💠Especially for DeFi projects, you must absolutely look at the audit reports

🔹WHY?

GMX has been audited by more than one company and was recently attacked by hackers. Therefore, the audit report is a necessary but not sufficient condition for safety. If a DEX doesn't even have an audit report, would you dare to use it?

This is why many dog DEXes are hesitant to use it.

There are thousands of rivers, but I only take a scoop of UX!

This is no joke, because both UniversalX and its underlying chain abstraction infrastructure, Particle, have audit reports from more than one company.

🔹HOW?

Friends, don’t think that we can’t understand the audit reports. We actually only need to look at two things.

✦First is the auditing agency

The reputation of the auditing agency may be related to the project's reputation.

For example, UniversalX + Particle have undergone code audits by Certik and Slow Mist, respectively.

Certik has a direct deep cooperation relationship with CoinMarket and an indirect relationship with Binance. Regardless of the quality of Certik's audits, its reputation is established.

Slow Mist is well-known as a prestigious auditing agency.

✦Second is the audit summary

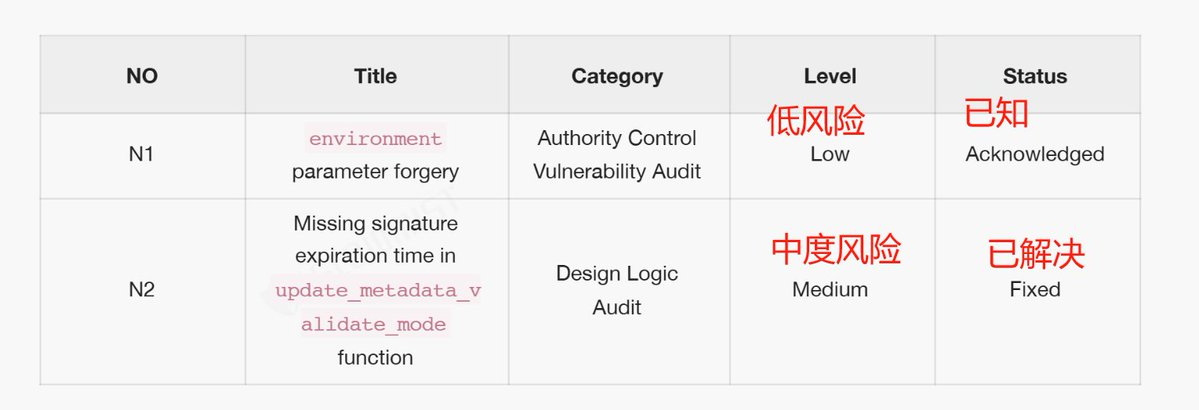

Look for a table similar to this in the audit report; most audit reports have one.

For example, this is the audit report from Slow Mist Technology for UniversalX + Particle.

There is only 1 low risk and 1 medium risk here, and the medium risk has already been resolved.

Although this does not represent 100% safety, it indicates that the safety of UniversalX + Particle is relatively mature.

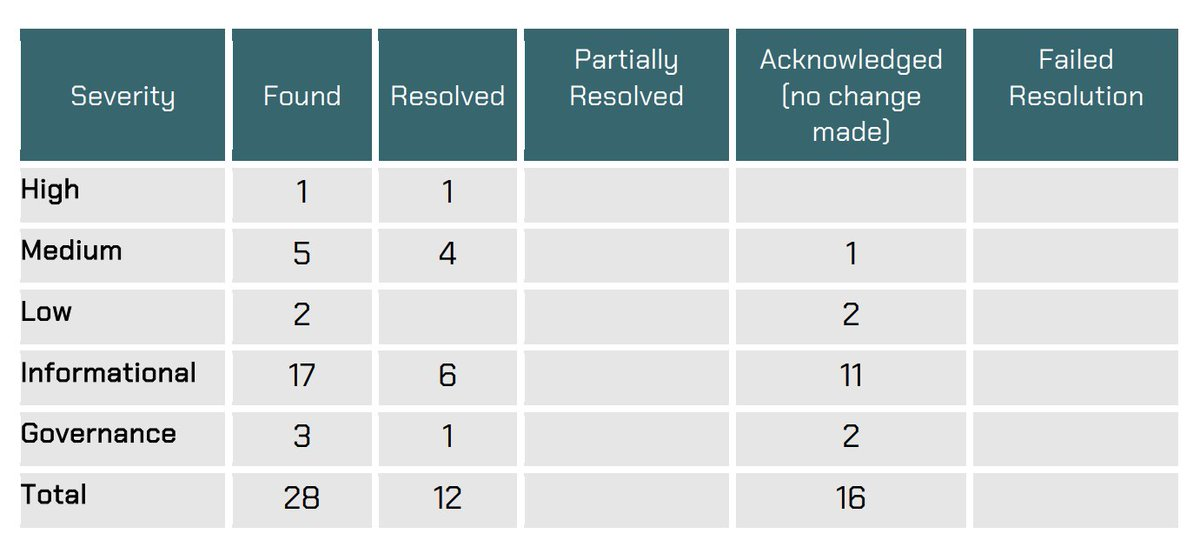

The following table is a summary of the audit report for a DeFi application in the Sonic ecosystem. A total of 1 high risk, 5 medium risks, 2 low risks, 17 informational risks, and 3 governance issues were found.

Among them, 1 high risk, 4 medium risks, 6 informational risks, and 1 governance issue have been resolved. There are still 1 medium risk, 2 low risks, 11 informational risks, and 2 governance issues remaining.

The project should still be working on improving the code, and a new audit report should be released in some time. But for now, the code development of this DeFi application in the Sonic ecosystem is still relatively immature.

✦If heavily invested, it is recommended to understand specific risk issues

If you are heavily invested in a DeFi protocol, it is advisable to understand the unresolved risks, including low risks, as low risks may not necessarily be truly low.

Of course, you can send the risk-related content to Claude; Claude is probably the best AI for code and analysis, and he will explain the specific situation, severity, and impact of these risks.

💠For technical projects, look at the GitHub code repository

🔹WHY?

Through the GitHub code repository, we can understand a project's originality and attention, thus gauging its technical strength.

Technology, of course, cannot determine value, but unless a project is application-based, if it lacks technology and is all narrative, its value may also be limited.

🔹HOW?

Friends might think they can't understand the code again.

Actually, we don’t need to look at the code in detail; we still mainly look at two things.

✦First is the code submission status

First, look at the number of code repositories.

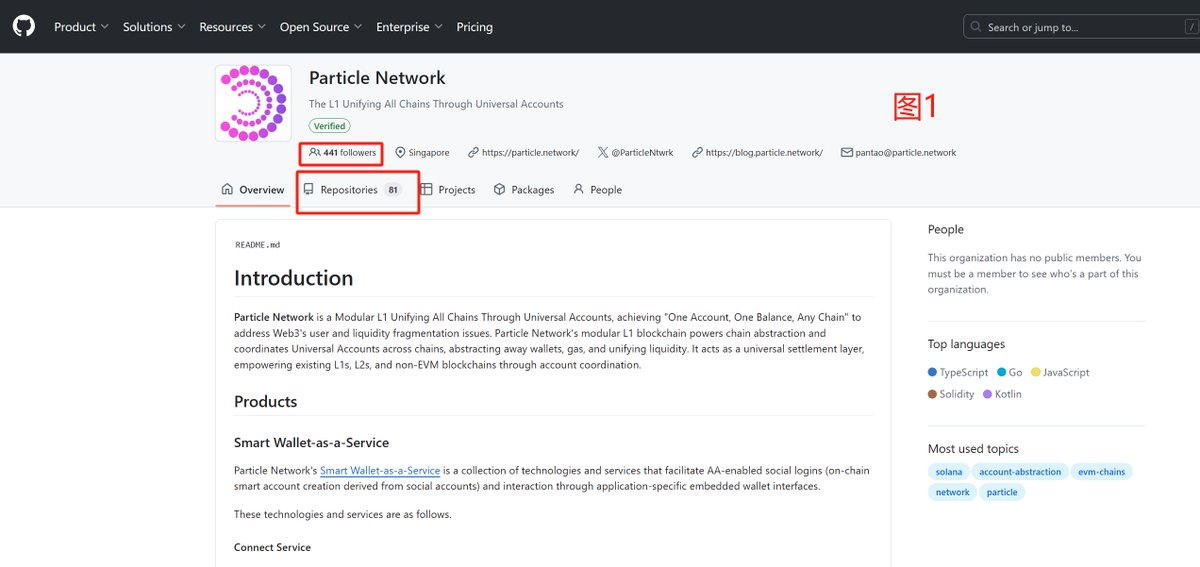

Particle + UniversalX has a total of 81 code repositories, indicating a relatively complex technical system.

Second, look at the frequency of code submissions.

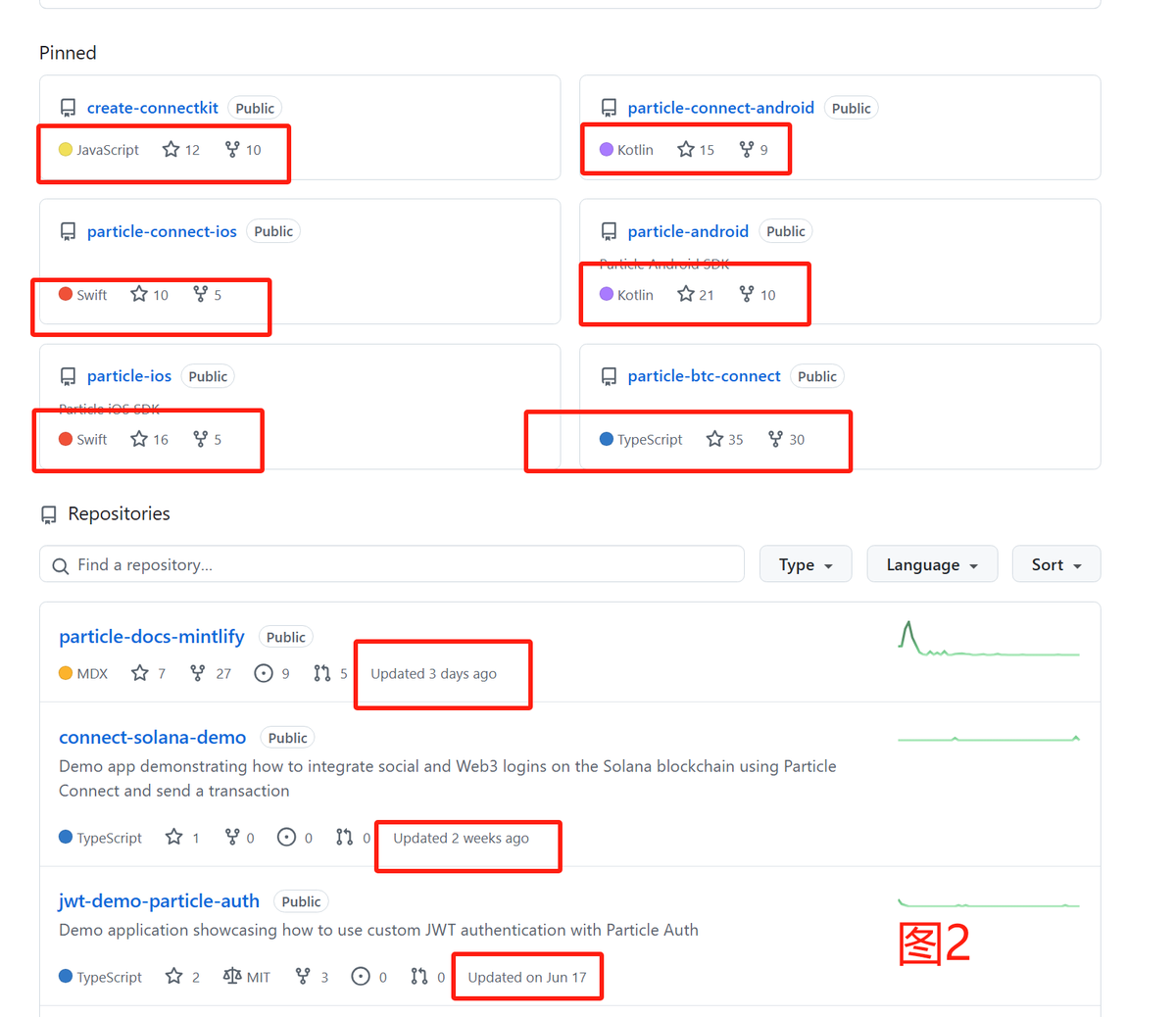

You can see code submissions in the Repositories or scroll down on the homepage.

The most recent submission was 3 days ago, and before that, it was 2 weeks ago, which is not an exceptionally active submission frequency, belonging to a medium frequency. This indicates that the project's technology has reached a certain level of maturity, and the focus is now on developing the ecosystem.

Third, look at the number of code submissions.

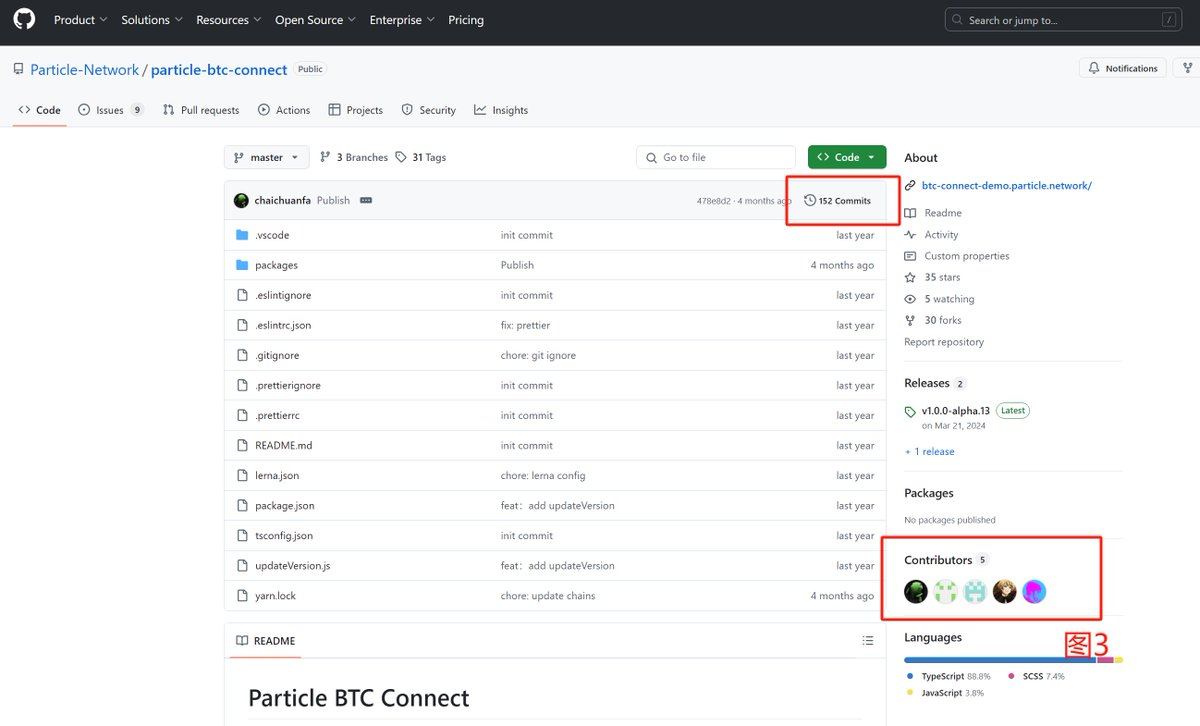

In the top repositories in Figure 2, for example, the Particle-btc-connect repository, you can tell from the name that it is the code for connecting Particle to the BTC ecosystem, with a total of 152 code submissions.

Fourth, look at the code contributors.

You cannot just look at the number and frequency of code submissions, as some projects may inflate submission frequency. For instance, the well-known AI Agent project Swarms has a bit of this… Of course, this project is still technically good, but the submission frequency has some inflation.

Still looking at Figure 3, the Particle-btc-connect repository has a total of 5 code contributors.

✦Second is code attention and participation

In Figure 1, you can see that Particle + UniversalX has a total of 441 developer followers.

You should know that the GitHub team is definitely the pinnacle of the coding community; no one can fake this data, and GitHub bans accounts very seriously. So there are indeed 441 developers following Particle + UniversalX. This number of followers reflects the strong technical nature of Particle + UniversalX.

On the other hand, in Figure 2, the top repositories have between 10-35 stars and 5-30 forks.

This indicates that many developers are paying attention to, learning from, and forking Particle's code.

Overall, Particle + UniversalX is a powerful technical project with significant influence in the developer community.

⬇ Now let’s take a look at Humanity's GitHub:

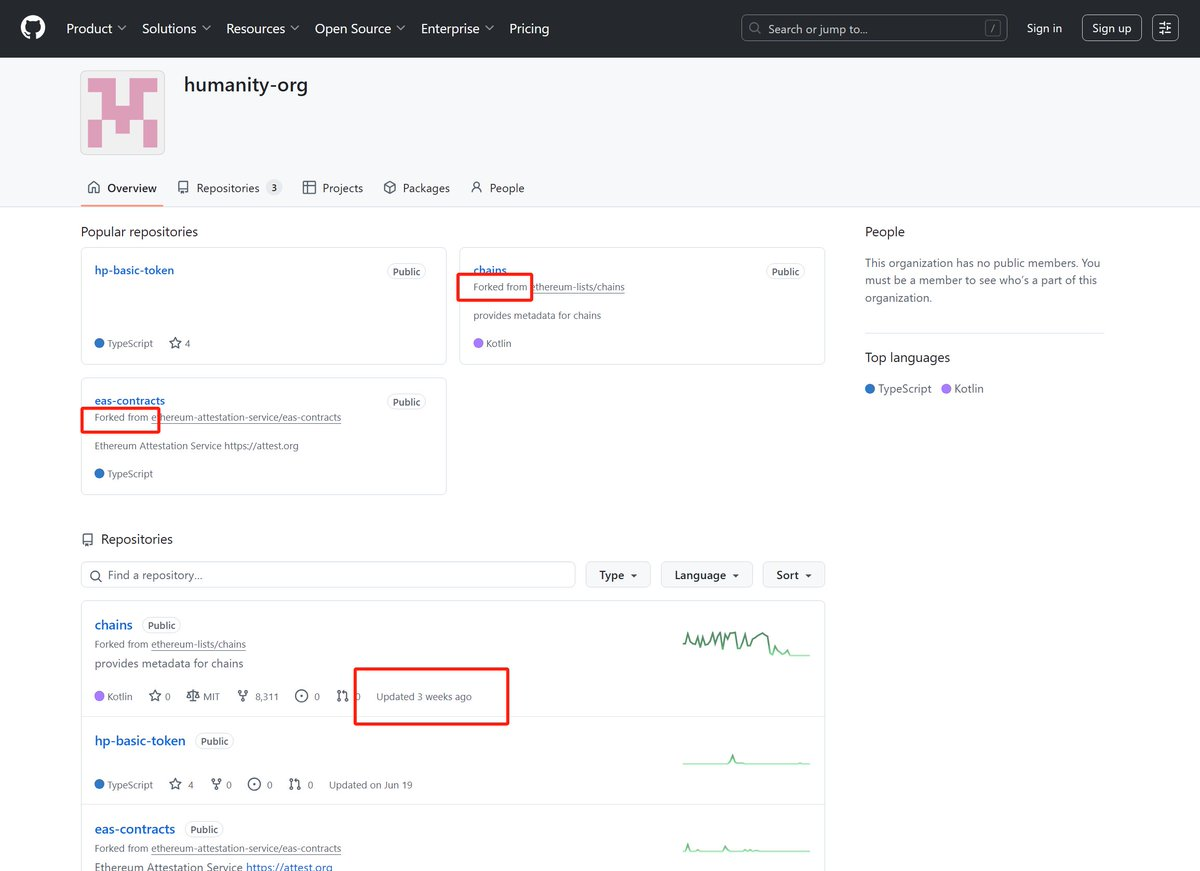

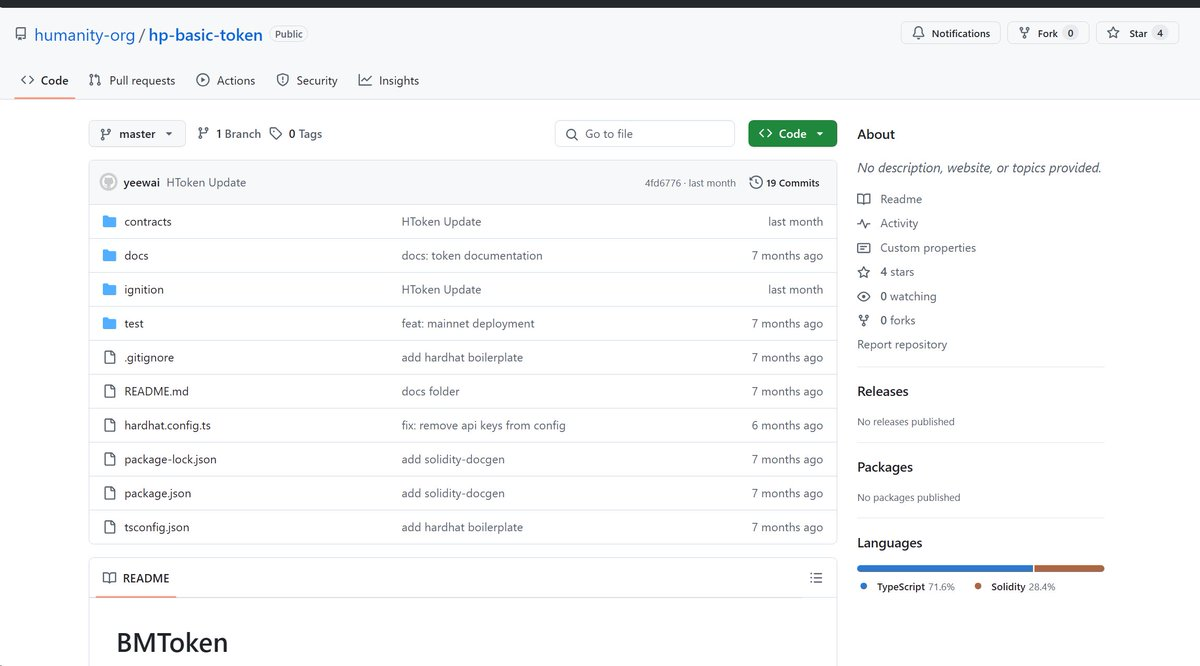

First, there are only 3 code repositories in total, of which 2 are forks of other programs.

Second, the most recent code submission was 3 weeks ago. Logically, compared to Particle, Humanity is a new project, yet the most recent code submission was 3 weeks ago…

Third, the only non-fork code repository has only 19 code submissions.

Fourth, in this one non-fork code repository, there is no display of the number of contributors. With only 19 submissions, it’s possible that just one person made all the submissions.

Fifth, Humanity's GitHub does not show any followers.

The comparison is clear: Particle is technically strong and continues to submit new code at a certain frequency. Humanity is technically weak and has a very slow submission frequency.

✦Additional Tips

First, observe the specific code contributors.

See which major technical projects they have participated in, which can help better understand the strength and background of the project developers.

I once looked at the code contributors of Aptos, most of whom came from Libra, a stablecoin project developed by Meta (formerly Facebook). Although Libra ultimately faced opposition from many central banks, the US dollar stablecoin is on the rise, reminding us of the former Libra and the current Aptos, which has strong technical capabilities.

Second, compare the number of contributors in the same project's code repositories.

This can reveal the project's core advantages. For example,

This project has a total of 48 code contributors in its storage node repository, while the 0g chain has only 3 contributors. This indicates that its core competitiveness lies in decentralized storage.

✦If heavily invested, it is advisable to understand the specific submission content

If you are heavily invested in a project, it is advisable to understand the content of the project's code submissions. This way, you can observe the project's progress and also stay informed during major updates to plan ahead.

Of course, if you are an outsider, it’s okay; you can still ask Claude.

✦ Where to access the project's open-source code repository?

Generally, you can find the link to the GitHub code repository on the project's official website or in the documentation.

💠In conclusion

The auditing agency and code contributors can help us understand the project's reputation.

The audit report summary and code submission status can help us gauge the maturity of the project's development.

The specific issues in the audit report and the specific content of code submissions can provide us with a more detailed understanding of the project's specific risks and updates. If heavily invested, it is recommended to use Claude to understand these two aspects in detail.

As for why I like to use Particle + UniversalX as an example? Of course, it’s because I am heavily invested in

$Parti……

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。