Master Discusses Hot Topics:

Speaking of which, the data from the U.S. last night was really subtle. The ISM Non-Manufacturing PMI was lower than expected, but still held above the line of expansion and contraction. On the other hand, the S&P Services PMI was higher than both expectations and previous values. To put it simply, it's not terrible, but it's not outstanding either.

This combination of factors can temporarily ease the panic about an economic recession, but here comes the problem: the ISM Non-Manufacturing Employment component is quite strong. What does that mean?

It means that the July CPI might be hotter than the market expects. If next week's data doesn't deviate much from expectations, it can be glossed over. But if it deviates too much, the market is likely to react negatively.

Don't forget that tariffs are still in place, and the situation between the U.S. and India is still uncertain. Negotiations with the EU are also not completely settled, and Trump is still shouting about imposing tariffs on pharmaceuticals. If that happens, risk aversion will spike in no time.

To put it plainly, the market is currently experiencing minor shocks, but the big logic hasn't changed. As for U.S. stocks? Damn, even if this adjustment doesn't collapse, it should drop by about 10%. Let's pray it doesn't fall out of our pants. Before U.S. stocks really crash, we in the crypto circle shouldn't dream of having a separate market trend; at most, we can just follow along.

Moreover, the market is looking forward to a rate cut in September. From a first principles perspective, a rate cut indeed benefits Bitcoin. But the market will digest this expectation early.

When the rate cut actually happens, there is a high probability of profit-taking, leading to a price correction. More critically, if the rate cut is due to concerns about an economic recession, all risk assets will suffer, and the dollar may strengthen first. Funds will cling to cash, and Bitcoin will also take a hit.

Another point that is easily overlooked is that a rate cut doesn't mean all the money flows into the crypto circle; it may trigger a global capital retreat. Why do I say this? Because U.S. interest rates have dropped, making dollar yields less attractive.

So where will international funds go? They will flee to emerging markets, commodities, or even gold. What's more frightening is that if the rate cut signal is interpreted as the U.S. economy peaking, with U.S. stocks at a high, funds will directly withdraw.

The logic is: U.S. stocks crash → Risk appetite collapses → Bitcoin gets hammered. Looking at the money that came in through ETFs, it's clearly sourced from U.S. stocks, and when it withdraws, it won't be gentle.

To conclude, the first wave of rate cuts will lead to a correction in risk assets, and the second wave will be a recovery driven by liquidity. Want to buy the dip in Bitcoin? Wait until the first wave of bloodshed is over.

Back to the market, last night's correction in Bitcoin had a hint of things that should have been cleared but weren't. The price rebounded above the liquidation zone. If a higher high can be established in a smaller timeframe, this correction can be considered over.

Looking solely at contract liquidity, it's currently not very friendly to shorts. The main pressure for the correction is from the selling pressure of dollar spot funds; only when this is done can a real rebound occur.

In the short term, the cost-effectiveness of shorting has decreased, but if you really want to go long, a signal is still needed. That is, after pulling a long bullish candle with volume at 115.8k, I would dare to say the market has returned.

To be honest, this correction is really not severe compared to the first half of the year. It's just that market sentiment is low, and demand is weak, making it feel like a disaster. But the negative premium hasn't collapsed much, indicating that dollar spot funds haven't withdrawn; either it can't fall further, or a big pit is still on the way.

To be more realistic, the entire market is shouting for Bitcoin to reach 130K and Ethereum to 4K. When it really gets to that price, who the hell will take over? A bunch of people will collectively take profits and run, leaving retail investors laughing.

Are we still hoping institutions will push it to 200K before finding a buyer? But the current reality is that FOMO sentiment is at an all-time high, with those who missed out, lost everything, and leveraged all squeezed onto the same boat. If you really want to survive in this market, don't be the last one to light the fire…

Master Looks at Trends:

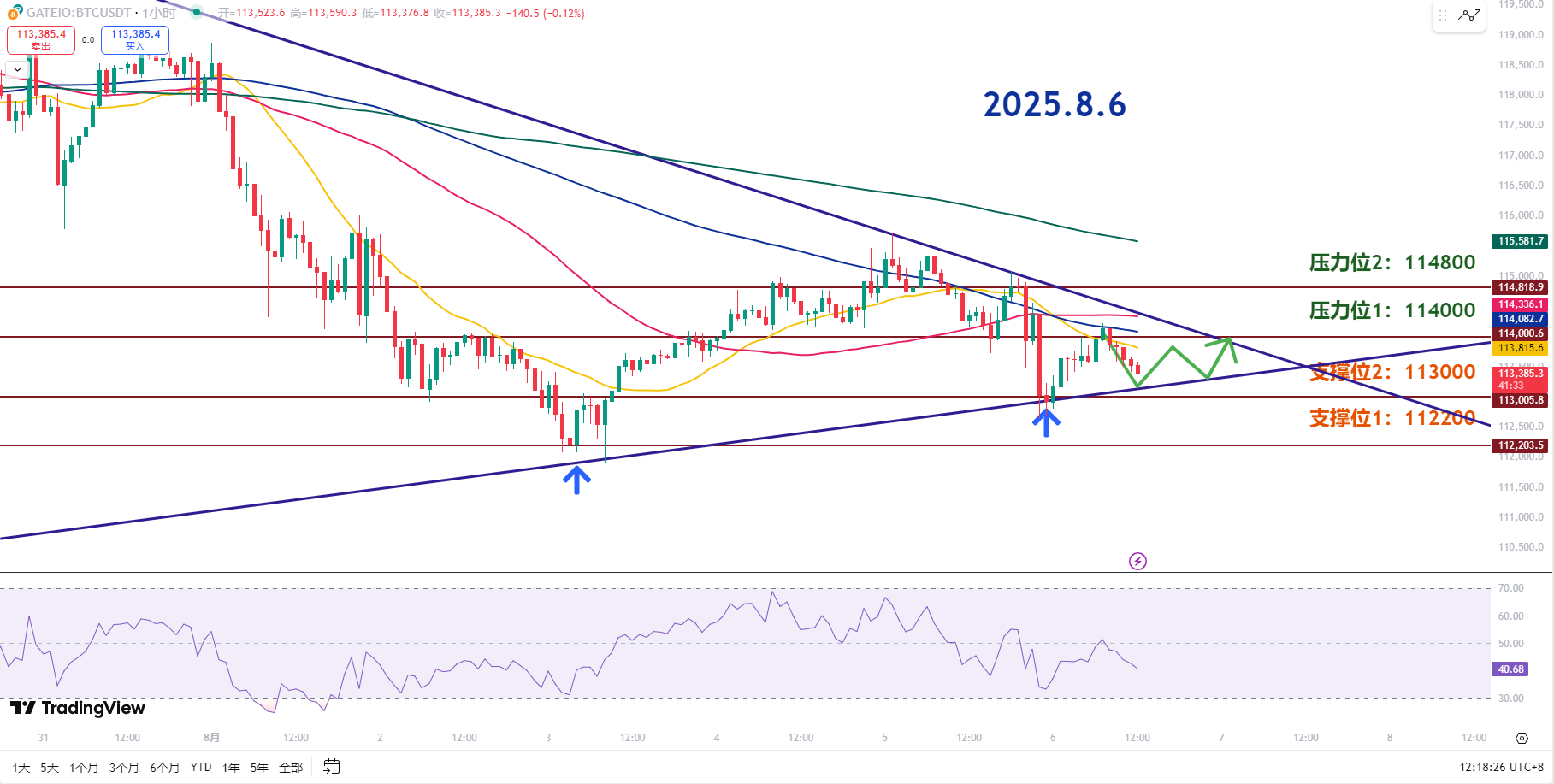

Resistance Levels Reference:

Second Resistance Level: 114800

First Resistance Level: 114000

Support Levels Reference:

Second Support Level: 113000

First Support Level: 112200

Bitcoin is forming a triangle consolidation after the drop, and the probability of sideways movement is increasing. Therefore, it must break through the descending trend line at the upper edge of the triangle consolidation to have a chance for further upward movement.

Near the ascending trend line at the lower edge of the consolidation, a short-term rebound strategy can still be maintained. 113K is an important support level; if it is not broken again, it will be more favorable for a rebound. After a significant drop, the resistance above has clearly increased, and any subsequent rise must be accompanied by larger trading volumes.

The first resistance is at 114K, where the previous key support has turned into resistance. If we see continuously rising lows on lower timeframes, the probability of testing 114K again will increase.

Due to the significant increase in short-term selling pressure, the probability of retesting has decreased. Only by breaking the descending trend line and strongly surpassing the second resistance at 114.8K can the market escape the adjustment pattern.

The first support at 113K is today's key support area and also a psychological barrier. If it does not break below 113K, the short-term strategy can still be treated as a rebound, but it is necessary to patiently observe for support confirmation and only intervene in the short-term rebound strategy after seeing signs of stabilization.

The second support at 112.2K, if broken, may open up further downward space. The current short-term low is at 112.2K; if this level is broken, it may trigger selling pressure leading to a sharp short-term drop, which needs to be anticipated in advance.

8.6 Master’s Wave Strategy:

Long Entry Reference: Accumulate in the 112200-113000 range, Target: 114000-114800

Short Entry Reference: Not currently applicable

If you truly want to learn something from a blogger, you need to keep following them, rather than just looking at a few market movements and jumping to conclusions. This market is filled with performers; today they screenshot long positions, tomorrow they summarize short positions, making it seem like they "always catch the top and bottom," but in reality, it's all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don't be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This article is exclusively planned and published by Master Chen (WeChat: Coin Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。