Recent Support for Cryptocurrency Policies in the Past Week

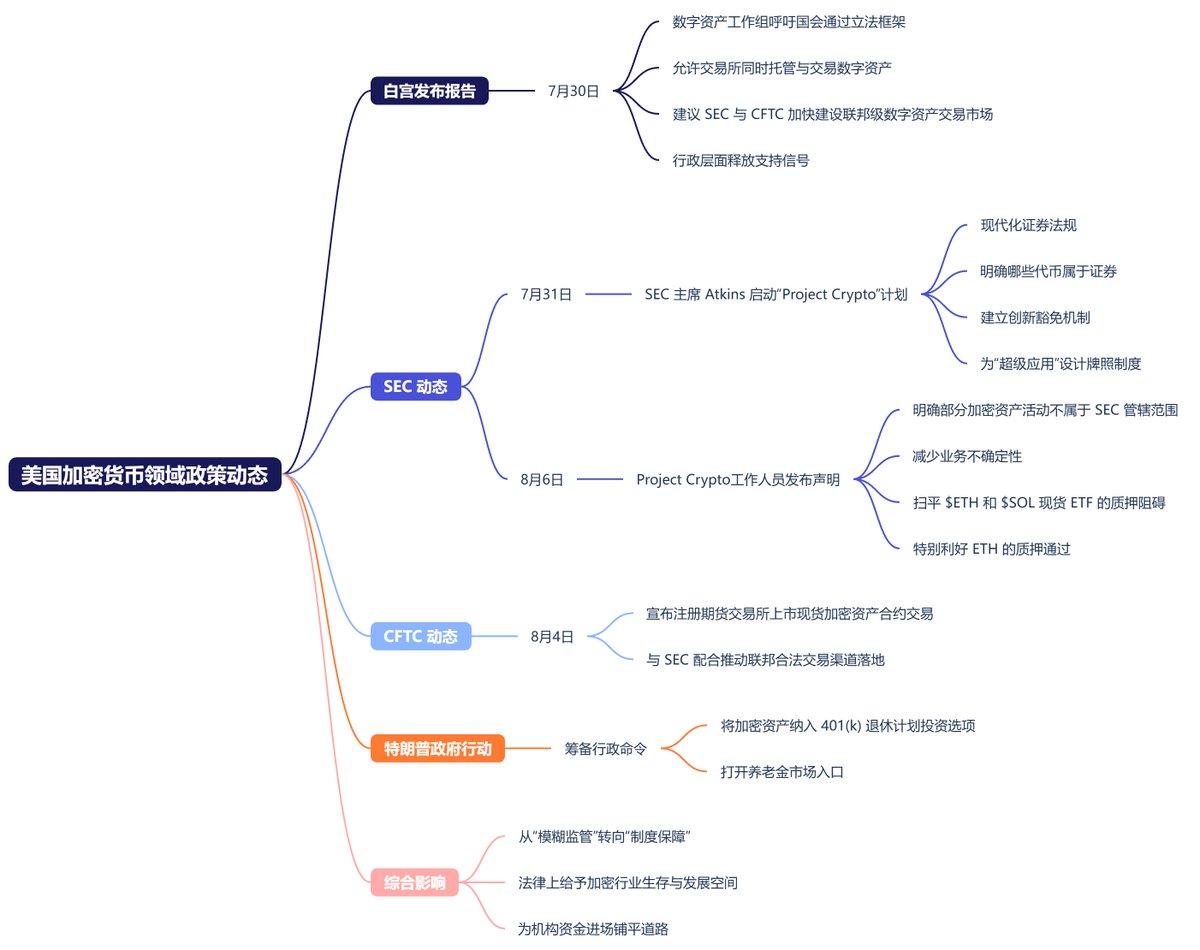

In the past week, the United States has continuously released positive policies in the cryptocurrency sector. The White House, SEC, CFTC, and Congress have all been advancing the regulation and institutional development of digital assets towards a more lenient phase.

On July 30, the White House Digital Asset Working Group released a report calling for Congress to pass a more operational legislative framework that clearly allows exchanges to simultaneously custody and trade digital assets. It also suggested that the SEC and CFTC accelerate the establishment of a federal-level digital asset trading market under their existing authority, sending a clear signal of support from the executive level.

On July 31, SEC Chairman Atkins announced the launch of the "Project Crypto" initiative, aimed at modernizing securities regulations, clarifying which tokens are considered securities, establishing an innovative exemption mechanism, and designing a licensing system for "super apps" that integrate trading, staking, and lending functions.

On August 6, Atkins announced a formal statement regarding liquid staking, clarifying that certain cryptocurrency activities do not fall under the SEC's jurisdiction. This move directly delineated clearer compliance boundaries for the industry, reducing business uncertainty.

More importantly, it cleared the way for the staking of $ETH and $SOL spot ETFs, especially for ETH, where the approval of ETF staking is just a matter of time, benefiting good ETH.

On August 4, the CFTC announced that it would list spot cryptocurrency asset contracts for trading on registered futures exchanges, aligning with the SEC's regulatory approach to jointly promote the establishment of legitimate trading channels at the federal level.

At the same time, the Trump administration is preparing an executive order to include cryptocurrency assets in 401(k) retirement plan investment options, potentially allowing trillions of dollars in pension markets to enter the cryptocurrency sector.

This series of actions collectively reflects that U.S. regulators are shifting from "ambiguous regulation" to "institutional guarantees," not only providing legal space for the survival and development of the cryptocurrency industry but also paving the way for institutional funds to enter the market.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。