Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

The chase for ETH by hot money has not diminished — Following a short-term correction in the entire cryptocurrency market in the latter half of last week, the market finally welcomed a rebound this week, with ETH once again becoming the leading player in this small phase of rebound.

According to OKX market data, as of 8:40 AM Beijing time on August 5, ETH was reported at 3708 USDT, rebounding over 10% from last Sunday morning's low of 3355 USDT, significantly outperforming other mainstream coins like BTC and SOL during the same period.

Rising Logic: Institutions Buy, Buy, Buy

Regarding the logic behind ETH's rise, we previously provided a detailed analysis in the article “Five Major Rising Logics Becoming Clearer, ETH May Welcome Structural Reversal.” In short, supported by five major rising logics including regulatory easing, institutional accumulation, foundation reform, growth in on-chain activities, and a return of market confidence, ETH, which has undergone a long consolidation period, may welcome a structural reversal, with the potential for further upward momentum in the long term.

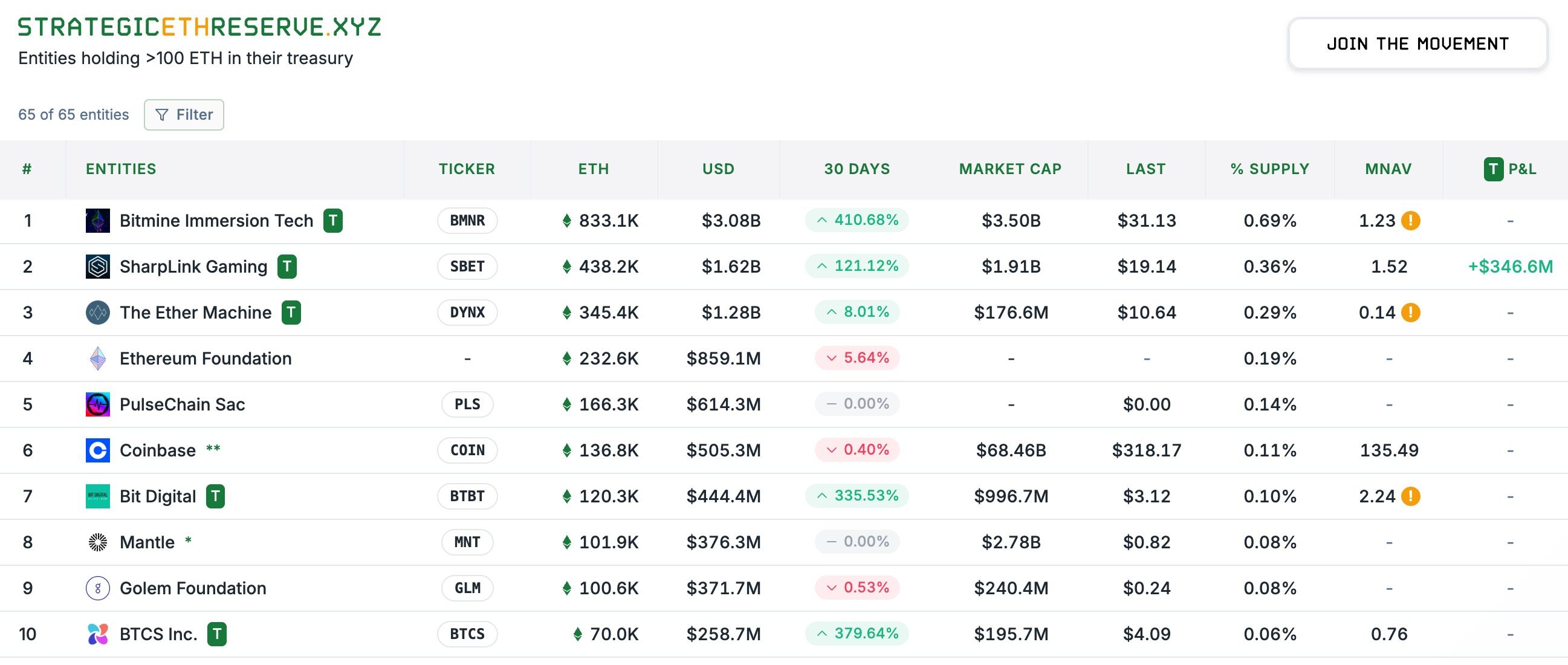

The most critical reason is undoubtedly the “crazy pursuit of ETH by institutional funds.” Strategic ETH Reserve data shows that as of August 5, three entities have completed their holdings in the Ethereum Foundation after aggressive accumulation, surpassing the previous scale — BitMine holds 833,000 coins, valued at approximately 3.08 billion USD; Sharplink holds 438,000 coins, valued at approximately 1.62 billion USD; The Ether Machine holds 345,000 coins, valued at approximately 1.28 billion USD.

It is not an exaggeration to say that the institutional forces represented by BitMine, Sharplink, and The Ether Machine have become the current controllers of ETH's price narrative, and their continuous accumulation has become the strongest buying support for ETH's price.

Next Stop, Battle for 4000 USD?

With ETH's strong rebound, more and more people are starting to anticipate when ETH will reclaim the crucial psychological barrier of 4000 USD.

The emphasis on the significance of 4000 USD is because this price represents ETH's most glorious past. During the last bull market driven by the DeFi and NFT boom, ETH once reached a peak of 4878 USD; at the end of last year, when BTC surged past the 100,000 USD mark with the favorable news of Trump's victory, ETH briefly reclaimed the 4000 USD mark but quickly fell again.

Considering ETH's historical performance, the 4000 USD mark has, in a sense, become an obsession for many "e-guards." If it can effectively break through, it will significantly boost community confidence; conversely, if it fails to break through despite so many favorable conditions, it will inevitably lead to a larger-scale collapse of faith.

Last week, ETH made several attempts to test the 4000 USD mark but ended in failure. The most regrettable attempt was on the eve of last Tuesday's tenth anniversary, when ETH briefly touched 3941 USD, and there were hopes of witnessing a "return of the king" on the anniversary, but unfortunately, it did not come to fruition.

As ETH shows strong momentum again in this week's phase of rebound, the 4000 USD mark is once again in sight… Can this time ETH reclaim its former glory? Based on the analyses from various experts, there seems to be a general consensus that ETH will continue to test the 4000 USD mark, but opinions differ on whether it will succeed and when.

Well-known trader Eugene Ng Ah Sio stated yesterday on his personal TG channel: “The market has been thrilling these days, but we made it through — we were almost forced to cut losses at the bottom, but after seeing BTC rebound from 112,000 USD, we decided to hold on. Now we are watching whether ETH can once again surge to 3800–4000 USD, looking for a short-term opportunity. However, if the market weakens again…”

Benjamin Cowen, founder of ITC Crypto, expressed on X: “I believe ETH is most likely to take two paths right now. I hope to see ETH break through 4000 USD in August; if this breakthrough occurs, even if there is a pullback testing the 4000 USD support in September, it will lay the foundation for a higher price at the end of the cycle. The other scenario is that if August fails to break through, we need to pay attention to the performance under pressure of the bull market support zone — ideally, ETH will build higher lows in this area in September. My basic judgment remains that ETH will set a historical high this year, but the path to achieving this goal is difficult to predict accurately.”

Overseas KOL Alyo stated: “In my view, ETH still maintains a strong posture. During this market sell-off, ETH has shown relative resilience compared to Bitcoin and has firmly stood above all key moving averages. The pullback after this surge is very healthy; we should regroup and prepare to challenge the ultimate Boss — the 4000 USD mark again. Although we have faced setbacks in previous attempts, we will surely conquer this fortress next time. Now is not the time to waver, retreat, or indulge in bear market panic.”

Additionally, some traders have set their sights on even higher positions. Greeks.live mentioned in its latest English community briefing that the community is showing a cautiously optimistic sentiment, with traders expecting a market rebound rather than an immediate new high, while maintaining a mixed position of bullish and bearish options. The altcoin market shows clear differentiation, with some traders still optimistic about ETH, believing that ETH's target price will break through 5000 USD.

Tom Lee, the head of BitMine and a die-hard bull in cryptocurrency, holds a more aggressive view, believing that 4000 USD is just a matter of time, and that within the next 12 months, ETH's fair price could be around 10,000 to 20,000 USD…

Will Altcoins Follow the Rise?

Another major question surrounding ETH's continued rise is — will altcoins follow suit?

Looking at a larger sample, during ETH's strong rebound from the bottom of 1385 USD, the altcoin market did show a noticeable follow-up, with some tokens like ENA even outperforming ETH itself; however, narrowing the sample down to this week's phase of ETH's rebound, most altcoins have not kept pace with ETH's rebound, except for a few tokens like FLUID that have clear favorable conditions.

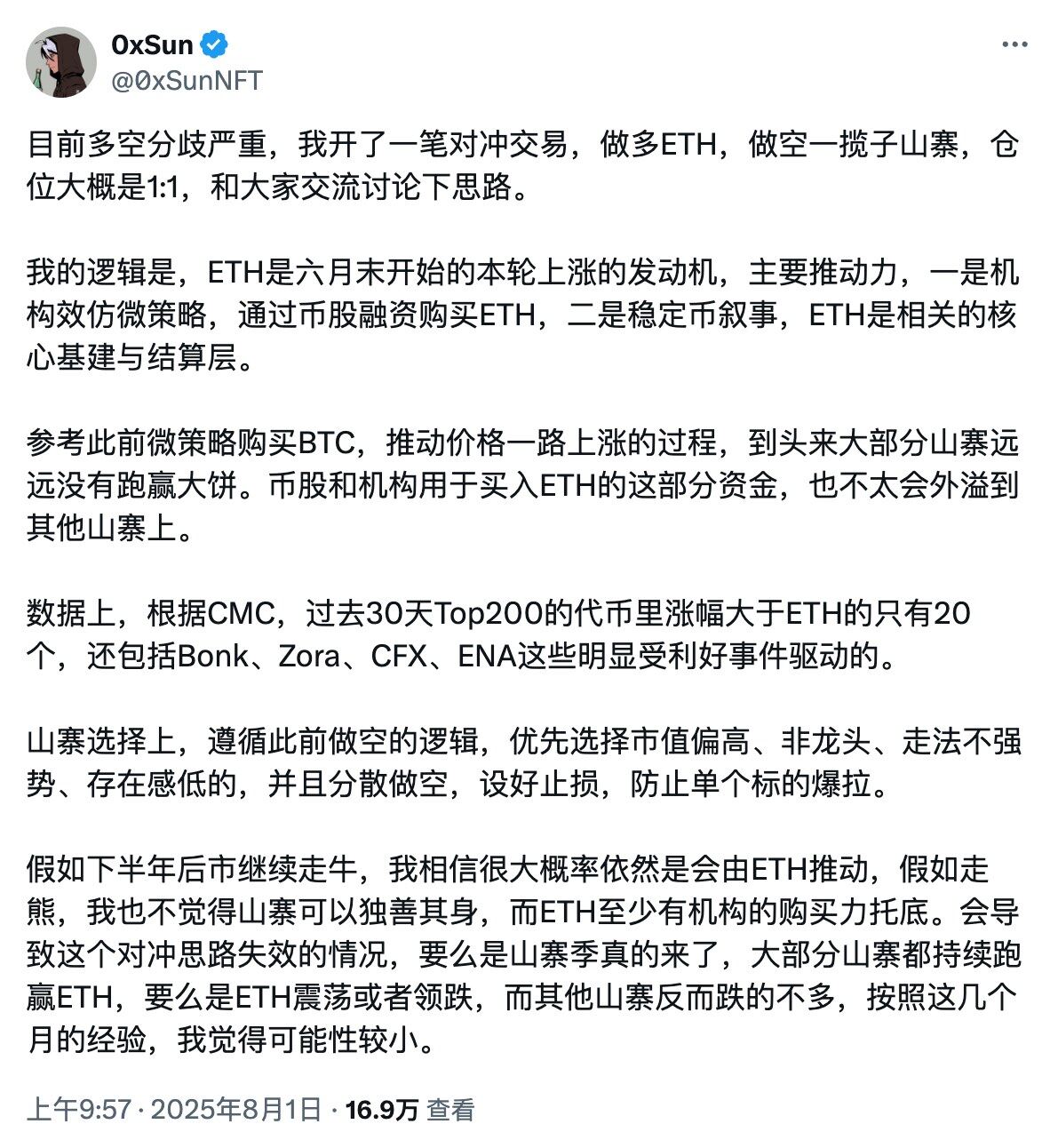

Earlier last week, well-known trader 0xSun stated that he has gone long on ETH and diversified by shorting weak altcoins for hedging, reasoning that he does not believe the funds flowing into ETH will spill over to altcoins.

We tend to agree with this operational strategy. In several previous analyses regarding the "altcoin season," we have repeatedly mentioned a viewpoint from Evgeny Gaevoy, founder and CEO of Wintermute — “There may not be a comprehensive bull market again; investors will pay more attention to protocols that have real utility and sustainable economic models.”

This viewpoint has indeed been repeatedly validated in the market trends over the past two years; the era of mindless speculation where “one coin rises, all coins follow” is over. As the cryptocurrency market matures, the research and investment demand surrounding individual protocols will continue to grow, and investors should not generalize all altcoins but should filter out their own Alpha and Beta through more comprehensive and in-depth analysis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。