Original | Odaily Planet Daily (@OdailyChina)

According to official news from Ondo Finance, the project has been included in the latest White House report released by the President's Working Group on Digital Assets. The report recognizes tokenized securities, stablecoins, and programmable settlements as important components of the future financial system. This policy endorsement not only provides authoritative support for Ondo's business model but also highlights the strategic value of tokenized assets in the global financial market.

In fact, as early as April 24, Ondo demonstrated a proactive stance in the compliance field. It met with representatives from the well-known law firm Davis Polk & Wardwell LLP and the SEC's crypto working group to discuss the compliance framework for tokenized U.S. securities in depth. Key topics of the meeting included asset structure models, registration requirements, market regulation, and financial crime compliance. Ondo proposed the establishment of a regulatory sandbox or seeking exemptions to create a more relaxed compliance environment for the issuance of tokenized assets. This dialogue provides important references for the standardization of tokenized securities in the U.S. market and highlights Ondo's foresight in regulatory communication.

Market Overview and Outlook: The Rise of Tokenized Assets

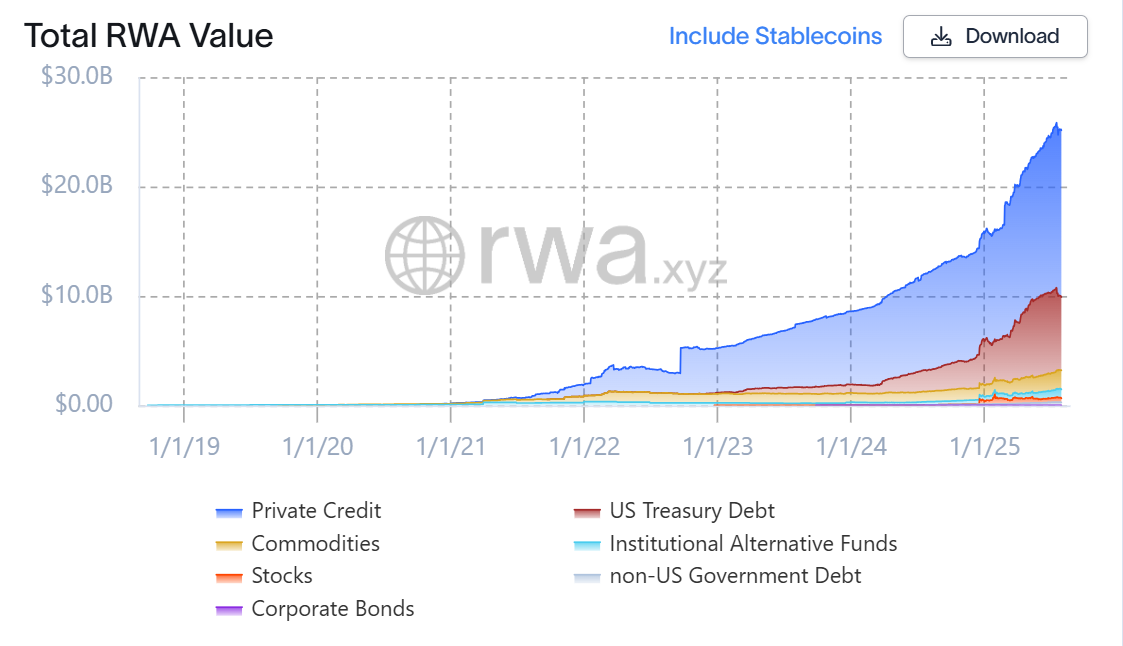

As a crypto-financial project focused on the tokenization of real-world assets (RWA), Ondo Finance has become an important player in this field since its mainnet launch in 2021. According to data from rwa.xyz, the global RWA market has surpassed $25 billion, and the market growth rate is expected to accelerate significantly after 2024. As a bridge connecting traditional finance and blockchain technology, RWA is becoming one of the core tracks in the crypto economy.

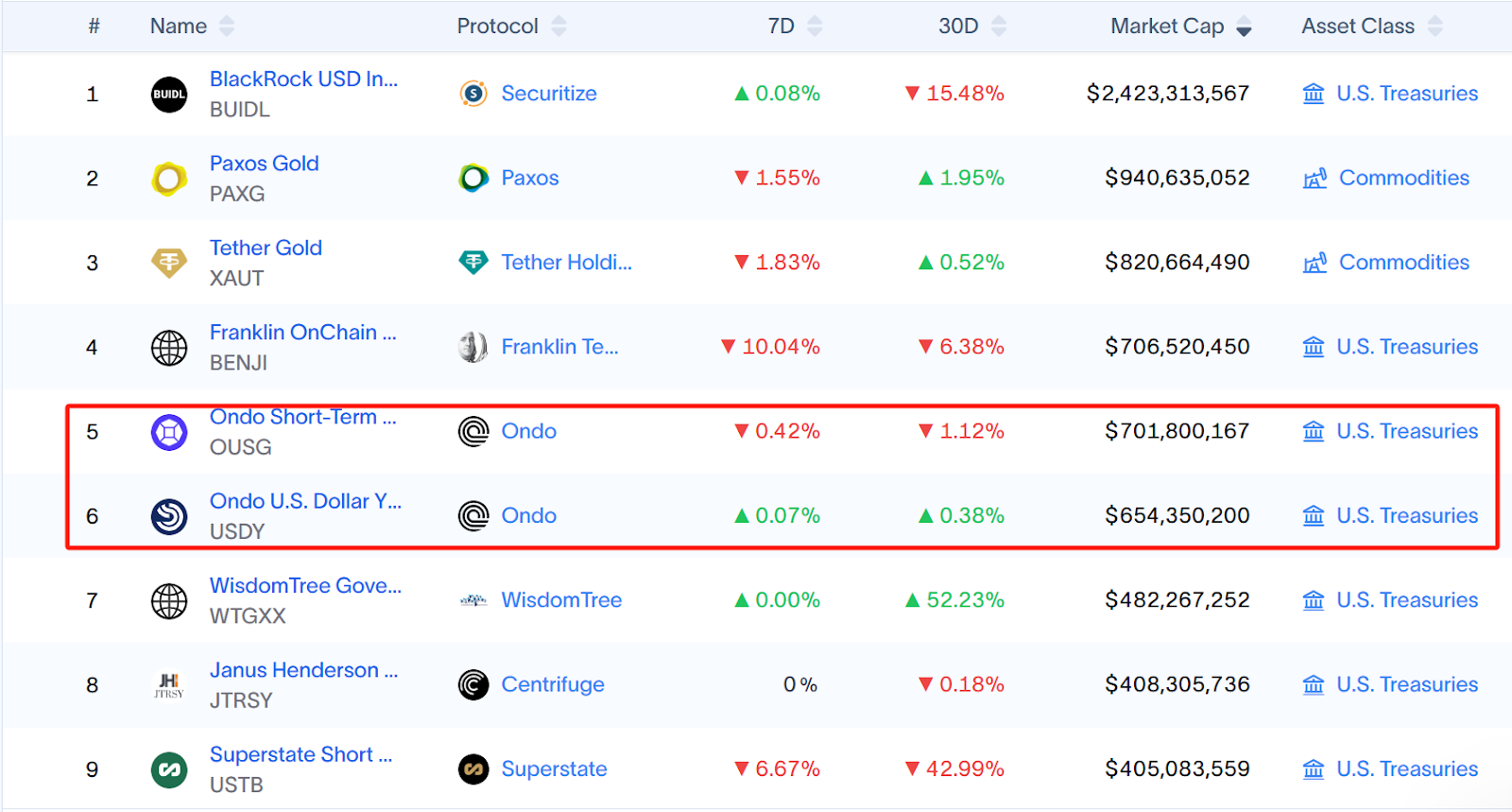

BlackRock's BUIDL fund maintains its industry leadership with a tokenized asset scale of $2.4 billion, a success supported by Securitize's underlying protocol. However, Securitize has yet to launch its token, although it has partnered with Ethena to launch the EVM-compatible chain Converge, which aims to focus on RWA product development. While it was originally scheduled to launch in the second quarter of 2025, the mainnet has not yet been realized. In contrast, Ondo has secured a place in the market with a tokenized asset scale of $1.34 billion and has taken the lead in issuing tokens, demonstrating its competitiveness in the market.

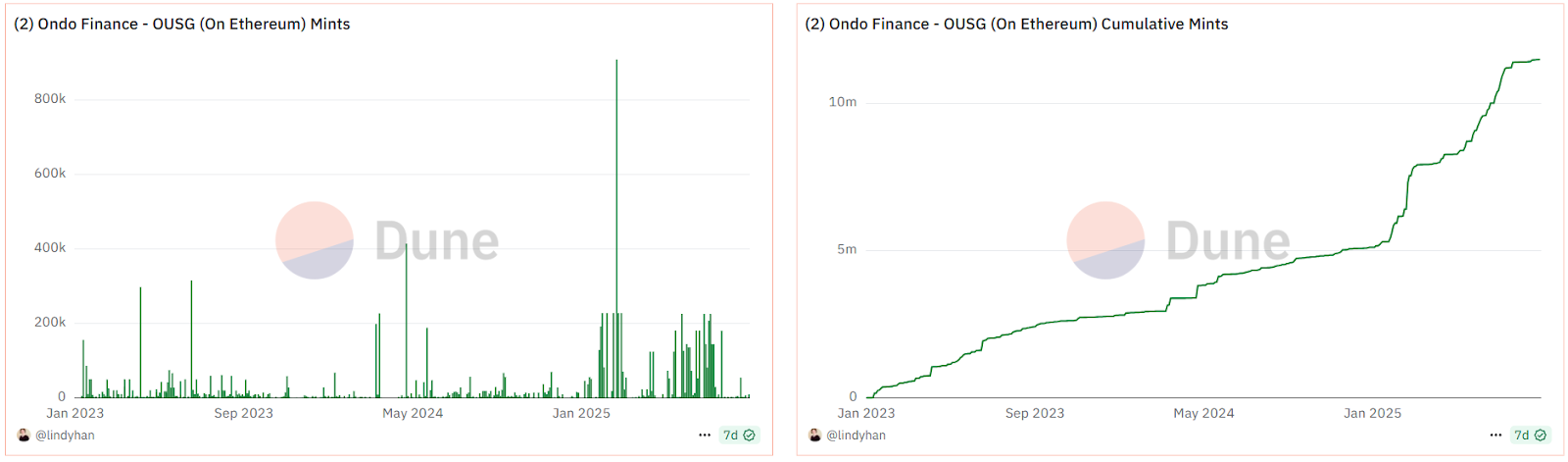

Starting in January 2025, the asset minting frequency on Ondo Finance has become more intensive, driving the on-chain OUSG scale to new heights.

Market Competition: ETF Applications on the Agenda

The current market has entered a tokenization arms race, with exchanges accelerating their layout of tokenized stocks and ETF products. On July 23, 21 Shares submitted an S-1 application for the ONDO ETF to the SEC. If this application is approved, the ONDO ETF will become a new target for institutional funds, significantly enhancing the liquidity and market recognition of Ondo's assets. This move also marks a key step for Ondo from an on-chain protocol to the traditional financial market.

Strategic Acquisitions: Enhancing Core Competitiveness and Technological Upgrades

Ondo's strategic layout includes not only active communication with regulatory agencies but also precise acquisitions to further enhance its core competitiveness. On July 4, 2025, Ondo announced the acquisition of the SEC-regulated broker Oasis Pro, pending regulatory approval. If the transaction is completed, Ondo will obtain licenses for broker-dealers, alternative trading systems (ATS), and digital securities transfer agents, laying a solid foundation for its expansion in the U.S. tokenized stock market. Additionally, on July 14, 2025, Ondo acquired the blockchain development company Strangelove, further enhancing its capabilities in RWA on-chain infrastructure development. These strategic acquisitions not only enhance Ondo's technological and compliance advantages but also provide strong support for its deep expansion in the on-chain financial field.

Platform Development and Technological Innovation: Breaking Down Traditional Financial Barriers

Ondo Finance's core mission is to seamlessly migrate traditional financial assets to the blockchain, and its flagship product—Ondo Global Markets—is a manifestation of this vision. On May 23, 2025, Ondo officially launched the platform, supporting the trading of public securities (including stocks) on the Solana blockchain. On July 2, 2025, Ondo further disclosed that the platform will launch this summer, with the first batch of over 100 U.S. stocks to be tokenized, and plans to expand to thousands by the end of the year. These tokens are pegged 1:1 to the underlying stocks or cash, supporting on-demand redemption and providing continuous trading five days a week, 24 hours a day. The platform deeply integrates with the Solana DeFi ecosystem, further enhancing the composability and flexibility of on-chain finance.

Moreover, Ondo's technological capabilities have been widely recognized by traditional financial institutions. On May 14, 2025, JPMorgan successfully completed a transaction settlement on a public ledger in collaboration with Ondo and Chainlink. Although the transaction used a private network in a "walled garden" model, this collaboration still validated Ondo's technology in institutional-level scenarios and added important endorsement for its market expansion in traditional finance.

Industry Collaboration: Promoting the Globalization and Standardization of Tokenized Securities

Ondo Finance understands that the long-term success of tokenized securities relies on collaborative cooperation within the industry and the establishment of standards. On June 17, 2025, Ondo initiated the Global Markets Alliance, aimed at promoting industry norms for tokenized securities. This alliance brings together several industry giants, including the Solana Foundation, Bitget Wallet, Jupiter, Trust Wallet, OKX Wallet, BitGo, Fireblocks, 1 inch, and Alpaca. Through this cross-institutional collaboration, Ondo not only promotes the establishment of global standards for tokenized securities but also lays a solid foundation for its influence in the on-chain financial ecosystem.

In addition, Ondo Finance, in collaboration with Pantera Capital, established the $250 million Ondo Catalyst Fund, aimed at investing in RWA tokenization projects, covering equity and tokens. Ondo's Chief Strategy Officer stated that the current market has entered a "tokenization arms race," with exchanges accelerating their layout of tokenized stocks and ETF products. The fund simultaneously promotes the construction of on-chain financial infrastructure, and OKX Wallet has joined its Global Markets Alliance.

Conclusion

Amid the noisy narrative wave, Ondo Finance is quietly laying out its strategy, actively embracing compliance. From policy communication to technological implementation, from product design to industry collaboration, every step revolves around "compliance" and "sustainability." It has not chosen the quick-hit approach of leveraging emotions but is quietly building its own moat at the levels of licensing, systems, and infrastructure. The doors of the mainstream financial world will not open for those who shout the loudest, but for those builders who truly understand the rules and can endure the cycles.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。