📉 I just read an article from Youzhi Youxing that said:

In China's A-shares, whether small-cap or large-cap stocks, holding for more than 10 years can almost guarantee a profit of 100%.

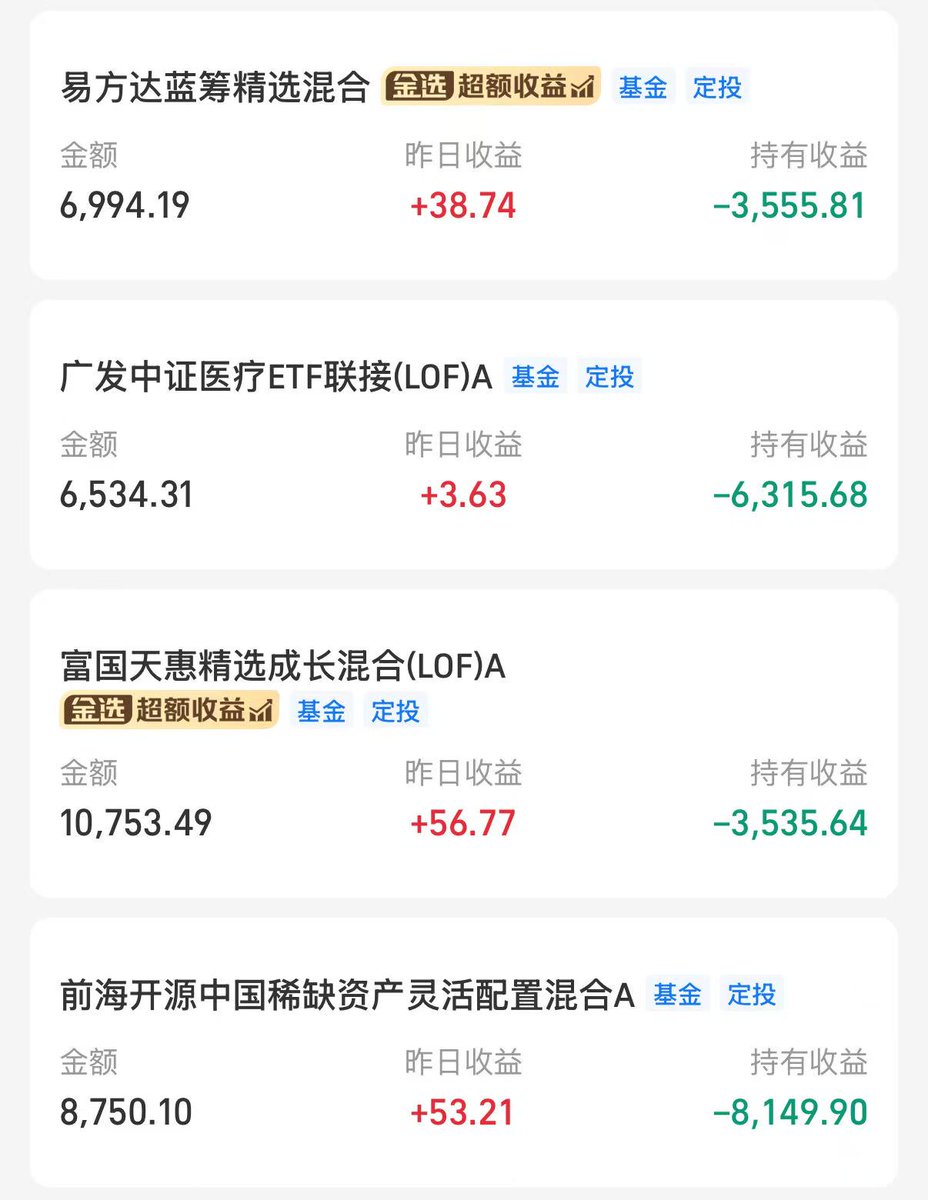

Coincidentally, while browsing Alipay yesterday, I discovered a few funds that I had forgotten about. I can't even remember when I bought them, but I estimate it was at least 4 years ago, and I can't recall why I bought them at the time.

Looking at the -50% return, the losses are quite significant, but fortunately, it's not a large amount of money, and I've been too lazy to manage it.

This shows that my investment skills in this area are really not great; I can even say they are poor.

I never seriously understood what I was investing in, why I was investing, nor did I pay attention to subsequent trends and changes.

So regarding this "long-termism," I think many people still have misconceptions—

It's not about holding for a long time that qualifies as long-term investment, but rather knowing what you are holding that gives you the right to talk about the long term.

Blindly holding long-term only wears down your time, confidence, and principal.

Take these few funds I have, for example—

If I continue to leave them untouched, perhaps in another five years, I might break even.

But am I making a 10-year investment just to break even and earn 1%? Clearly not.

So I ultimately chose to sell decisively.

I clearly know: this is just a mess that I'm too lazy to clean up, and continuing to hold it is meaningless.

I won't study it, I won't build up my understanding, and I won't have the confidence and patience to accompany it on the road ahead.

It's better to take that money and invest in things I believe in and am more interested in!

Instead of blindly believing that "long-term will definitely win," it's better to look back and ask: do the things we hold truly deserve the term "long-term"?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。