In the July interest rate meeting, Powell's hawkish remarks dampened expectations for interest rate cuts—on one hand, he affirmed the robust performance of the current labor market and reiterated the inflationary pressures that tariffs could bring, warning that one-time price shocks could evolve into persistent inflation risks; on the other hand, despite the ongoing political pressure from Trump, Powell showed no signs of retreat, adhering to the "data-driven" principle and emphasizing the importance of maintaining the Federal Reserve's independence. This statement quickly cooled the market's previously high expectations for rate cuts.

However, the non-farm payroll data released on Friday caused a sharp downturn in market sentiment: July's new jobs increased by only 73,000, marking a nine-month low. More critically, the employment data for May and June was revised down by a total of 258,000, leaving only 33,000 jobs, the lowest level since the pandemic began. Expectations of a recession suddenly intensified, leading to a significant pullback in both the U.S. stock market and the cryptocurrency market.

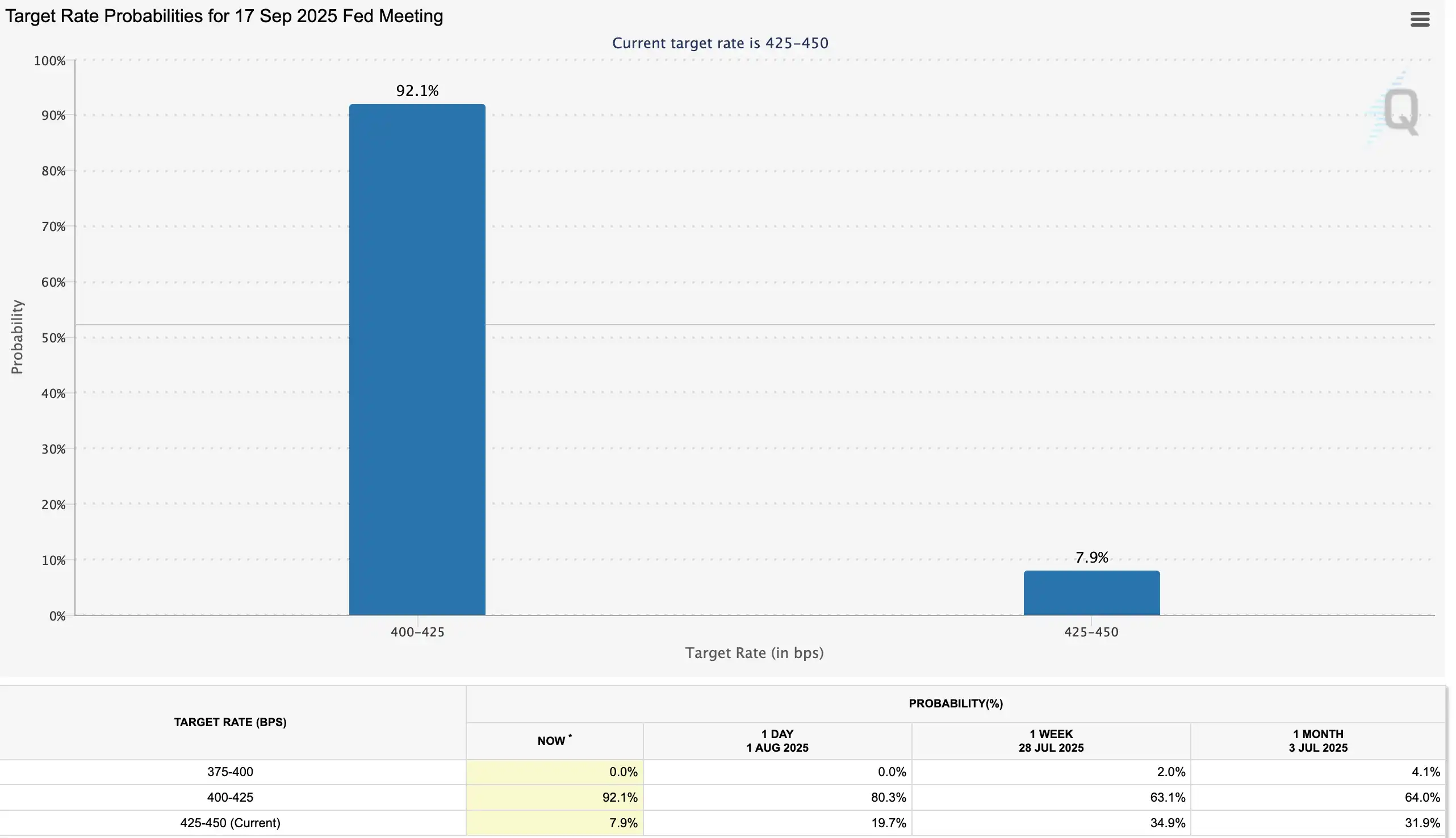

As a result, expectations for a rate cut in September surged—CME's FedWatch tool indicated that the probability of a rate cut in September has skyrocketed to 92.1%, up from just 63.1% a week ago. Meanwhile, the White House officially launched a "hunting" campaign against the Federal Reserve: on the day the data was released, Trump fired the Labor Statistics Bureau director appointed by the Biden administration and accepted the resignation of Fed Governor Quarles, indicating that the White House is determined to influence the September meeting.

Next, Rhythm BlockBeats compiled traders' views on the upcoming market situation to provide some directional references for trading this week.

Future Market Trends

@CryptoHayes

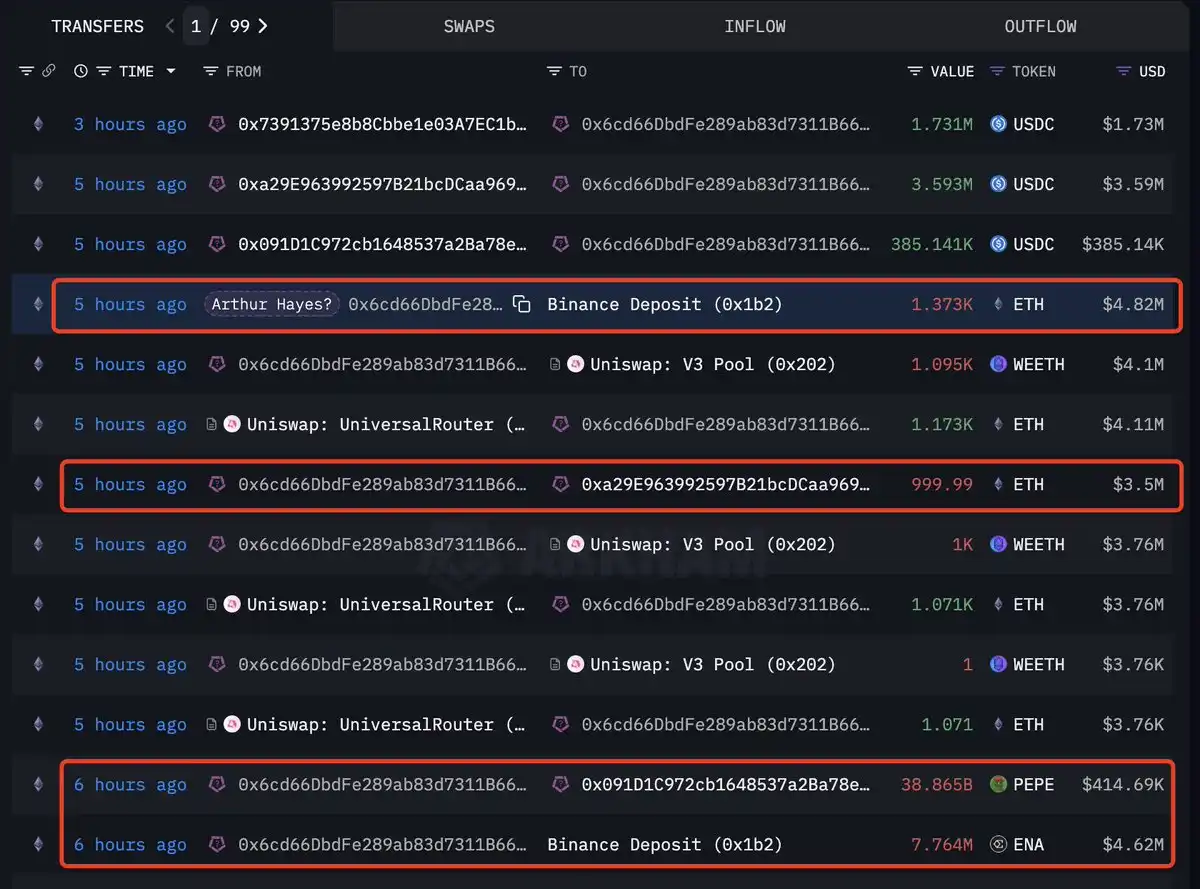

@CryptoHayes recently sold various tokens including ETH, ENA, and PEPE, cashing out nearly $13 million, and explicitly stated a bearish outlook, predicting that BTC may fall back to test the $100,000 mark, while ETH could drop to $3,000.

He pointed out that the U.S. tariff legislation may expire in the third quarter, which means fiscal stimulus will weaken; combined with the latest weak non-farm data, concerns about sluggish economic growth are intensifying. Meanwhile, major economies have not released enough credit to support GDP, further heightening expectations for risk assets to face pressure in the short term.

@qinbafrank

The market is likely to first exhaust the narrative of "recession expectations" before smoothly transitioning to the main theme of "rate cut expectations." The logic is not hard to understand—U.S. stocks have hardly experienced any significant adjustments since April, and once a clearly unexpected negative data point appears, it can easily trigger a valuation correction, leading to a sell-off in U.S. stocks and cryptocurrencies, with sentiment cooling in tandem. However, from a medium to long-term perspective, such a correction could actually be beneficial.

On the macro policy level, the "one body, two wings" combination continues to support the market. "One body" refers to the comprehensive fiscal stimulus package covered by the "Great American Rescue Plan," which includes tax cuts, increased defense and immigration spending, reduced welfare spending, and adjustments to the debt ceiling; "two wings" refer to the "AI Action Plan" in the field of artificial intelligence and the "Stablecoin Act" and "Digital Asset Market Structure Act" in the field of cryptocurrency. These policies not only signal future industrial investment but also strengthen the willingness of the U.S. government to expand its fiscal and industrial base.

Fundamentally, the U.S. economy has not yet entered a recession, and corporate earnings reports are generally robust; once interest rates decline, the cost of servicing U.S. debt will also decrease, further releasing fiscal space. Notably, Biden's nominee for Fed Governor Quarles has announced his resignation and will leave office on August 8, opening a window for Trump to appoint a new governor aligned with his stance, which may directly influence the rate cut pace at the September meeting.

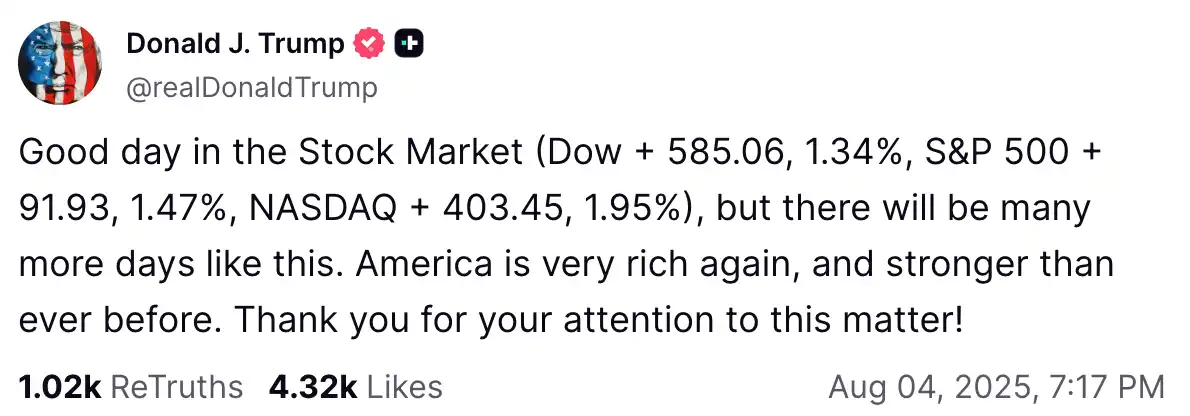

On August 4, U.S. stocks rebounded after a short-term adjustment, with the S&P 500 index rising by 1.47% and the Nasdaq index increasing by 1.95%, indicating that market sentiment is quickly recovering from panic, and Trump also celebrated in a post-market statement.

@Murphychen888

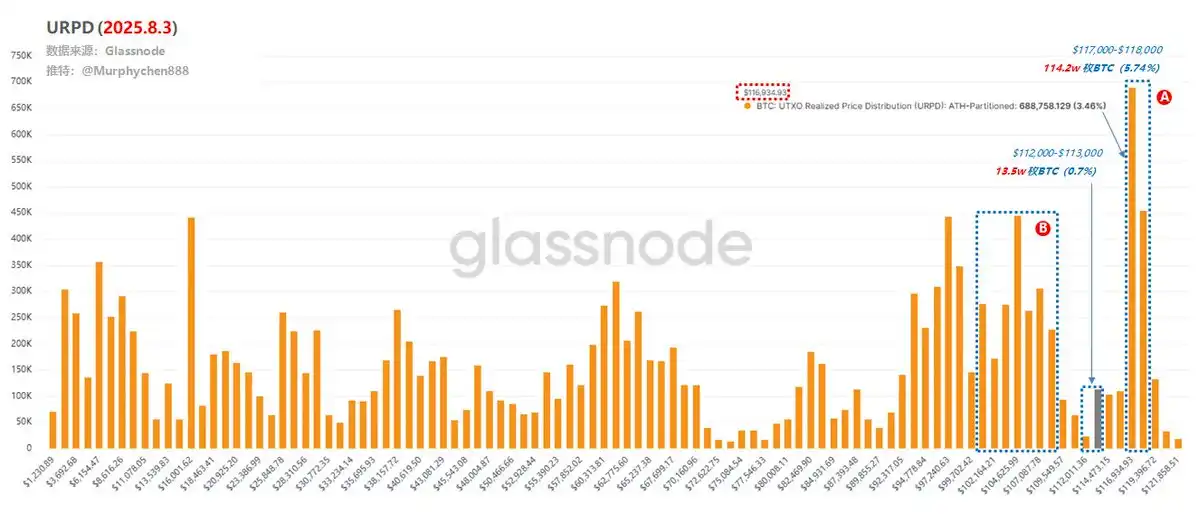

In a tweet on August 1, we concluded through an analysis of the chip structure that "once the important support at 117K is lost, filling the gap is a high-probability event." The current gap location of $112,000-$113,000 has already been filled, and this is also the midpoint of two chip accumulation zones (A and B). Testing has once again validated the effectiveness of the dual-anchor structure.

As of today, 135,000 BTC have changed hands in the $112,000-$113,000 range, with nearly half coming from high-position trapped chips in zone A. Exchanging high positions for low positions will lower the overall holding cost, helping the market to find a price consensus again. Once the uncertain floating loss/gain chips in the A/B zones are all exchanged here, this will be a relative bottom. Objectively speaking, based on the current chip distribution and operational logic, the following two scenarios may occur:

A new accumulation zone forms in the $112,000-$113,000 range (the chip column getting higher), and the trapped chips in zone A are gradually digested (1.14 million BTC), then after a period of adjustment, BTC will attempt to break upward again.

A large number of chips in the A/B zones become loose, and the market cannot sustain it, continuing to decline in search of support. This would lead to entering zone B, which is also a truly strong support area during BTC's correction process, having both width and height (1.95 million BTC).

Do the Coin-Stock Narratives Have Sustainability?

@fundstrat

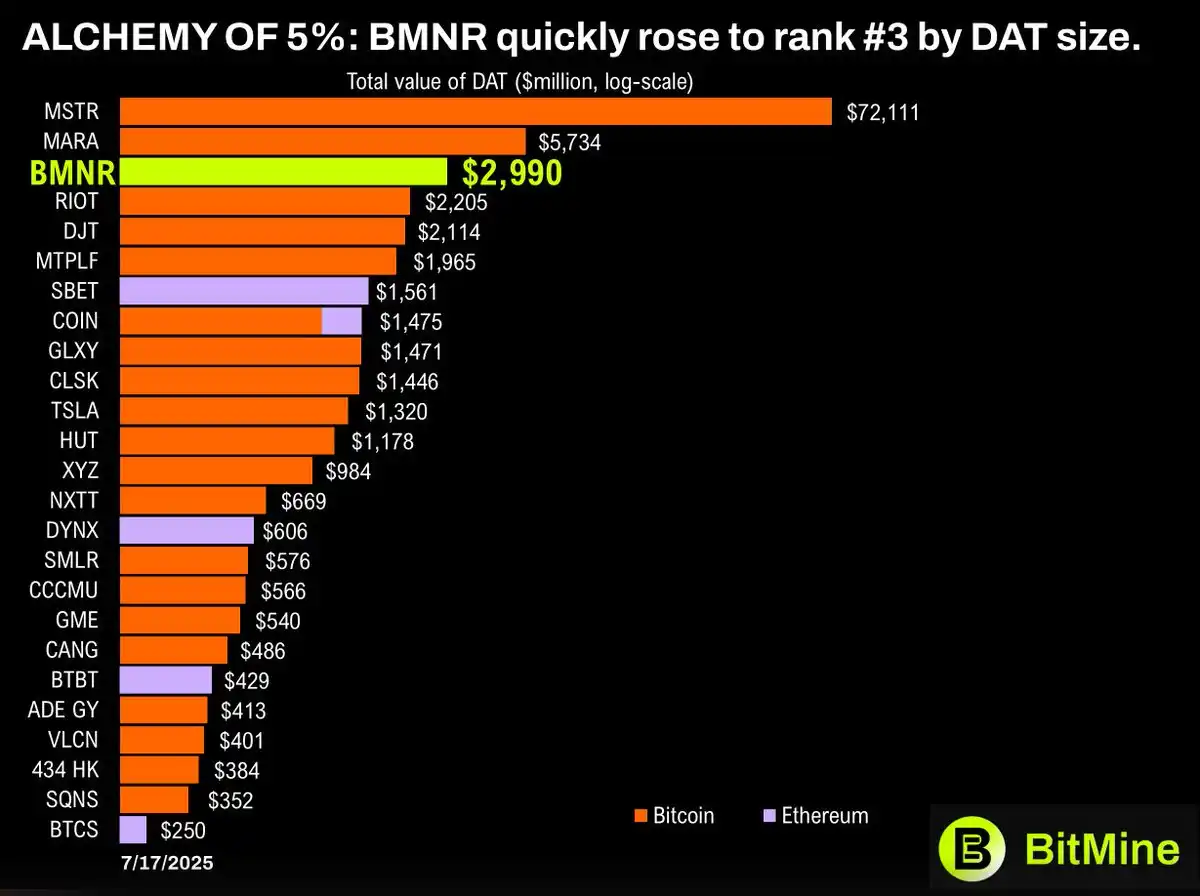

Tom Lee, chairman of Bitmine, stated: "Wall Street generally believes that Ethereum will be one of the most important macro trades in the next decade."

Currently, BMNR holds 833,133 ETH, with a market value of about $3 billion—making it not only the largest ETH treasury in the world but also the third-largest cryptocurrency treasury globally. Lee emphasized that ETH remains one of the core macro trends for the next 10-15 years, as Wall Street pushes for the financialization of blockchain and the tokenization of AI-driven robotic assets, this trend will accelerate further.

He pointed out that as the SEC and the White House launch Project Crypto, the U.S. financial market is accelerating its migration on-chain, and as the largest smart contract public chain, Ethereum is undoubtedly the biggest beneficiary. The key reason Wall Street favors ETH is its zero downtime record, and it has been adopted by traditional financial and tech giants like JPMorgan and Robinhood.

The Bitmine digital asset team expects that the fair value of ETH could reach $10,000 to $20,000 in the next 12 months; the current wave of stablecoin momentum is as significant for Ethereum as ChatGPT is for AI, which will drive Wall Street to accelerate its entry. In the long term, as Wall Street tokenizes real-world assets (RWA) and migrates them on-chain while participating massively in ETH staking, the price of ETH is expected to challenge $60,000 or even higher, becoming the core infrastructure of on-chain finance, similar to NVIDIA's position in the AI wave.

@0xSunNFT

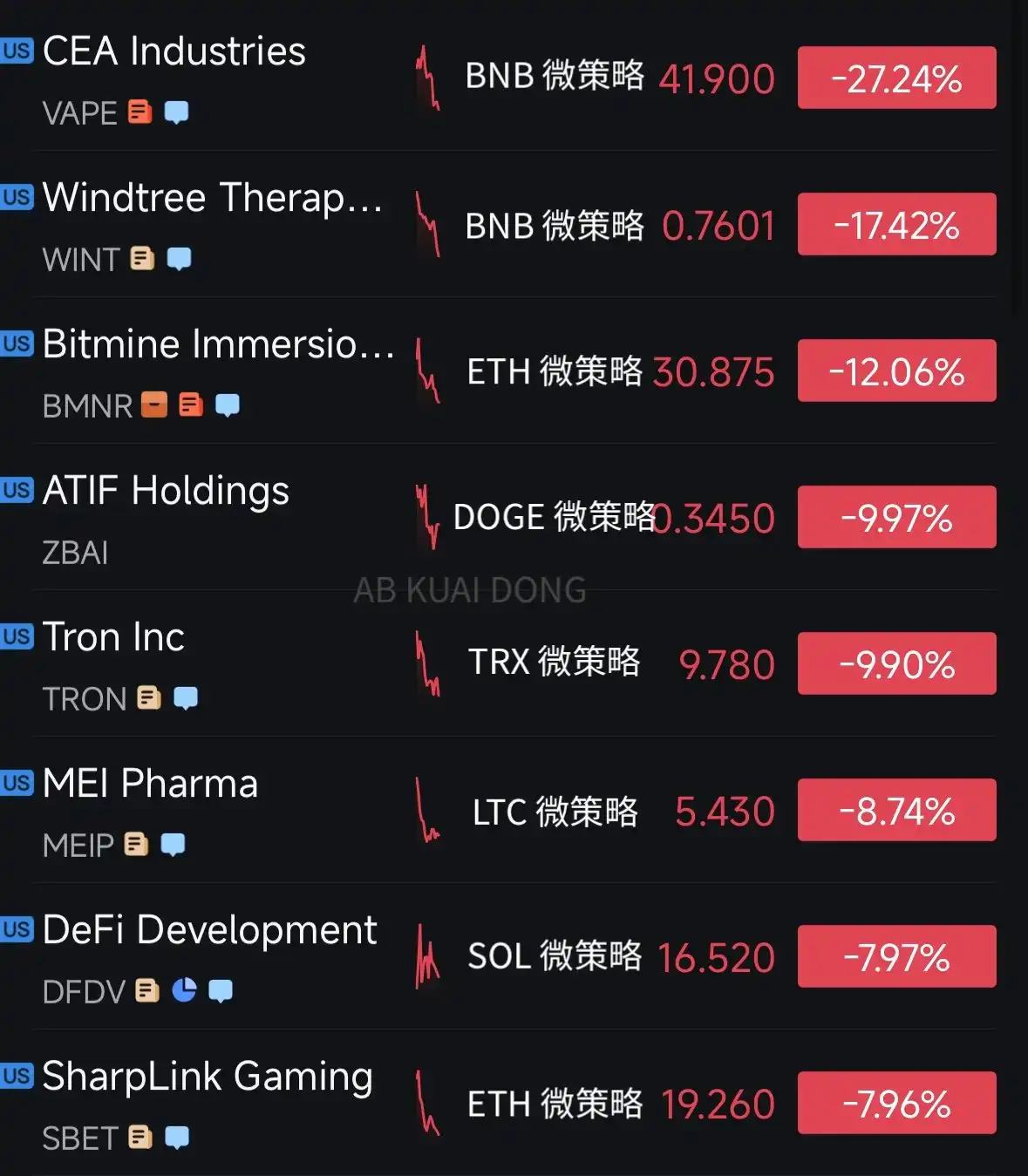

On July 29, "Altcoin MicroStrategy" collectively plummeted, sparking discussions among traders about its sustainability. Currently, most traders in the market remain optimistic about the "ETH MicroStrategy," but are more cautious about other "altcoin micro strategies."

Trader @0xSunNFT pointed out that ETH has been the core engine of this round of increases since the end of June, driven by two main forces: one is institutions mimicking MicroStrategy by buying ETH through coin-stock financing; the other is the warming of the stablecoin narrative, with ETH being the core infrastructure and settlement layer related to it.

Referring to the previous process where MicroStrategy drove BTC prices up, most altcoins still failed to outperform Bitcoin. For the ETH micro strategy, the funds invested by coin-stock and institutions are unlikely to spill over to other altcoins. Data shows that according to CMC statistics, among the top 200 tokens in the past 30 days, only 20 have outperformed ETH, most of which are driven by specific favorable events like Bonk, Zora, CFX, and ENA.

In terms of altcoin selection, the strategy still follows the previous short logic: prioritize locking in high market cap, non-leading, weak-performing, and low-awareness targets, and adopt a diversified shorting approach with strict stop-loss measures to prevent sudden surges in a single target.

Looking ahead to the second half of the year, if the market continues in a bullish pattern, it is likely to still be led by ETH; if it turns into a bear market, altcoins may struggle to stand alone, while ETH at least still has institutional buying support providing some bottoming strength.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。