Original | Odaily Planet Daily (@OdailyChina)

From SharpLink Gaming to BitMine, the ETH treasury strategy of listed companies has driven a new growth narrative for ETH, pushing the price of ETH from a low of $2,100 to a high of $3,940, an increase of over 87%. A new trend is now forming: the focus of corporate treasury strategies is quietly shifting from "holding" to "staking." This will reshape the perception of the "activeness" of crypto assets: ETH is no longer just a static reserve but is seen as a productive asset that can generate sustainable output.

SharpLink Gaming is a pioneer of this trend. Since launching its ETH treasury strategy on June 2, the company has staked all of its approximately 438,190 ETH. As of now, it has accumulated about 722 ETH in staking rewards, valued at approximately $2.6 million.

According to on-chain analyst Yu Jin, a suspected ETH reserve address has accumulated a total of 41,452 ETH (approximately $148 million) since August 1, with an average price of about $3,575, all staked through Figment. On August 3, it staked another 15,846 ETH (approximately $55.34 million). This operation is similar to that of SharpLink Gaming, suspected to be its reserve address, but the specific ownership of this address is still unclear.

This strategy not only demonstrates corporate confidence in the long-term value of ETH but also gradually transforms ETH from a price speculation asset into a corporate-level, institutionalized "cash flow tool."

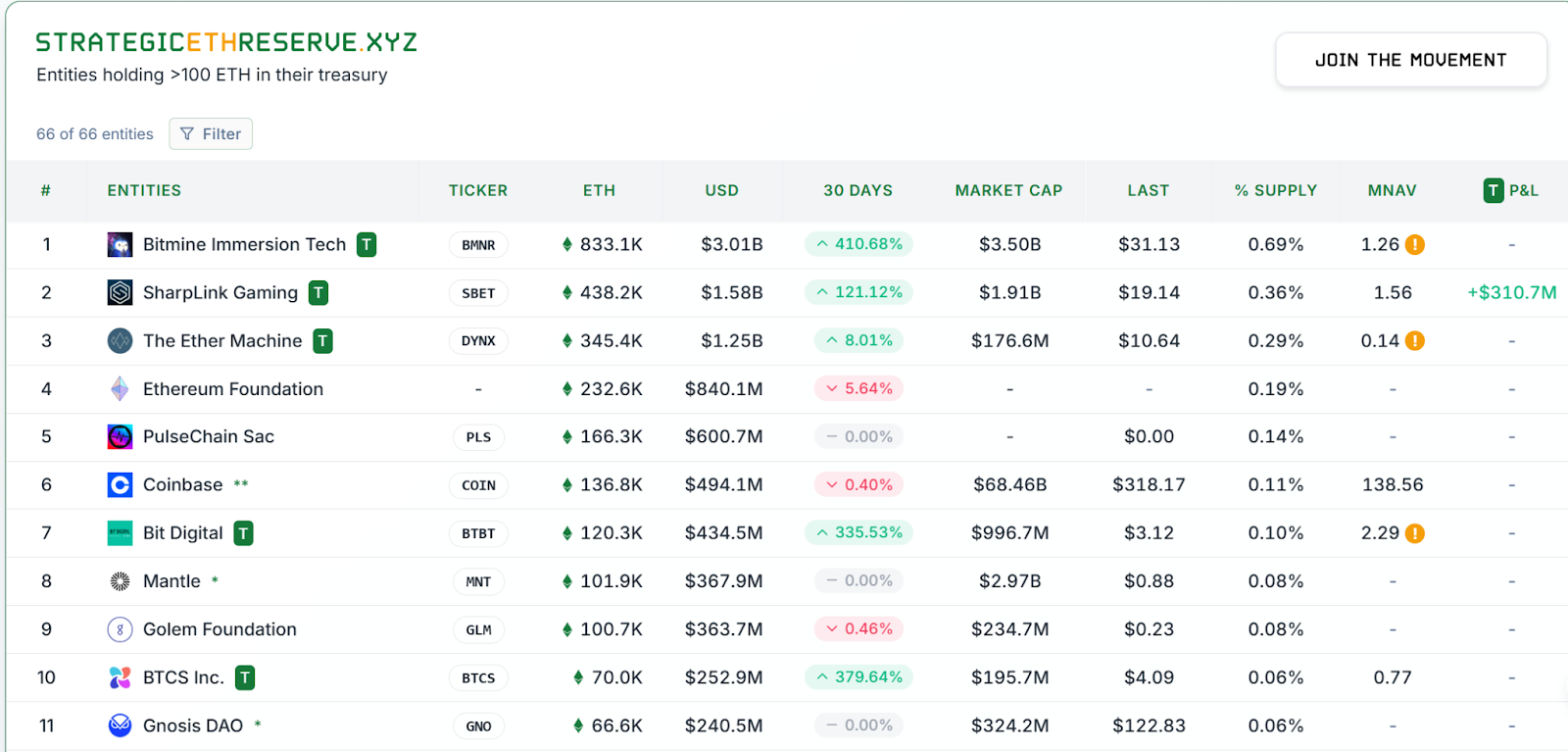

Who is the King of Treasuries? The Three Giants Compete for the Top ETH Reserve

According to StrategicETHReserve data, three listed companies currently hold more ETH than the Ethereum Foundation.

BitMine: Financial Strength Suppresses All

With a holding of 833,000 ETH (approximately $3.06 billion), BitMine firmly holds the top position. Originally a Bitcoin mining company, BitMine announced the launch of its Bitcoin reserve strategy on June 9, 2025, having used proceeds from an $18 million common stock issuance to purchase 154.167 Bitcoin.

However, on June 30, the company raised $250 million through private placement financing and announced the launch of its ETH treasury strategy, marking its official shift from BTC to ETH.

The shareholder lineup behind it is also eye-catching. PayPal co-founder Peter Thiel holds 9.1% of its shares, and "Cathie Wood" of Ark Investment has invested a total of $182 million in BitMine stock through three funds. BitMine has publicly stated that this funding will primarily be used to purchase ETH.

Although its average entry cost is currently $3,755 and it is still in a floating loss, BitMine has established itself as the largest ETH treasury globally and the third-largest cryptocurrency treasury.

SharpLink Gaming: Full Staking Occupies the Compound Interest High Ground

With 498,884 ETH (approximately $1.8 billion, StrategicETHReserve data may be slightly delayed, based on SEC filings), SharpLink ranks second and is the first publicly listed company to declare ETH as a reserve asset. The company submitted a plan to the SEC in June to raise $1 billion through stock issuance to purchase ETH. Compared to BitMine, SharpLink not only has a significant position but also enhances asset utilization efficiency through a "full staking" strategy, taking the lead in the financial application of ETH.

The Ether Machine: Latecomer Gaining Ground

With 345,000 ETH (approximately $1.26 billion), The Ether Machine ranks third, surpassing the Ethereum Foundation. On July 21, the company officially launched its ETH reserve plan, aiming to exceed $1.5 billion in holdings. Although it started later, its rapid advancement has made it an important variable in this round of the "treasury competition."

The three companies have different strategies: BitMine is racing ahead with financial advantages, SharpLink is seizing returns through staking, and The Ether Machine is rapidly catching up.

ETH Treasury ≠ BTC Treasury: Structural Differences Bring New Financial Models

The differences between ETH treasuries and Bitcoin (BTC) treasuries stem from their fundamentally different asset properties. The reserve logic of Bitcoin primarily relies on price appreciation, which is a typical "passive holding"; whereas ETH has native yield mechanisms such as staking, re-staking, and lending, which can provide sustainable cash flow, introducing a compound interest variable into the financial model.

According to estimates by Wall Street brokerage Bernstein, a $1 billion ETH reserve can generate approximately $30 million to $50 million in annual returns through staking, with an annualized return rate of 3%-5%. SharpLink's full staking strategy is a prime example of this logic, achieving exponential growth of assets through continuous reinvestment of staking rewards.

In contrast, BTC treasuries rely more on market sentiment and the "digital gold" narrative, lacking a stable native yield structure. Bitwise Chief Investment Officer Matt Hougan pointed out that ETH treasuries, packaged as "stock shells," convert staking rewards into a model similar to corporate dividends, clarifying the ambiguity of Ethereum's value narrative. He stated, "ETH treasuries stake $1 billion in ETH, immediately generating quantifiable returns, which is highly attractive to institutional investors."

Regulatory Winds Turning Favorable: Staking ETFs Are on the Way

Not only corporations but traditional finance is also beginning to pave the way for the possibility of ETH staking.

In early August, the U.S. SEC indicated that it is reviewing BlackRock's application for a rule change, proposing to allow its iShares Ethereum Trust to incorporate an Ethereum staking mechanism. This application was submitted by Nasdaq and is similar to proposals from institutions like 21 Shares and Grayscale.

Once approved, the ETF will be able to stake its held ETH and return block rewards and transaction fees to fund investors, effectively achieving "ETF dividends." This not only lowers the technical barriers for institutions to enter ETH staking (no need to run their own validation nodes) but also introduces a more robust source of funding for the PoS ecosystem. For traditional investors, this is a new way to participate that avoids operational risks while enjoying 3%-5% annualized returns. However, ETH staking must be cautious of slashing risks, as validator failures may lead to small principal losses.

The change in regulatory attitude is providing compliance support for the ETH treasury model.

The Systemic Significance of ETH Treasuries: More Than Just Returns, But Ecological Game Theory

The significance of ETH treasuries goes far beyond "book returns."

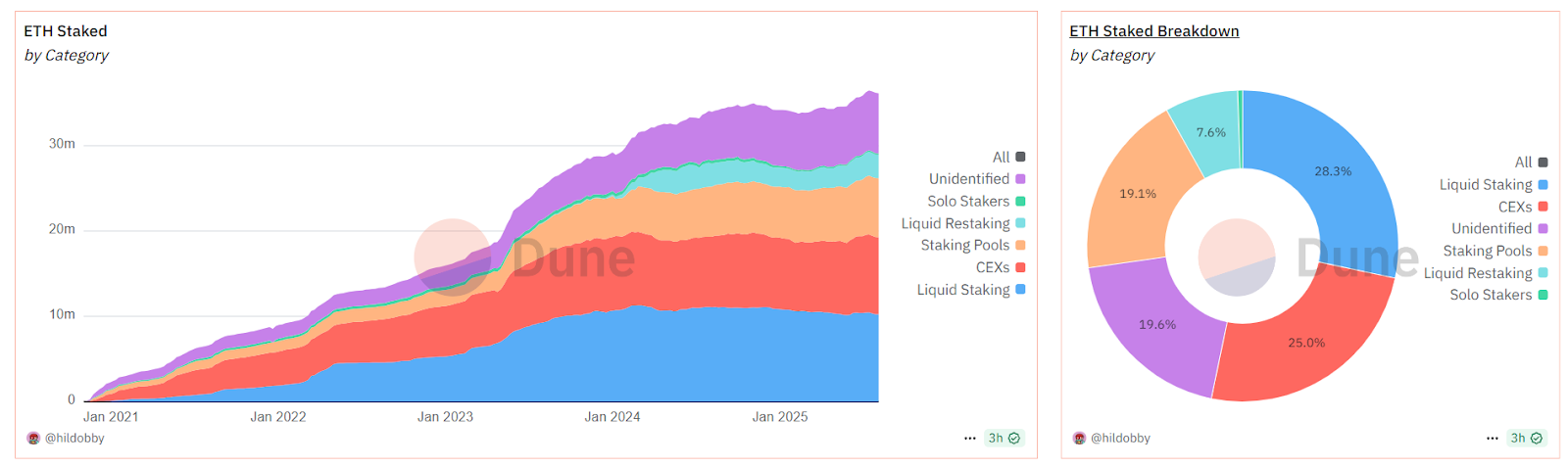

As shown in the figure, ETH staking can be roughly divided into five categories: liquid staking (28.3%), centralized exchange staking (25%), staking pools (19.1%), unidentified individual or entity staking (19.6%), and liquidity re-staking (7.6%).

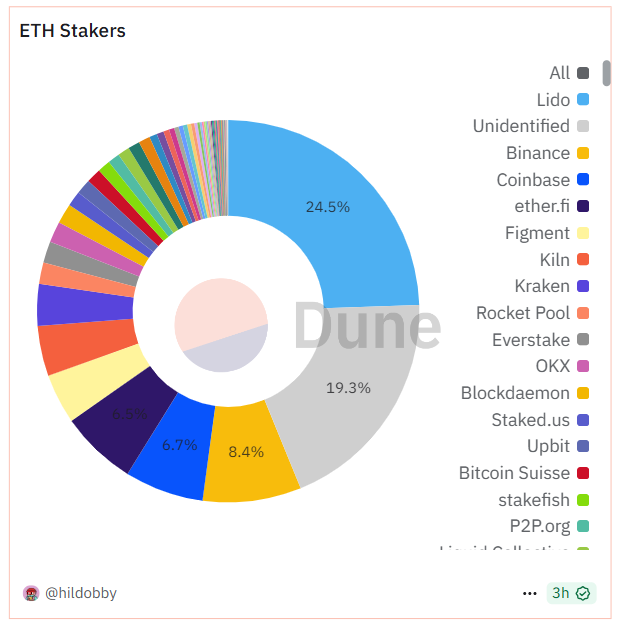

One of the biggest challenges facing Ethereum currently is the increasing concentration of validators and staked ETH (mainly in liquid staking protocols like Lido and centralized exchanges like Binance).

ETH treasuries help counteract this trend and promote validator decentralization. For example, a suspected ETH reserve address has accumulated 41,452 ETH (approximately $148 million), all staked through Figment. If these companies were to diversify their ETH across multiple staking service providers and operate their own validation nodes when possible, it could change the current concentration pattern and inject true decentralization into the Ethereum network.

In the long term, corporate participation in staking means more entities joining Ethereum's governance ecosystem, which helps to decentralize governance power, reducing the control of core developers or single entities, and promoting Ethereum to become a true global public infrastructure.

From BitMine's financing offensive to SharpLink's full staking and the paving of the ETF path, Ethereum is undergoing a structural identity leap: from speculative asset to production tool, from price bet to cash flow asset. The ETH treasury strategy is no longer just a financial operation of a single enterprise but a collective trial regarding the new financial order of Web 3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。