The homework on Monday is easier to write. So far, it is very similar to expectations. The US stock market has already recovered the decline from Friday and is now looking to match the drop from Thursday. As of one hour before the market closed, the Nasdaq was up over 1.6%, the S&P was up over 1.2%, and the Dow Jones was up nearly 1.2%. Investor sentiment has reversed from the pessimistic expectations of Friday, mainly because Trump has more cards in hand.

Moreover, US Treasury yields are gradually declining, which reflects the market's expectations for a Federal Reserve rate cut. The yield on the ten-year Treasury has fallen below 4.2%, and the bond market remains optimistic. This line of thought has been discussed since Friday's homework. The biggest game now is no longer between the Federal Reserve, inflation, and unemployment rates, but rather the game between Trump's aggressive stance and the Federal Reserve's conservatives.

The fundamental logic of the market has not changed; it still revolves around tariffs and monetary policy. However, tariffs have progressed significantly, and Trump has directly intimidated India. On the monetary policy front, Trump's faction is stimulating the market by changing personnel, providing a strong boost to the market. Therefore, the biggest battle is in the interest rate meeting in September.

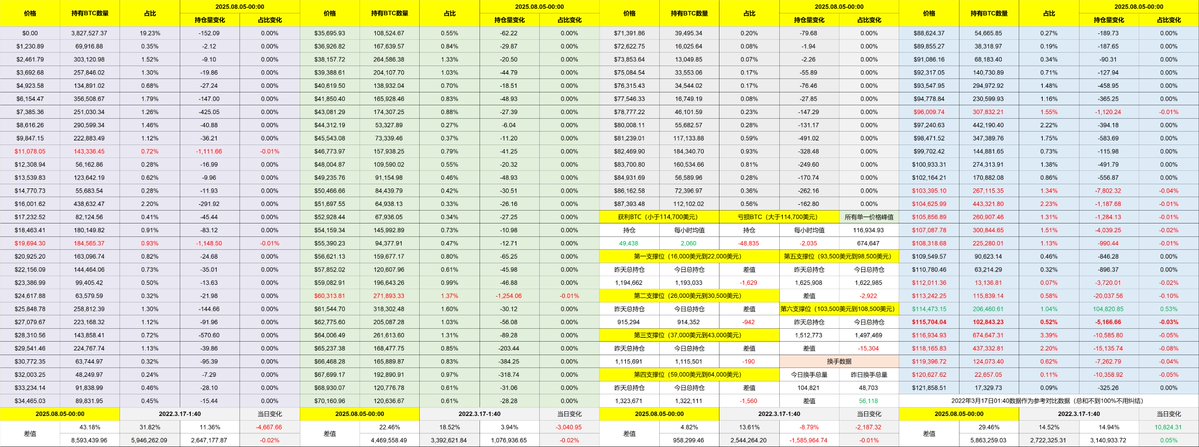

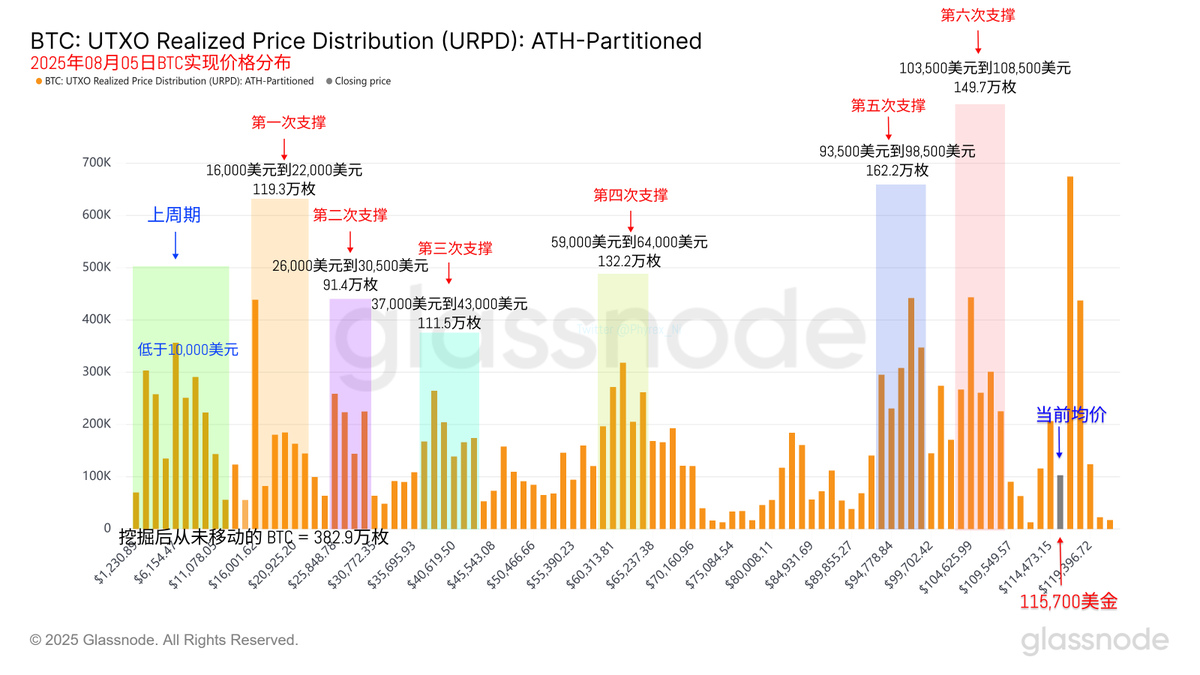

Looking back at Bitcoin's data, the turnover rate began to rise again on Monday, with short-term investors showing significant signs of reduction in holdings, especially those with short-term losses exiting the market. It is estimated that they are worried this rebound is temporary and fear being trapped further. However, I do not know if it is temporary; what I do know is that the current game has not yet determined a winner.

The support level remains quite stable, and it has not even reached the first support level yet. Investor sentiment is also okay. Of course, I am not sure if it can continue to rise; from my understanding, there is currently no systemic risk. Let's continue to observe.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。