Life is like chess, and every move is made without regret. We firmly believe that there are no wasted paths in life; every step is a pull of fate in the dark. Don't feel dim just because others shine. True growth is not anxious self-doubt, but calm self-acceptance!

Yesterday's market performance was also quite in line with expectations. The market first rebounded to above 119200, then retraced again to below 117000. As of now, after hitting the bottom, it has oscillated back up to above 118000. The market analysis we provided yesterday indicated that the short-term bullish liquidity clearing area above 119800 was not reached. The short position we planned to execute below 118000, which we operated the day before yesterday, was unable to be realized after the short position was reduced to above 119000 to secure a break-even loss. This wave of downward movement was perfectly missed, but fortunately, we completed a low buy below 117000, which is currently profitable. Overall, the operation has been quite good, capturing the low point to gain profit.

Returning to today's market, after a couple of days of oscillation, the current liquidity distribution shows that both bulls and bears are in a state of not giving an inch. Due to the oscillation, there is a significant distribution of liquidity on both sides. This week, the price volatility has surprisingly decreased significantly, with a greater overall quantity of bearish liquidity at high levels, while the bullish liquidity at low levels has a more structured clearing level. To be honest, within this range, it is completely unclear which direction the price will clear first. According to the short-term oscillation trend, we can actually see that the market has been clearing both high and low liquidity back and forth recently. The main reason for this situation is that the accumulated clearing volume in the futures market has not reached a clearing limit, while the macro environment is waiting for some clear directional expectations. Therefore, the price tends to exhibit a state of oscillation balance. If there is a slight news stimulus or some fluctuations in the spot market, it could trigger a high volatility market again. In the short term, the bearish clearing strength is around 118700, while the bullish clearing strength is around 116000. Considering the recent oscillation trend, we can use this for short-term operations.

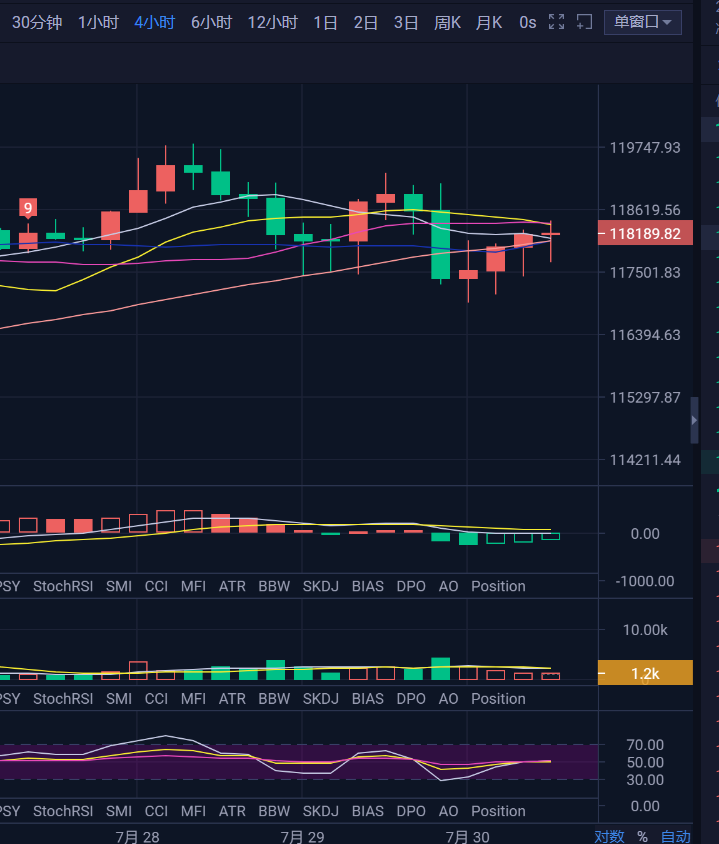

On the technical side, the daily level received a doji candlestick yesterday. From a structural perspective, if the rebound provided in the past two days does not engulf the high point of the doji, then under the structure of high-level oscillation, it may form a weak oscillation trend. The short-term moving averages are beginning to converge, showing slight signs of a death cross, and there are no significant changes in technical indicators compared to yesterday.

On the four-hour level, the recent K-line structure shows a bullish rebound arrangement, with the bottom-finding K-line forming a bullish doji. Compared to yesterday's bottom-finding with continuous long lower shadow bearish lines, this looks better. Yesterday we mentioned that the K-line closing had issues, which would affect the strength of the rebound. The result was a rebound followed by another downward movement, resulting in a lower low on the recent chart. Currently, looking at the entire four-hour cycle, the market is still operating around the 114700-120400 range. At this point, it is still unclear how it will move, so regardless of how the price moves, it is currently a standard range oscillation. Besides waiting for a breakout or breakdown of this small range, there is basically no directional judgment to be made.

In terms of operations, the long positions below 117000 can be reduced and the stop-loss position can be moved up. Our operations will continue to maintain a range-bound approach, which means we will short after clearing the short-term bearish liquidity above 118700, while the long position will be below 116000.

Ethereum's recent market is making choices between oscillation and breakout. However, the short-term Ethereum trend has started to follow Bitcoin, but due to the delayed retracement, we cannot prove whether Ethereum's strong trend has ended. If we operate Ethereum according to the oscillation approach, then around 3850 is a consideration for a short position, and it is important to set a stop-loss. The long position would be around 3620.

【The above analysis and strategies are for reference only. Please bear the risk yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and strategies may not be timely. Specific operations should be based on real-time strategies. Feel free to contact us for market discussions.】

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。