The homework on Sunday is much easier to write than on Saturday. The price of $BTC has almost dropped below $112,000 compared to 24 hours ago, and by the time I go to bed, it’s close to my liquidation line. I don’t know if this means a rebound has started, but my logic has been very clear these days: currently, it is not a systemic risk; it is still the game between Trump and Powell regarding monetary policy.

If you believe in Trump, then the data doesn’t matter; what’s important is whether Trump can consolidate a Federal Reserve centered around him. At this moment, he already has one-third of the votes on his list. If he can gain two more, Trump’s plan is very likely to be implemented.

Even if he doesn’t gain more, the 3+1 (three voting members + one Federal Reserve Chair candidate) structure will give the market more ideas in the short term. It’s clear that even with bad data, after Kugler announced his resignation, the probability of a rate cut in September rose to 80%. This is the market betting on Trump’s victory.

Of course, if you don’t believe in Trump, the current data is indeed not good. Inflation still has the potential to rise, the unemployment rate has not exceeded the Federal Reserve’s expectations, and tariffs have not been officially implemented. Overall, based on this data, the difficulty of a rate cut is indeed not high, but the internal pressure within the Federal Reserve is also significant. In fact, another voting member, Williams, publicly expressed support for a rate cut in September yesterday.

Therefore, my personal view is that if this drop is due to concerns about a recession, it might be a bit early. The market sentiment can gradually stabilize. If we are really talking about a recession, I think it won’t happen until 2026; the probability of entering a recession in 2025 is not high. Let’s talk about the unemployment rate after it exceeds 4.5%. Currently, a 4.2% unemployment rate is still quite low in U.S. history.

If the concern is not about a recession but about the Federal Reserve cutting rates, the current sentiment is much better than when the data was released on Friday. Kugler + Williams have already given September four votes, and there is still more than a month left, so it’s not impossible to persuade a few more people.

Therefore, from any perspective, this is not a very pessimistic situation. The uncertainty of tariffs with Mexico continues to be postponed, China continues to postpone, and the major trading partner, the EU, has also been settled, as well as Japan and South Korea. Now it’s just about making a show with India. I currently do not see any systemic risks.

So I will continue to hold my long positions. I don’t expect new highs, but I still have some confidence in returning to the previous moving averages. Of course, this is just my personal view and may not be correct. As I always say, if I’m right, I’ll come back and boast; if I’m wrong, I’ll stand at attention and take the hit.

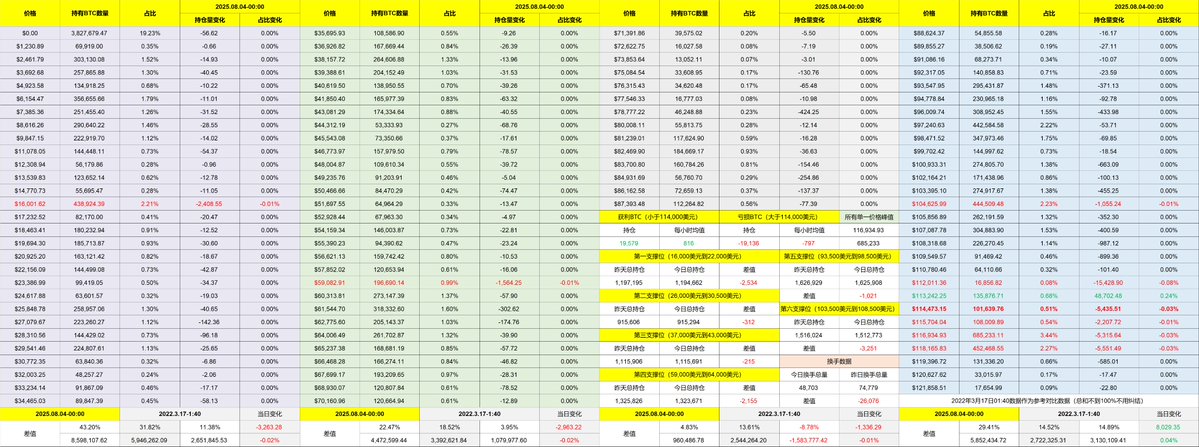

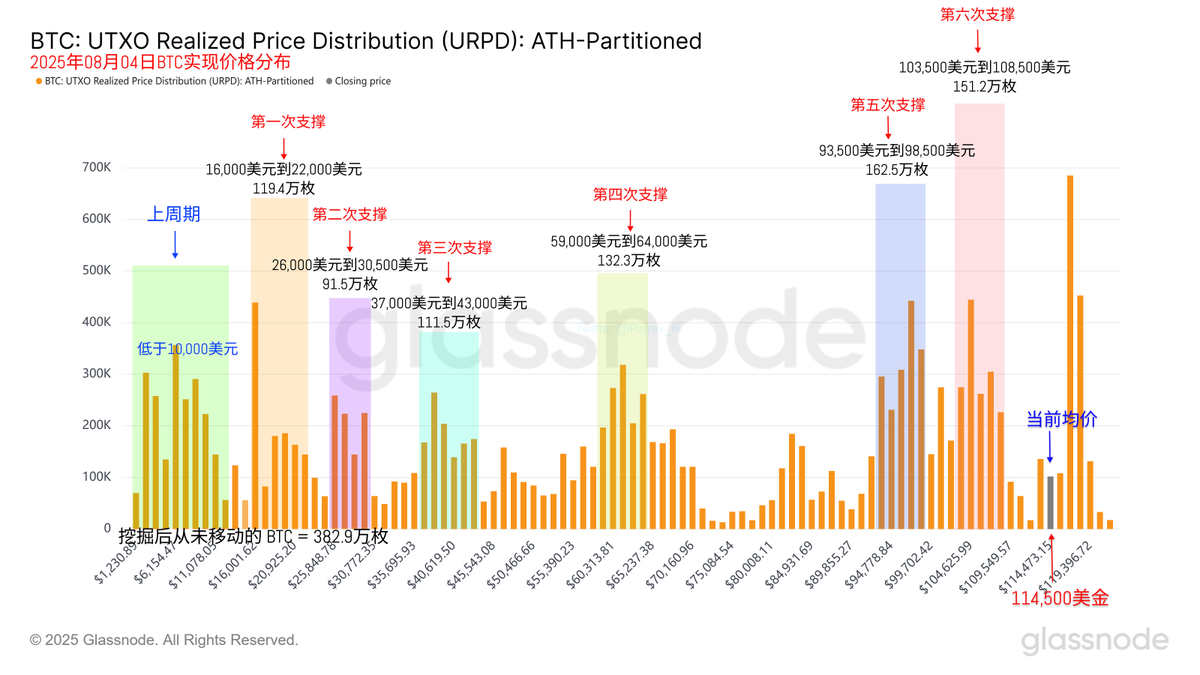

Looking back at the Bitcoin data, it’s still the same old story. There’s nothing new over the weekend, and the turnover is very low, indicating that investors' panic did not carry over into the weekend. The remaining factor is the state of U.S. stock investors on Monday, and the decrease in turnover has also reduced the volatility of the $BTC price. The main ones leaving the market are short-term investors with losses, while earlier investors are still in a wait-and-see state.

Support and other data are still very intact. After smoothing out the URPD gap, the subsequent trend becomes harder to predict. However, my view remains focused on tariffs and the Federal Reserve’s monetary policy, which may be the main direction; other factors may only affect the short term.

Data address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。