Original Title: "Former NYSE President Leads Bullish to Sprint for NYSE: Holding 24,000 Bitcoins with a Valuation Exceeding $4 Billion, Roadshow PPT Exposed"

Original Author: Lei Jianping, Lei Di Network

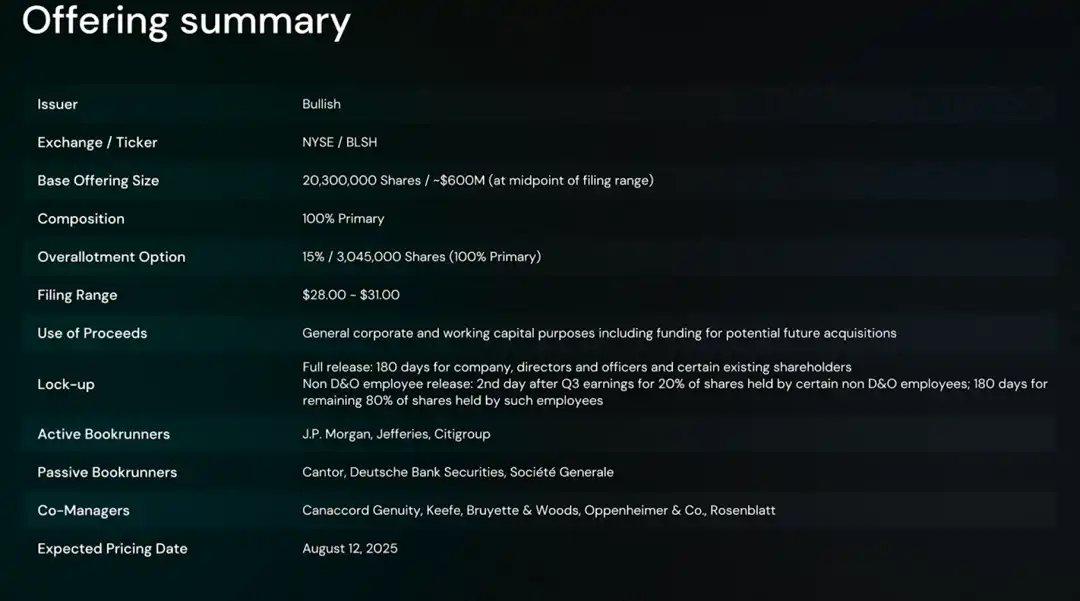

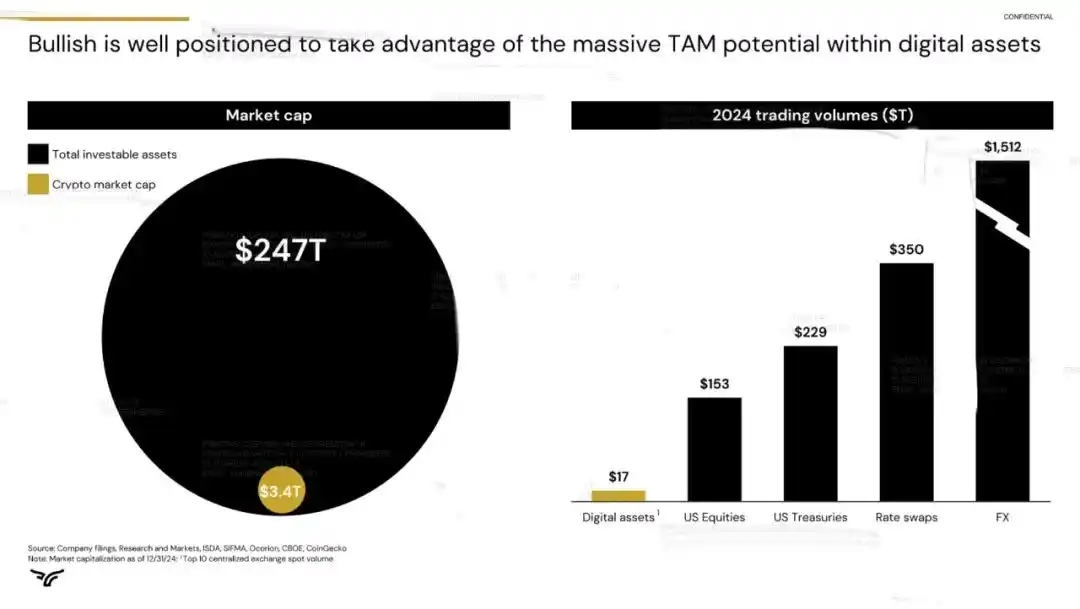

Silicon Valley investment mogul and billionaire Peter Thiel-backed digital asset exchange operator Bullish (stock code: BLSH) has updated its prospectus, preparing to list on the NYSE on August 13, 2025.

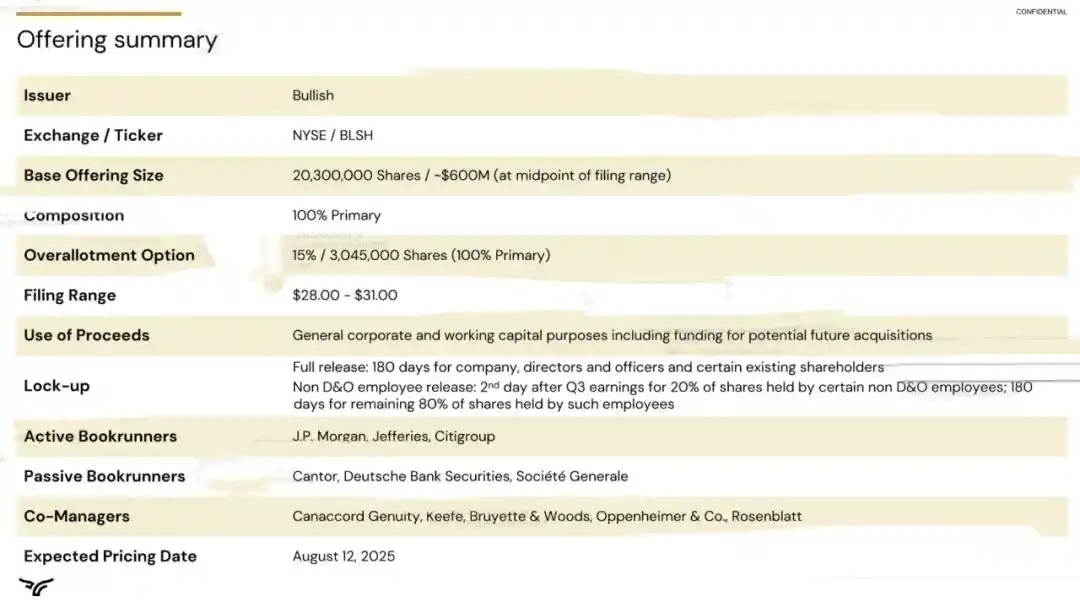

Bullish's issuance range is set between $28 and $31, issuing 20.3 million shares, with a maximum fundraising of $629 million. At the highest issuance price, Bullish's valuation will reach $4.2 billion.

Funds managed by BlackRock and ARK Investment Management have expressed interest in subscribing to common stock worth up to $200 million at the IPO price.

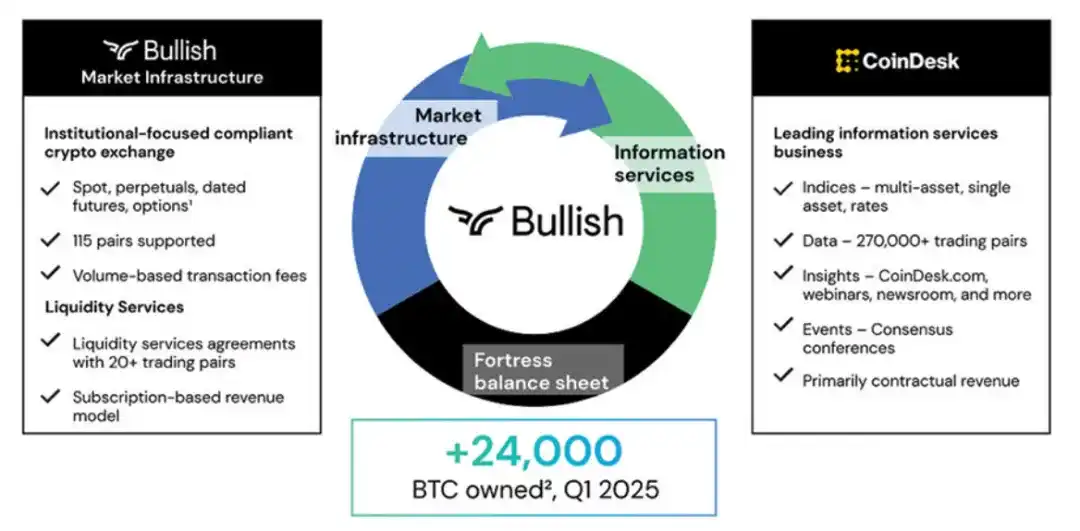

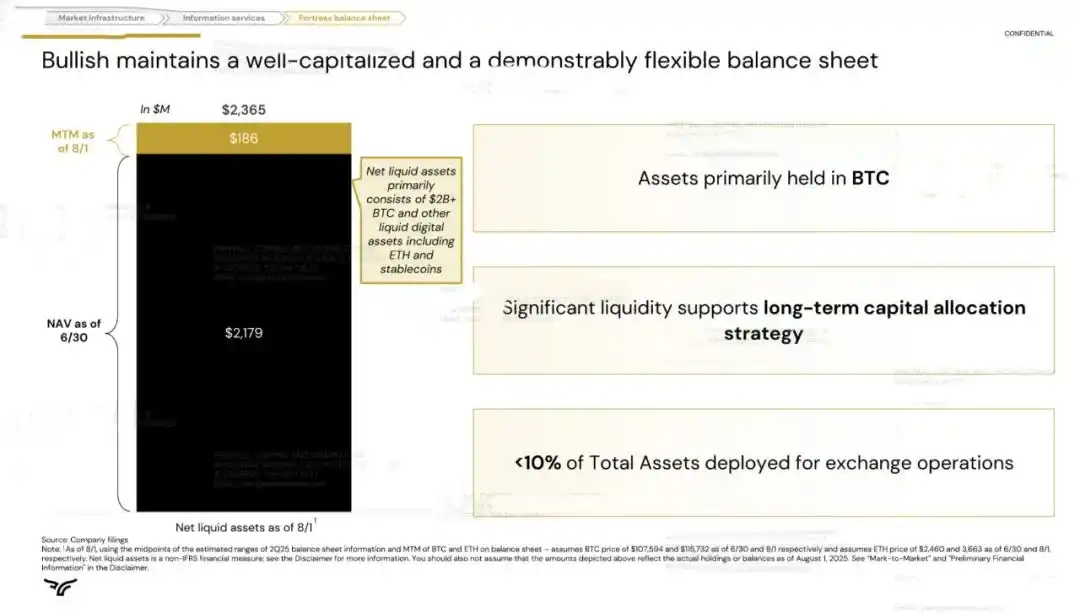

Bullish stated in its filing that it holds over $3 billion in liquid assets, including 24,000 Bitcoins, 12,600 Ethereums, and over $418 million in cash and stablecoins.

Bullish indicated that this funding also includes capital provided to decentralized finance protocols, although these funds are "not significant" to the total capital.

Cryptocurrency Industry Continues IPOs

Bullish had previously planned to merge with the special purpose acquisition company Far Peak Acquisition (FPAC.US) at a valuation of $9 billion, but ultimately failed to complete the transaction.

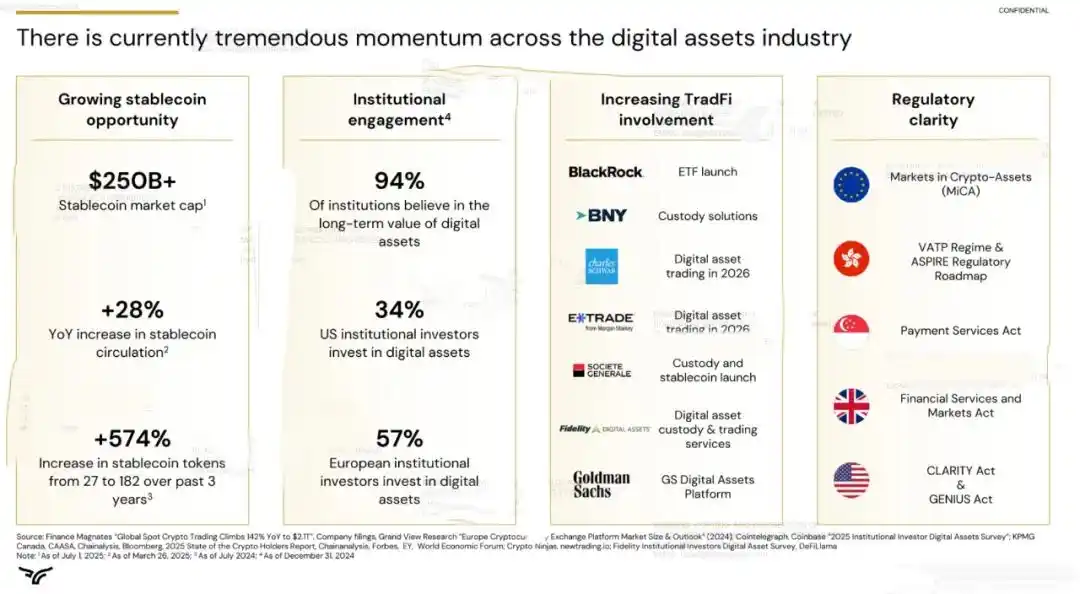

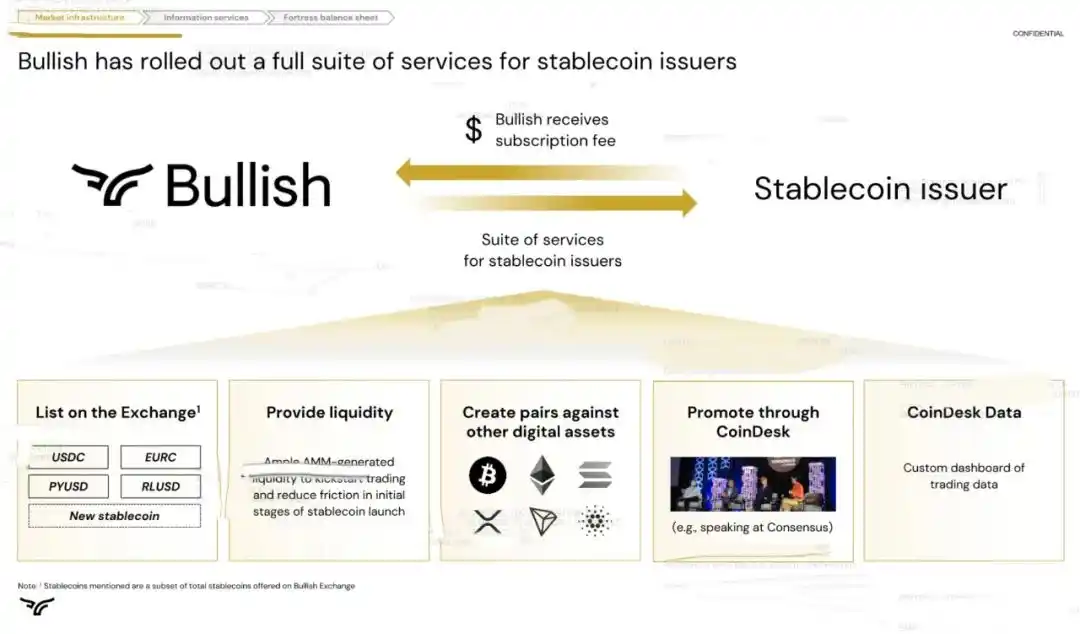

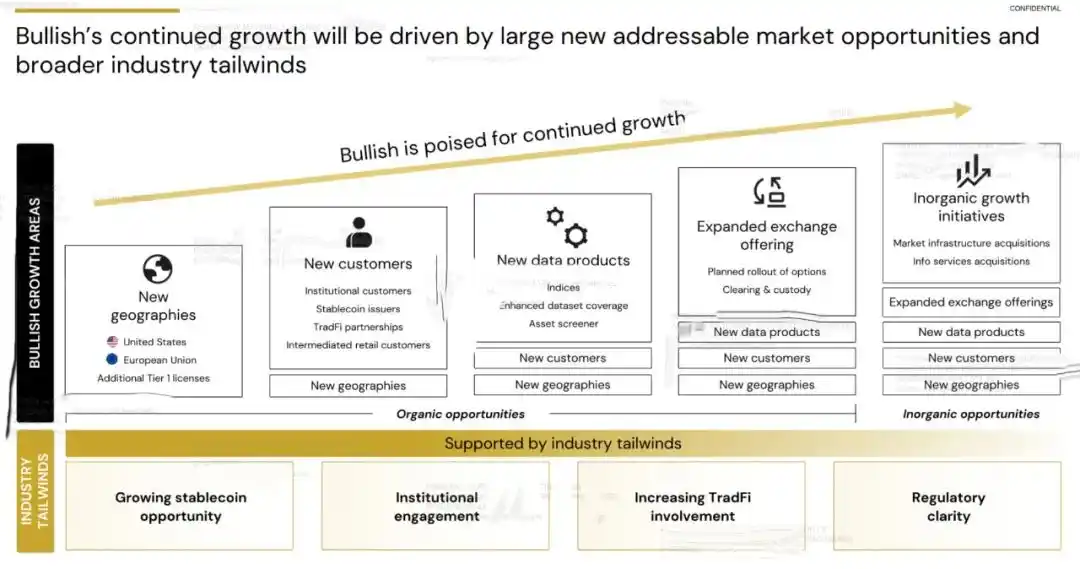

Cryptocurrency companies in the U.S. have benefited from the Trump administration's support for the cryptocurrency industry and Congress's push for cryptocurrency legislation, which ultimately led to the passage and signing of the Genius Act, aimed at regulating stablecoins.

Earlier, USDC stablecoin issuer Circle went public on the NYSE, issuing a total of 34 million shares and raising $1.054 billion; of which, Circle sold 14.8 million shares in this IPO, raising $459 million; existing shareholders, including the CEO, reduced their holdings by 19.2 million shares, cashing out nearly $600 million.

Circle is one of the few pure cryptocurrency companies to go public in the U.S. after Coinbase. As of today's close, Circle's market capitalization reached $37.5 billion.

Israeli social trading platform eToro has also gone public. Industry giants including BitGo and Grayscale have also applied for IPOs.

Q1 Net Loss of $348 Million

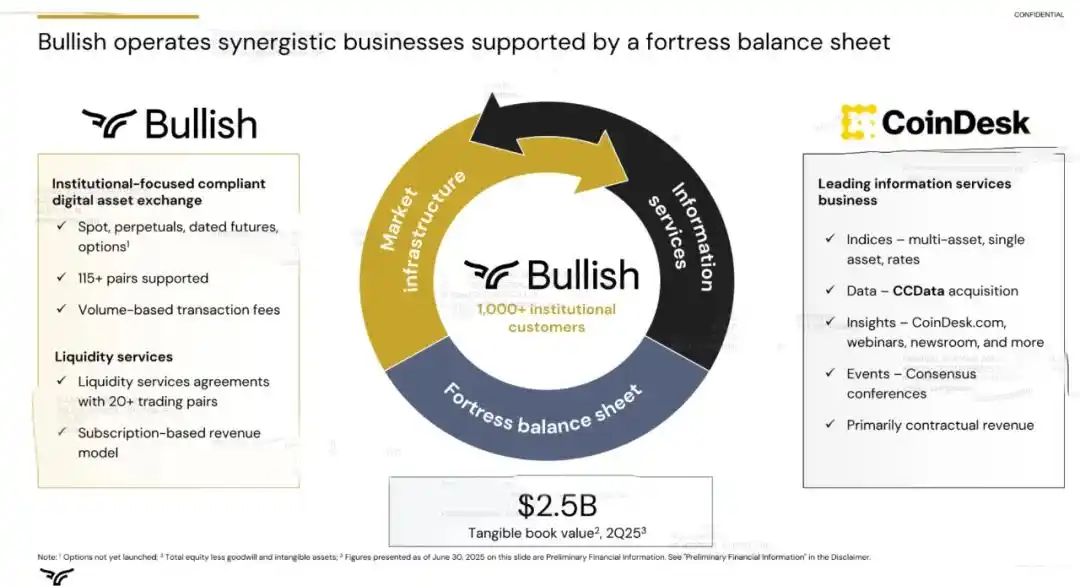

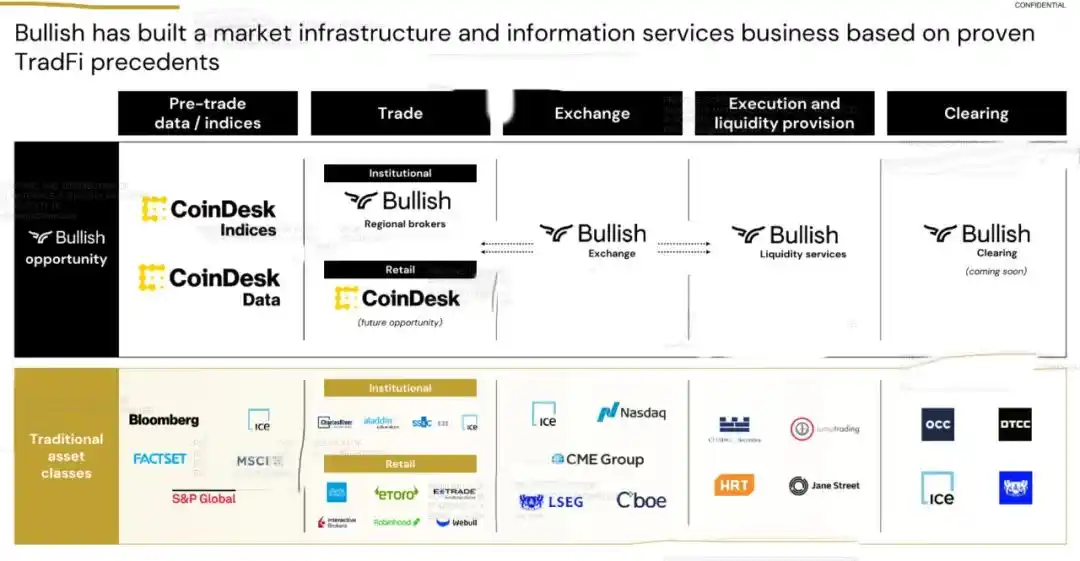

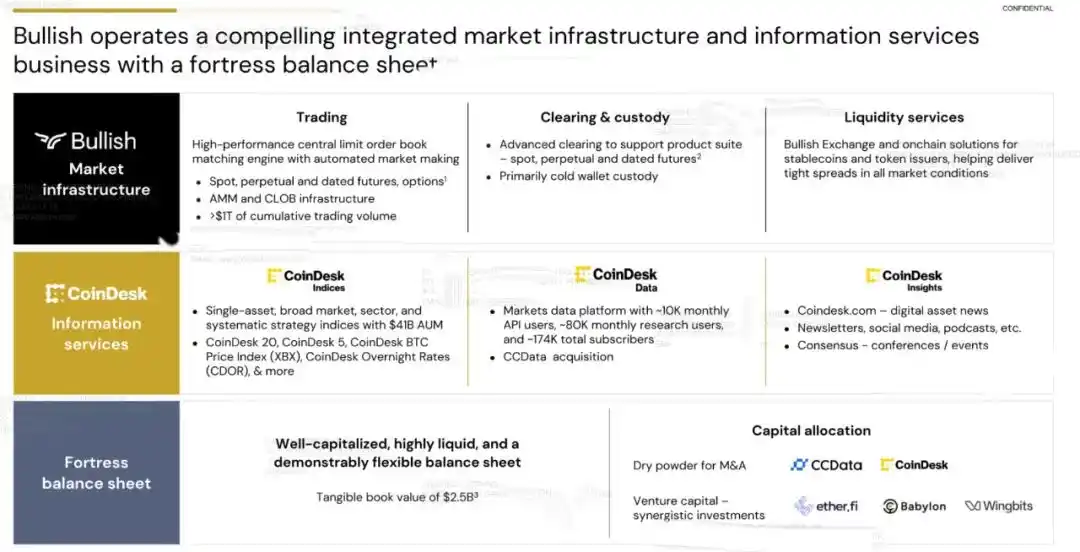

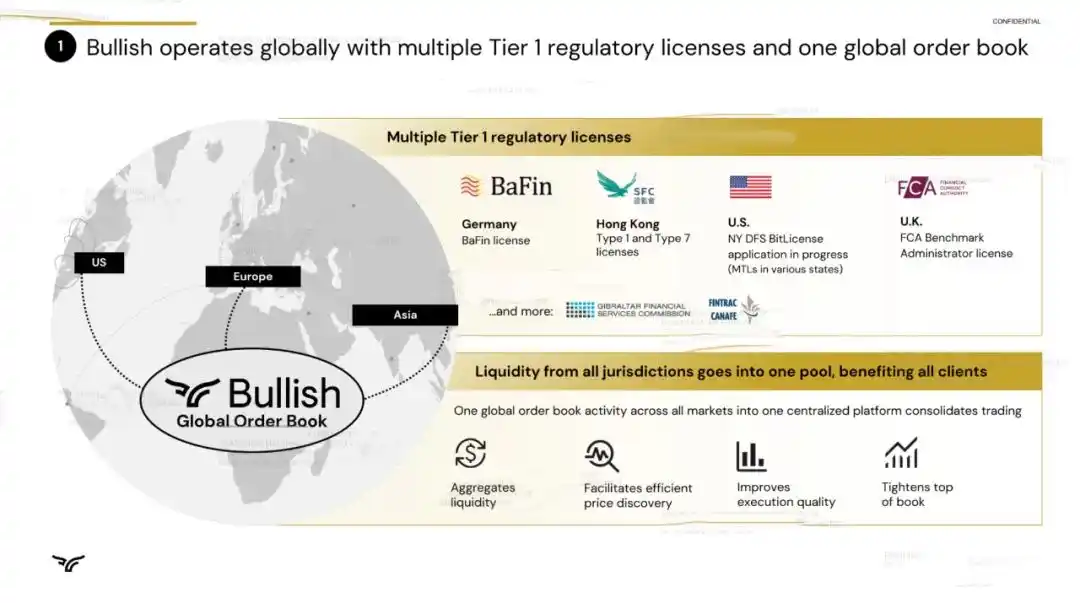

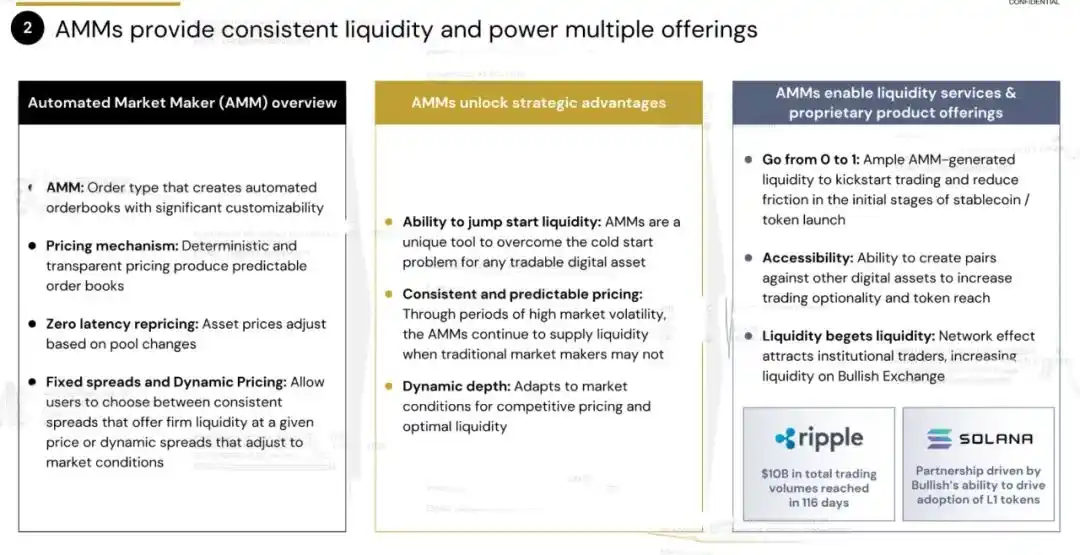

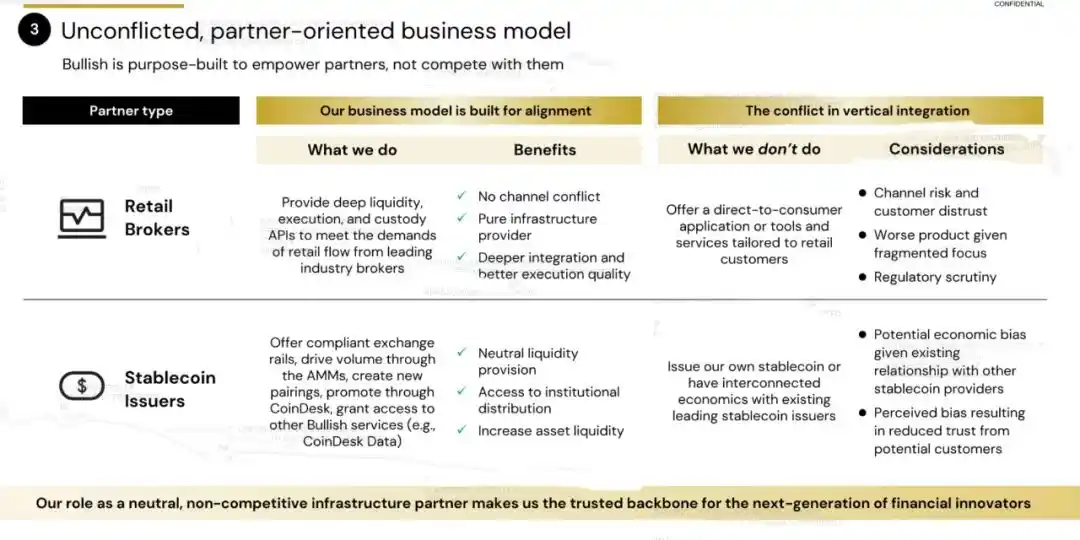

Bullish was founded in 2020 and is a global digital asset platform focused on institutional investors, aiming to provide mission-critical products and services to help institutional investors expand their businesses, empower individual clients, and promote the adoption of stablecoins, digital assets, and blockchain technology.

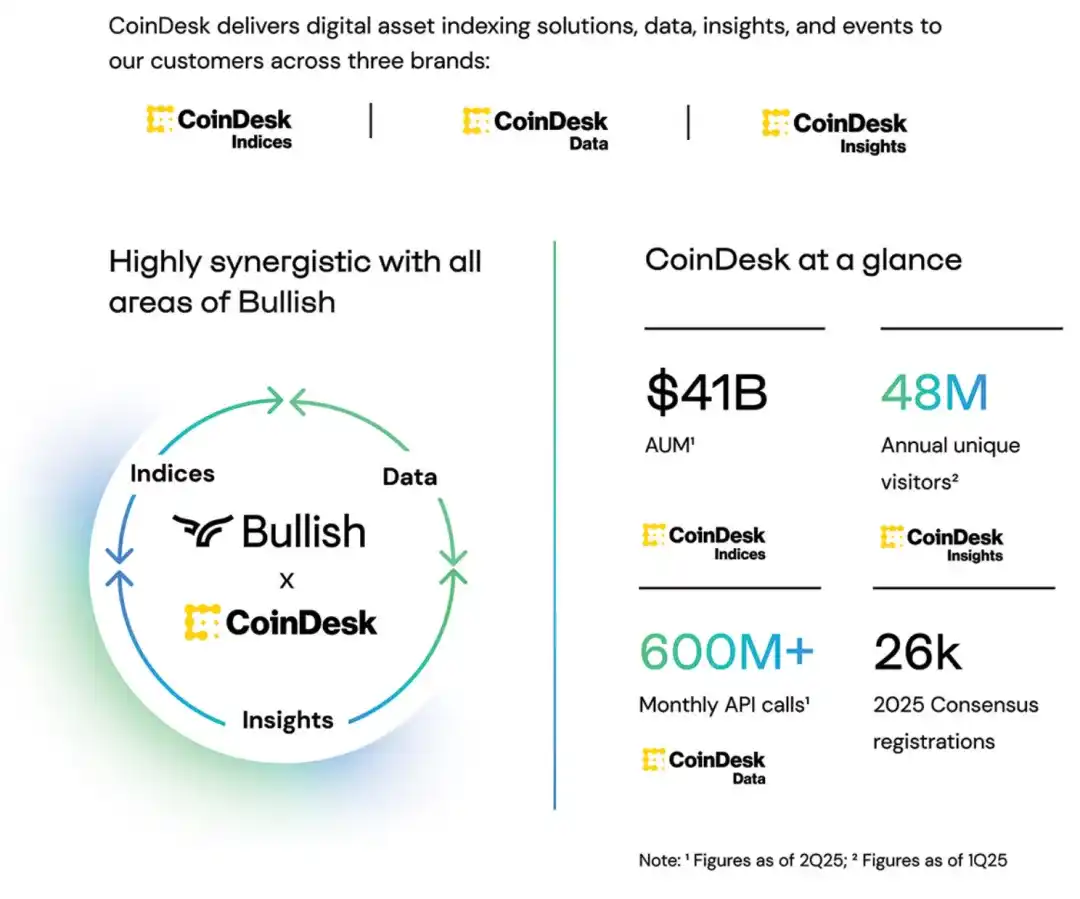

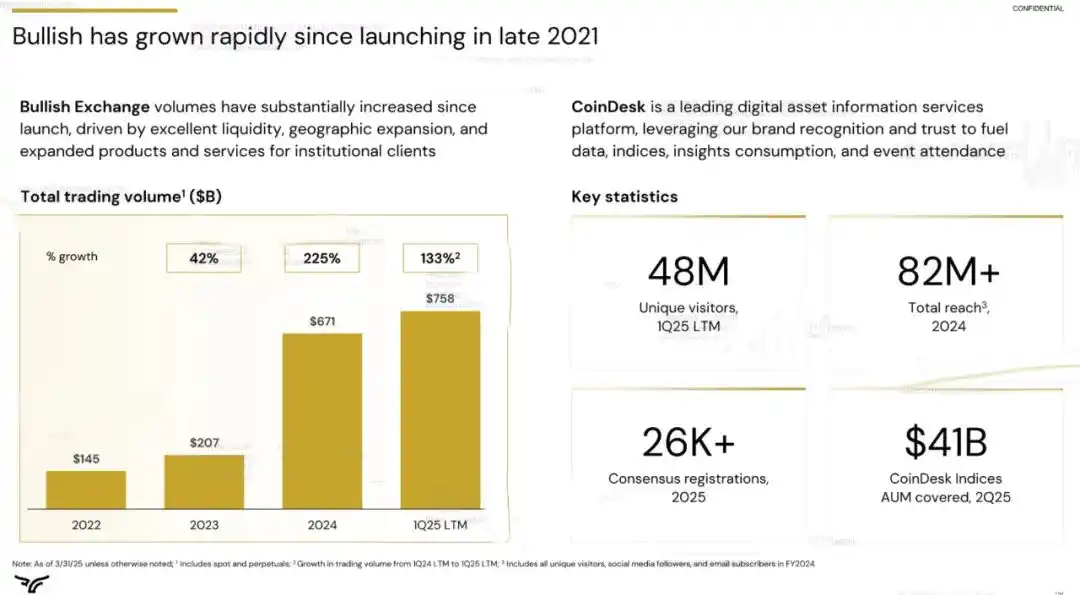

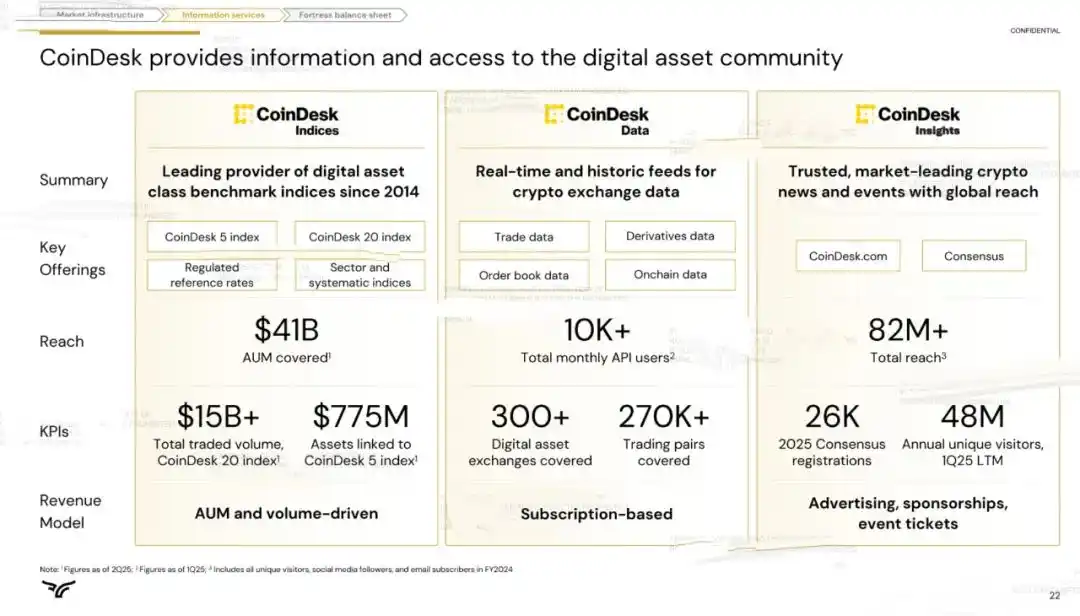

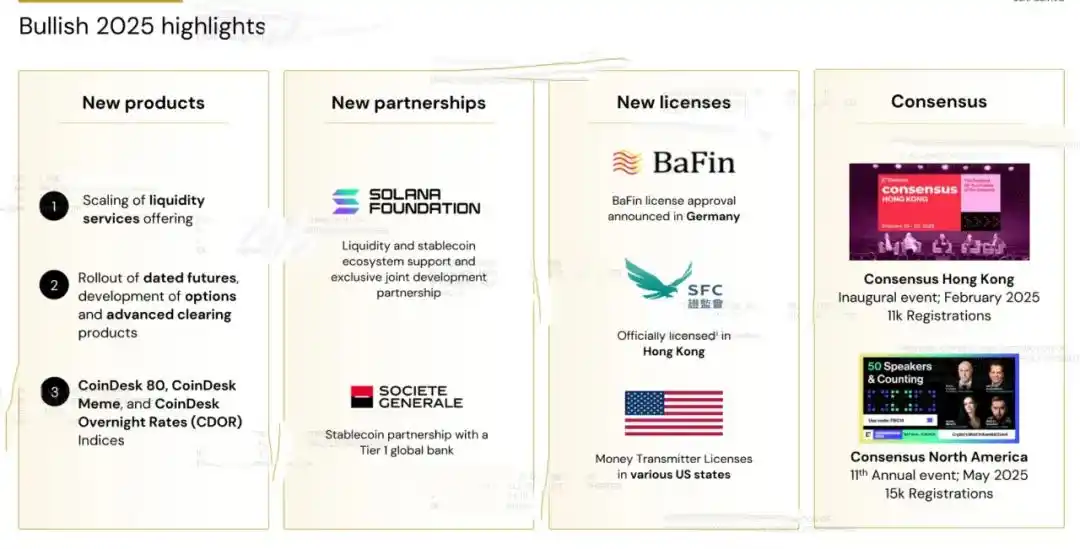

In 2023, Bullish acquired CoinDesk, expanding its product line to provide trusted insights, authoritative news, data, indices, and transparent analysis for the digital asset industry, while facilitating partnerships, investment opportunities, and community engagement through its flagship conference, Consensus.

In October 2024, Bullish acquired CCData, enhancing its data and information service capabilities by integrating one of the industry's leading digital asset data and index providers, further solidifying its product portfolio.

Currently, Bullish operates under the "Bullish" and "CoinDesk" brands, offering a range of unique but complementary services covering the digital asset industry.

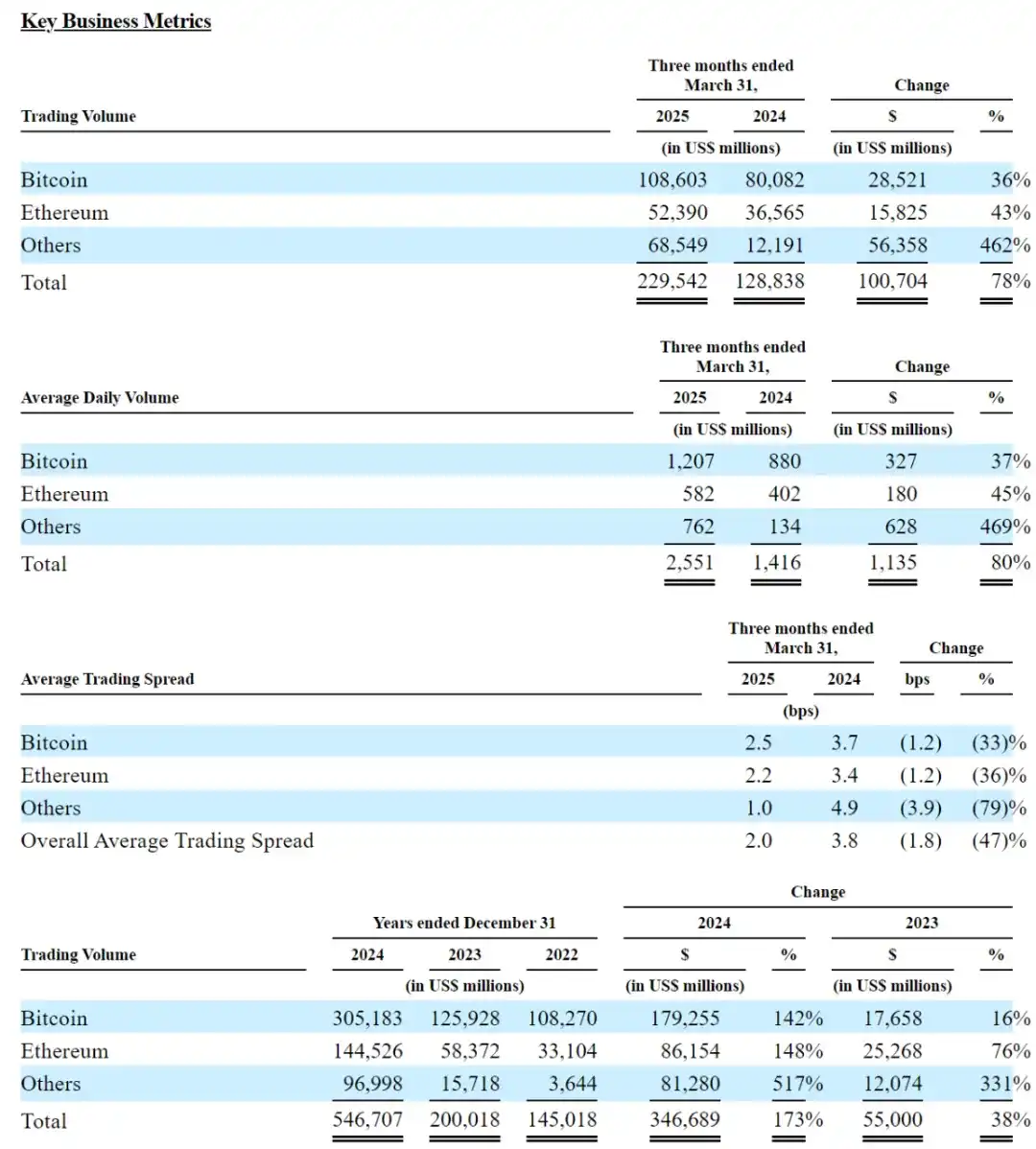

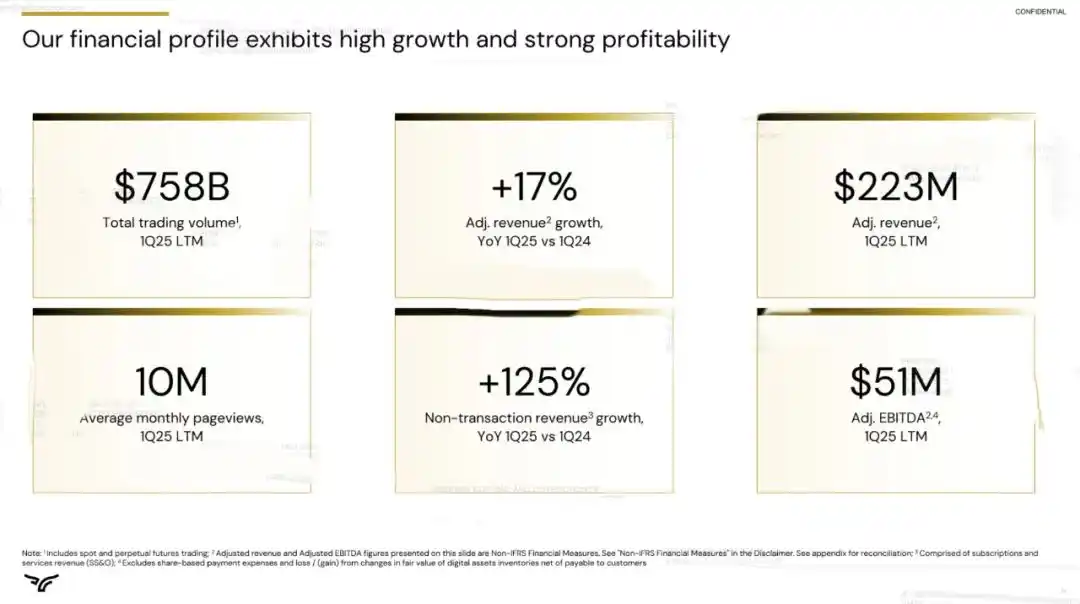

In the first quarter of 2025, Bullish's Bitcoin trading volume was $108.6 billion, a 36% increase from $80.08 billion in the same period last year; the daily trading volume of Bitcoin was $1.207 billion, a 37% increase from $880 million in the same period last year.

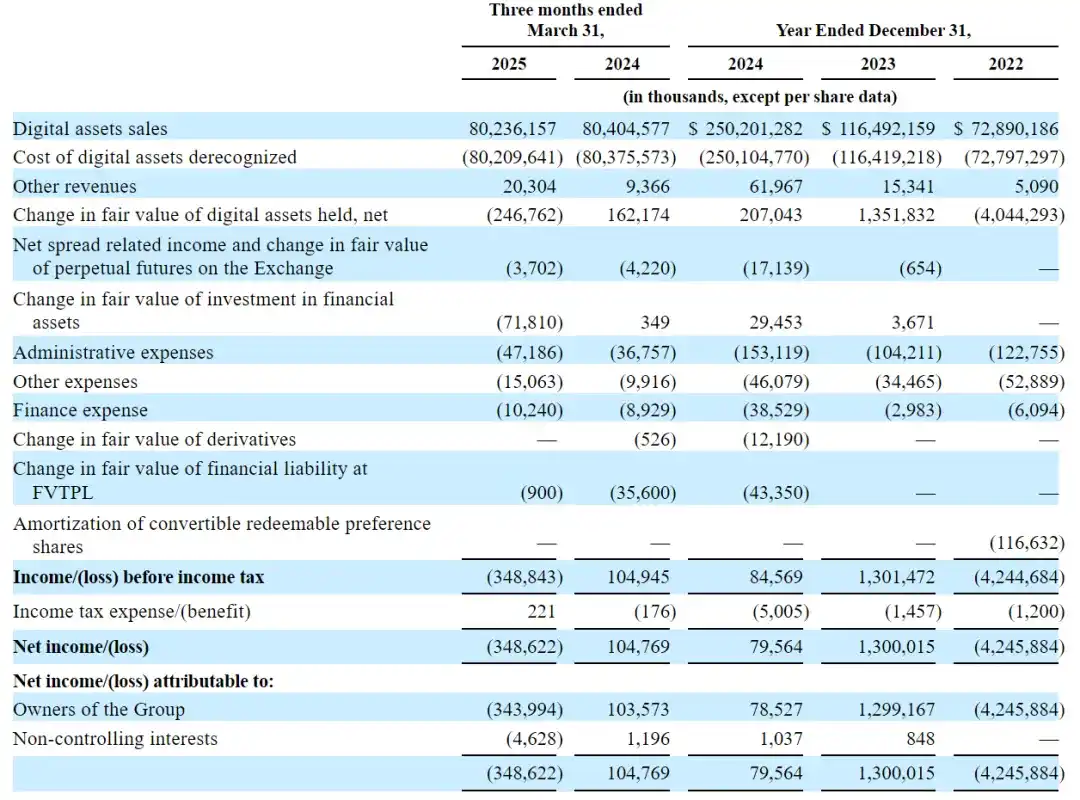

The prospectus shows that Bullish's digital asset sales for 2022, 2023, and 2024 were $72.89 billion, $116.49 billion, and $250.2 billion, respectively; net profits were -$4.246 billion, $1.3 billion, and $79.56 million.

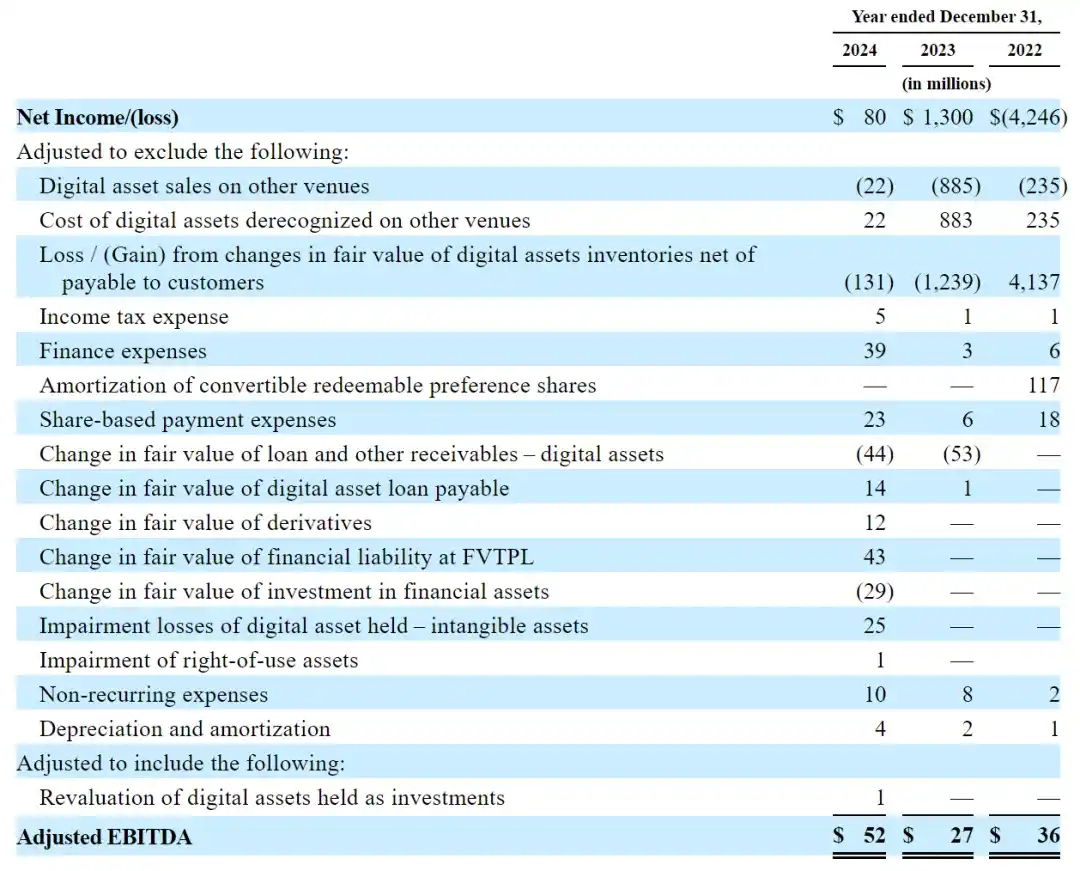

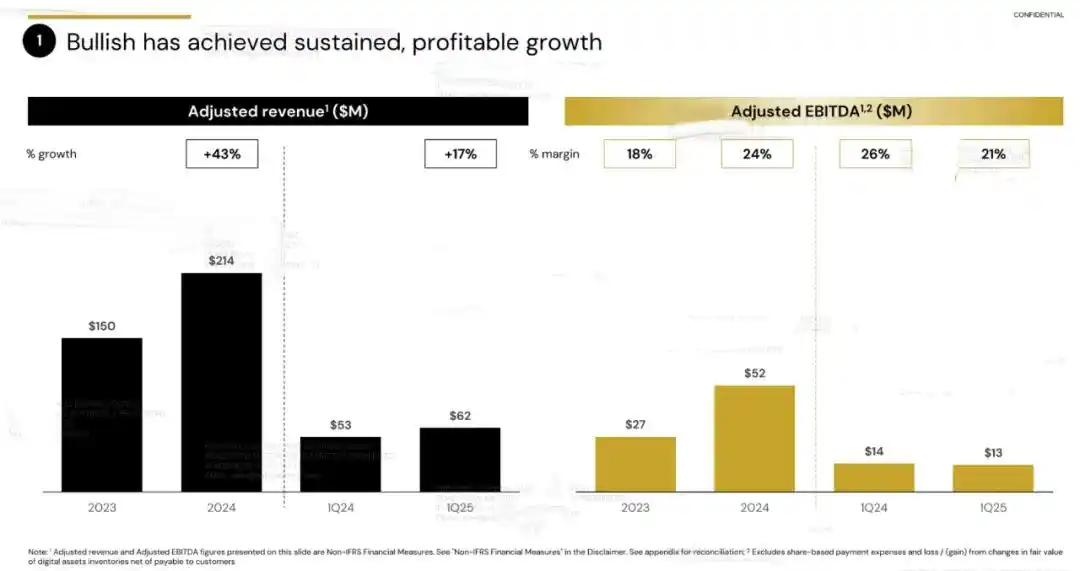

Bullish's Adjusted EBITDA for 2022, 2023, and 2024 were $36 million, $27 million, and $52 million, respectively.

In the first quarter of 2025, Bullish's digital asset sales were $80.236 billion, compared to $80.4 billion in the same period last year; the net loss was $348 million, compared to a net profit of $105 million in the same period last year.

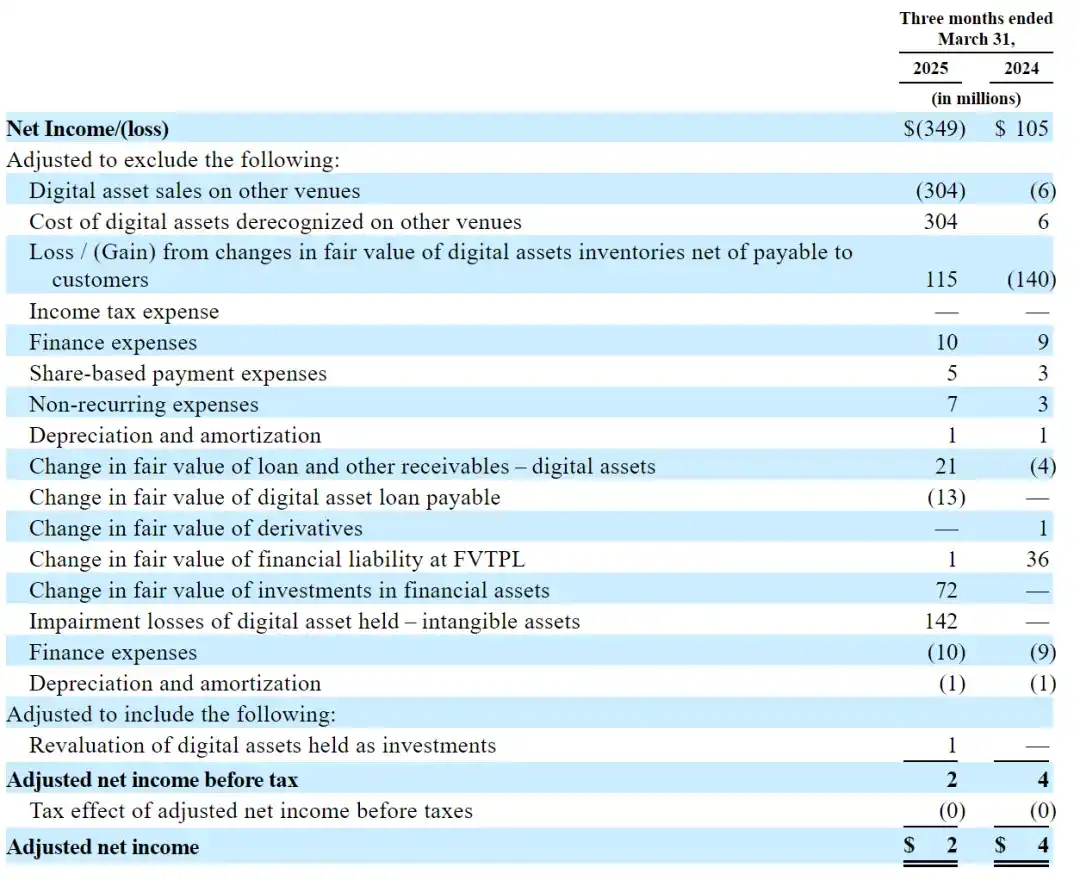

In the first quarter of 2025, Bullish's Adjusted net profit was $2 million, compared to $4 million in the same period last year.

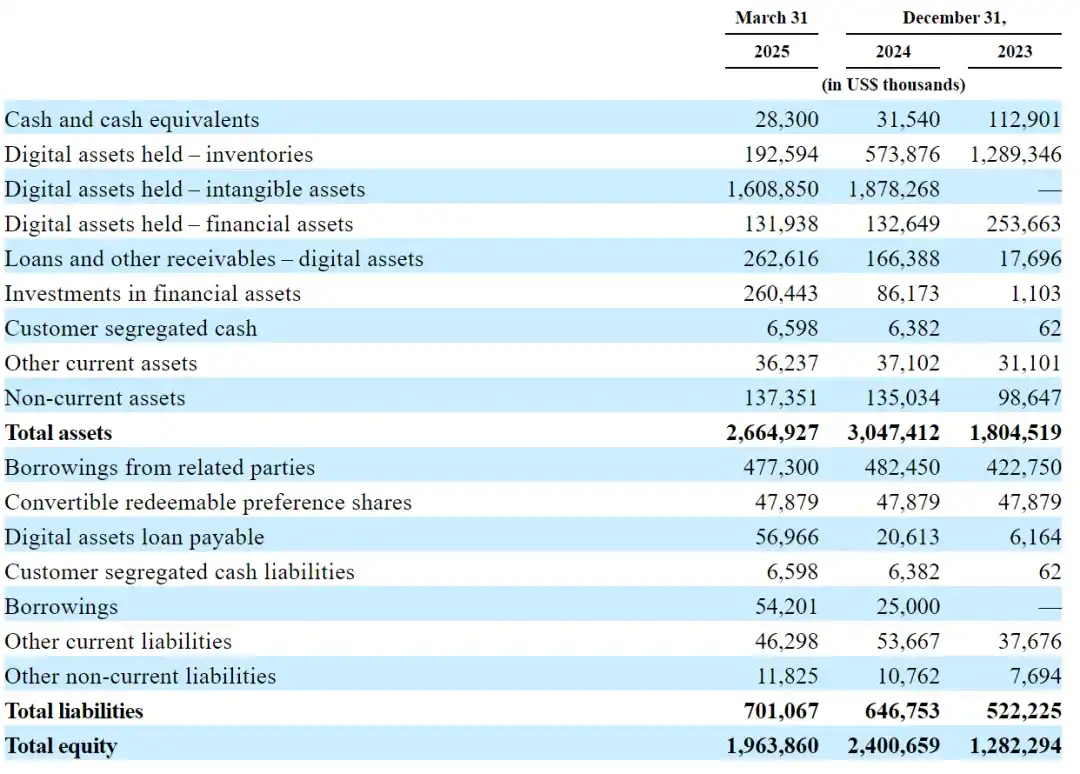

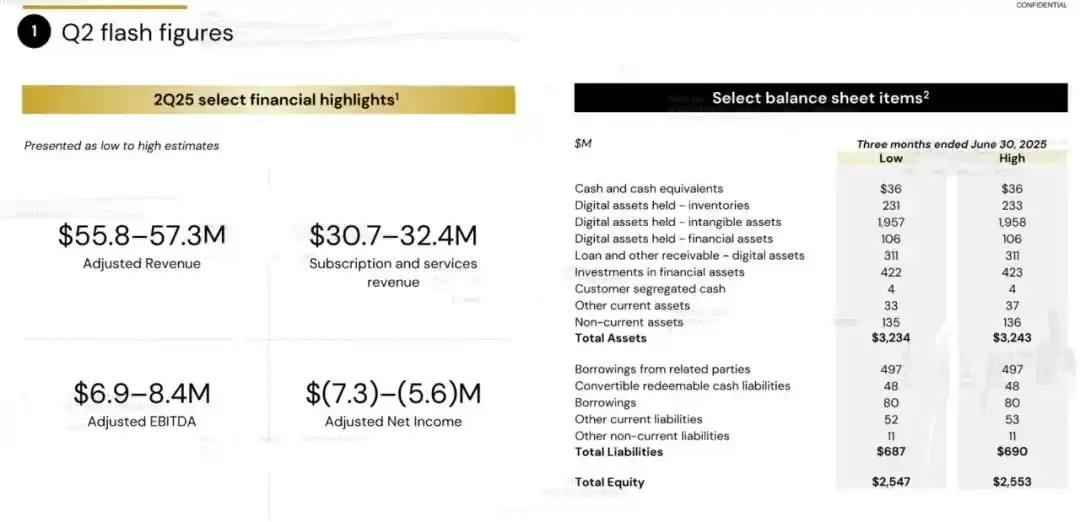

As of March 31, 2025, Bullish held cash and cash equivalents of $28.3 million, total assets of $2.665 billion, total liabilities of $700 million, and equity of $1.964 billion.

Silicon Valley Investment Mogul Peter Thiel is a Shareholder

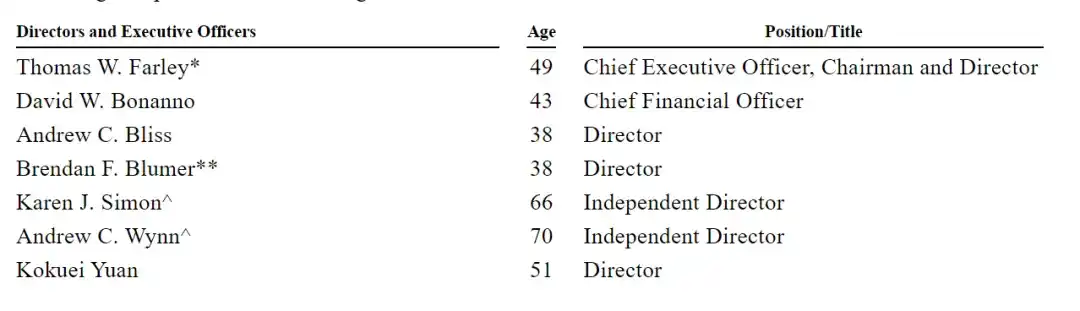

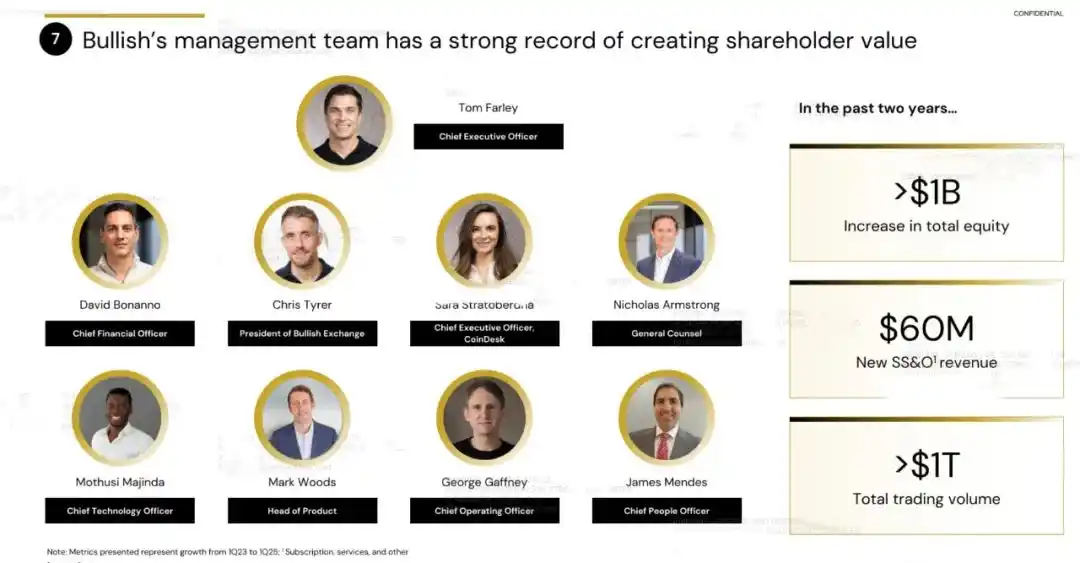

Bullish's Chairman and CEO is Thomas W. Farley, and the CFO is David W. Bonanno.

Tom Farley was the President of the NYSE and served as the Chairman, CEO, and President of FPAC before becoming the CEO of Bullish.

Silicon Valley investment mogul and billionaire Peter Thiel is also a shareholder of Bullish.

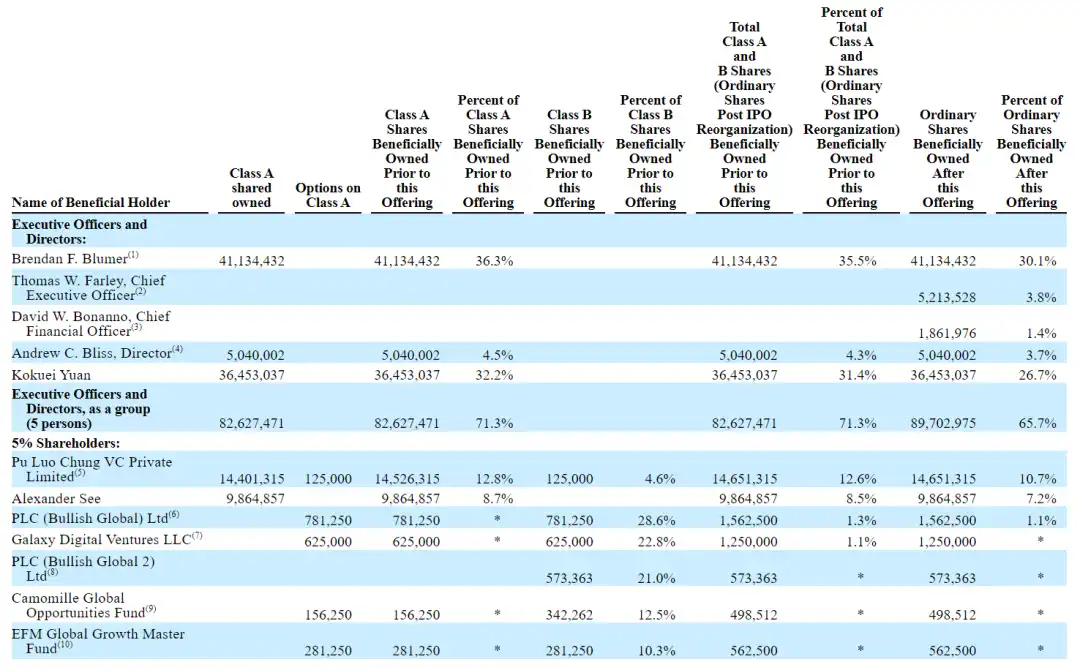

Before the IPO, Brendan F. Blumer held 36.3% of Class A shares, representing 35.5% of the equity; Andrew C. Bliss, Director, held 4.5% of Class A shares, representing 4.3% of the equity; Kokuei Yuan held 32.2% of Class A shares, representing 31.4% of the equity.

Pu Luo Chung VC Private held 12.8% of Class A shares and 4.57% of Class B shares, representing 12.6% of the equity; Alexander See held 8.7% of Class A shares, representing 8.5% of the equity. PLC (Bullish Global) Ltd held 28.56% of Class B shares, representing 1.3% of the equity;

Galaxy Digital Ventures held 22.84% of Class B shares, representing 1.1% of the equity; PLC (Bullish Global) held 20.96% of Class B shares, Camomille Global held 12.51% of Class B shares, and EFM Global Growth Master held 10.28% of Class B shares.

After the IPO, Brendan F. Blumer held 30.1% of the shares; Andrew C. Bliss, Director, held 3.8%; Kokuei Yuan held 26.7% of the equity.

Pu Luo Chung VC Private held 10.7%, Alexander See held 7.2% of the equity, and PLC (Bullish Global) Ltd held 1.1% of the equity.

Here is the Bullish roadshow PPT:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。