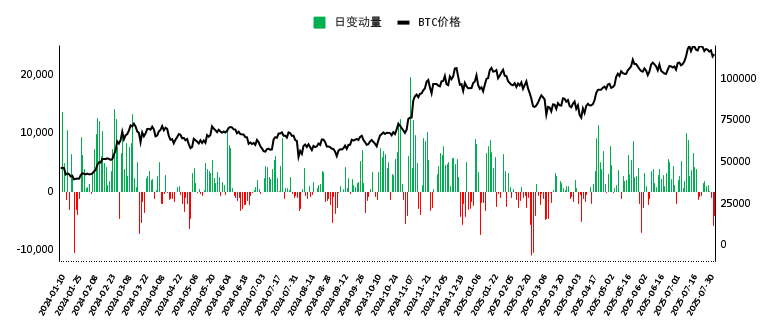

In fact, it's not just the exchanges; even in the data of the $BTC spot ETF, we can clearly see a significant decline in purchasing power over the past week. There have been signs of net outflows for three consecutive working days, and the outflow volume is quite high. Combined with the macro information mentioned earlier, the expectation of an economic downturn has led to a pessimistic sentiment among investors, including BlackRock, and this sentiment reversal currently relies on Trump.

If Trump cannot address investors' concerns about the economy, not only Bitcoin but also the performance of the U.S. stock market may not be very favorable. As of the close on Tuesday morning, the average decline in U.S. stocks was over 0.5%. Therefore, on Wednesday morning, Trump released a lot of information to the market, including that the next president might consider Vance as a candidate. This was to balance Trump's erratic statement on Tuesday night about possibly running for election again. Trump has made statements about running for election again twice before, each time resulting in a drop in his approval ratings.

In addition, Trump announced early Wednesday morning that he might distribute dividends to the American public, which instantly reminded the market of the massive liquidity injections in 2021. This is the most direct stimulus for the market. Next, we will see whether investors respond positively to Trump's words and actions after the U.S. stock market opens. From the pre-market data on CME, it appears that Asian investors are showing improved sentiment.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。