The essence of trading lies in the ability to find opportunities, to plan before acting, and to strategize effectively. This has always been the key to Minghui's success in the market. Many people fail due to chaotic operations, lack of planning, and no strategy. Most losses occur from locking positions, holding onto trades, and not using stop-losses. The root cause is often a lack of skills and ideas, blindly trusting others' trades, following the wrong orders, and having a poor mindset, resulting in small gains and large losses. The saying "think thrice before acting" holds true; only well-considered entry points should be taken. Aggressive points can leave traders in a dilemma, either catching the highest or lowest points, leading to significant price differences. If one is reluctant to take a loss, they can only hold on. Stable entry points allow for profitable exits or the option to withdraw.

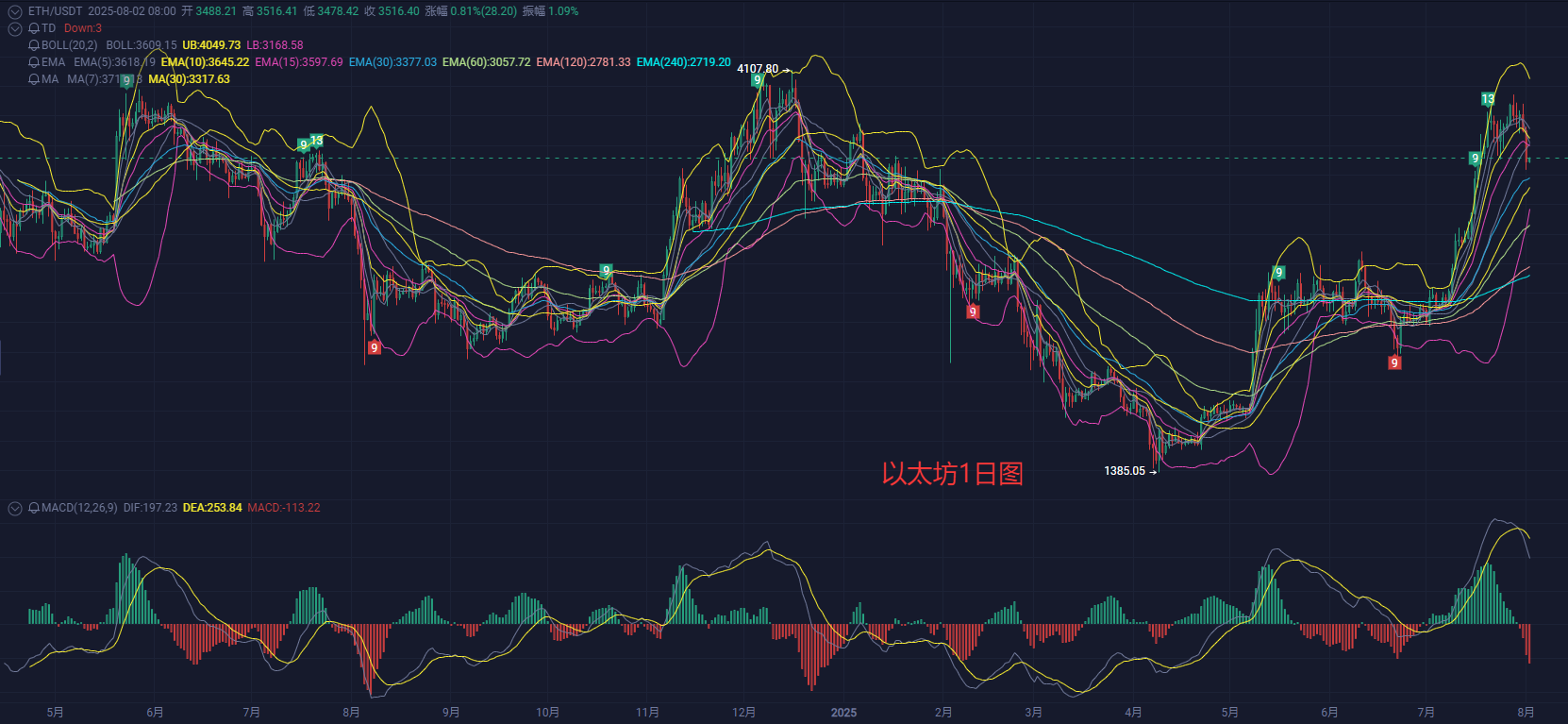

8.2 Minghui in the Crypto Circle: Ethereum (ETH) Market Strategy Analysis Reference

Ethereum is also influenced by the overall market, with the price breaking downwards, currently at a low of 3430. The overall trend appears weak, and the subsequent rebound lacks strength, failing to break through the upper resistance area. Bears still hold the advantage, so the main strategy for the day should be to follow the trend with short positions. The upper resistance to watch is in the 3560-3600 range.

On the short-term hourly chart, the market is under pressure and entering a correction phase, maintaining a downward oscillation. The short-term support at 3500 has been broken, and prices are expected to further decline towards the day's low support line. I hope all crypto friends are prepared in advance. In terms of operations, it is still advisable to maintain a focus on short positions during rebounds, with long positions as a supplement.

8.2 Short-term Strategy Reference for Ethereum:

- For short positions, suggest 3545-3600, with a stop-loss of 30 points, targeting below 3510.

- For long positions, suggest 3435-3395, with a defense at 3200, stop-loss of 30 points, targeting around 3500.

8.2 Short-term Strategy Reference for Bitcoin:

- For short positions, suggest 115000-116000, with a defense at 121500, stop-loss of 500 points, targeting below 117300.

- For long positions, suggest 111000-110000, with a defense at 108500, stop-loss of 500 points, targeting above 112000.

The points are time-sensitive, and there may be delays in posting, so please refer to real-time market conditions. Again, I emphasize the importance of risk control; no matter how confident you are in your future market predictions, always manage your take-profit and stop-loss effectively! If you need analysis on other cryptocurrencies, feel free to comment or message privately. Friends who like this content, please give a thumbs up for support. For more real-time trading strategies, online technical learning, and exit strategies, you can follow the mentor's public account: (Minghui in the Crypto Circle). The first ten daily participants can receive free exit strategy advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。