Key Points

- The dates that have the greatest impact on Bitcoin and Ethereum volatility are: August 1 (U.S. Non-Farm Payrolls), August 12 (U.S. CPI), August 21–23 (Jackson Hole Annual Meeting), and August 29 (Core PCE and Q2 GDP).

- August 12 marks the expiration date of the U.S.-China tariff truce, which may influence market risk appetite and the flow of stablecoin funds.

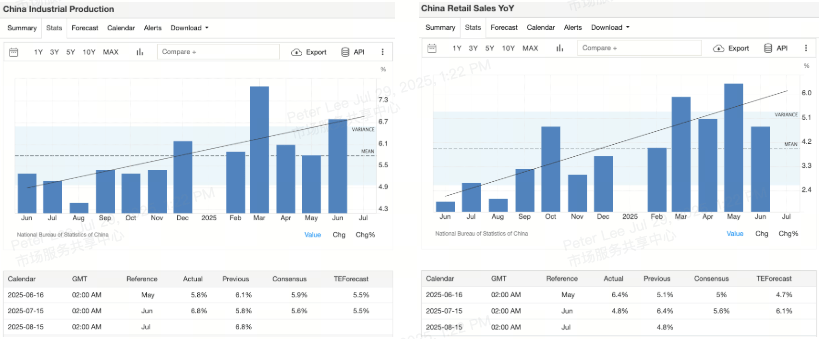

- The Chinese data and PMI (Purchasing Managers' Index) released in the middle of the month typically determine the risk appetite in the Asia-Pacific region and are important signals for trading BTC and ETH.

- On key event days, using a One Cancels Other (OCO) order with BTC/USDT and ETH/USDT futures can capture volatility while avoiding directional bets.

- Pay attention to on-chain signals: the minting and burning volume of stablecoins, BTC staking inflows, and changes in ETH staking to capture institutional positioning trends.

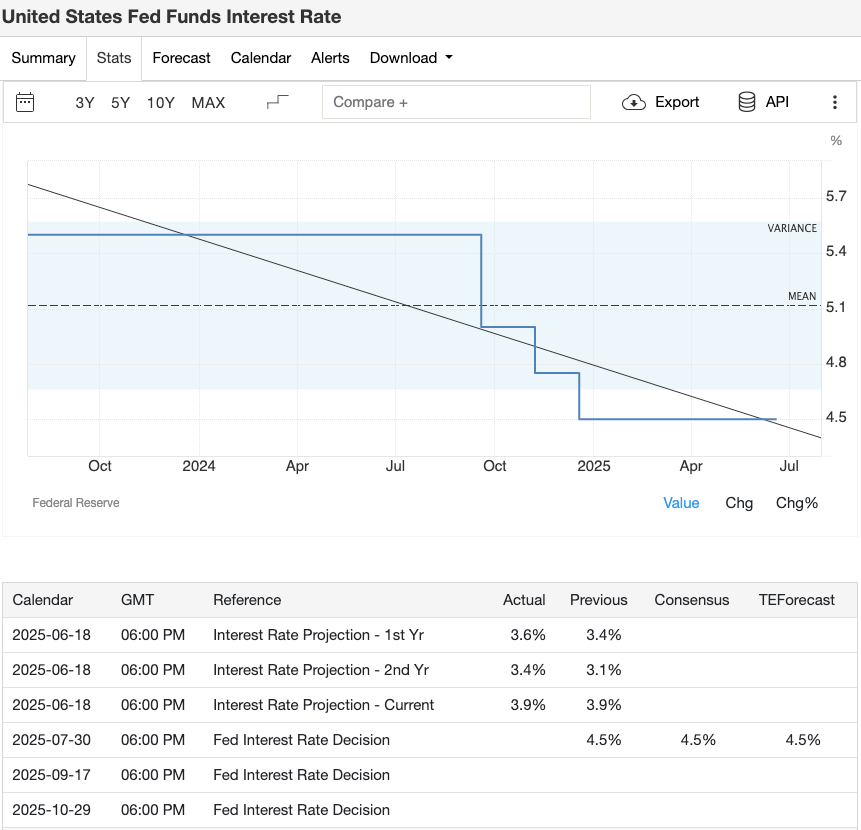

As August 2025 approaches, the global market is at a critical crossroads. Although U.S. inflation has fallen from its peak, it remains above target levels, and the Federal Reserve remains vigilant.

As August 2025 approaches, the global market is at a critical crossroads. Although U.S. inflation has fallen from its peak, it remains above target levels, and the Federal Reserve remains vigilant.

At the same time, global growth is showing significant divergence: Europe is stagnating with weak recovery; China's recovery process is lagging; while India and other emerging markets are leading the way.

In this context, Bitcoin** andEthereum play dual roles.**

They rise and fall with risk appetite—when investors chase high returns, they go up, but they retreat to their safe-haven attributes during global risk events. On the other hand, with real interest rates remaining low for an extended period, coupled with central banks weighing the timing of rate hikes and cuts, they are increasingly viewed as "digital gold."

This August's schedule is particularly packed. The U.S. employment and inflation data at the beginning and end of the month will influence the Federal Reserve's policy expectations; the Chinese data and PMI in the middle of the month will test the resilience of the global economy; and the Jackson Hole Annual Meeting in late August will provide an important "barometer" for the Fed's future direction.

Additionally, the geopolitical risk fluctuations brought about by the expiration of the U.S.-China tariff truce mean that traders need a clear timetable to decide when to increase their positions in BTC and ETH, when to hedge with futures, or when to shift idle funds into staking and XT Earn and other yield products.

Let’s outline the key schedule for August and prepare for trading.

August Macroeconomic and Policy Overview

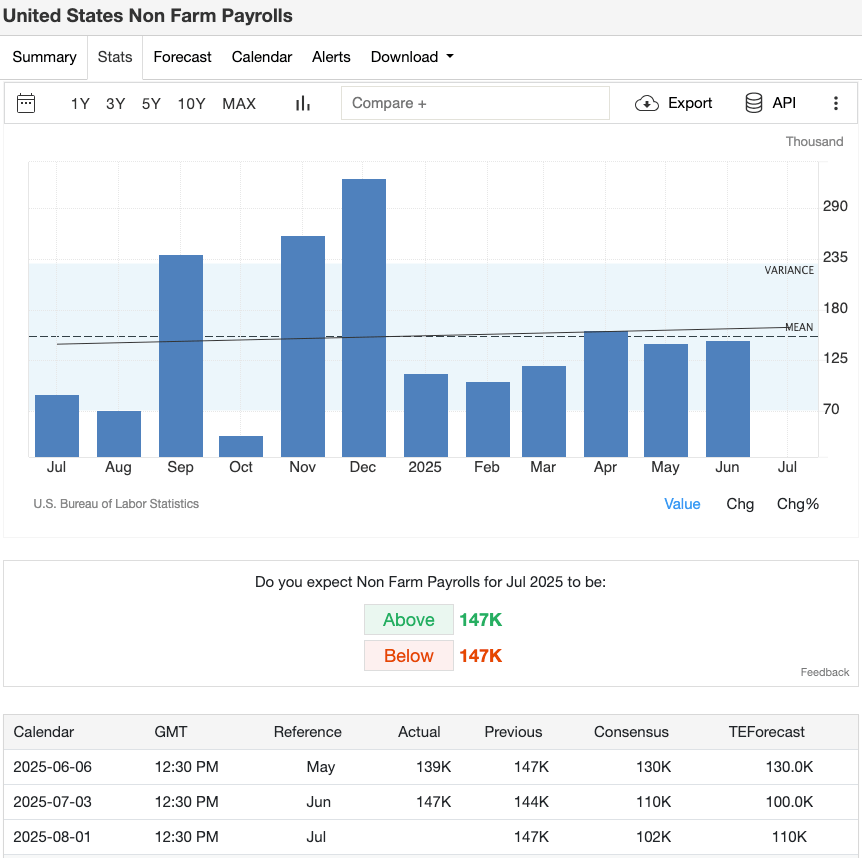

Major Events to Watch in August

August 1: U.S. Non-Farm Payrolls and Unemployment Rate ★★★

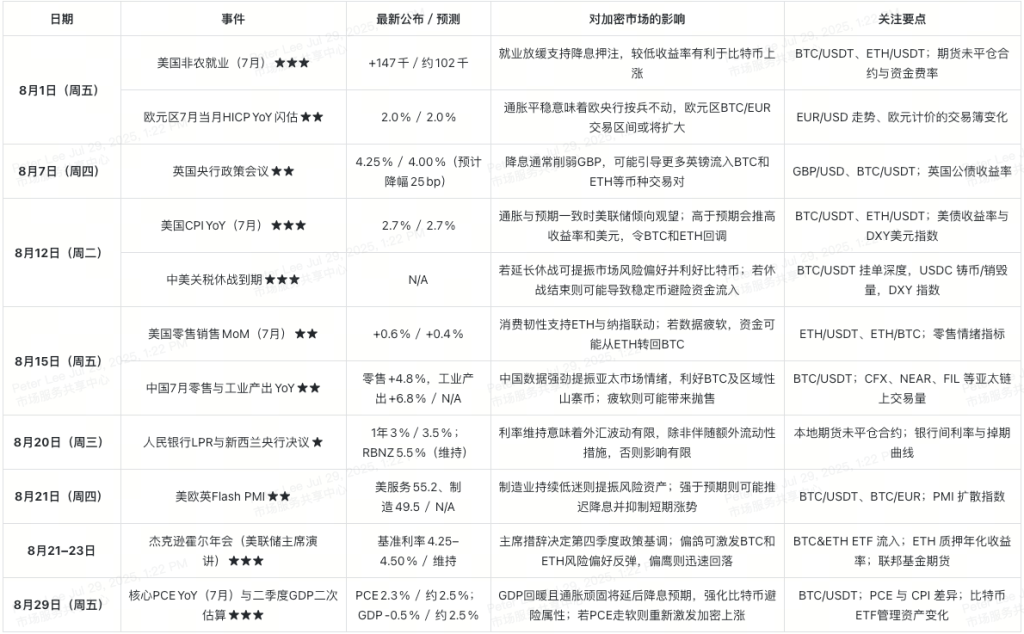

- What to Watch: Last month added 147,000 jobs, with market expectations around 102,000.

- Why It Matters: A slowdown in employment will increase expectations for rate cuts, usually driving Bitcoin and Ethereum up; conversely, strong data will boost the dollar and yields, leading to a pullback in cryptocurrencies.

- Trading Tip: Monitor the open interest and funding rates of BTC/USDT futures and ETH/USDT futures.

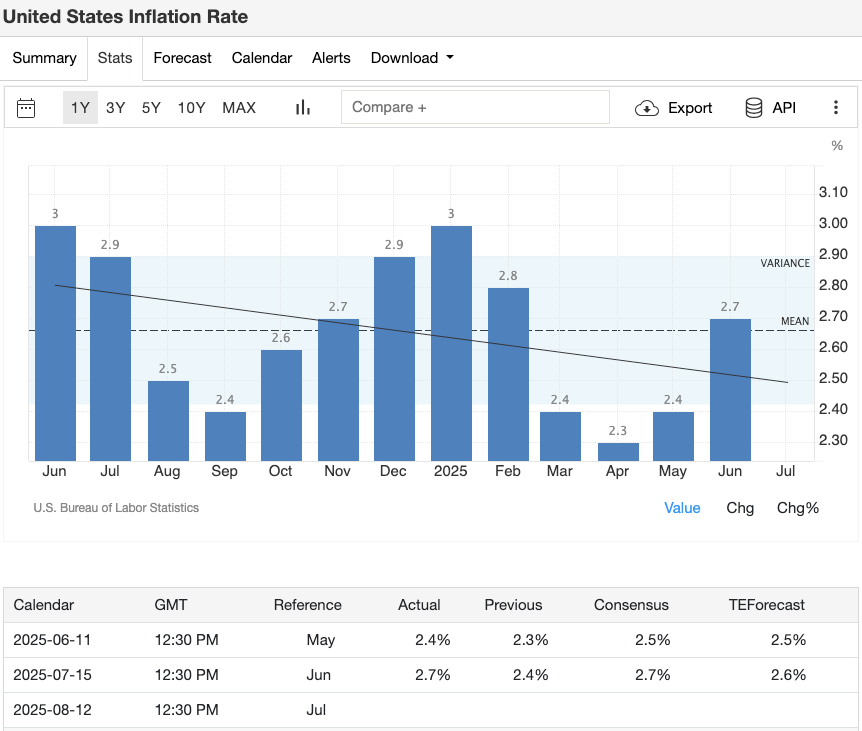

August 12: U.S. CPI Year-on-Year (July) ★★★

- What to Watch: Last month's inflation rate was 2.7%, expected to remain flat.

- Why It Matters: Data in line with expectations will keep the Fed on hold, leading to a relatively stable market; if it exceeds expectations, yields and the dollar will rise, causing selling pressure on Bitcoin and Ethereum.

- Trading Tip: Track U.S. Treasury yields, the DXY dollar index, and the trading volume of BTC/USDT and ETH/USDT.

Early August: Expiration of U.S.-China Tariff Truce ★★★

- What to Watch: The 90-day tariff suspension enters its final phase.

- Why It Matters: If the truce is extended, market risk appetite will rebound, benefiting cryptocurrencies; if the truce ends, funds often flow into stablecoins for safety.

- Trading Tip: Monitor USDC minting and redemption volumes, changes in the dollar index, and the buy-sell depth of BTC/USDT.

August 21–23: Jackson Hole Annual Meeting ★★★

- What to Watch: The Fed Chair delivers an important speech.

- Why It Matters: Dovish language may trigger a new round of increases in BTC and ETH; hawkish signals often lead to immediate sell-offs.

- Trading Tip: Pay attention to federal funds futures prices, CME Fed rate expectation probabilities, and the fund flows of BTC and ETH ETFs.

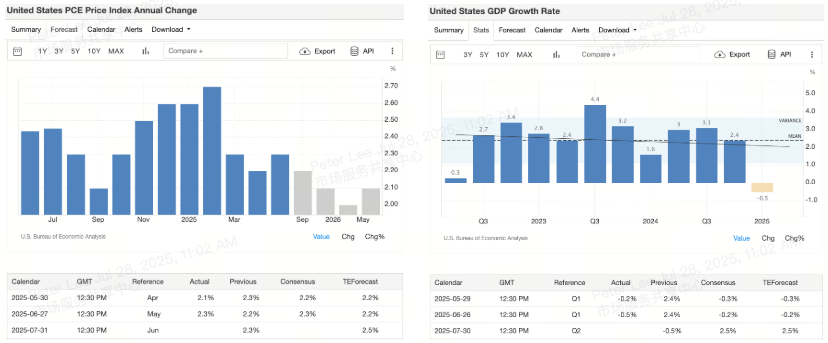

August 29: Core PCE Year-on-Year & Q2 GDP Second Estimate ★★★

- What to Watch: Core PCE around 2.3% compared to an expectation of 2.5%; GDP around -0.5% compared to an expectation of 2.5%.

- Why It Matters: If the economy is recovering but inflation remains stubborn, it may delay rate cuts, thereby enhancing the safe-haven value of BTC; if PCE unexpectedly softens, it may reignite upward momentum for cryptocurrencies.

- Trading Tip: Closely monitor changes in the assets under management of Bitcoin ETFs and the price trends of BTC/USDT.

August Weekly Economic Calendar Breakdown

Week 1: August 1–7

Week 1: August 1–7

August 1 brings two major data releases. The U.S. Non-Farm Payrolls for July are expected to be around 102,000, down from 147,000 in June. If employment growth slows, the market will increase bets on rate cuts, and Bitcoin and Ethereum typically rise; if the data is unexpectedly strong, the dollar and Treasury yields will rise, potentially leading to a pullback in BTC and ETH. On the same day, the Eurozone flash CPI will also be released, and a stable inflation rate of 2% year-on-year usually keeps the ECB on hold, potentially widening the volatility range of BTC/EUR and ETH/EUR.

Image Credit:Trading Economics

Image Credit:Trading Economics

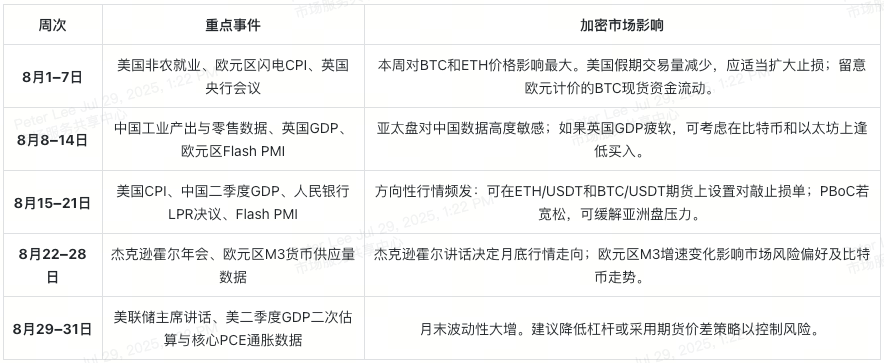

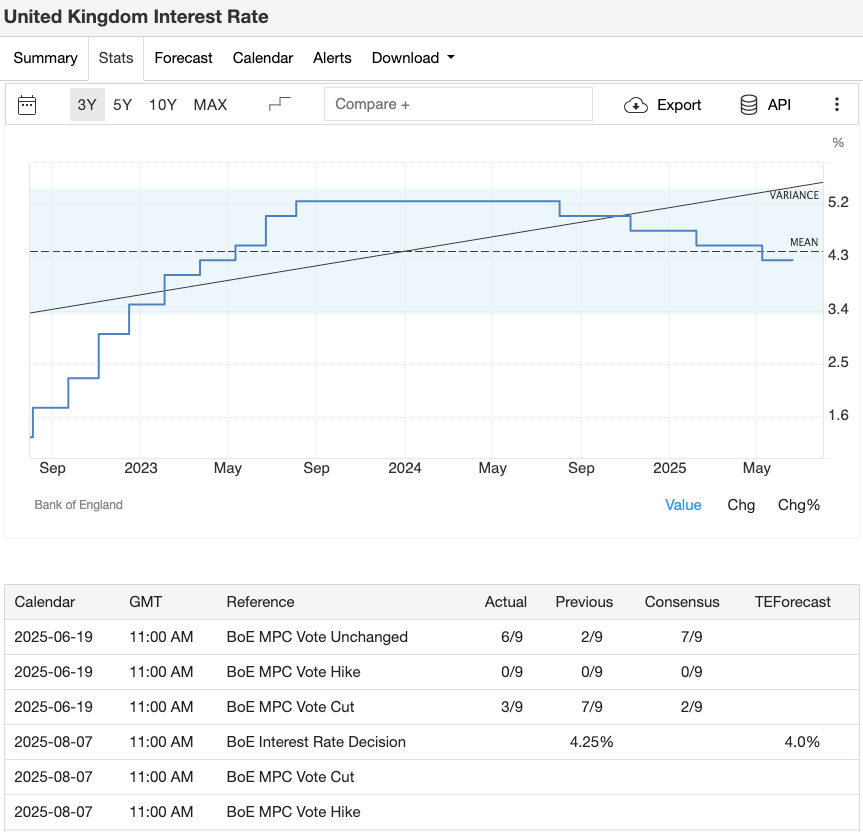

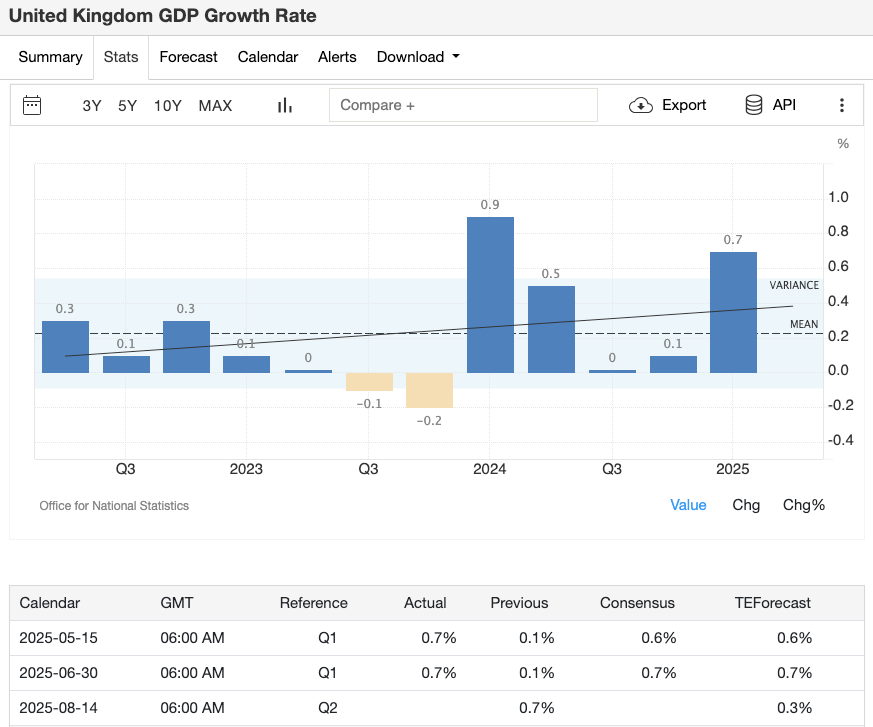

On August 7, the Bank of England meeting will be closely watched, with the market widely expecting a 25 basis point rate cut; such a cut typically weakens the pound.

Image Credit:Trading Economics

Image Credit:Trading Economics

Trading Tips

- Trading volume is usually low during U.S. holidays, so it is advisable to widen stop-loss ranges to avoid being swept out by sudden market movements.

- Monitor changes in futures open interest to discern whether large players are choosing to increase positions or exit.

- Keep a close eye on the buy-sell depth in euro-denominated trades to capture sudden changes in BTC/EUR demand.

Week 2: August 8–14

This week is relatively calm but still worth paying attention to. On August 14, the UK will release preliminary GDP data for the second quarter. If there is a contraction or it is significantly below expectations, it often dampens global risk appetite, creating opportunities to buy BTC and ETH.

Image Credit:Trading Economics

Image Credit:Trading Economics

Earlier this week, traders need to pay attention to the performance in the Asia-Pacific market, especially looking for any policy signals from China that could set the stage for next week's official release of industrial output and retail data.

Trading Tips

- If the UK GDP unexpectedly weakens, look for buying opportunities in the ETH/USDT spot market.

- Track the trading volume of BTC/USDT futures in the Asia-Pacific region to grasp changes in regional sentiment.

Week 3: August 15–21

This week is data-heavy and will be decisive for market direction. If the U.S. CPI on August 12 (year-on-year 2.7%) aligns with expectations, it usually supports a rise in cryptocurrencies; if it exceeds expectations, BTC and ETH often experience a quick pullback.

Image Credit:Trading Economics

Image Credit:Trading Economics

Following that, on August 14, China will release retail and industrial output data for July. If the data exceeds expectations, altcoins and mining-related tokens in the Asia-Pacific market will receive a boost. If the People's Bank of China announces interest rate cuts or other liquidity support around August 20, local exchange futures and spot markets may show significant recovery.

Image Credit:Trading Economics

Image Credit:Trading Economics

On August 21, flash PMI data from the U.S., Europe, and the UK will be released. If manufacturing remains below the expansion line, it often increases risk appetite in the crypto market; if service sector data significantly exceeds expectations, it may temporarily suppress market expectations for rate cuts.

Trading Tips

- Build positions in BTC and ETH in batches before the U.S. CPI, and moderately reduce leverage to mitigate risk.

- Set up stop-loss orders for hedging in ETH/USDT and BTC/USDT futures to capture volatility without needing to predict direction.

- Pay attention to changes in the order books of local exchanges after the release of Chinese policy signals to capture early market movements.

Week 4: August 22–28

From August 21 to 23, the Jackson Hole Annual Meeting will take place, with the Fed Chair's speech serving as a market barometer. Dovish remarks often trigger rebounds in Bitcoin and Ethereum, while hawkish warnings can lead to rapid pullbacks.

Image Credit:Trading Economics

Image Credit:Trading Economics

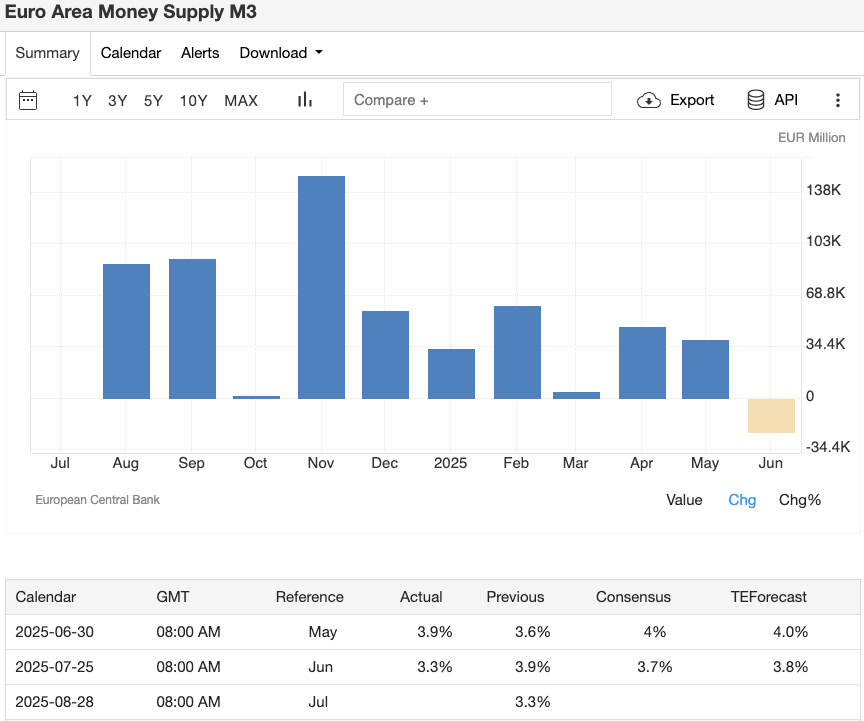

In the same week, the ECB will also release M3 broad money supply data. If M3 growth accelerates, it will help boost inflation expectations, benefiting crypto assets; if growth slows, it may heighten market concerns about economic slowdown, suppressing risk assets.

Image Credit:Trading Economics

Image Credit:Trading Economics

Trading Tips

- During Jackson Hole, monitor federal funds futures and ETF fund flows to gauge institutional demand for BTC and ETH.

- Track the minting and burning volumes of stablecoins to infer liquidity trends following changes in the eurozone money supply.

Week 5: August 29–31

The end of the month is often the most volatile. On August 29, the Fed Chair will speak again, and the second estimate of Q2 GDP and core PCE inflation data will be released. If economic growth recovers while inflation remains stubborn, it will further delay rate cut expectations, enhancing Bitcoin's "macro hedge" properties; if PCE unexpectedly softens, it may reignite upward momentum for cryptocurrencies.

Image Credit:Trading Economics

Image Credit:Trading Economics

Trading Tips

- Consider reducing leverage or shifting to inter-period spread strategies to smooth out end-of-month volatility.

- After the Fed's speech, closely monitor changes in Bitcoin ETF asset sizes to confirm institutional fund inflows.

Risk Management and Precautions

Beware of False Breakouts

- Major events often see "buy the rumor" followed by "sell the fact" after data is released. When Bitcoin or Ethereum breaks key price levels, it is advisable to wait for daily close confirmations before adding positions.

Prevent Flash Crashes

- Major headlines can sometimes trigger flash crashes, especially for small-cap tokens with leveraged positions. It may be wise to pause trading immediately after such releases or set wider stop-losses for these tokens.

Watch for Slippage and Spreads

- Market liquidity can easily dry up near holidays or policy announcements. For large BTC or ETH trades, it is advisable to split them into multiple smaller trades or use over-the-counter (OTC) methods to reduce slippage costs.

Be Aware of Stablecoin "Bottlenecks"

- Regulatory changes may slow down the redemption speed of stablecoins. It is advisable to keep a portion of funds in non-algorithmic dollar assets to prevent issues with liquidity when stablecoin withdrawals become tight.

Frequently Asked Questions About the August Economic Calendar

1. Which events in August are most critical for the crypto market?

The U.S. Non-Farm Payrolls on August 1, the U.S. CPI on August 12, the Jackson Hole meeting speeches on August 21–23, and the core PCE and second estimate of Q2 GDP on August 29. These releases often trigger the largest volatility in BTC and ETH.

2. How should I prepare before major data releases?

It is recommended to build positions in Bitcoin and Ethereum in batches a few days in advance, then reduce leverage before the data is released. If on-chain liquidity weakens, consider placing idle funds into yield products like XT Earn.

3. What order types are suitable for release days?

One Cancels Other (OCO) orders and buy-sell stop-loss orders are most practical in the BTC/USDT or ETH/USDT futures markets, allowing you to capture market movements without needing to predict direction.

4. How can I distinguish between real and false breakouts?

True trends are usually accompanied by high trading volumes. Whether in spot or futures, if price movements lack volume support, they are likely to be temporary false breakouts.

5. Should staking strategies be adjusted during high volatility?

Yes. Major events can affect staking yields and liquidity. It is essential to dynamically adjust the ratios of Bitcoin staking and Ethereum staking based on on-chain staking inflow conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。