This report analyzes the growing DeFi sectors, focusing on the core functionalities offered by various protocols and their adopted GTM (Go-To-Market) strategies.

Written by: Castle Capital Source: X, @castle_labs

Translated by: Shan Oppa, Jinse Finance

The Arbitrum ecosystem is experiencing rapid growth, with increasing user numbers, total value locked (TVL), and underlying technological capabilities. Recent major developments include:

- Ethena_labs collaborating with Arbitrum to launch Convergeonchain

- Robinhoodapp partnering with Arbitrum

- The introduction of the Timeboost mechanism aimed at capturing MEV and enhancing protocol revenue

These innovations continue to expand, showing a clear development trajectory. However, to move forward, it is crucial to understand Arbitrum's positioning within the broader crypto ecosystem and identify areas for improvement. This analysis aims to reveal these aspects.

Current Status of Arbitrum

This section will explore Arbitrum's performance in terms of TVL, the development of the Arbitrum Stack, incentive programs, and recent dynamics.

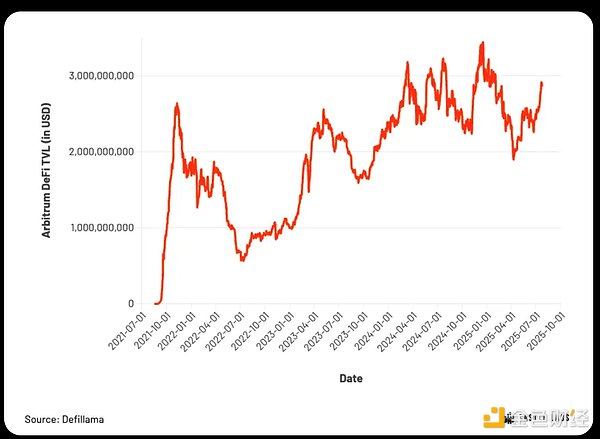

Liquidity Status: Arbitrum's DeFi TVL currently stands at approximately $2.9 billion, with the majority locked in @Aave, @GMX_io, and @Uniswap, which together account for 64% of the TVL.

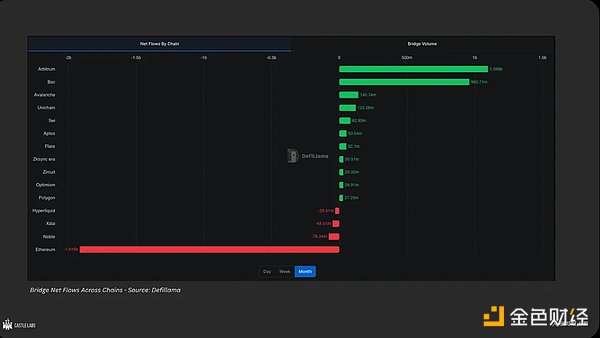

In the past month, Arbitrum has seen net inflows exceeding $1 billion, ranking first among all networks.

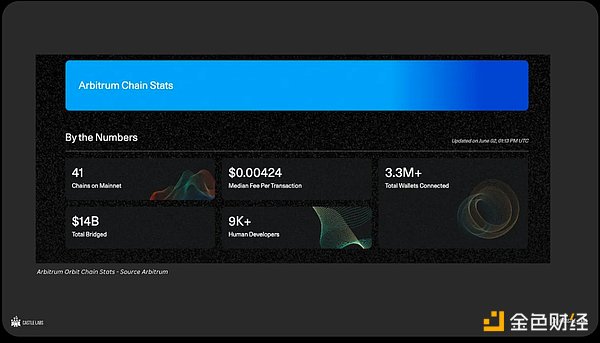

Arbitrum Orbit: Following the announcements of deployments by Ethena and Robinhood, Arbitrum Orbit has seen rapid growth. The Arbitrum Stack simplifies the deployment process for developers on L2 and L3. Currently, 41 chains are live on the mainnet, with over 100 chains in development, covering various fields such as DeFi, real-world assets (RWA), gaming, NFTs, AI, and DePIN.

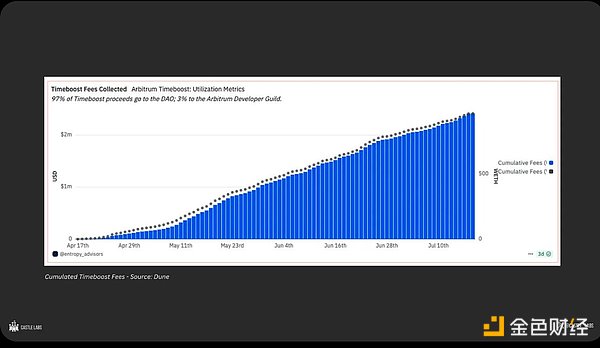

Timeboost: Arbitrum Timeboost is a transaction ordering mechanism that helps the chain capture MEV profits and reduce network spam transactions. Since its launch in April 2025, Timeboost has generated approximately $2.4 million in fees, with its share of Arbitrum DAO revenue continuously increasing.

Developer Ecosystem and Toolchain: As an EVM chain, Arbitrum can directly utilize the same development tools as the Ethereum mainnet. Additionally, the introduction of Stylus allows developers to use WASM-compatible languages such as Rust, C, and C++, further expanding use case scenarios and enhancing development convenience.

Incentive Programs: Arbitrum initially launched incentive programs such as STIP, LTIPP, and STIP.b, but these experimental programs failed to maintain long-term growth after their conclusion. The new program DRIP marks a shift towards a more precise incentive strategy, focusing on attracting projects that have achieved product-market fit (PMF).

Competitive Landscape

Currently, there are several verticals worth noting. To focus the scope of this study, we selected rapidly growing sectors that attract the most TVL (total value locked) and narrowed it down to 10 sectors closely related to DeFi, which have good potential for expansion or focused development. In each sector, we not only consider TVL but also reference the recent growth trends of the protocols to select representative key projects.

This section will analyze the comparative landscape of these selected sectors, assessing Arbitrum's performance in TVL, functional characteristics, and the market expansion (GTM) strategies adopted by various protocols compared to other chains.

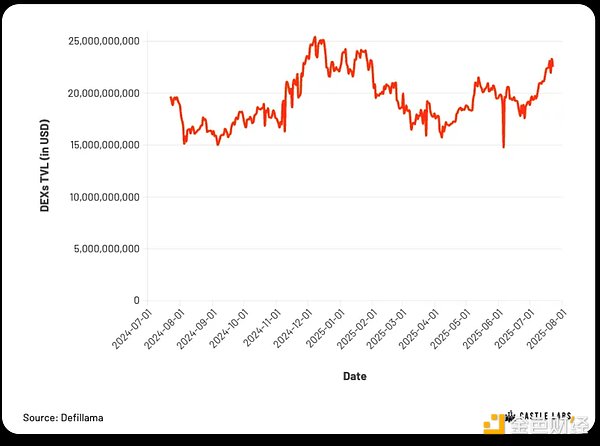

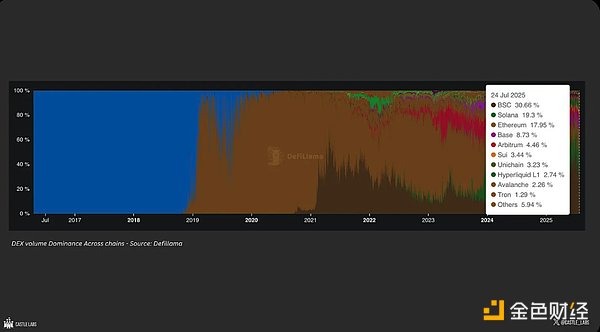

Decentralized Exchanges (DEX)

The total TVL of DEX across all chains is approximately $23 billion, with Arbitrum's DEX TVL at $565.5 million, accounting for about 2.4%. Major protocols include Uniswap, CamelotDEX, Curvefinance, and Balancer.

Currently, DEX trading volume is primarily concentrated on three chains: BSC, Solana, and the Ethereum mainnet, which together account for over 65% of the total trading volume. DEX activity on Arbitrum remains relatively stable, primarily driven by Uniswap, but its sluggish growth in an increasingly competitive market may become a concern. For instance, in the past three months, Arbitrum's DEX trading volume has lagged behind its main competitor, Base.

Curve: Curve's current TVL is $2.24 billion, with 95% deployed on the Ethereum mainnet. Curve remains a major platform for stablecoin swaps and yield strategies. In Q1 2025, Curve's trading volume reached $35 billion. Through its composability with yield products like Convexfinance, Curve has attracted a large user base. Recently, Curve has begun to focus more on the ecological integration of its CDP stablecoin crvUSD, collaborating with multiple partner protocols.

Uniswap: Uniswap is one of the mainstream DEX protocols on Ethereum, continuously developing its products, with recent highlights including the "hooks" mechanism in v4. Uniswap's current TVL is $5.82 billion, processing over $150 billion in trading volume in Q1 2025, covering the Ethereum mainnet and various L2 networks. Currently, Uniswap is directing incentive resources towards its "Unichain" initiative to expand its ecosystem.

Balancer: Balancer's TVL is $945 million, primarily concentrated on the Ethereum mainnet. The protocol supports multi-asset pools, allowing users to diversify their asset exposure and yield within the same pool. Balancer employs a veCRV-like model, incentivizing users through voting rights and governance. Additionally, Balancer has integrated Aura—a protocol aimed at enhancing yields and increasing user traffic, similar to Convex's support for Curve.

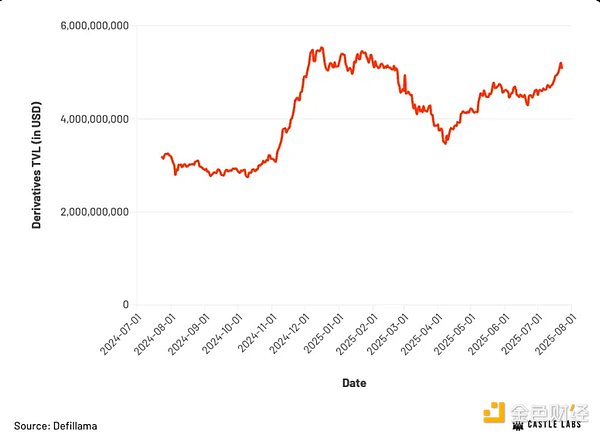

Derivatives Market

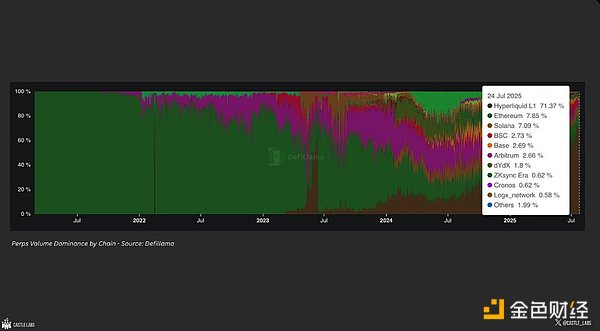

The perpetual contract market continues to grow, with trading volume tripling since the 2021 cycle. This trend is driven by significant improvements in on-chain user experience (UX), thanks to products like Hyperliquid. Currently, Hyperliquid accounts for about 70% of on-chain perpetual contract trading volume, followed by Solana and Ethereum. On Arbitrum, the most representative protocol in the derivatives space is GMX, which contributes significant TVL to the chain, followed by OstiumLabs.

Arbitrum's perpetual trading activity has decreased by about 50% over the past year, primarily due to HyperliquidX siphoning off a significant amount of trading volume from other ecosystems. However, the launch of Ostium is a positive development for Arbitrum, as its unique product design (such as on-chain indices, commodities, and forex leveraged trading) has had a positive impact.

Lighter: Lighter is a zk-rollup focused on derivatives trading, deployed on Ethereum, offering performance comparable to centralized exchanges (CEX). The protocol's TVL is $213 million and shows a positive growth trend. It provides gas-free and fast trading experiences, supporting zk-based order matching, high-frequency trading (HFT) with less than 5 milliseconds latency, and sub-account management, suitable for both retail and professional traders.

Lighter currently employs a points-based incentive mechanism, with no trading fees charged on the platform, making trading "zero-cost" for users, and there are potential rewards for points users in the future, making it highly attractive.

Paradex: Paradex is an order book trading platform based on appchain, built on the @Starknet Stack and CairoVM, offering CEX-level trading performance and supporting perpetual contracts and options products. Paradex's current TVL is $55.2 million and maintains stable growth.

Paradex's native token $DIME aims to achieve community ownership, with 57.6% of the tokens allocated for user airdrops and incentive usage. This token is also used as a gas token on the Paradex chain. Similar to Lighter, Paradex also uses a points and referral system to incentivize trading behavior.

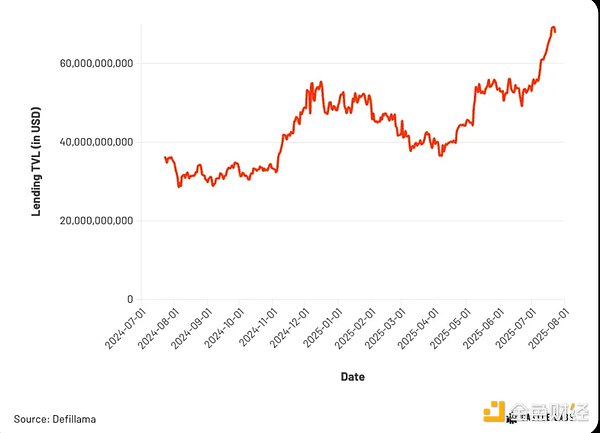

Lending Market

Lending is one of the largest sectors by TVL, currently totaling $69.53 billion, with Aave holding a 48.2% market share. In addition to Aave, competition among protocols such as @MorphoLabs, @sparkdotfi, and @Eulerfinance is also intense, indicating significant market development potential.

On Arbitrum, most of the lending TVL comes from Aave, which has exceeded $1.1 billion, while other protocols like @Compoundfinance and @0xFluid have relatively small market shares. Overall, Arbitrum accounts for 2.2% of the total lending TVL across all chains.

Aave: Aave's current TVL is $33.54 billion, capturing 48% of the lending market. Aave offers a range of features, including an Efficiency Mode that increases LTV, an Isolation Mode for new or high-risk assets, and a Portal that supports cross-chain lending. Recently, Aave Umbrella was launched, which is a staking mechanism allowing users to earn rewards through staking while also bearing some penalty risk in case of bad debts to ensure the safety of the Aave ecosystem.

The total value of Pendle assets deposited in Aave has exceeded $2 billion, enhancing the application value of Pendle assets and increasing user inflow. Aave is also actively implementing incentive measures on chains like Base and @SonicLabs to expand its market share. On Arbitrum, Aave has established a strong market foundation, and Arbitrum is also the chain with the largest TVL for Aave among all L2s.

Morpho: Morpho's TVL is $5.52 billion, accounting for about 8% of the total lending TVL. Morpho provides a range of features, including open market creation, Vaults, and batch trading processing. Its V2 version will introduce new features such as peer-to-peer lending and cross-chain lending.

Morpho incentivizes users through its native token and partner tokens, allowing users to view their reward distribution on a dedicated rewards page. The reward distribution is handled by the Merkl protocol. Additionally, Morpho has partnered with Coinbase to offer Bitcoin collateralized loan services to Coinbase users.

Sparklend: Sparklend's TVL is $4.95 billion, making it the third-largest lending protocol. Its growth is primarily due to the Stablecoin Liquidity Layer (SLL) provided by Spark DAO, which has injected significant funds into the protocol. Functionally, Sparklend is similar to Aave v3, as it is a fork of Aave v3.

Similar to Morpho, Sparklend also has a dedicated incentive page, supporting multi-chain incentives and different types of user behavior incentives. The TGE (Token Generation Event) of Spark DAO was held in June, distributing rewards to Sparklend users.

Compound: Compound's current TVL is $3.13 billion, making it the fifth-largest lending protocol, capturing 5% of the lending market. Compound offers a dynamic interest rate mechanism and a unified market model, helping to reduce user risk.

Recently, Compound launched Compound Blue in collaboration with Morpho and Polygon, featuring a dedicated front-end interface and offering rewards in COMP and POL tokens. Additionally, most markets within the core protocol are still primarily incentivized through COMP tokens.

Fluid: Fluid's current TVL is $1.16 billion, showing a good growth trend. It introduces unique mechanisms in its lending architecture, such as "Smart Debt" and "Smart Collateral," allowing users to use collateral assets as LP positions to participate in liquidity, thereby enhancing capital efficiency and reducing lending rates. Fluid's liquidation mechanism is also more efficient, only partially liquidating positions to restore a healthy state.

Currently, Fluid is actively expanding to multiple chains and driving user growth through its governance token FLUID and chain-specific incentive programs.

Euler: Euler's current TVL is also $1.16 billion, accounting for 1.8% of the total lending TVL. Its features include open Vault creation, a Hooks mechanism that can trigger under specific conditions, and a Multiply function that supports the creation of leveraged positions. Euler has recently launched on Arbitrum.

Euler's liquidity pools are incentivized through rEUL (reward EUL tokens) and partner tokens along with points. Additionally, Pendle's PT (Principal Token) assets can also be deposited in Euler, similar to Aave, providing more utility for PT holders.

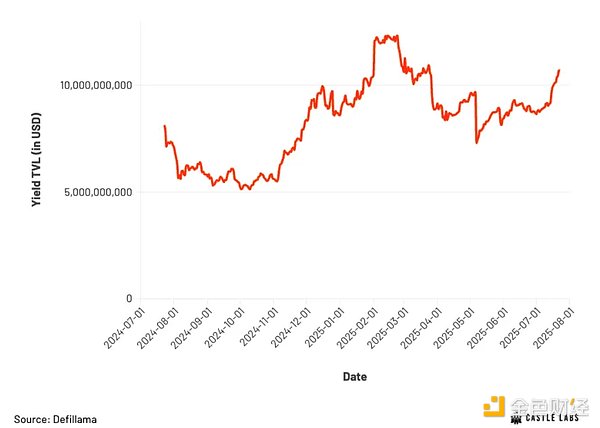

Yield Protocols

Yield protocols are a growing sector, currently totaling $10.5 billion in TVL, primarily contributed by Pendle and Convex, which together account for about 68% of the yield market. Most of the TVL is locked on Ethereum, followed by Solana and Arbitrum. On Arbitrum, this sector is continuously growing, showing a month-on-month positive growth trend, with protocols like @Pendle_fi, @Magpiexyz_io, @Torosfinance, and @Aurafinance actively expanding.

Pendle: Pendle's total TVL across multiple chains is $5.64 billion, capturing about 54% of the yield market. Pendle allows users to tokenize yields through PT (Principal Token) and YT (Yield Token). It supports open market creation and provides a dedicated AMM (Automated Market Maker) for trade matching.

Pendle's market advancement strategy is closely related to its native token, which is used for both incentives and governance. Pendle assets are integrated into a broader DeFi ecosystem through collaborations with protocols like Morpho, Euler, and Aave.

Convex: Convex's TVL across multiple chains is $1.45 billion, accounting for 13.8% of the yield market. Convex focuses on optimizing yields for LPs and token holders, primarily by aggregating and enhancing rewards from Curve, Frax, and f(x) Protocol. Its liquid staking tokens like cvxCRV, cvxFXS, and cvxFXN are also incorporated into the DeFi ecosystem through collaborations with other protocols.

Convex's incentive mechanism relies on its governance token CVX, which can participate in governance and serves as a source of user rewards. The integration effects with multiple protocols create a "flywheel effect," enhancing the growth potential of the protocol itself.

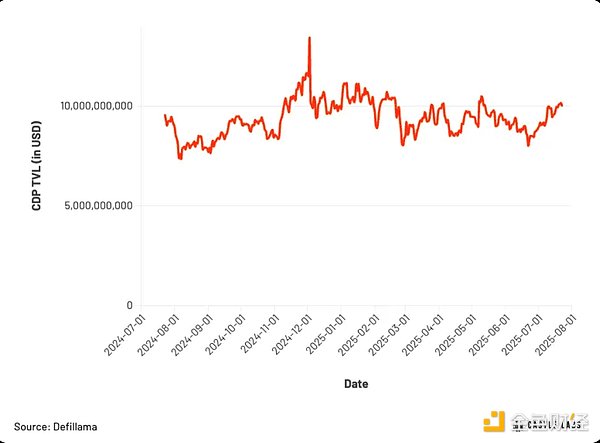

CDP

The current TVL of CDP-type protocols is $10 billion, with major protocols including @Skyecosystem Lending and @Lista_dao, which together account for 68% of the market share in this sector. The CDP sector experienced significant growth in the last cycle, but since the end of 2022, its TVL has stabilized at current levels.

Most CDP protocols are concentrated on Ethereum, followed by the BSC chain. Currently, there are no mainstream CDP protocols on Arbitrum, with the total TVL in this sector only at $26 million. However, @Neriteorg (a multi-chain deployment version of Liquity) has recently launched, providing new growth opportunities for CDP protocols on Arbitrum.

Sky Lending: Sky Lending is a lending protocol using the CDP model, allowing users to collateralize assets and mint its stablecoin USDS. Its TVL (locked amount) is $5.77 billion, accounting for about 57% of the market. Its asset sUSDS (staked version of USDS) is achieving multi-chain deployment and providing liquidity across multiple protocols. Additionally, their launched Spark project aims to enhance the composability of the native token in DeFi.

Sky Lending uses governance tokens SKY and SPK to incentivize users and liquidity providers, with 3.25 billion SPK tokens to be distributed over two years.

crvUSD: crvUSD is a stablecoin protocol launched by Curve, currently with a TVL of about $250 million. Curve uses a unique LLAMMA (Lending-Liquidating AMM) mechanism to gradually swap collateral during price declines, reducing liquidation shocks and improving capital efficiency. Users can mint crvUSD using ETH, stETH, and other volatile assets.

crvUSD is deeply integrated into Curve's liquidity pools, allowing LP tokens to be used as collateral, enhancing platform liquidity. Staking Curve's CRV tokens also grants governance rights to decide on crvUSD's liquidity incentives. Additionally, crvUSD is integrated into a broader DeFi ecosystem through Convex, Yearn, and Frax.

Liquity: Liquityprotocol's TVL is $526 million, with its stablecoin BOLD fully backed by ETH and staked ETH assets (such as wstETH and rETH). The protocol allows for higher LTV ratios, with ETH at 90.91% and LST at 83.3%. Furthermore, all protocol revenue (including borrowing interest and liquidation profits) is directly distributed to depositors and liquidity providers in the stability pool, continuously providing yields.

Liquity encourages community-operated front ends and achieves multi-chain expansion through collaborative protocols and products (such as Nerite deployed on Arbitrum).

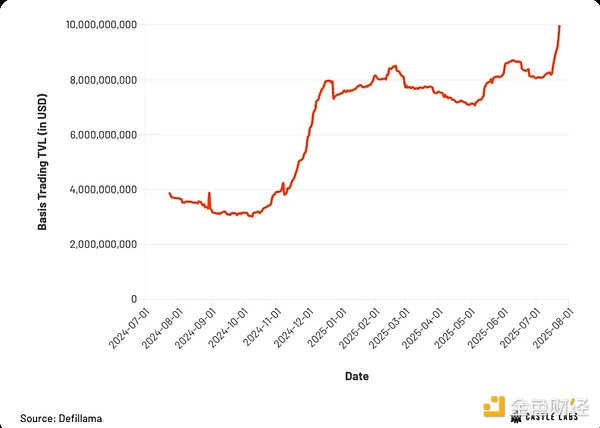

Basis Trading

Currently, the total TVL of basis trading is approximately $9 billion, primarily provided by Ethena, which occupies over 80% of the market share. Most of the TVL is concentrated on the Ethereum chain, with a smaller proportion on Arbitrum, where the main protocol is Stable Labs, with a TVL of $11.8 million, showing stagnant growth.

Ethena: Ethena's TVL is $7.54 billion, dominating the market. Its token USDe has become the third-largest stablecoin, recently surpassing Sky Lending's USDS. The recently announced $260 million ENA buyback plan has caused its governance token price to soar.

Ethena's USDe is deeply integrated into the DeFi ecosystem, participating in incentive and point activities across multiple protocols. They also plan to launch the Converge chain in collaboration with Securitize through the Arbitrum tech stack to improve infrastructure.

Resolv: ResolvLabs currently has a TVL of $500 million and has deployed the USR stablecoin on Ethereum. The design of USR is similar to Ethena's USDe but only uses crypto-native assets as backing.

The main difference lies in RLP—Resolv's backing and insurance pool, represented by RLP tokens, which users can mint and earn premiums.

The protocol features DeFi composability, deployed across multiple protocols, utilizing the native token RESOLV for fee distribution and incentivizing liquidity and insurance pool participants.

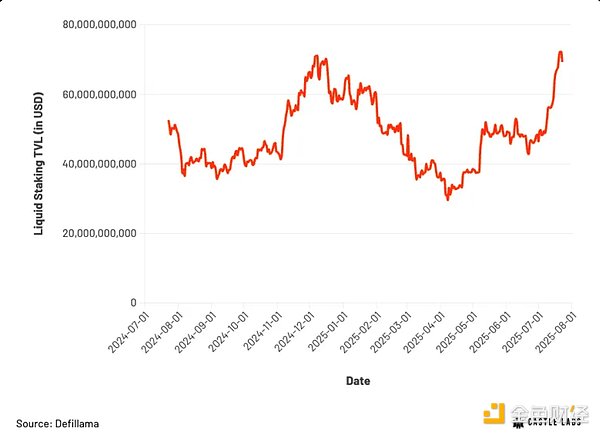

Liquid Staking

Liquid staking is one of the largest sectors in DeFi, primarily dominated by Lido, with a total TVL of $66.8 billion. From a chain perspective, Ethereum is dominant, followed by Solana, together accounting for about 90% of the market share. These assets are distributed across multiple chains, with most still on the Ethereum mainnet (L1), while the proportion of liquid staking tokens on other chains is relatively small.

Lido: Lido's current TVL is $34 billion, capturing about 50% of the market share. Lido's token stETH can be composably used across multiple DeFi protocols, and its strong composability and market entry timing are key reasons for its asset growth.

Lido v3 has launched stVaults, a customizable staking vault system that allows institutions and advanced users to customize staking plans, such as selecting specific node operators and setting fee structures.

StakeWise: StakeWise has a TVL of $1.4 billion, making it the eighth-largest liquid staking protocol, with its token osETH. The core highlight of StakeWise is its vault staking system, allowing users to create or join independent staking pools with customizable parameters (such as fee structures, node operators, MEV strategies, etc.).

StakeWise's go-to-market strategy focuses on providing advanced staking solutions through modular infrastructure while maintaining osETH's composability in DeFi. Its vault system is particularly suitable for DAOs, institutions, and individual users implementing customized staking strategies. Additionally, its support for "independent validator staking" expands its target user base.

Liquid Collective: Liquid Collective has a TVL of $1.35 billion, with its token LsETH. The protocol features a lineup of institutional-grade node operators, including Coinbase Cloud, Figment, Blockdaemon, and Staked, ensuring high-performance operation of validation nodes.

Its market strategy revolves around institutional collaboration, compliance, and strong composability, distinguishing it from retail-focused staking protocols. LsETH has been integrated into multiple protocols, including EigenLayer, Morpho, and Aerodrome.

Re-staking

There are fewer re-staking protocols, but the total cross-chain TVL has reached $25.63 billion. @EigenLayer is the leading protocol, capturing about 70% of the market share. On Arbitrum, the only major re-staking protocol is @Karak_network, which operates as a re-staking layer, allowing stakers to delegate assets to AVS (Active Validation Services) while maintaining compatibility with Arbitrum.

EigenLayer: EigenLayer has a TVL of $18.4 billion, making it the market-leading re-staking product. It allows users to re-stake already staked assets to provide security for other networks and services (AVS).

EigenLayer supports mainstream LSTs, such as stETH, rETH, and cbETH, which can be directly deposited into the platform. Its early growth has been driven by incentive programs.

The protocol supports seamless re-staking for direct ETH stakers and LST holders, attracting large staking service providers and DeFi-native users looking to optimize yields, thereby promoting the development of the Ethereum ecosystem.

Karak: Karak is a smaller protocol currently operating on Arbitrum, with a TVL of $270 million. It provides modular security for AVS through the re-staking of ETH and LSTs, achieving layered yields.

Karak's cross-chain deployment allows AVS from other ecosystems to access its shared staking security pool while maintaining Ethereum-style trust mechanisms.

Karak is transitioning to its own L1 and plans to achieve on-chain tokenization of financial assets (such as stocks and bonds) in the future, transforming into a settlement layer with its security architecture.

Liquid Re-staking

Liquid re-staking is another important sector, with a TVL of $14.1 billion, represented by protocols such as @Ether_fi, @Kelpdao, and @Renzoprotocol. These protocols have begun establishing liquidity pools on Arbitrum, demonstrating the potential of the Arbitrum ecosystem under the expansion of the LSDfi sector.

Ether.fi: Ether.fi allows users to earn Ethereum staking rewards, EigenLayer re-staking rewards, and additional DeFi yields by providing liquidity. Its current TVL is approximately $10 billion, capturing about 70% of the market share.

The integration of eETH in DeFi is continuously increasing, for example, being used in the lending market on Morpho, enhancing its utility.

Kelp: Kelp is the second-largest liquid re-staking protocol, with functionality similar to Ether.fi, the main difference being that users can choose their own AVS. Its TVL is $1.78 billion, accounting for about 12.5% of the market. Users can earn Kernel and EigenLayer points by participating.

Renzo: Renzo currently has a TVL of $1.26 billion, characterized by its automated vault architecture, which can execute validation node delegation and AVS selection on behalf of users, distributing staked ETH across different AVS.

To promote its token ezETH (Renzo LRT), it initially adopted the ezPoints program, later transitioning to the Renzo Rewards program, directly incentivizing DeFi protocol integration and user activity to enhance the practical use of ezETH.

YieldNest: YieldNestfi is a liquid staking and re-staking protocol, currently with a TVL of approximately $11 million. Its core innovation is MAX LRTs, which integrate staking, re-staking, and DeFi yield strategies into a unified yield token.

YieldNest's advantage lies in providing a unified, composable yield tool while maintaining settlement guarantees. Additionally, its modular strategy architecture can efficiently integrate new opportunities, further enhancing yield capabilities.

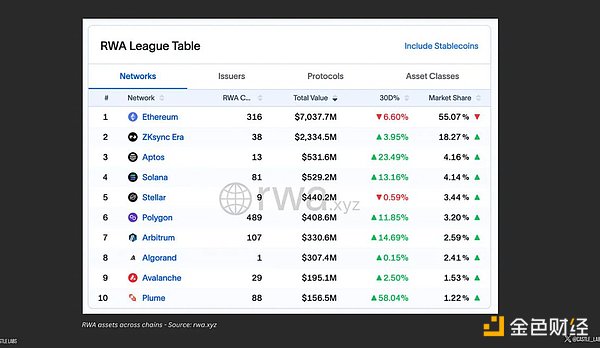

RWA

The real-world asset sector continues to grow, with a total on-chain asset value of $25.49 billion, covering various fields such as private credit, U.S. Treasury bonds, and commodities. From a network perspective, Ethereum still holds the largest market share.

Arbitrum's market share in the RWA sector is relatively small, accounting for only 1.3%, with a TVL of $342 million. Among them, Spiko and Franklin Templeton occupy 70% of the Arbitrum RWA market, while Securitize and Ondo have shown relatively weak growth.

Ondo: OndoFinance is a rapidly growing protocol with a TVL of $1.39 billion, showing continuous growth. Ondo's core value lies in tokenizing traditionally hard-to-access, secure, and yield-generating financial instruments. Its USDY token is backed by highly liquid short-term U.S. Treasury bonds, providing users with yields.

Securitize: Securitize is a leading compliant RWA tokenization platform that allows institutions to issue, manage, and trade regulated financial instruments on-chain, fully complying with regulatory frameworks. Securitize supports various asset classes, including private credit, U.S. Treasury bonds, and corporate bonds. Its growth strategy relies on building institutional trust and strategic partnerships, such as with BlackRock, Franklin Templeton, and Hamilton Lane.

Midas: MidasRWA is an emerging RWA protocol focused on the tokenization of private credit and alternative yield products, providing DeFi users with high-yield, risk-adjusted returns. Its TVL is $189 million, primarily deployed on Ethereum, and continues to grow.

Midas's key advantage is its collaboration with professional risk management institutions (such as MEV Capital and Edge Capital), enabling it to design and deploy structured credit products.

Recommendations and Key Directions

The above analysis primarily focuses on the characteristics, strategies, and core indicator differences of various protocols across chains. This section will concentrate on development areas that Arbitrum can prioritize.

Recommendations will focus on asset types, protocol selection, functional design, and GTM (Go-To-Market) strategies, clearly identifying which directions are worth emulating or increasing investment in.

Most recommended protocols have already been deployed on Arbitrum, but some have not yet landed but have shown significant growth on other chains, making them suitable for introduction (see the "Asset Layer Gap" section).

Decentralized Exchanges

On Ethereum, Curve has formed a strong growth flywheel with protocols like Convex and LlamaLend. Uniswap is building its ecosystem through @Unichain.

To activate the entire ecosystem, it is necessary to incentivize multiple components: while incentivizing Curve, Convex also needs to be incentivized; otherwise, the effect is incomplete.

No new suggestions are proposed in this section, as incentivizing DEX activities alone has limited marginal benefits for Arbitrum. As mentioned earlier, a more effective approach is to promote the synchronized development of the entire ecosystem.

Derivatives

Although there are already some perpetual contract protocols on Arbitrum covering different designs (such as order book mechanisms), there is still a lack of high-performance trading platforms with excellent user experience, like Lighter and Paradex.

Arbitrum's tech stack can fully support the deployment of such products. If someone builds a competing product that offers gas-free, fast trading experiences, it could represent a significant breakthrough for the ecosystem.

Additionally, existing products are still worth continuous incentives: Ostium supports leveraged trading in forex and commodities, with excellent product functionality; GMX, as a well-known brand, contributes significantly to Arbitrum's TVL.

Protocol Recommendations

Ostium: Offers differentiated features and has growth potential, with a current TVL of approximately $64 million, deployed solely on Arbitrum, meaning its growth space and ecological impact are highly tied to Arbitrum.

GMX: One of the pillar protocols on Arbitrum, significantly contributing to TVL. In the upcoming multi-chain product, Arbitrum will continue to serve as its "main chain," attracting users and liquidity from other EVM ecosystems. Supporting GMX's multi-chain deployment is a net positive effect for Arbitrum and is worth continued resource investment.

Lending

With the recent deployment of Fluid and Euler, Arbitrum currently has no functional differences in the lending space compared to other blockchains. These protocols have several notable advantages, including permissionless vault creation, batch trading, single transaction loops, and efficient liquidation, which have been successfully validated on other blockchains. Given that these deployments are currently active on Arbitrum, it is best to leverage these advantages and help them gain more development space on Arbitrum through incentives.

In terms of GTM, Arbitrum has fewer rewards and incentives, which are provided through platforms like Merkl, actively used by lending protocols on different blockchains. Additionally, on blockchains like Ethereum and Base, the protocol Superformxyz has deployed its stablecoin SuperUSDC, generating yields by deploying capital in the lending market. Potential collaboration with it could unlock new yield opportunities and enhance user retention.

Protocol Suggestions

Morpho: Currently not yet launched on Arbitrum, this high-growth protocol has a range of unique features, including vaults, risk control, and permissionless market creation. Morpho's cross-chain total locked value (TVL) has reached a historical high of $4.5 billion.

Euler Finance: Recently launched on Arbitrum and offering a $100,000 incentive. A high-growth protocol with a range of unique features, including permissionless market creation, pegging, and trade bundling. Euler's cross-chain total locked value (TVL) is $1.13 billion.

Liquidity Lending: Launched on Arbitrum, its unique features include a unified liquidity layer, smart debt, smart collateral, and high loan-to-value ratios. The cross-chain total locked value (TVL) of liquidity lending is $1.13 billion.

Aave: Aave has the highest locked value in L2 on Arbitrum, with a TVL of $839 million and a cross-chain TVL exceeding $2.7 billion.

Silo: SiloFinance has a low cross-chain total locked value (TVL), but it has seen an increase since the release of its V2 version. It offers features like isolated pools.

Dolomite: Dolomite has a low cross-chain TVL and has been declining since its launch on Berachain failed, while growth on Arbitrum has stagnated.

Asset Gaps on Arbitrum

- LBTC (@Lombard_Finance): Primarily has TVL on Ethereum, followed by chains like Base, with lending TVL exceeding $600 million but low utilization.

- cbBTC (@Coinbase): Natively minted on Base and Ethereum, with lending TVL exceeding $2 billion and growing.

- sUSDe (Ethena): Lending TVL exceeds $3 billion but has low utilization.

- USDe (Ethena): High utilization on Ethereum, with lending TVL of $300 million.

- USDS (Sky): Most of the lending portion is locked on Ethereum, with TVL exceeding $100 million on Arbitrum but a low market share.

Asset Recommendations

- weETH: weETH has a high TVL in the lending space but low utilization. Its value on Arbitrum is approximately $300 million, with significant opportunity size.

- wstETH: wstETH has a high total locked value (TVL) in lending but low utilization. Its value on Arbitrum is approximately $220 million, with significant opportunity size.

- TBTC, SRUSD, MCWETH, SOLVBTC, ETH+: Represent low TVL and high lending growth rates, primarily existing on Ethereum, with SOLVBTC present on multiple chains and SRUSD on Ethereum and Berachain.

- wETH: High TVL on the Arbitrum platform with high utilization (around 73%). High cross-chain TVL. The TVL of WETH on Arbitrum's lending platform exceeds $10 million, with cross-chain TVL reaching $1.6 billion. Due to its success, fewer incentives are needed.

- USDT: Low TVL on the Arbitrum platform but high utilization (>90%). The lending platform has high cross-chain TVL ($1.8 billion).

- wBTC: High TVL but low utilization. Incentives are needed for borrowers.

Yield

On Ethereum, Convex offers a range of LST products (such as cvxCRV, cvxFXS, cvxFXN) to earn by staking Curve, Frax, and f(x) protocols. These tokens possess strong DeFi composability due to Convex's deep integration with mainstream protocols.

However, since Convex's ecological focus is on Ethereum, replicating its ecosystem on Arbitrum would be very challenging.

In contrast, Pendle has been deployed on Arbitrum, with a TVL exceeding $50 million, making it more suitable for incentives to promote Arbitrum's growth.

Currently, the utilization of yield assets on Arbitrum remains low (e.g., Pendle's PT token), but by integrating these assets into multiple DeFi protocols, more asset use cases can be provided to enhance user stickiness.

Protocol Suggestions

- Pendle: A high-growth protocol with strong DeFi composability. Its current TVL is $4.9 billion, capturing 56% of the DeFi yield market, presenting a huge opportunity.

- Magpie (@Magpiexyz_io): A distributed yield optimizer and governance aggregator, showing positive monthly growth but has not yet recovered to historical highs.

- Toros (@Torosfinance): With a TVL of $11.96 million on Arbitrum, it ranks third among yield protocols. It offers unique features such as leveraged yield vaults, neutral volatility strategies, and automatic rebalancing, and integrates with GMX and Pendle.

- Aura (@Aurafinance): A yield and governance aggregator based on Balancer, dedicated to maximizing returns for LPs and governance token holders.

Asset Gaps on Arbitrum

- eUSDe (Ethena): The market share of eUSDe continues to grow, with TVL yields reaching $400 million.

- sUSDe (Ethena): The market share of sUSDe has begun to rebound, currently below historical highs. The launch of Ethena rewards has provided support.

- USDS (Sky): The yield of USDS is continuously growing, with liquidity on Arbitrum already very substantial (around $100 million). This represents a significant opportunity.

Asset Recommendations

- wstETH: WSTETH's yield is growing on Arbitrum. Its value on Arbitrum exceeds $200 million, showing significant potential.

- weETH: WEETH is a growth asset in the yield category on Arbitrum. Its value on Arbitrum exceeds $300 million, showing significant potential.

CDP

The CDP sector on Arbitrum is currently small but growing, with native projects like Nerite (a friendly fork of Liquity V2) already deployed. Currently, these protocols have low TVL and can be driven to grow through incentives. Due to the small TVL, the usage scale of these assets in DeFi is currently limited.

As incentives progress, it will be necessary to introduce these assets into more mainstream DeFi protocols in the future to enhance the tokens' availability and on-chain utility.

The asset recommendations are divided into two categories:

- Collateral Assets: The underlying assets used to mint CDP stablecoins.

- Stablecoin Assets: Stablecoins minted through the CDP mechanism.

For next-generation CDP protocols like Nerite, in addition to protocol-level incentives, it is also recommended to incentivize at the asset level to enhance the usage of these assets on Arbitrum. They already have high liquidity on Ethereum and possess value for introduction.

The focus of asset incentives should be on enhancing the tokens' composability and yield capabilities in DeFi, thereby retaining on-chain capital.

Protocol Recommendations

- Sky Lending: The largest CDP protocol by TVL, issuing USDS. Introducing it to Arbitrum would help establish a liquidity foundation for CDP stablecoins.

- Liquity V2 (Nerite): A governance-free CDP protocol supporting ETH and LST collateral, suitable for the Arbitrum native CDP ecosystem.

- crvUSD: Active on Ethereum but has a weak presence on Arbitrum. Expanding it to Arbitrum could enhance the diversity and liquidity of stablecoins.

Collateral Asset Recommendations

- WETH: TVL $2.74 billion, the largest CDP collateral asset, with a utilization rate of 75% on Arbitrum and high market demand.

- wstETH: Locked value of $586 million, combining staking rewards with CDP minting functionality, widely used in DeFi, with $220 million already on Arbitrum.

- wBTC: Used in CDPs with a value of $546 million, meeting the liquidity release needs of BTC users in DeFi.

- tBTC: A trustless BTC collateral asset, although locked value is only $23 million, it is of high quality and accounts for over 10% of crvUSD collateral.

- Stablecoin Asset Recommendations

- USDS: Market cap of $7 billion, widely used for lending and DEX liquidity, but with only $2 million TVL on Arbitrum, there is significant room for improvement.

- crvUSD: Market cap of $119 million, with DEX TVL of $51 million, and liquidity of $6 million on Arbitrum, suitable for expansion through incentives.

Basis Trading

Currently, Arbitrum has not formed a unique selling point in basis trading, with overall protocol designs similar to other chains. Stable Labs holds a position on Arbitrum, but growth has stagnated in recent months and can be improved through incentives to increase its market share. Additionally, attention can be paid to the ecological development of Ethena, including products like Ethereal and Derive, as Ethena uses USDe and ENA as primary liquidity sources. Ethena is collaborating with Arbitrum to launch the Converge chain, enhancing its infrastructure. Given the existing partnerships, incentivizing and introducing its assets will help enhance Arbitrum's liquidity and yield opportunities.

Protocol Recommendations

- Stable Labs USDX: One of the main basis protocols on Arbitrum, with a TVL of approximately $120 million.

- Ethena: Holds about 82% market share, with a strong ecosystem expanding into multi-chain and traditional finance.

- Resolv: Smaller market share compared to the first two, with stagnant growth and TVL not returning to previous highs.

- Asset Gaps

- USDe (Ethena): Although growing rapidly on Ethereum, minting and bridging volumes on Arbitrum are low.

- Asset Recommendations

- USDX: Natively minted on Arbitrum, with a TVL of $120 million, accounting for a large portion of Stable Labs' total TVL, and a cross-chain total TVL of $670 million.

Liquid Staking

Liquid staking assets are rapidly expanding across multiple chains and possess strong composability. Incentivizing these assets will help Arbitrum improve on-chain liquidity and expand yield sources.

Currently, Arbitrum lacks structured incentives for LSTs. Relevant incentives can be implemented through platforms like Merkl. Aggregated yield platforms like @SuperlendHQ and Superform have not yet been widely deployed, and collaboration with them could guide an increase in LST usage.

Asset Recommendations

- sETH: TVL $668 million, with lending TVL on Ethereum reaching $400 million, not yet fully utilized on Arbitrum.

- SUPEROETHB: TVL $409 million on Base, featuring an automatic compounding reward mechanism, not yet deployed on Arbitrum, presenting a good opportunity for traffic.

- LSETH: TVL $367 million, aimed at institutional users, with only $95,000 DEX liquidity on Arbitrum, suitable for targeted incentives.

- ETHX: TVL $276 million, launched by Stader, with multi-chain coverage but almost unused on Arbitrum.

- cbETH: TVL $235 million, primarily used on Ethereum and Base, with low liquidity on Arbitrum but high institutional trust.

Re-staking

The majority of the re-staking market is controlled by EigenLayer and @Babylonlabs_io, with these two protocols occupying over 85% of the market share. Since re-staking activities must occur at the settlement layer, incentivizing or introducing these protocols is of little significance for Arbitrum; instead, incentivizing activities related to LSTs and LRTs will help the chain gain liquidity and activity associated with staking. Therefore, this section does not provide any protocol or asset-level recommendations.

Liquid Re-staking

In terms of functionality, protocols like Yieldnest offer automatic compounding vaults that can aggregate staking rewards, re-staking rewards, and DeFi yields into a single, user-friendly asset. Such structured products have not yet launched on Arbitrum, indicating a lack of user-friendly LRT yield products on the Arbitrum network.

Liquid re-staking assets are also growing, with assets like eETH holding a larger market share. However, Arbitrum lacks structured incentive mechanisms specifically targeting these assets. Additionally, yield platforms and liquidity routers (such as Pendle and Superform) can integrate liquid re-staking tokens to expand their utility on Arbitrum, which requires incentive mechanisms.

Protocol Recommendations

- Renzo: A leading LRT protocol on Ethereum, with weak presence on Arbitrum, suitable for incentivizing the migration of liquidity and lending demand.

- Kelp DAO: TVL $1.3 billion, with modular AVS re-staking capabilities, can expand the lending and vault applications of rsETH through incentives.

- YieldNest: TVL $195 million, offering automatic compounding products, not yet deployed, with a first-mover advantage.

Asset Recommendations

- WEETH (eETH): TVL $7.5 billion on Ethereum, active in DeFi, with only $9 million DEX liquidity on Arbitrum, presenting significant opportunities.

- ezETH: TVL $900 million, strong retail user demand, with only $6 million liquidity on Arbitrum, suitable for building lending and yield strategies.

- rsETH: Lending TVL $1.45 billion, with cross-chain DEX liquidity of $35.6 million, but only $5.5 million on Arbitrum, demand has been validated and is scalable.

- LBTC: Lending TVL $573 million, with DEX liquidity of $85 million, not deployed on Arbitrum, can be introduced as a native BTC staking/DeFi hub.

RWA

For Risk-Weighted Assets (RWA), its strategy is unique and not constrained by conventional incentive mechanisms. Robinhood's recent partnership with Arbitrum has positioned Robinhood as an excellent platform for tokenization. Additionally, Robinhood can attract more capital allocation by engaging TradFi partners.

ZKsync's ability to thrive and attract institutional investors is primarily due to its privacy layer, which supports strict compliance without disclosing user identities. Arbitrum can incentivize or create privacy-centric blockchains through its Orbit Stack and expand on that basis.

Protocol Recommendations

- Midas: Rapidly growing, DeFi-oriented, providing liquidity-rich, high-yield assets. Primarily operating on Ethereum, this presents an opportunity for Arbitrum to capture market share.

- Ondo: Strong foundation and extensive network, with astonishing growth (tripling in a year from $450 million to $1.35 billion).

- Securitize: A leader in the field, with a good reputation among numerous chains. Arbitrum needs to focus on addressing increasingly fierce competition.

Asset Recommendations

- USDY: Yield-bearing assets are very popular. The total locked value (TVL) of USDY has doubled in the past year. Given Ondo's rapid growth, incentivizing USDY to capture market share is a wise move.

- OUSG: OUSG has not yet been widely distributed on L2. Arbitrum can attract OUSG to the chain by providing incentives and structures, thereby enhancing competitiveness.

- BENJI: BENJI has established itself on multiple blockchains, with Arbitrum as its main custodian. As BENJI expands in the tokenization space, providing DeFi infrastructure and incentive mechanisms will be key to maintaining market share.

- SPIKO US/EU Treasury Bonds: Demand for government debt tokens continues to grow. Supporting Spiko's development on Arbitrum will enhance on-chain growth in this area.

- PAXG/XAUT and other commodities: Tokenized commodities are thriving, and related protocols are exploring yield models. Attracting liquidity and building supporting infrastructure is crucial for capturing market share.

Conclusion

Currently, EVM chains control over 60% of DeFi liquidity, with Arbitrum accounting for only about 2%, providing significant potential for expansion and growth across multiple verticals.

This report analyzes these growing DeFi tracks, focusing on the core functionalities offered by various protocols and their GTM (Go-To-Market) strategies.

After analyzing each vertical, we propose directions for Arbitrum to take the lead and expand its market share based on the existing gaps and potential points in the current ecosystem.

These suggestions include: incentivizing multiple mature protocols such as GMX, Ostium, Stable Labs, Euler, Fluid, Pendle, etc.; optimizing user reward mechanisms through platforms like Merkl; enhancing the availability of yield-bearing assets (e.g., Pendle's PT assets), which can be achieved through deeper integration with lending protocols on Arbitrum.

Some suggestions can be directly promoted through incentive mechanisms, while others will require business development (BD) collaborations to facilitate protocol onboarding or promote ecological cooperation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。