Author: Liu Jiao Chain

The day before yesterday, Jiao Chain mentioned that a prehistoric giant whale from the so-called Satoshi era has completed the liquidation of its 80,000 BTC. This event was praised by institutional trader Galaxy Digital as "one of the earliest and most significant exits in the digital asset market." So, what thoughts and insights can we gain from this major exit event?

First, let's review the basic facts:

The BTC sold this time came from a position established in early 2011. In fact, this is already in the post-Satoshi era rather than the Satoshi era, as Satoshi had already withdrawn by this time.

The total amount sold was approximately 80,009 BTC, equivalent to about $9 billion. The time window for the sale was from July 16, 2025, to July 25, 2025.

The impact of this sale on the market was like a small splash. The price of BTC only dropped from a new high of $119k to $115k, a decline of only about 3.5%, and rebounded to $118k the day after the liquidation.

What does this phenomenon mean?

It means that the market absorbed about 0.4% of the total supply of BTC within a few hours without triggering any cascading liquidations or chain collapses.

It seems that the structure and resilience of the crypto market have quietly undergone a tremendous change. As some netizens have said, this almost sends a strong signal to the market, proving that BTC now possesses extremely deep, institutional-level liquidity. This greatly strengthens BTC's market resilience and absorption capacity.

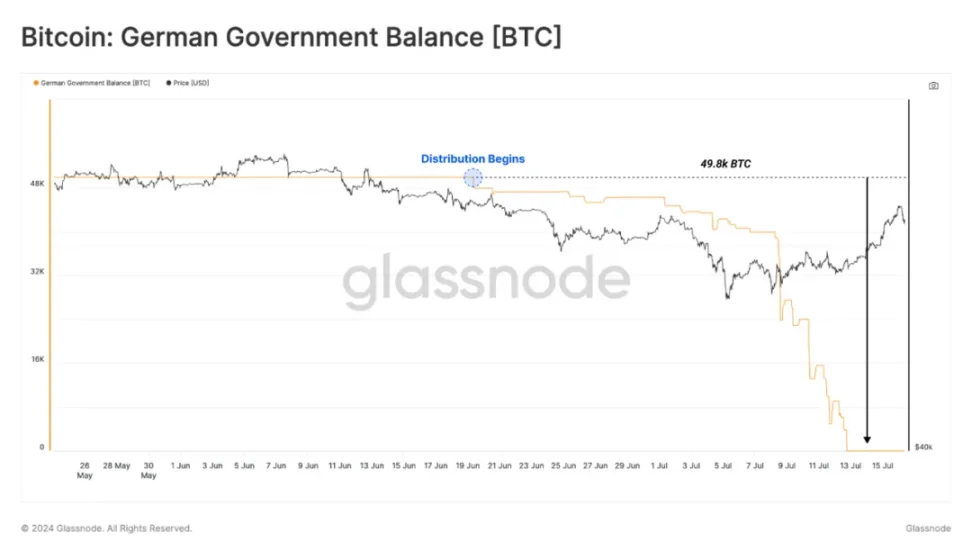

It's worth noting that just a year ago, from late June to early July 2024, the German government liquidated approximately 50,000 BTC (49,858 BTC), with an average selling price of $57.9k, making a profit of about $2.88 billion.

Notably, the time window for the German liquidation was from June 19, 2024, to July 13, 2024, during which Mt. Gox had not yet started distributing its BTC compensation.

Basically, during the German liquidation period, BTC dropped from a low of $66k to $53k, a decline of nearly 20%. Even with the subsequent distribution of compensation from Mt. Gox, BTC only dipped to $49k on August 5, 2024, which was the last low before BTC surged to $100k by the end of the year.

In comparison, BTC, which once traded at $70k, required a drop of over 20% to absorb the selling pressure of 50,000 BTC, while now, BTC at $120k only needed a 3.5% drop to absorb the selling pressure of 80,000 BTC. In other words, a loss of less than $3 billion could cause BTC to drop over 20%, while a loss of $9 billion only caused a small drop of 3.5% and a quick recovery. How incredible!

It's important to note that the higher the price of BTC, the greater the selling pressure generated by each BTC. Selling one BTC at $70k requires the market to provide $70k to absorb it; selling one BTC at $120k requires the market to provide $120k to absorb it.

Has the liquidity depth and absorption capacity of BTC really undergone such a significant leap in just one year?

Another classic case for comparison is the Luna/UST collapse in May 2022, when Do Kwon, the operator behind UST, was forced to dump 80,000 BTC into the market. According to the article "UST Decouples, Algorithmic Stablecoin Curse Reappears" from Liu Jiao Chain Pro on May 11, 2022, "On May 10, with the severe decoupling of UST, Do Kwon sold off assets other than BTC, but it was futile. In the end, he liquidated over 80,000 BTC that he had previously acquired for free to save UST."

These 80,000 BTC were stuck near the critical testing level of $30k during the mid-2021 "512" crash, directly taking away the fantasy of a second rebound to continue the bull market. A month later, BTC officially lost the $30k bull-bear dividing line, marking the beginning of a deep bear market.

While we cannot attribute the total decline of nearly 77% from $69k to $16k in 2022 solely to the Luna/UST collapse, even if we attribute the cliff-like drop from $30k to $20k in May to June 2022 to it, that still accounts for a decline of up to 33%.

The urgent dumping of over 80,000 BTC, if calculated at $30k, only resulted in a loss of $2.4 billion.

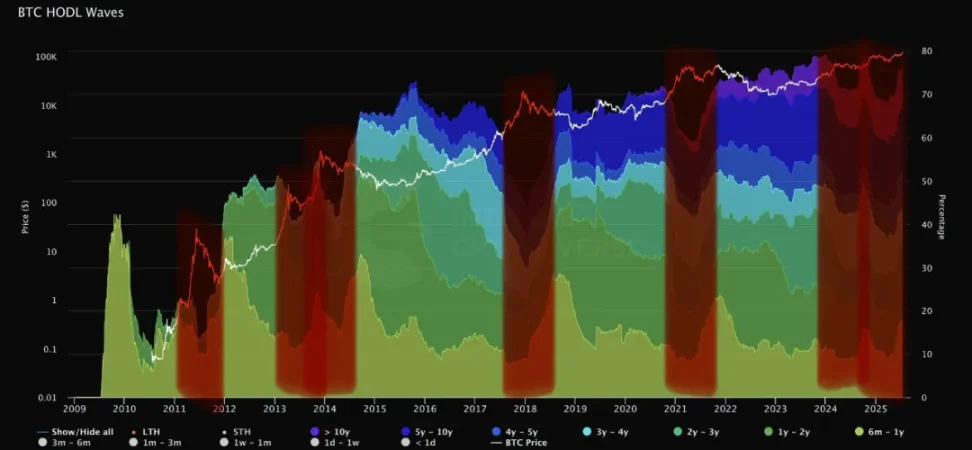

This illustrates the changes in the BTC market structure and liquidity absorption capacity in recent years:

At a height of $30k in 2022, an 80,000 BTC sale resulted in a loss of $2.4 billion, accelerating the entry into a deep bear market.

At a height of $60k in 2024, a 50,000 BTC sale resulted in a loss of $2.88 billion, leading to the start of a bull market by the end of the year, breaking through $100k and reaching a historical high.

At a height of $120k in 2025, an 80,000 BTC sale resulted in a loss of $9 billion, and currently, it seems there is no major issue.

Of course, if we refer to the 2022 sale, it may take more than a month for internal injuries to manifest, so it may still be too early to draw conclusions.

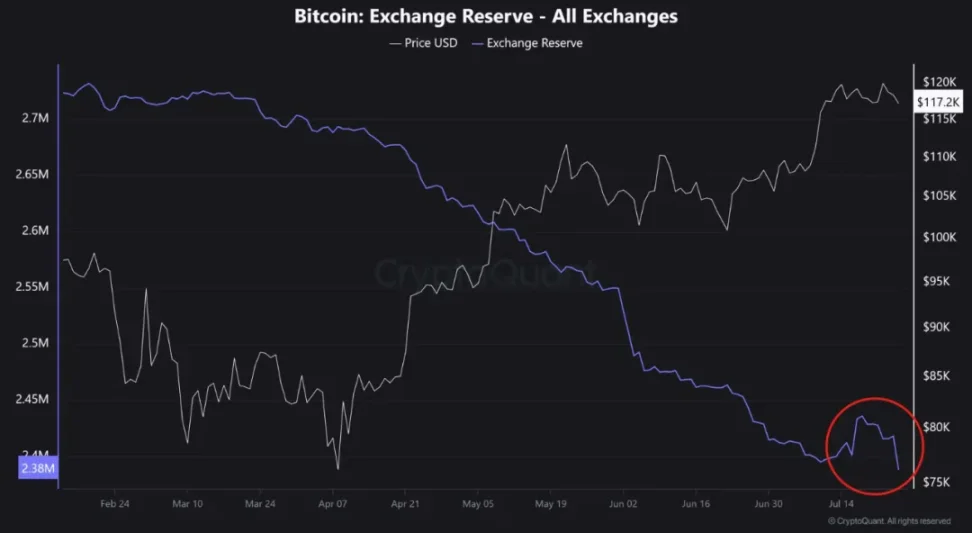

From the perspective of BTC inventory on exchanges, this wave of selling seems to have been quickly "bought up."

In response, netizens have two attitudes:

One believes that the large chips that needed to be sold have been sold off, making it easier for the market to rise in the future.

The other believes that the sale by long-term holders is concerning, which may hint at a potential wave of selling to come, or even a quiet shift in long-term beliefs.

Regardless, a new era for BTC may have quietly begun: ancient giant whales are handing over their chips, and institutions are gradually taking over.

A new era requires fresh blood, and a new phase needs new forces to lead, so that the new waves can push the old waves forward, continuously driving BTC forward without end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。