On August 5, the U.S. crypto capital market welcomed a special "new face" — Figure Technology Solutions (FTS). Founded by SoFi co-founder and former CEO Mike Cagney, this fintech company has submitted its S-1 filing to the U.S. Securities and Exchange Commission (SEC), officially starting the IPO process. Unlike traditional financial institutions that adhere to conventional methods, Figure has been built on a blockchain framework from its inception, reshaping the financial paradigm of mortgages and crypto-backed loans.

Mike Cagney, who led SoFi to create a wave in the internet finance sector, now aims to disrupt the business models that traditional banks rely on using blockchain technology. He stated, "The funding validates our vision of redefining capital markets using blockchain technology, and we are also gaining real benefits by adopting blockchain in our lending and capital market operations."

Entering the Mortgage Market: The Largest Non-Bank HELOC Provider in the U.S.

In the mortgage market, Figure directly hit the soft spot of traditional banks with speed and transparency. In the past, applying for a HELOC loan could take weeks or even months, but on Figure's platform, users can get approved in as fast as 5 minutes through a 100% online application, with funds disbursed within 5 days.

To date, Figure has helped over 200,000 households unlock $16 billion in home equity, rising to become one of the largest non-bank HELOC providers in the U.S. Interestingly, this success is not due to "simplified reviews" for speed, but rather thanks to Figure's self-developed Provenance blockchain. This is a public, PoS blockchain based on the Cosmos SDK, supporting instant finality, meaning once confirmed, it cannot be rolled back, ensuring the security and transparency of loan settlements.

Provenance not only establishes standardized, tamper-proof on-chain records for each loan but also directly connects to Figure's own Figure Connect — a native on-chain private capital market platform. Through it, loan originators and investors can complete matching, pricing, and settlement on-chain, compressing the entire process from traditional months to just days, almost redefining the efficiency of private credit circulation.

Crypto-Backed Loans: HODL and Liquidity Combined

If HELOC has allowed Figure to establish a foothold in the traditional mortgage sector, then crypto-backed loans are its way of making a mark in the digital asset arena.

In this business, customers can use Bitcoin (BTC) or Ethereum (ETH) as collateral to borrow cash at a maximum LTV (loan-to-value ratio) of 75%, with interest rates as low as 8.91% (50% LTV), and no credit score required.

All collateralized assets are stored in a decentralized, isolated multi-party computation (MPC) custody wallet, allowing customers to directly view the on-chain address, ensuring that funds are never misappropriated. This means that even if you are borrowing against BTC or ETH, you can continue to "HODL" with peace of mind, while the cash in hand can be used to pay off debts, buy homes, renovate, or even directly increase your holdings in more crypto assets.

This design is particularly popular in bull markets — investors can release liquidity without having to sell at a loss while retaining the potential for asset appreciation; in bear markets, they can obtain emergency funds through collateralization, avoiding forced liquidation.

Actively Integrating into the Crypto Space: RWA and Stablecoin Dual-Drive

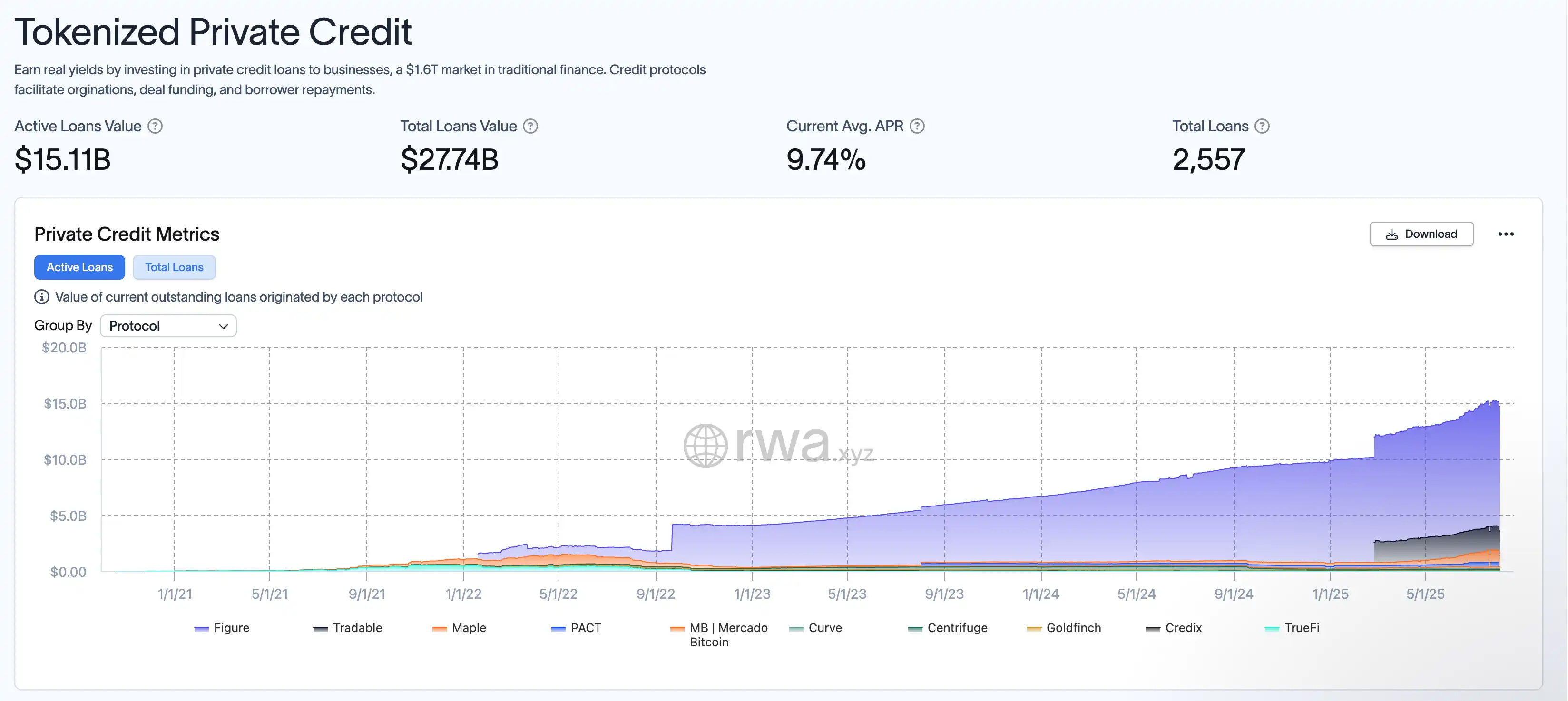

Figure's ambitions extend far beyond mortgages and crypto loans. Leveraging the underlying technology of the Provenance blockchain, Figure has issued a total of $13 billion in loans within the $27.74 billion tokenized private credit market, with active loans reaching $11 billion and a utilization rate exceeding 84%. As seen on rwa.xyz, Figure consistently ranks first in the private credit category. Whether it's mortgage assets or private credit, Figure can digitize, program, and achieve standardized issuance and trading on-chain. These on-chain assets are inherently compatible with decentralized finance (DeFi) protocols, allowing funds that were previously locked in traditional financial systems to circulate, collateralize, and be reused globally, completely blurring the lines between TradFi and DeFi.

At the same time, the YLDS stablecoin launched by Figure Markets has become the world's first interest-bearing stablecoin approved by the SEC, pegged 1:1 to the U.S. dollar and calculating interest at SOFR-50bp, with an annual yield of approximately 3.79%. YLDS not only has impeccable compliance but also provides users with stable returns, applicable for payments, cross-border settlements, collateral financing, and various other scenarios. This "RWA + stablecoin" combination not only locks in dual increments from the real asset and digital asset markets for Figure but also positions it at the entrance of the next multi-trillion-dollar market.

Capital Layout and IPO Preparation

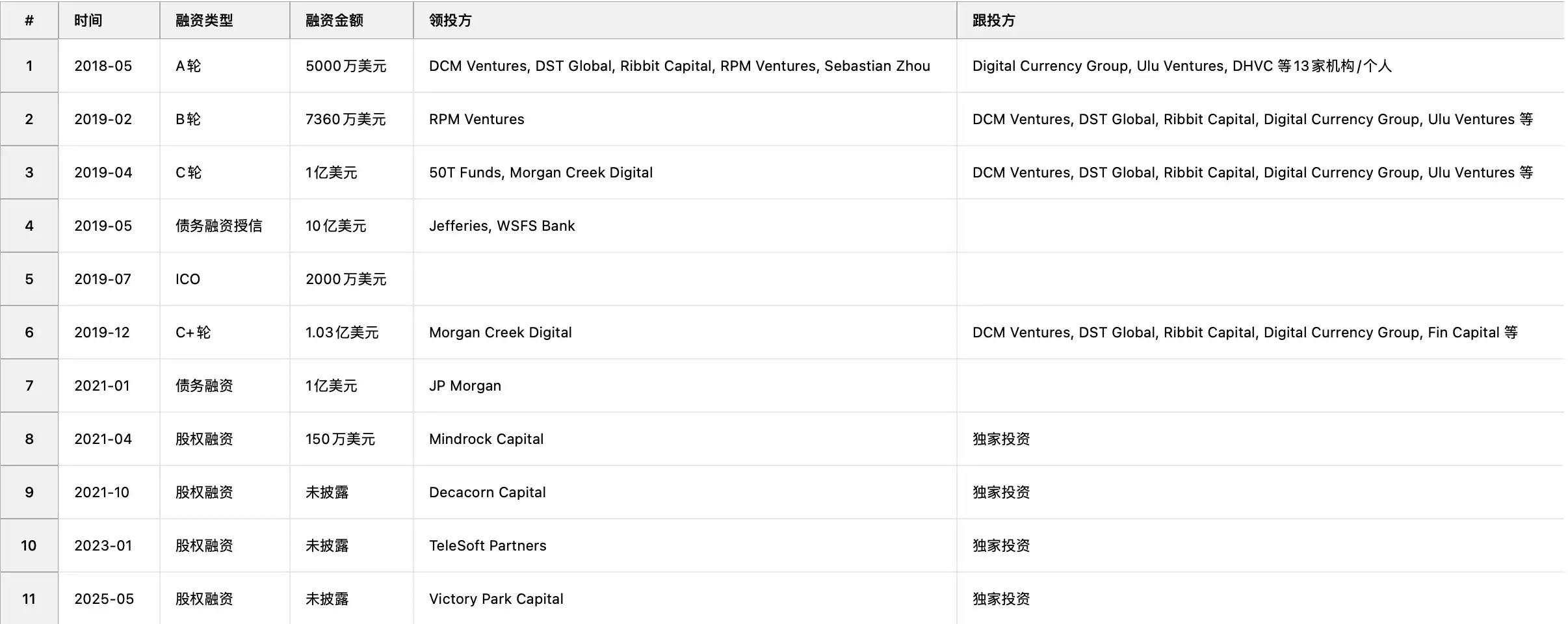

In just a few years, Figure has completed multiple rounds of financing, with investors including renowned institutions such as DCM Ventures, DST Global, Ribbit Capital, and Morgan Creek Digital, and has secured billions of dollars in debt credit from Jefferies, JPMorgan, and others. According to market news, the IPO underwriting lineup includes top Wall Street investment banks such as Goldman Sachs and JPMorgan.

Prior to this, Figure has restructured its internal framework, incorporating the lending entity Figure Lending LLC into the Figure Technology Solutions brand system and bringing in a management team with rich regulatory and corporate governance experience to pave the way for the IPO.

Conclusion

The year 2025 may be remembered as the year of crypto stocks. From the emergence of various "shanzhai coin versions of MicroStrategy" to the crazy myth of CRCL creating a tenfold increase a month after its IPO, to top crypto companies like Kraken gearing up, the integration of capital markets and on-chain markets is entering deeper waters.

Now, everyone is waiting for that true RWA whale — one that can bring trillion-level real assets on-chain and redefine the market landscape like Bitcoin and Ethereum. Figure is racing towards this position at full speed, and its next step may very well be a part of history.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。