Yesterday, it was speculated that the fluctuations in the $BTC price were related to investors' risk-averse sentiment. Today, in addition to some risk-averse sentiment, the price fluctuations also include the potential reversals in the U.S. tariff policy towards China. Later today, both Bessent and Trump made speeches, and both mentioned issues regarding China.

Bessent stated that expectations for a pause in tariffs from China are somewhat high, and he believes that only by applying more pressure on China can there be better cooperation regarding tariffs. He also echoed Trump’s comments that if China continues to purchase oil from Russia, it may face high tariffs, suggesting that Trump’s patience with Russia is running thin.

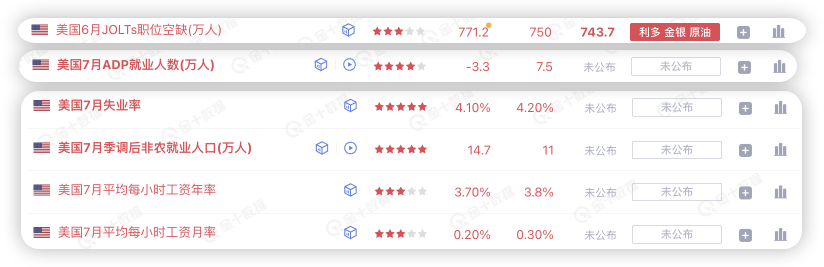

Additionally, tomorrow there will be data released on the small non-farm payrolls. Today's drop in job vacancies has already caused a slight market fluctuation. If tomorrow's ADP (small non-farm) data meets expectations and private sector employment is on the rise, it would indicate a strong employment environment in the U.S. and robust economic resilience, which would not be favorable for the Federal Reserve to cut interest rates.

Of course, everyone already knows that there will be no rate cuts in July. The speculation is whether Powell will turn dovish in September due to pressure. It’s hard to say at this point, especially since the non-farm data will not be available before Powell speaks, so the ADP data might influence some of Powell's thoughts.

There is a lot of data this week, and there are too many variables affecting prices, so caution is necessary when opening positions. Personally, I slightly anticipate some dovish remarks from Powell regarding a rate cut in September.

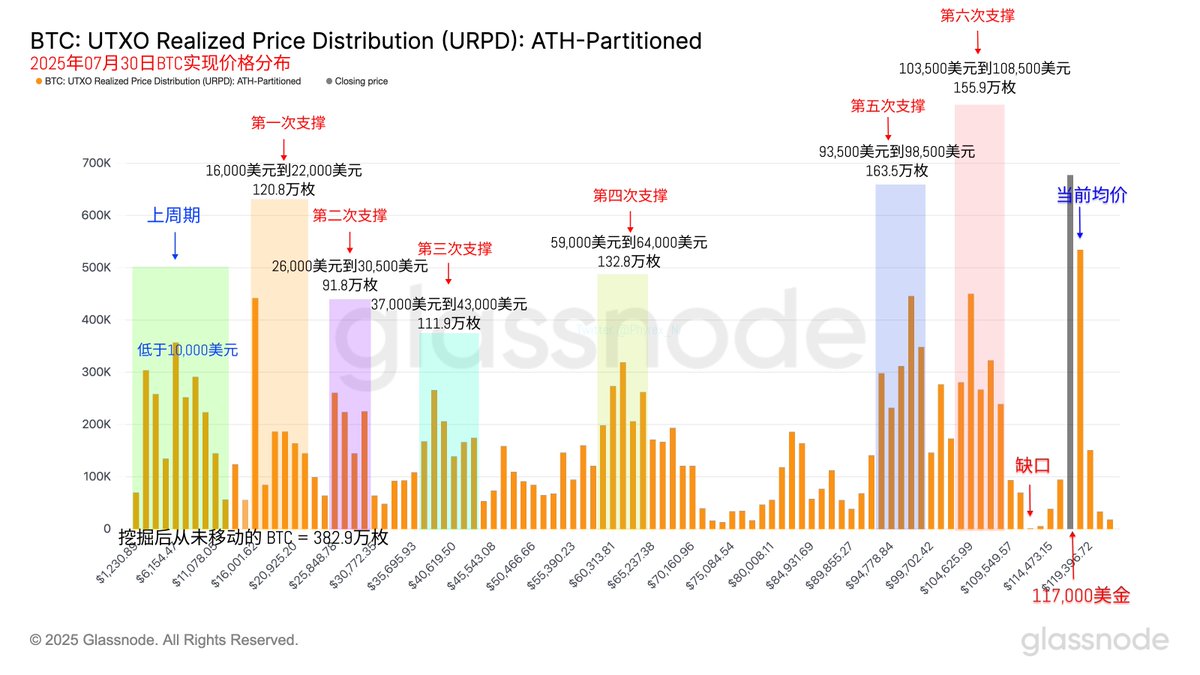

Looking at Bitcoin's data, as the workweek progresses, the turnover rate has slightly increased, but not significantly. A large amount of turnover is still concentrated among investors with positions priced above $100,000, who may be concerned about renewed trade friction between China and the U.S. Each time this occurs, it tends to lead to a decline in risk markets. Additionally, it is normal to see risk aversion towards Powell's hawkish stance.

Overall, through the on-chain data of $BTC and ETF data, it can be seen that investors' FOMO sentiment has mostly dissipated, and purchasing power is beginning to decline. The good news is that selling pressure is also gradually decreasing, returning to a situation of less selling and less purchasing power. Let’s see if this time Powell can break the deadlock.

On the support side, it remains stable, and no issues have been found. However, the URPD gap at $112,000 has not yet been filled, which is also a risk.

Data address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。