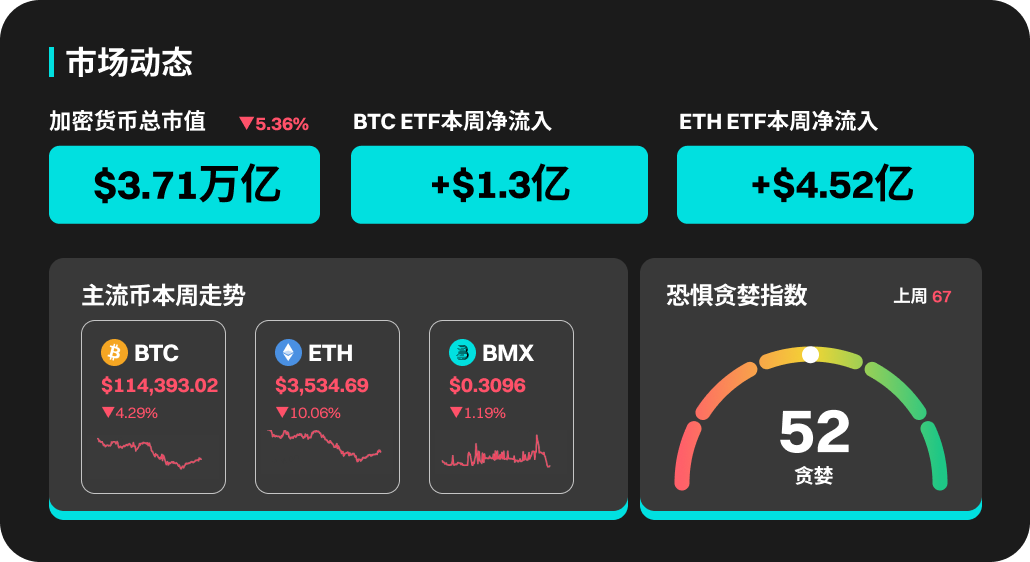

This Week's Cryptocurrency Market Dynamics

Last week, the net inflow amount for BTC ETFs was $130 million. BTC dropped significantly from around $120,000 to approximately $112,000, finding some support near $112,000. Despite the substantial drop in BTC, its market share slightly rebounded to 61.2%, indicating that BTC remained more resilient during the overall market downturn, while altcoins experienced larger declines.

Last week, ETH ETFs saw a net inflow of $452 million, marking a record of nine consecutive weeks of net inflows, with over $7 billion flowing in during the last nine weeks. ETH briefly surged to around $3,940 last week before retreating back to $3,500 as the market declined. Over the past 30 days, ETH has still seen a remarkable increase of 41%, with its market share currently reported at 11.5%.

This Week's Popular Cryptocurrencies

In terms of popular cryptocurrencies, MAGIC, M, TON, WIZARD, and MEME have all performed well. MAGIC's price increased by 25.06% this week, reaching a peak price of 0.2032 USDT. M's price rose by 50.94%. WIZARD's price surged by 94.41% this week, with a 24-hour trading volume of 679.99M USDT.

U.S. Market Overview and Hot News

Last week, the U.S. stock market showed a downward trend influenced by various factors. The S&P 500 index fell by 1.60% on Friday (August 1), with a cumulative decline of 2.36% for the week; the Dow Jones Industrial Average dropped by 1.23% on Friday, with a total weekly decline of 2.92%; the Nasdaq Composite Index fell by 2.24% on Friday, with a cumulative weekly drop of 2.17%. Market sentiment was affected by July's non-farm payroll data, which was far below expectations, indicating a rapid deterioration in the labor market, leading traders to increase bets on a rate cut by the Federal Reserve in September. Additionally, the White House announced plans to raise tariffs on trade partners with whom no agreement has been reached, effective midnight on August 7, further exacerbating market uncertainty.

Trump delays the effective date of reciprocal tariffs by one week to August 7.

Popular Sectors and Project Unlocks

DeFi

The DeFi sector was one of the hot areas last week, covering subfields such as liquidity provision, stablecoins, and real-world assets (RWA). Among them, Ethena rose by 105% in July, mainly due to its listing on Upbit and accumulation by whales. Curve DAO increased by 85% as its V3 upgrade reduced gas fees and collaborated with stablecoin projects. Ondo Finance also gained attention for its applications in the RWA field. Other projects like PancakeSwap, Tetu.io, DIA, and MetaKujira were frequently mentioned in social media discussions, indicating the activity level in the DeFi sector.

IOTA (IOTA) will unlock approximately 8.63 million tokens at 8:00 AM Beijing time on August 4, representing 0.22% of the current circulating supply, valued at about $1.6 million.

GoGoPool (GGP) will unlock approximately 750,000 tokens at 8:00 AM Beijing time on August 4, representing 10.60% of the current circulating supply, valued at about $1.2 million.

Ethena (ENA) will unlock approximately 172 million tokens at 3:00 PM Beijing time on August 5, representing 2.70% of the current circulating supply, valued at about $95.8 million.

Immutable (IMX) will unlock approximately 24.52 million tokens at 8:00 AM Beijing time on August 8, representing 1.30% of the current circulating supply, valued at about $12.2 million.

Risk Warning:

The risks associated with using BitMart services are entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and there may be significant risks associated with buying, selling, holding, or trading digital currencies. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。