Source: DMI News

On August 1, 2025, Hong Kong's "Stablecoin Regulation" officially came into effect, marking the transition of virtual asset regulation in Hong Kong from framework construction to practical implementation. This regulation not only sets clear entry thresholds for stablecoin issuance but also provides payment settlement infrastructure for the on-chain representation of real-world assets (RWA) by standardizing the finality of settlement for fiat-backed tokens, propelling Hong Kong towards becoming a global tokenized financial center.

Coincidentally, the U.S. "GENIUS Act" was implemented around the same time, indicating a shift in the perception of crypto infrastructure among major global economies from "speculative digital assets" to "components of the financial system," initiating an evolutionary path from on-chain payments to on-chain credit. According to OKG Research, if development proceeds smoothly, the global supply of stablecoins is expected to exceed $30 trillion by 2030, with annual transaction volumes potentially approaching the current global GDP.

Additionally, the world's first RWA registration platform, initiated by the industry self-regulatory organization "Hong Kong Web 3.0 Standardization Association," is set to launch today (August 7). This platform aims to streamline the entire service system for the digitization, assetization, and financialization of RWA, marking the dawn of an era of large-scale on-chain representation of physical assets.

In this race for infrastructure reconstruction, Hong Kong is striving to gain an advantage in the development of stablecoins and asset tokenization, leveraging its financial infrastructure foundation and policy responsiveness. This article aims to review Hong Kong's virtual asset regulatory framework, outline the evolution of RWA policies, and focus on the technological and institutional logic, key pilots, and future trends under their synergy.

Note: The RWA projects referenced in this article do not include on-chain ecosystems or concepts not approved by the Hong Kong Securities and Futures Commission or recognized by the Hong Kong Monetary Authority's Ensemble sandbox pilot.

Stablecoins and RWA: The Integration of Payment Systems and Value Systems

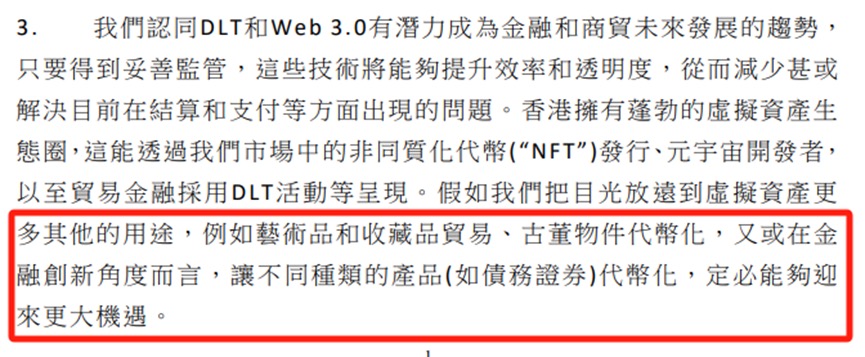

Tokenization of Real World Assets ("RWA") refers to the digital representation of physical assets (such as real estate and commodities), financial assets (such as bonds and stocks), or other property rights (such as intellectual property and carbon credits) through blockchain technology, smart contracts, and compliance frameworks, forming tokenized certificates that can be recorded, traded, and managed on-chain. Currently, more mature international RWA tokenization cases (such as BlackRock's BUIDL government bond tokenization fund and Dubai Land Department's tokenization platform) are mostly built on the Ethereum standard for smart contracts.

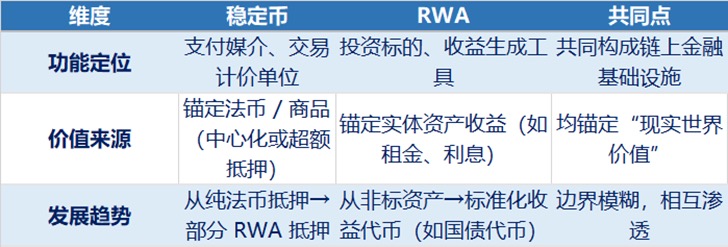

From the perspective of tokenization, stablecoins (Stablecoin) and RWA essentially stem from the same technological paradigm—restructuring the holding, trading, and management of traditional assets through blockchain's digital ledger, programmability of smart contracts, and decentralized verification. The two represent the extension of this technological paradigm across different functional dimensions: stablecoins focus on creating a medium of exchange on-chain, while RWA focuses on building a value anchoring system.

Generally, stablecoins (such as USDT and USDC) become "bridge assets" connecting traditional finance and the crypto economy by anchoring to fiat currencies or commodities, sacrificing asset diversity for the stability of high-frequency trading; whereas RWA transforms various real assets or complex rights into programmable, divisible on-chain certificates, providing "real support" for digital currencies. Together, they construct a complete closed loop of on-chain finance, fundamentally addressing pain points in traditional financial transaction processes, such as inefficiencies (e.g., cross-border settlements) and high barriers (e.g., real estate investment).

RWA Regulatory Framework: Dual-Track Parallel, Penetrative Regulation

The implementation of the "Stablecoin Regulation" and a series of prior virtual asset regulatory policies create a synergistic effect. According to Chen Mingjie and Tang Weijia, consultants at Zhonghao Law Firm, the overall principles and framework for RWA regulation in Hong Kong include:

1. "Substance Over Form" (See-Through) Principle:

First, the underlying asset attributes are determined, focusing on the physical asset attributes behind the tokenization, which do not change simply because they are "on-chain":

Based on the Hong Kong Securities and Futures Commission's regulatory principle of "same business, same risk, same rules," security tokens (STO) are clearly defined as securities, subject to the Securities and Futures Ordinance, requiring licensed operation (such as Type 1, 4, and 9 licenses), and limited to professional investors (the mandatory requirement will be lifted in November 2023); non-security RWA (such as carbon credits and real estate revenue rights) are incorporated into the Anti-Money Laundering Ordinance framework, innovating and exploring compliance paths through sandbox pilots.

Note: Although STOs and RWA both fall under the category of asset tokenization, the main differences, aside from regulatory compliance paths (whether recognized as securities), lie in design philosophy and underlying asset ownership structure: STOs focus on the securities field, typically representing equity or debt, where holders enjoy partial ownership and control rights over the asset, including dividends, voting rights, liquidation rights, and other statutory rights; whereas RWA (securities/non-securities) emphasizes bringing various real-world assets onto the blockchain, focusing more on the on-chain representation of revenue rights, where investors typically do not own the underlying assets but share in future cash flows (such as rental income, energy revenues, etc.), thus providing more liquidity and exchange options.

2. Collaboration Between the Monetary Authority and the Securities Commission

The Hong Kong Monetary Authority focuses on financial stability and payment function regulation, promoting tokenization technology trials through the Ensemble sandbox (launched in March 2024, officially entering the testing phase in August 2024) to accumulate experience and refine business processes in a controlled environment; the Hong Kong Securities and Futures Commission is responsible for capital market and investor protection regulation, clarifying product safety, information disclosure, and risk management requirements based on the "same industry, same regulation" penetrative regulatory principle.

3. Stablecoin Legislation Completes the Payment Loop

The implementation of stablecoin regulations not only provides a legal basis for the application of stablecoins in the RWA ecosystem but also fills the compliance gap in the funding end of the RWA financing chain, facilitating smoother and safer flows of funds between the traditional financial system and the blockchain world, laying the foundation for the large-scale promotion and application of RWA projects.

Hong Kong RWA Industry Policy Evolution: Three-Stage Advancement, Parallel Systems and Pilots

1. Initial Exploration Stage (2017–2022)

- September 2017: The Hong Kong Securities and Futures Commission issued a Statement on Initial Coin Offerings, clearly stating that digital token businesses that meet the definition of "securities" fall under regulatory scope and must be licensed/registered.

- December 2020: The Hong Kong Securities and Futures Commission officially issued the first virtual asset trading platform license, with the licensed entity being OSL Exchange under BC Technology Group, which only allows services to professional investors, marking Hong Kong's first compliant platform under the virtual asset regulatory framework.

- October 2022: The Hong Kong government released the Virtual Asset Policy Declaration, proposing the concept of real asset tokenization and a green bond tokenization pilot program, initiating the exploration of asset on-chain and compliance.

2. Improving the Regulatory System (2023–2024)

- June 2023: The Hong Kong Virtual Asset Service Provider (VASP) system was officially implemented, with a 12-month licensing transition period for platforms operating in Hong Kong before June 1, establishing a compliance foundation.

- November 2023: The Hong Kong Securities and Futures Commission issued two important circulars—Circular on Tokenized Investment Products Recognized by the Commission and Circular on Intermediaries Engaging in Tokenized Securities Activities, emphasizing that tokenized securities are essentially traditional securities and must comply with the Securities and Futures Ordinance and other existing securities regulations, while lifting the "professional investor only" restriction.

- March 2024: The Hong Kong Monetary Authority launched the Ensemble Project Sandbox, focusing on exploring application scenarios for tokenization technology, with multiple RWA tokenization pilot projects in green bonds, supply chain finance, carbon credits, and real estate gradually being implemented.

- November 2024: The Hong Kong Monetary Authority introduced the Digital Bond Funding Program, encouraging more financial institutions and issuers to adopt tokenization technology in capital market transactions.

- December 2024: The draft of the "Stablecoin Regulation" was submitted to the Legislative Council for review, clarifying that issuers of fiat currency stablecoins must obtain a license.

3. Deepening Innovative Applications (2025 to Present)

- February 2025: The Hong Kong Securities and Futures Commission released the “A-S-P-I-Re” (Access, Safeguards, Products, Infrastructure, Relationships) regulatory roadmap and 12 specific action plans, covering a new regulatory framework for over-the-counter virtual asset trading and virtual asset custody services.

- May 2025: The Hong Kong Legislative Council passed the “Stablecoin Regulation”, clarifying that stablecoin issuers must be licensed institutions, ensure full reserves, meet capital adequacy requirements, and comply with sales channel restrictions.

- June 2025: The Hong Kong government released the “Hong Kong Digital Asset Development Policy Declaration 2.0” and launched the LEAP framework, clearly positioning RWA tokenization as a core driving direction, with policy support for government bond tokenization and the tokenization of proprietary assets and financial instruments, emphasizing various physical asset fields such as precious metals and renewable energy.

- August 2025: The “Stablecoin Regulation” officially came into effect, with the first batch of stablecoin licenses expected to be issued as early as early 2026, and the number of initial licenses limited.

Hong Kong RWA Iconic Pilots and Market Cases

- February 2023: The Hong Kong government **issued the world's first government green bond tokens, totaling approximately HKD 800 million, integrating the Hong Kong Bond Custody System (CMU) with Goldman Sachs' GS DAP blockchain tokenization platform, enhancing settlement efficiency (T+5 → T+1).

- September 2023: Taiji Capital and Prince Property **issued the first real estate STO in Hong Kong, opening the door for on-chain tokenization of real estate assets in Hong Kong.

- December 2023: Harvest International **successfully issued Hong Kong's first tokenized fund, which is only available to professional investors and invests in high-rated U.S. Treasury bonds. The fund is managed by Harvest Fund's Hong Kong subsidiary, Harvest International Asset Management, with tokenization solutions provided by Meta Lab HK.

- March 2024: HSBC officially launched a tokenized gold product, becoming Hong Kong's first RWA product to receive a retail license from the Securities and Futures Commission, with the underlying asset being physical gold bars certified by the London Bullion Market Association (LBMA).

- August 2024: Longxin Technology and Ant Group launched the first domestic RWA based on new energy physical assets, validating the path for cross-border asset tokenization based on the Hong Kong Monetary Authority's Ensemble sandbox.

- February 2025: Huaxia Fund (**Hong Kong) launched the first retail tokenized fund in the Asia-Pacific region (in HKD), supporting subscriptions and redemptions in HKD, USD, and RMB, with immediate settlement.

- March 2025: Taiping Asset Management and HashKey Chain **jointly launched the first on-chain money market fund for Chinese institutions, “CPIC Estable MMF,” with first-day subscriptions reaching USD 100 million.

- July 2025: Derlin Holdings **plans to tokenize assets with a total value of up to HKD 500 million, including certain rights in “Derlin Building” at 92 Wellington Street, Central, and fund asset rights.

Hong Kong Listed Companies Layout RWA, Capital Market Actively Responds

Derlin Holdings Invests in RWA Fintech Company Asseto

On August 1, 2025, Derlin Holdings invested USD 1.2903 million in Asseto Holdings Limited, a company focused on RWA tokenization, covering asset classes such as funds, bonds, stocks, and real estate. As a strategic partner of HashKey Group, Asseto's strategic industry collaboration network also includes two companies preparing to apply for Hong Kong stablecoin licenses.

Huajian Medical and BGI Collaborate to Establish RWA Fund

On July 30, 2025, Huajian Medical and BGI jointly established the world's first innovative drug intellectual property tokenization fund (IVD-BGI CoWin), focusing on the digital circulation of pharmaceutical assets. The fund will invest in Huajian Medical's Web3 exchange ecosystem projects in Hong Kong and the United States.

Fosun International's Star Road Technology Completes Nearly USD 10 Million Series A Financing

On July 30, 2025, Star Road Technology announced investment from the Solana Foundation and other Web3 institutions to build the RWA platform (FinRWA Platform), integrating fiat currencies, stablecoins, and digital assets to provide connection solutions between traditional finance and digital assets.

Alibaba's Lion Rock Holdings Enters Stablecoin and RWA

On July 28, 2025, Lion Rock Holdings announced the establishment of a digital financial group led by former Standard Chartered Bank executive Zeng Jingxuan, planning to develop multi-currency stablecoins and RWA tokenization solutions, and collaborate with traditional financial institutions to build and deploy a new generation of digital payment infrastructure.

Guofu Quantum Strategy Invests in RTree, Deepening RWA Layout

On July 28, 2025, Guofu Quantum Strategy invested USD 489,000 in RTree Tech Service to promote the tokenization process of its assets, which include proprietary artworks, trade receivables, letters of credit, and other supply chain assets.

Huaxing Capital Plans to Expand Digital Asset Business

On June 26, 2025, Huaxing Capital announced a USD 100 million investment to enter the Web3.0 and cryptocurrency fields, planning to apply to expand its existing Securities and Futures Commission licenses (Types 1, 4, and 9) to digital asset businesses and increase investment in RWA assets to support Hong Kong in becoming a global digital asset center.

Conclusion

Obtaining a license is just the starting point. Under Hong Kong's regulatory philosophy of "system first, seeking progress while maintaining stability," stablecoins will achieve efficient collaboration with real assets on a controllable risk basis. Meanwhile, the core competitiveness of RWA lies in enabling traditional low-liquidity assets to be split and achieve high-frequency circulation through blockchain technology, releasing flexibility and market potential far exceeding traditional ABS, with stablecoins serving as the trading medium for these on-chain assets.

Looking ahead, how to balance innovation and risk, and attract global capital participation, remains a direction that the Hong Kong industry needs to continuously explore. If stablecoins can serve as a hub and RWA as an engine, with the synergy of systems, industries, and technologies, it will help Hong Kong truly step into the core value area of global on-chain finance, achieving a leap from a "virtual asset testing ground" to a "global tokenized financial center."

If there are any copyright disputes regarding the reprinted article, please contact us for removal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。