BlackRock Ethereum Bet: Why Institutions Are Buying More ETH Than BTC

BlackRock Ethereum Surge: Is it Becoming the Institutional Favorite?

BlackRock has made a bold statement, buying over $1.2 billion in ether last week, compared to just $267 million in Bitcoin. According to Arkham Intelligence, BlackRock Ethereum inflows were more than four times higher, suggesting an aging shift in institutional preference.

Source: X

A Strategic Shift in Motion

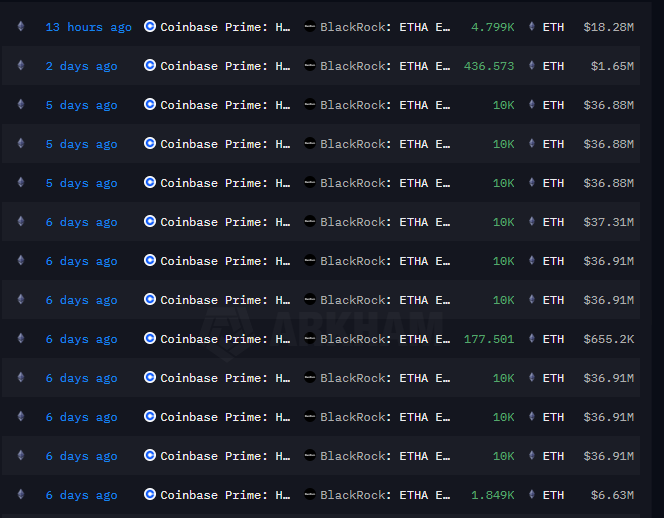

On-Chain data shows consistent ETh transfers from Coinbase Prime (a well known exchange) to the company's wallets, with many transactions in 10,000 coin chunks. As of now, BlackRock Ethereum holds went to 2.585 million of ~$9.87 billion worth, making it the second largest asset in its crypto portfolio BTC which is worth around $86.6 billion.

Source: Arkham

Adding momentum, the company's iShare ETF (ETHA) became the third fastest ETF globally to hit $10 billion AUM, doubling from $5B in just 10 days.

But the question here is, why now, and what it has to be Ether?

Why Ethereum Is Getting the Edge

The digital asset’s value goes beyond being digital money. It empowers smart systems, tokenisation, decentralized finance (DeFi), and more. While Bitcoin offers stable values, it offers configurable infrastructure, and that is why drawing corporate interest.

Organisations like Bitmine Technologies hold over 566,000 coins worth approximately $2B, aiming to control 5% of all ETH (million tokens). Sharplink also made recent buys, exceeding new token issuance, totaling to 438k+ of more than 1.68 billion value. While other admirers of the currency include Coinbase, Bit Digital, BTCS Inc., many more.

Bitcoin Still Dominates, But ETH Is Catching Up

Along with BlackRock Ethereum large reserve, it remains a major BTC holder with 733,000 BTC , and continues adding hundreds more. However, July saw ether inflows beat BTC, with $547 million in ETH compared to $497 million for BTC.

This doesn’t mean bitcoin is losing relevance, rather, it reflects a more diversified strategy by institutions as they differentiate use cases.

From Scarcity to Supremacy: The Token’s Institutional Climb

As organisational interest deepens, it could face a new form of scarcity. With staking incentives high and more ethers being pulled into long term corporate reserves, circulating supply could shrink significantly. This could pressure prices upward even without a surge in retail demand.

But what if smart contract platforms like Solana or Avalanche rebound and challenge itss edge? Could ETH lose ground, or will its first-mover advantage prove too strong?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。