Everyone will go through a particularly difficult time, facing the hardships of life, the disappointments of work, and the anxiety of love. If you can get through it, life will become clear and bright; if you can't, time will teach you how to make peace with them. Therefore, we must persevere, as the sun rises and sets, there will always be dawn!

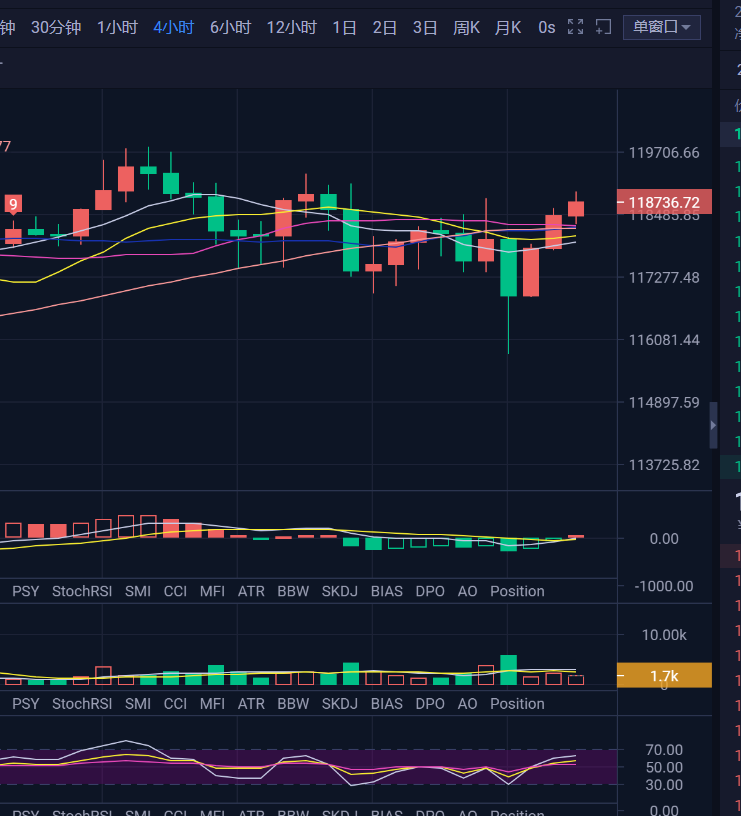

Yesterday's market was truly exciting. With our precise grasp of market points, it was quite easy to navigate such a market. From the recent market trends, we have consistently maintained a strategy of operating within a range. So yesterday, the market first rebounded to give us a short position above 118700, and after this position was established, it began to retrace quickly, dropping to below 116000 in the early hours, which was also the target position for the decline we set yesterday. We successfully captured both the highest and lowest points to complete our long and short operations, thoroughly understanding this round of market movements, resulting in profits from both sides. Congratulations to those who participated in this operation; as long as you strictly follow the strategy, it leads to the most perfect gains.

Returning to today's market, after the back-and-forth clearing of the market, currently, from a liquidity perspective, the short-term high-leverage long and short liquidity has been largely cleared. The strong liquidity clearing intensity formed by the long and short positions yesterday has diminished, and today it seems that both sides are relatively conservative, with no particularly large new long or short liquidity appearing. We have repeatedly emphasized a viewpoint regarding the recent market's oscillating trend: as long as there is accumulation of high-leverage long and short liquidity during oscillations, there is a high probability that both sides will undergo a clearing process. This is a common clearing method in oscillating markets, and our recent operations have repeatedly validated this viewpoint. Currently, in terms of liquidity, the distribution of short liquidity above is still higher than that of long liquidity. The short-term liquidity clearing intensity has reached around 119700, with the upper level still around 121000. Below, the long liquidity has started to regroup around 117000, and further down is around 115000. It appears that the short liquidity above is more enticing; it remains to be seen if the longs have the confidence to take it down.

On the technical front, the daily candlestick has formed a bearish doji, creating a structure of three consecutive bearish candles, with the doji closing indicating a weak oscillation in the current market. Under the influence of continuous oscillation, the moving averages and indicators are running flat and converged, still failing to provide significant reference for the short-term market. On the four-hour level, after completing a bottoming rebound in the early hours, the current structure shows a bullish trend pulling up from the bottom. If it can break through yesterday's high of 118800, the bullish performance in the short term should continue. From the technical indicators, MACD has re-entered the early bullish phase during the rebound, with the two lines forming a golden cross near the zero axis, and RSI is diverging upwards, running in a higher position. The bullish sentiment in the market is becoming more apparent; however, due to the current oscillating trend, we should not overly anticipate a major trend until a true breakout occurs.

In terms of operations, for the long positions established below 116000, after taking profits and moving the stop loss up, if it continues to rise and first reaches above 119700, we will again look for short positions. A pullback would allow us to re-enter long positions around 117000. For now, we will continue to operate with an oscillating mindset.

Ethereum's points yesterday were not very strong; it first rebounded without providing the best entry for a short position, and during the subsequent pullback, it also failed to provide a long entry. Recently, Ethereum has started to follow Bitcoin's movements. If it reaches around 3920-3940, we can consider a short position, and if it pulls back to around 3815, we can look for a short-term long operation.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and strategies may not be timely. Specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。