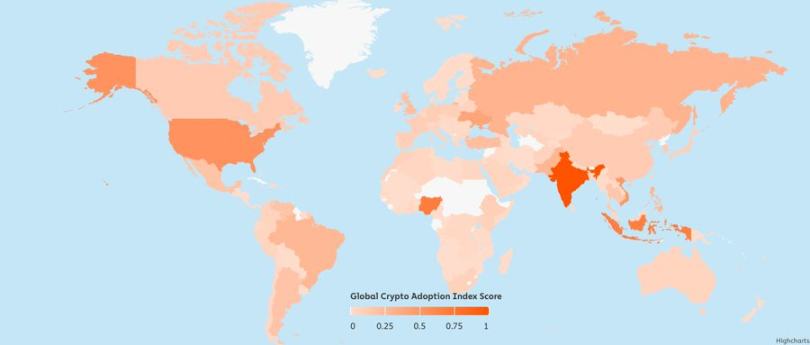

Note: The 2024 Chainalysis Global Cryptocurrency Adoption Index ranks 151 countries based on four sub-indicators that measure the usage of different cryptocurrency services. The ranking results are adjusted for population and purchasing power parity, averaged, and standardized to a range of 0-1. This data is based on estimated transaction volumes from traffic to cryptocurrency service websites and cross-validated with local expert survey results.

Definition of Money Circulation Velocity

Money circulation velocity refers to the rate at which money is exchanged within an economy, typically calculated using the following formula:

Velocity = Gross Domestic Product (GDP) / Money Supply

It measures the production efficiency of each unit of currency. A high velocity indicates that money is frequently used to purchase goods and services; a low velocity suggests that money is being saved or idled.

However, "money" is not a singular concept. Economists categorize it into different levels:

- M1: Cash + Demand Deposits, the most liquid form of money.

- M2: M1 + Savings Accounts + Time Deposits under $100,000 + Money Market Funds.

- M3 (no longer used in the U.S.): M2 + Large Time Deposits + Institutional Money Market Funds + Other Large Financial Instruments.

Stablecoins fully backed by fiat currency and redeemable at any time behave similarly to M1: they are highly liquid and can be used instantly.

Fluctuations in Money Circulation Velocity During the Internet Era

From the late 1990s to the early 21st century, the rise of the internet significantly increased money circulation velocity:

- E-commerce enabled comprehensive consumption upgrades.

- Email accelerated transactions and contract signing.

- Market access became globalized.

- Digital banking made money more liquid.

This early efficiency boost drove the growth of M1 circulation velocity.

However, as the internet matured, another trend took precedence:

- Capital appreciation created immense wealth.

- This wealth was saved and invested in stocks, bonds, and real estate.

- More funds were allocated to investment rather than consumption.

The circulation velocity slowed, but GDP continued to grow, as capital formation gradually replaced pure consumption activities.

M3 Money Supply and S&P 500 Index Growth Trends Over the Years

How Stablecoins Enhance Global Money Circulation Velocity

Today, stablecoins are introducing similar dynamics: they significantly increase the speed, accessibility, and availability of money. However, unlike the early internet, this transformation has been global from the start. Here are the specific manifestations:

1. 24/7 Borderless Transfers

In the cross-border payment sector, stablecoins enable instant settlement 24/7. Issuers like Circle and Tether have built a global payment network, allowing fund transfers to no longer be constrained by the operating hours and cross-border limitations of traditional banking systems. This efficiency boost is particularly evident in the remittance market, where traditional cross-border remittances that require 3-5 business days can be completed in minutes using stablecoins.

2. On-chain Finance and DeFi

The development of decentralized finance (DeFi) further amplifies the economic value of stablecoins. On platforms like Aave and Compound, stablecoin holders can participate in lending markets, converting idle funds into productive capital. This improvement in fund utilization efficiency directly promotes an increase in money circulation velocity, with platforms like Morpho Labs and Pendle allowing users to use stablecoins for lending, yield products, or liquidity provision.

3. Remittances and Payments

APIs developed by startups like Stablecoin enable businesses to integrate stablecoin payments into existing cash flows while supporting global instant settlement around the clock, reducing foreign exchange costs and reaching markets that traditional finance struggles to cover.

Another example is cryptocurrency debit cards, which allow users to directly use their on-chain stablecoin balances for everyday purchases. By connecting with major payment networks like Visa and Mastercard, these cards instantly convert stablecoins into local currency at the time of purchase, eliminating the need for additional exchanges. This bridge between on-chain and the real world makes stablecoins an active medium for purchasing daily necessities, traveling, and other everyday needs, thereby enhancing global money circulation velocity.

4. Permissionless Access to Dollars

In countries like Turkey, Argentina, and Nigeria, stablecoins serve as an important financial tool, allowing users to store dollar value and trade freely with just a mobile phone and internet connection. By reducing reliance on intermediaries and enabling instant, borderless payments, stablecoins more efficiently activate local capital and incorporate more participants into the economic system.

For small and medium-sized enterprises (whether in manufacturing, agriculture, digital services, or local retail), stablecoins facilitate direct connections between international buyers and suppliers, reducing friction in cross-border trade, eliminating settlement delays, and protecting businesses from sudden devaluation of local currency. Stablecoins enable individuals and businesses to maintain capital circulation within the local economy, which not only accelerates money circulation velocity but also enhances economic resilience in high-volatility currency environments.

Stablecoin Practices in Southeast Asia

In developing markets like Thailand, Vietnam, and the Philippines, the adoption of stablecoins is accelerating through P2P and over-the-counter trading channels. For example, Siam Commercial Bank (SCB) in Thailand has partnered with Lightnet through its innovative division SCB 10X to utilize stablecoins on public blockchains for cross-border payments and remittances. This is Thailand's first settlement case based on stablecoins, setting a benchmark for the regional financial industry. By integrating Fireblocks' custody infrastructure, the service ensures institutional-grade asset security and enhances trust among all parties. In the future, SCB and Lightnet plan to expand services to corporate clients, enabling two-way remittances and providing the same efficiency and cost advantages to retail users.

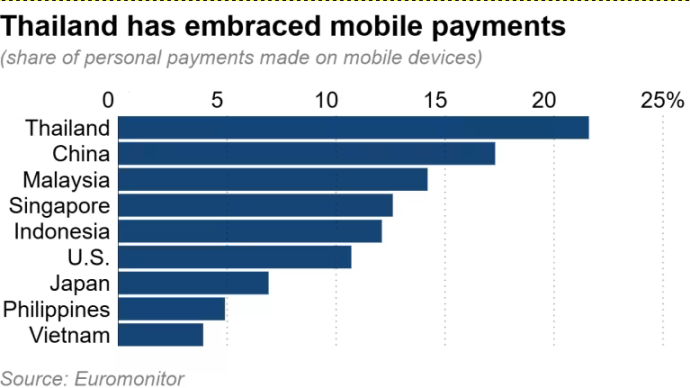

Euromonitor Mobile Payment Data

Short-term Impact: Enhanced Economic Efficiency

In the short term, the increase in money circulation velocity driven by stablecoins brings significant economic benefits:

- GDP Growth: Faster circulation of the same capital pool promotes economic activity.

- Increased Productivity: Instant, low-friction payments and faster working capital cycles optimize business efficiency.

- Enhanced Financial Inclusion: Gig economy workers, creators, and merchants can transact using stable dollar assets without relying on traditional banks.

This unleashes long-suppressed economic potential in emerging markets. Just as the early internet accelerated business development by eliminating friction in communication and distribution, stablecoins are doing the same for value transfer, allowing funds to flow freely, around the clock, and at almost zero cost.

Long-term Impact: From Speed to Scale

The long-term effects are more complex.

As users in emerging markets gain access to dollars and stablecoins, some capital is not used for consumption but is saved or invested:

- Staked in DeFi for passive income.

- Used to purchase assets (real estate, tokens, stocks).

- Reserved for business expansion.

These behaviors remove funds from short-term trading cycles, reducing local circulation velocity. However, this is not a negative outcome. Similar to the early 21st century, it reflects a shift from speed-driven consumption to wealth accumulation and capital formation, which is a hallmark of economic maturity.

Even if the frequency of money turnover decreases, its utilization efficiency is higher. In the early growth phase, emerging economies tend to focus on consumption, concentrating on infrastructure development and catching up with developed economies. As income grows and financial tools become more widespread, savings rates gradually rise, and households begin to accumulate wealth and invest in long-term assets. Stablecoins can accelerate this transformation.

Conclusion

Stablecoins are changing the way global funds flow, increasing transaction speed while deepening financial inclusion. In the short term, they are accelerators of circulation velocity, while in the long term, they are builders of capital formation.

Money circulation velocity, as a key indicator of economic vitality, is calculated as the ratio of GDP to money supply. The emergence of stablecoins injects new meaning into this traditional economic concept. Fully backed by fiat currency and redeemable at any time, stablecoins exhibit liquidity characteristics similar to M1 money, but their operational efficiency far exceeds that of traditional fiat currency.

It is important to note that circulation velocity does not operate in isolation; its economic impact depends on the following factors:

- Interest Rates: High interest rates encourage saving, reducing circulation velocity.

- Inflation Expectations: If prices are expected to rise, people will accelerate consumption.

- Tariffs and Capital Controls: These may restrict the use of stablecoins in certain regions.

- Fiscal Policy: Government transfer payments, taxes, and subsidies all affect money circulation.

Nevertheless, the result is the birth of a new type of global economic form: stablecoins can flow instantly, settle automatically, and remain robust in development. Just as the early internet reshaped communication and commerce, stablecoins are doing the same for money itself. This transformation is not about printing more money, but about utilizing existing resources more efficiently.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。