The Federal Reserve's interest rate changes are primarily decided by a voting system, consisting of 2 chairpersons (the chair and the vice chair), 5 governors, the president of the New York Federal Reserve Bank, and 4 out of 11 presidents of regional Federal Reserve Banks, totaling 12 members.

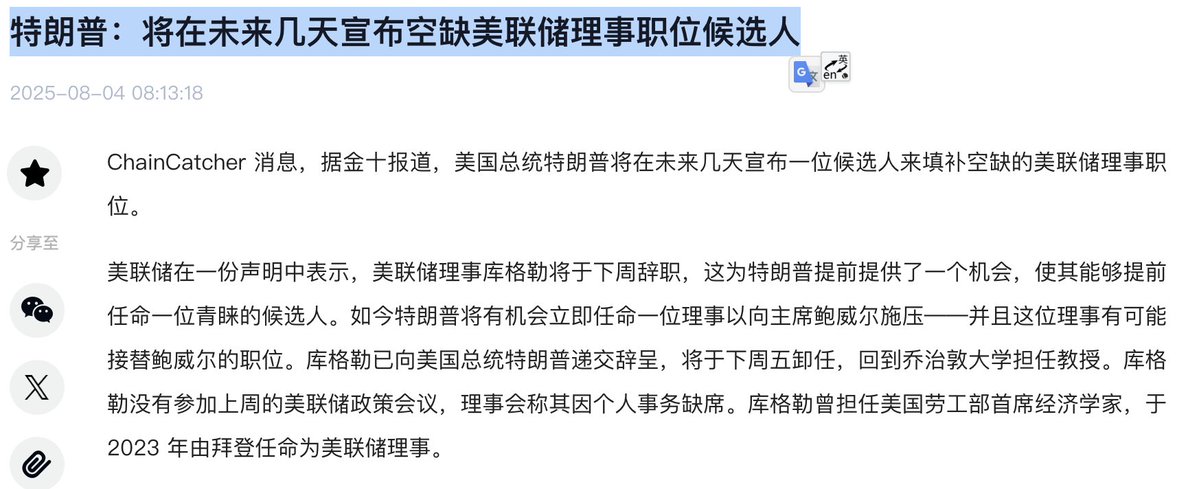

Every personnel change at the Federal Reserve affects the market's expectations for future interest rates. The upcoming change in Federal Reserve governors, with the new appointees likely to be directly designated by Trump, could have significant implications for the future direction of the Federal Reserve's monetary policy. I speculate that the new appointee may very well become a potential successor to Powell, as Powell's term is also nearing its end.

It is expected that this new governor will definitely be a "big dove," collaborating with Trump to accelerate interest rate cuts. This can be seen as injecting a certain positive expectation into the market (but expectations are one thing, and reality is another).

Under this expectation, it is highly likely that U.S. Treasury yields may decline first, and risk assets (especially Nasdaq component stocks) will rise in advance, with funds flowing back into the stock market. 🧐

So, this is Trump's bull market. Although the macro economy is somewhat struggling, it has been artificially propped up. Maintaining the midterm elections next year is also a top priority! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。