Author: Zhu Weisha

The author published “Will the Stablecoin Bill Trigger a Financial Tsunami After Its Launch?” and subsequently received feedback from readers, many of whom agreed with the article's assessment of the bill's flaws: “The current issuance method of stablecoins clearly has three major risks: no safety net, lack of transparency in fiat assets, and inconsistent naming of issued stablecoins. The safety net is not a technical issue, while the other two problems can be solved by technology.” They also supported the solutions I proposed, believing that transparent stablecoins could simplify regulation. Their concerns were based on the premise that “the U.S. pursues dollar hegemony, while Hong Kong seeks to be a financial center.” They hoped I would explain these two issues.

The pursuit of a financial center by Hong Kong is easy to understand. Readers are more interested in how the U.S. pursues financial hegemony.

High U.S. Debt and Sanctions Prompt De-dollarization

By early 2025, U.S. national debt had reached $37 trillion, with foreign investors holding $9.05 trillion. China significantly reduced its holdings to $756.3 billion, dropping to third place. From 2023 to June 2025, China accumulated an additional 267 tons of gold, bringing its total to 2,298 tons. During the same period, global central banks collectively increased their gold holdings by 2,500 tons. This accumulation by central banks disrupted the balance of gold demand, causing a significant rise in gold prices. This reflects a collective distrust of the dollar by world central banks, essentially a lack of confidence in the U.S.'s ability to repay its debts.

Currently, U.S. debt is 130% of the U.S. GDP. In 2024, interest payments on U.S. debt are projected to be $1.1 trillion, with estimates for 2025 also reaching $1 trillion. In 2025, $9 trillion of U.S. debt will mature, and if interest rates do not decrease, financing at rates exceeding 4.5% will become a huge burden on fiscal spending. This is also the reason for various countries' concerns about U.S. debt.

The financial sanctions imposed by the U.S. on Russia and the threats against Chinese banks are quite evident, prompting these countries to band together. This has led to the establishment of a currency payment system led by China (BRICS Pay) and China's Cross-Border Interbank Payment System (CIPS). According to data from Niubank Research, as of May 2025, the dollar accounted for 48% of global payments. Reports also indicate that in April 2025, the renminbi's settlement ratio in cross-border transactions in China surpassed 54% for the first time, while the dollar's share fell below 43%. This means that the dollar's settlement volume in Chinese trade has decreased. As China's payment system develops, it poses a threat to the dollar's status. The U.S.'s corresponding measures include tariffs, financial sanctions, and public opinion to threaten countries that join this system. Ultimately, the dollar's position is bound to be compromised.

The U.S. Faces Dilemmas and Choices

Although the dollar's position is beginning to waver in the fiat currency game, the settlement volume of stablecoins remains far ahead. As of July 2025, the dollar holds an absolute dominant position in the issuance of stablecoins, with a market share close to 99%, forming a new global payment landscape centered around dollar stablecoins. This is the U.S.'s absolute home ground.

Stablecoins offer high global payment efficiency; traditional cross-border payments require several days for settlement, while stablecoins can achieve near-instantaneous transactions, reducing costs by over 90%. In regions where banking is underdeveloped, Tether (USDT) has been deeply cultivated, expanding the use of dollar stablecoins.

The most significant feature of stablecoins is their alignment with the characteristics of the internet. Today, the global internet population stands at 5.5 billion, with developed countries achieving a population coverage rate of 91%. The peer-to-peer payment characteristic signifies disintermediation, which includes both commercial banks and central banks. Marked by the Genius Bill, a revolution in banking has begun.

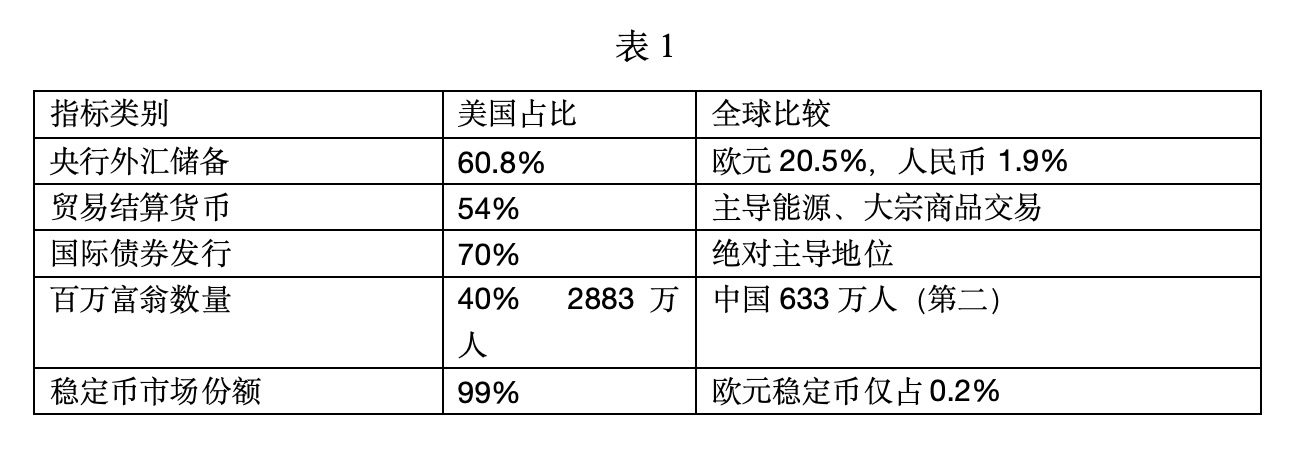

The U.S. has made concessions to banks, allowing only those with banking licenses to issue stablecoins, uniting banks to maintain financial stability, and U.S. banks have responded quickly. According to Deepseek statistics, Table 1 shows that the powerful U.S. financial industry has an absolute dominant position.

Non-bank large enterprises in the U.S. can issue dollar stablecoins in Hong Kong. Facebook has 3 billion users, while YouTube has 2 billion users, maintaining a dominant position in the internet market.

Thus, in the internet domain, whether in finance or market, the U.S. holds a dominant position. It does not require a revolutionary opponent; the issuance of stablecoins represents a revolution for itself and the financial industry that surpasses all opponents' actions.

While U.S. rivals aim to defeat it in fiat currency, the stablecoin strategy steps outside the fray: you fight your battles, and I fight mine; I won't engage in a fiat currency war but will open a new battlefield. Utilizing its absolute advantage, it reaches users directly, effectively undermining its competitors.

User votes determine that internet companies will defeat traditional enterprises, and crypto finance will defeat traditional finance; this scene will replay in the financial industry. Since the emergence of the TCP/IP protocol in 1983, the internet has served as a tool for traditional finance for 40 years; the introduction of the Bitcoin system on January 9, 2009, initiated the process of financial disintermediation. The U.S. Genius Bill aligns with the historical trend. The result is that slower banks and other financial institutions will perish first.

The possibility of traditional finance defeating crypto finance is zero. All arrangements are futile; the outcome is already determined. Thus, this is a winning move for the U.S., a “genius” move. The term genius embodies the U.S.'s “sunshine strategy” for unifying the world.

The Secrets Behind the Genius Bill

1. The Genius Plan Erects Competitive Barriers

Due to the unpreparedness of countries around the world for future financial changes, the Genius Bill marks the beginning of a financial dimensionality reduction strike. According to internet rules, only the top player can survive. Consequently, all sovereign currencies become targets of this strike. This is the free choice of the world's people. The collapse of sovereign currencies will inevitably begin with weaker nations. The next decade will see a competitive landscape among several strong stablecoins.

The two potential competitors to the U.S. are China and Europe.

The European Central Bank does not issue bonds; it releases liquidity by purchasing member states' bonds, adjusting interest rates anchored to a 2% inflation target. The Eurozone is very suitable for member states to issue a unified stablecoin called the euro. The European Central Bank has a regulatory function similar to that of the Hong Kong Monetary Authority, although the content of the regulation differs. The Eurozone is suitable for the issuance of transparent stablecoins as introduced in my article “Will the Stablecoin Bill Trigger a Financial Tsunami After Its Launch?”. The issuance of a CBDC by the European Central Bank would be a mistake, which is also the reason for the difficulties in developing a European CBDC. Europe has favorable conditions, but its actions are too slow, potentially missing competitive opportunities. Japan and the UK also have the conditions to issue transparent stablecoins based on the ideas presented in “Will the Stablecoin Bill Trigger a Financial Tsunami After Its Launch?”.

China's issue is currency control, which is a deadlock; without resolving this issue, it cannot even qualify to participate in the competition. China does have methods to achieve a unified issuance of stablecoins like the Eurozone, which involves effectively utilizing Hong Kong as a window without changing existing regulations, thereby breaking the deadlock of currency control. This is China's only hope.

If China cannot revolutionize itself like the U.S. to participate in this competition, the consequence will be: the song of the rear garden continues across the river.

2. Do We Still Need the Federal Reserve?

If U.S. debt is backed directly to issue currency, do we still need the Federal Reserve? In my article “From Peer-to-Peer Cash Systems to a Non-Bubble Financial System” and “Postscript: A New World Needs a Financial Yardstick That Does Not Change” I systematically discussed why we might not need a central bank or the Federal Reserve. In my series of articles on “Bitcoin Dollar Standard”, the Federal Reserve is still present, indicating that my thinking has limitations compared to the “genius” approach of issuing currency directly backed by U.S. debt.

Their method of using U.S. debt is similar to my approach of using Bitcoin as an anchor. My articles anchor on Bitcoin, while they anchor on U.S. debt. Backing U.S. debt to issue dollar stablecoins means the Federal Reserve has no role. This means that the quantity of dollars is gradually fixed. The dollar will no longer increase, and market adjustments will determine the demand for U.S. debt. The quantity of U.S. debt will regulate the stability of stablecoins. This is the underlying financial logic implied by the so-called “Genius Bill.” Of course, if there is still demand for dollars, it seems we still need the Federal Reserve.

3. How Much U.S. Debt Do We Need?

Assuming there is no Federal Reserve, the world is anchored to the dollar and U.S. debt. This way, the increase in U.S. debt can measure GDP growth, while stablecoins serve as the yardstick, with their issuance based on global purchasing power growth.

According to the Fisher equation, money and the multiplier equal the price level and total transaction volume, i.e., MV = PT. M represents the base money, V represents the velocity of money (multiplier), which equals the total price level P multiplied by the total transaction volume T. With stablecoins, we do not know the multiplier V; the turnover speed has increased from days to seconds, with efficiency improved by a factor of ten thousand. One thing is certain: GDP growth is definitely correlated with U.S. debt, and market demand automatically determines the quantity of U.S. debt. When the price of stablecoins rises, U.S. debt can be issued to maintain the price stability of stablecoins. Originally, stabilizing the dollar was the job of the Federal Reserve. However, with both the dollar and stablecoins as variable parameters, the adjustment is somewhat more complex compared to my Bitcoin standard proposal. Nevertheless, this adjustment is still better than the Federal Reserve's approach. The Federal Reserve stabilizes the dollar through money market funds, with monthly meetings causing fluctuations in the dollar market, while the market adjustment for stablecoins occurs every second. Readers can refer to “The Realization of DW20 Decentralized Standard Currency” for principles of automatic adjustment. Of course, without the Federal Reserve, assistance is still needed. The method of assistance is not difficult; it is another topic. The position of the Federal Reserve during the transition period is also an interesting topic.

Once U.S. debt is used as a backing asset, as long as the economy rises, U.S. debt can also rise, so there will be no worries about issuing U.S. debt. Musk opposes the U.S. Inflation Reduction Act because Trump did not let him in on this secret. He does not understand that the U.S. debt behind the dollar is not only the debt of Americans but also the seigniorage collected from the world's people.

4. The U.S. Unifies the Landscape

The above analysis is based on my years of research on cryptocurrencies, totaling 700,000 words, all published on Chainless. The U.S. approach shares similarities with my research ideas; my thoughts on the future of finance should proceed in three steps are reflected in U.S. operations. The first step I mentioned is the Bitcoin strategic reserve, which is later echoed in the proposal by U.S. House Representative Loomis. The second step is the Bitcoin dollar standard, corresponding to the U.S. “Genius Bill,” in which Representative Loomis also participated. It should be noted that their proposal's logic is coherent; some issues in the bill need to be iterated in practice, but the direction is good and will greatly promote the welfare of the people. The second step, the Bitcoin dollar standard, is necessary, but it is not the ultimate solution. The third step, the ultimate solution, is the Bitcoin standard.

The Bitcoin Standard is the Ultimate Solution

From the perspective of cryptocurrency practice, the U.S. plan involves centralized issuance; stablecoins are not equity tokens and are difficult to gain market recognition as consensus tokens. Zhou Xiaochuan, former governor of the People's Bank of China, believes that “creating an international reserve currency that is decoupled from sovereign states and can maintain long-term stability in value, thereby avoiding the inherent flaws of sovereign credit currencies as reserve currencies, is the ideal for reforming the international monetary system.” Bitcoin meets the conditions proposed by Mr. Zhou as a reserve currency. For a detailed analysis, refer to “From Peer-to-Peer Cash Systems to a Non-Bubble Financial System”, while the dollar and U.S. debt do not meet this condition.

U.S. debt is still backed by credit, operated by a central authority, and we cannot prevent human greed. Chinese scholar Guo Jianlong wrote in “The Financial Code of the Central Empire”: “As long as there is a monopoly on the issuance of paper money, the government’s use of paper money to subsidize finances is a natural behavior; no matter how people guard against it, there is no way to stop it. When there is an imbalance in fiscal revenue and expenditure, as long as the printing press is activated, the problem can be solved; this temptation is irresistible.” Centralized issuance is difficult to gain recognition from countries around the world and will not earn the people's approval.

Bitcoin is decentralized and has gained recognition from an increasing number of people worldwide because inflation is evident, deposits cannot retain value, and hard work does not lead to wealth; this is also the consensus of this era.

Let us look at how Satoshi Nakamoto explained why Bitcoin would succeed: “By choosing a fixed monetary base, early adopters are ensured to gain a windfall when Bitcoin becomes popular, which also attracts those who distrust government arbitrary monetary policies.”

Nakamoto pointed out the chronic issues of the fiat currency system and attempted to solve them. However, Bitcoin is not a complete currency; it is more like gold, serving as a consensus currency with store of value. Bitcoin needs a standard currency that matches its characteristics, a decentralized standard currency to complement it. The standard currency is the benchmark currency; currently, the dollar is the standard currency and also the pricing unit, i.e., the benchmark currency. However, the flaws of the dollar determine that the economy will experience bubbles and cyclical fluctuations. Readers can refer to “The Realization of DW20 Decentralized Standard Currency” for an explanation of how to construct a decentralized benchmark currency to complement Bitcoin, thereby achieving the Bitcoin standard. Historical development has its natural laws; details may differ, but the direction aligns with my expectations. The introduction of the Genius Bill is the second major move after Bitcoin enters its second half. Excellent politicians, financial experts, and entrepreneurs have taken the stage to collaboratively construct a fairer human society.

Based on a deep analysis of cryptocurrencies, we have launched the benchmark currency for Bitcoin—Distributed Standard Currency DW20. It consists of three phases: consensus currency phase, stablecoin phase, and standard currency phase. Currently, we are in the consensus phase, conducted through registration airdrops. Over the past year, 710,000 people have registered. Interested readers can log in to the website for more information. There is an airdrop download link available.

By filling the gaps in Bitcoin, the Bitcoin standard is thus perfected. The article “Postscript: A New World Needs a Financial Yardstick That Does Not Change” interprets the ultimate solution for Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。