Original Author: Nicky, Foresight News

As of August 6, the MYX token experienced extreme price volatility. According to Bitget data, its price surged from $0.113 to $2.1 in the past three days, an increase of over 1800%. However, within just 24 hours, the price plummeted by 60% to $0.8237, currently reported at $1.05.

On August 7, on-chain analyst @ai_9684 xtpa revealed a key movement. The early investment firm Hack VC extracted 1.27 million MYX (approximately $2.157 million) from the airdrop contract within 7 hours. Of this, 445,000 MYX were sold at an average price of $1.68 through an address starting with 0x259, cashing out $747,000.

This action triggered market panic, and the token's liquidity quickly dried up. During the crash, Binance's MYX contract trading volume surged to $7 billion in a single day, with intense long and short positions.

This steep price curve instantly attracted countless eyes.

Looking back to November 2023, MYX.Finance secured $5 million in seed funding at a valuation of $50 million. Sequoia China led the round, followed by over ten institutions including Consensys and Hack VC.

With the support of capital, MYX.Finance debuted with its innovative MPM (Matching Pool Mechanism) engine. It promised to achieve zero slippage trading, addressing the pain points of on-chain derivatives with up to 125 times on-chain leverage.

By June 2024, MYX.Finance became one of the first projects in the Linea Ecosystem Investment Alliance (LEIA). At the end of July this year, Linea officially announced the upcoming TGE and released the tokenomics.

On August 6, the decentralized trading platform Etherex, launched in collaboration with Linea, Consensys, and Nile, will introduce its native token REX, with MYX.Finance as a project partner.

A year later, key actions were implemented. By the end of May 2025, the MYX node staking system "Keeper System" officially launched. Institutions including Layer 2 public chain Linea and Sequoia China participated in the node election. This system created a value closed loop: node income is directly used to repurchase MYX tokens, benefiting stakers.

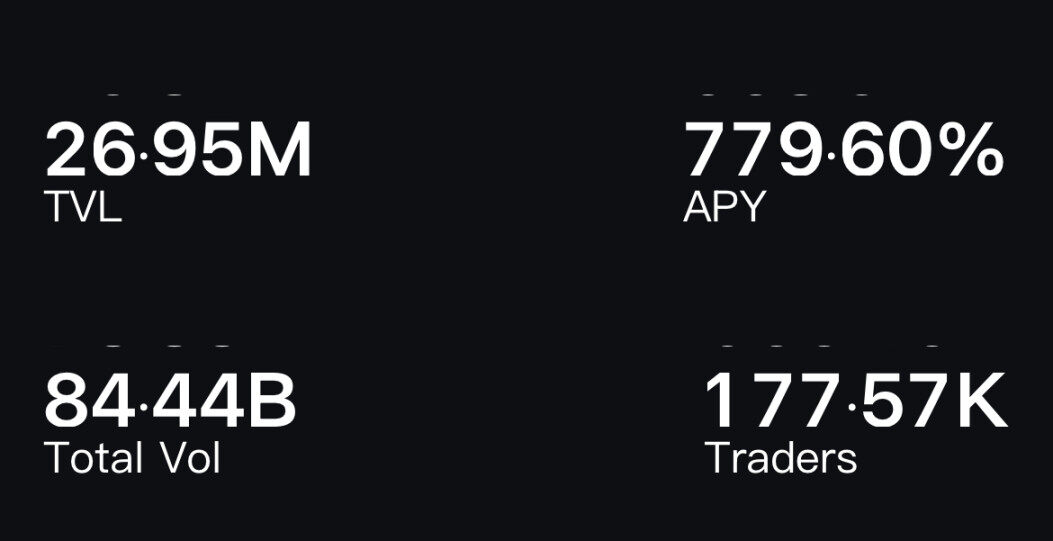

The official website shows that MYX.Finance's total locked value (TVL) has reached nearly $27 million. Total trading volume has surpassed $84 billion, with over 170,000 users.

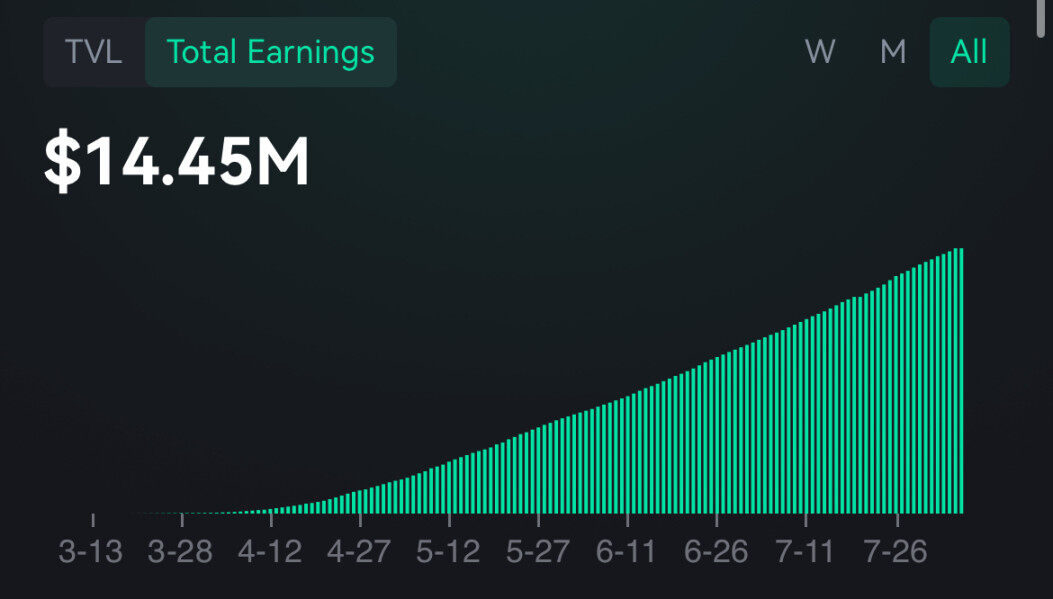

At the same time, the official website indicates that the total income of MLP liquidity providers has continued to rise, increasing from $35,000 on April 1, 2025, to the current $14.45 million. These figures serve as a testament to the ecosystem's vibrancy.

Harvesting Controversy

Behind the prosperity, the community's memory has not faded. In 2023, the BRC-20 inscribed token BMYX, associated with MYX.Finance, went through turmoil, with users accusing it of "harvesting."

Image Source: @FORAB_

Even on the eve of this year's MYX token TGE, there were still comments pointing to its incubating institution D 11 Labs, claiming that several projects it incubated had "adverse effects." "I thought it had already gone to zero," expressed the despair of investors at that time.

In response to the doubts, MYX.Finance's CEO Mrak Zhang publicly promised compensation.

By the end of May 2025, it was announced that compensation for BMYX holders would be distributed according to the plan. The plan specified: 30% in USDT equivalent stablecoins + 70% in MYX tokens (phased unlocking). The team stated that they also reserved 4% of the total token supply for future dynamic adjustments to compensation, ensuring fairness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。