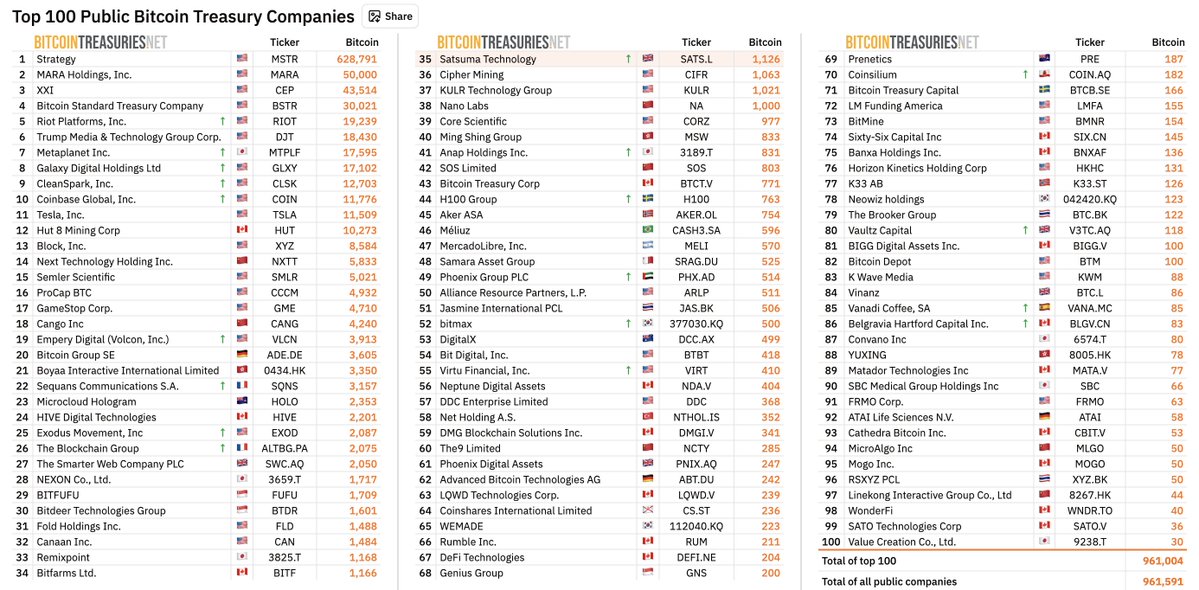

Today I saw a piece of data that surprised me: the top 100 listed companies currently hold a total of 955,000 #BTC, accounting for about 4.55% of the circulating supply of Bitcoin. This growth in data truly astonished me. 🧐

Data on listed companies holding #BTC can be found here🔗: https://bitcointreasuries.net/

Currently, the trend in the US stock market shows that “#BTC has become a favorable tool for asset allocation for emerging enterprises.”

In the past, when listed companies had cash, how did they preserve its value?

· Buy government bonds

· Deposit in banks

· Allocate gold

· Buy back stocks

But the reality in recent years is: high inflation, high interest rates, and severe currency devaluation, meaning cash lying idle has significantly shrunk in value.

At this time, the emergence of #BTC and the gradual path of compliance for US capital, along with its scarcity + decentralization + global liquidity + resistance to censorship, have made it gradually become a kind of "digital gold."

A group of keenly aware listed companies took the lead in treating Bitcoin as "digital cash" or "alternative reserve assets" on their balance sheets and began to enter the market.

🧱 Let's analyze the evolution of listed companies holding #BTC.

✅ Stage One:

Pioneer Phase (2020-2021)

Here, we must mention a key figure: Michael Saylor, CEO of MicroStrategy.

He was the first listed company boss to go all-in on #BTC, quietly buying $250 million worth of #BTC in 2020, shocking the market.

Then he began to aggressively increase his holdings, even issuing bonds, convertible bonds, and leveraging just to buy more BTC. Currently, #MSTR holds as much as 628,791 #BTC, accounting for over 66% of all publicly held #BTC.

This sparked a wave of "corporate buying of #BTC," with several companies following suit:

Tesla: Bought $150 million worth of Bitcoin in 2021 (currently holds about 11,509 coins)

Square (Block): Founder Jack Dorsey personally advocated for it (currently holds 8,584 coins)

Coinbase: As an exchange, it also allocated 11,776 coins

Mining companies like #GalaxyDigital, #Hut8, and #Riot also began to mine and hold.

✅ Stage Two:

Bear Market Resilience + Mining Companies Increasing Holdings (2022-2023)

The price of #BTC fell from $60,000 to $15,000, and many institutions faced "paper losses," but most did not sell.

Instead, many mining companies continued to "stockpile":

Marathon Digital (#MARA): Now holds 50,000 coins, becoming the second-largest publicly held company;

CleanSpark, Hut 8, BitFarms, and others continued to accumulate;

Some companies simply do not sell, directly recording it as long-term assets as "treasury."

At this time, some hedge funds and alternative investment companies also began to quietly follow suit.

✅ Stage Three:

Spot ETF Approval + Holding Diffusion (2024 to Present)

The spot Bitcoin ETF (such as #BlackRock's #IBIT) was officially approved in 2024, greatly accelerating the compliance pathway for mainstream institutions and enterprises to enter.

We are starting to see:

More small listed companies joining the holdings, such as Empery Digital and Semler Scientific;

Financial institutions like Galaxy Digital and Virtu Financial are also increasing their holdings;

Even GameStop and Trump Media (Trump's company) have bought #BTC.

In just the past week, 20 companies have added to their holdings, which is the spillover effect driven by the spot ETF.

In recent years, more and more companies have begun to treat #BTC as "strategic reserves," not only not selling but also holding long-term and publicly disclosing it, which is a new financial political declaration.

As more external channels such as ETFs and financial institutions enter the market, and more companies go on-chain, integrating #BTC into their balance sheets, the true meaning of "on-chain institution" is approaching. "Bitcoin is becoming the 'digital treasury' of listed companies; in the future, every listed company may need to consider one question: How long do you plan to be absent from #BTC?" 🧐

As the trend arrives, it is vast and powerful; those who follow it will prosper, while those who resist will perish! In line with the trend, ordinary people are at least advised to hold 1 #BTC!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。