In February 2025, the social platform Zora of the Base ecosystem launched the "COIN" feature, and within a few months, the Base official actively promoted the concept of "content coins." From "Base for everyone" to many tokens that later emerged, they would become popular for a while and then disappear, with few discussions in the market.

Until recently, the price surge of $ZORA attracted more attention and discussions. Researcher Sterlingcrispin from DelComplex retweeted a community member praising ZORA and sarcastically remarked, "Any token with low liquidity and an exponential price curve is garbage, regardless of whether you call it creator coins, cultural tokens, internet capital markets, or music tokens."

This sparked discussions among the founders of Base, with Jesse Pollak attempting to explain the differences between "creator coins," "content coins," and "meme coins." Solana co-founder Anatoly Yakovenko also joined the discussion, scoffing at Jesse's view of "content fundamentals." Their debate ignited community discussions on "the fundamental value of content versus speculative frenzy."

Source: BOLD

In fact, this discussion has continued since the NFT boom but has never reached a conclusion. The medium has simply shifted from "blue-chip NFTs" and "meme NFTs" to the current "content coins" and "meme coins." This article will analyze the underlying truth by combining multiple market perspectives with available data and research materials.

Do content coins have fundamental value?

From an economic perspective, fundamental value often refers to assets that can generate cash flow, usage rights, or long-term utility. This measurement standard is quite common in the stock market, as the business income of the company whose stock you purchase is often more related to its stock price. However, before this year's "compliance" trend in the cryptocurrency industry, few discussed this standard because most cryptocurrencies do not have actual business lines.

When Jesse raised the discussion, he repeatedly mentioned the term "Fundamentals Matter," which he abbreviated as "Content" that carries intrinsic value. Toly, after hearing Jesse's response, stated that his argument "sounds like the fundamentals are zero." He believes that creators rely entirely on personal reputation and social popularity to support prices, leading these coins to resemble one-time "pump and dump" marketing. If a token truly has fundamental value, then even if the creator sells, the token's value should not be affected because fundamental value should be independent of buying and selling behavior. This dependence on popularity differs from assets that have real output or cash flow, making it difficult to classify as "fundamental investment."

Most content coins are no different from memecoins, lacking sustainable income or rights, their value entirely dependent on creators or community maintaining popularity, and easily influenced by emotions and traffic, leading to wild price fluctuations or even going to zero. Toly bluntly stated that Coinbase should use transaction fees to buy those zero-value coins on Zora because they are below their "content fundamentals."

However, Jesse's viewpoint may not be unfounded. The fundamentals he discusses may not be the effects brought by individual tokens (at least not in their current state) but rather the model established after a mature distribution system and copyright economy. Most content coins are essentially short-term collectibles or gamified products, while true "creator fundamentals" require a large user base, sustained attention, and reasonable revenue distribution, which takes time and infrastructure development.

On this point, the head of Base's ecosystem had already provided his perspective months ago, which largely aligns with Base's values. He believes that whether it is the recently discussed polymarket, a quantitative "rumor/news" consensus prediction market, or Kaito, a quantitative "attention/content" market (quantitative attention/importance), or the "content field," all can be supported by blockchain rather than attacked.

KOL @WagmiAlexander wrote an article titled "Why I Find Zora So Interesting," arguing that the core of the attention market lies in creators and curators attracting users through free production and dissemination of content, with users contributing attention for free. This attention is ultimately sold to advertisers for monetization. Facebook (3 billion monthly active users, market value over $1 trillion, annual revenue of $164 billion), YouTube (2.7 billion monthly active users, valuation of $500 billion, annual revenue of $50 billion), and TikTok (1.6 billion monthly active users, valuation of $300 billion, annual revenue of $23 billion) are almost entirely built on extracting value from users and creators, with their valuations and revenue scales far exceeding those of the cryptocurrency industry. Even capturing a small portion of their market would significantly expand the on-chain economy, which is a trillion-dollar opportunity that decentralized social platforms can disrupt and compete for.

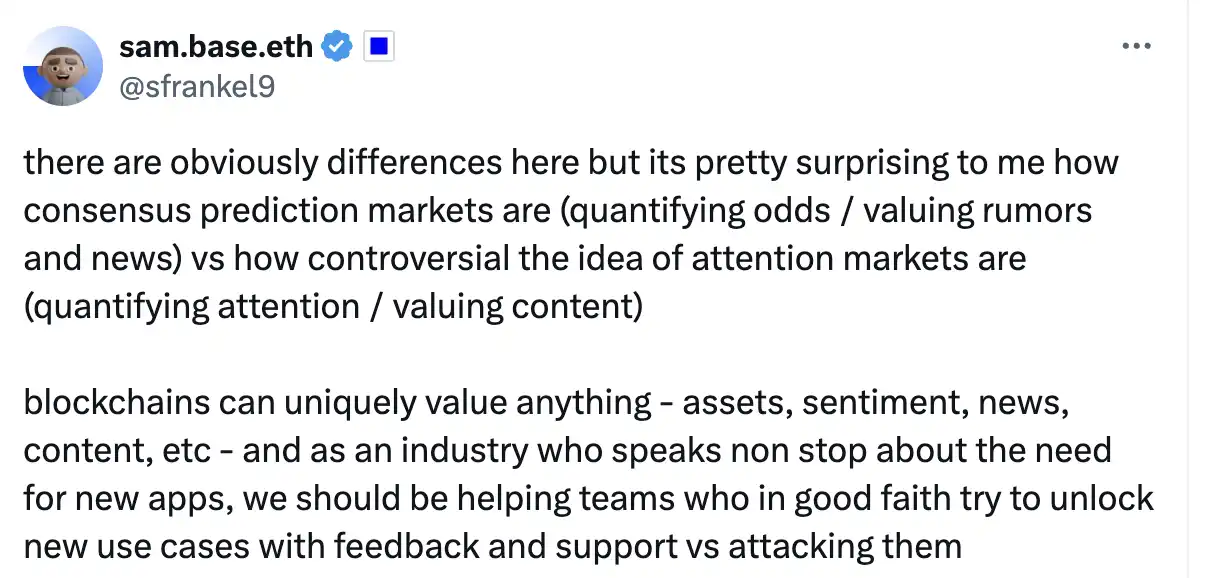

Zora flywheel structure, source: @WagmiAlexander

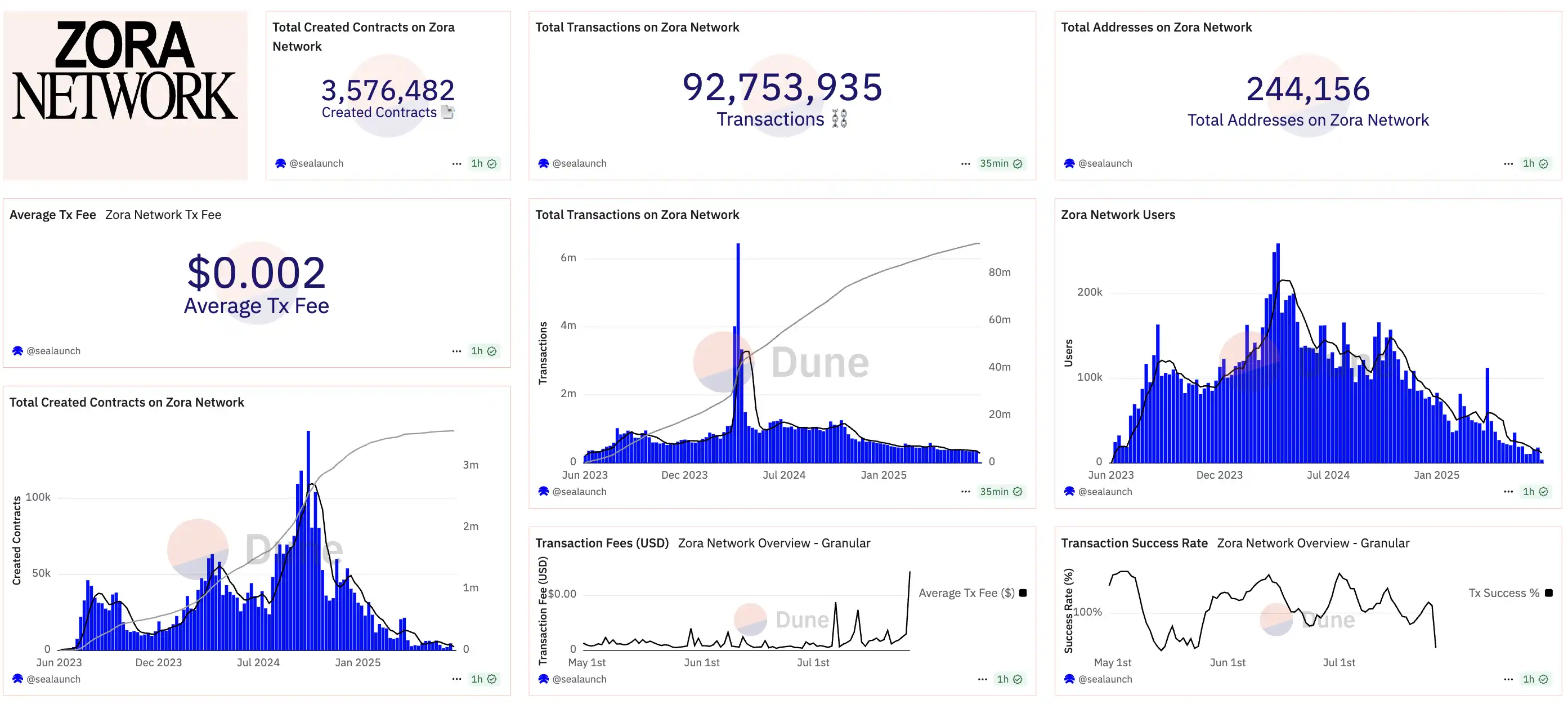

However, similar products have appeared in the market before, with tokens surging in price but failing to sustain the concept and subsequently disappearing. As of July 2025, Zora has processed over 100 million transactions, and its market cap recently reached $1 billion, but the number of active addresses is only 250,000, with about 37,000 daily active addresses.

Zora chain data, source: DUNE

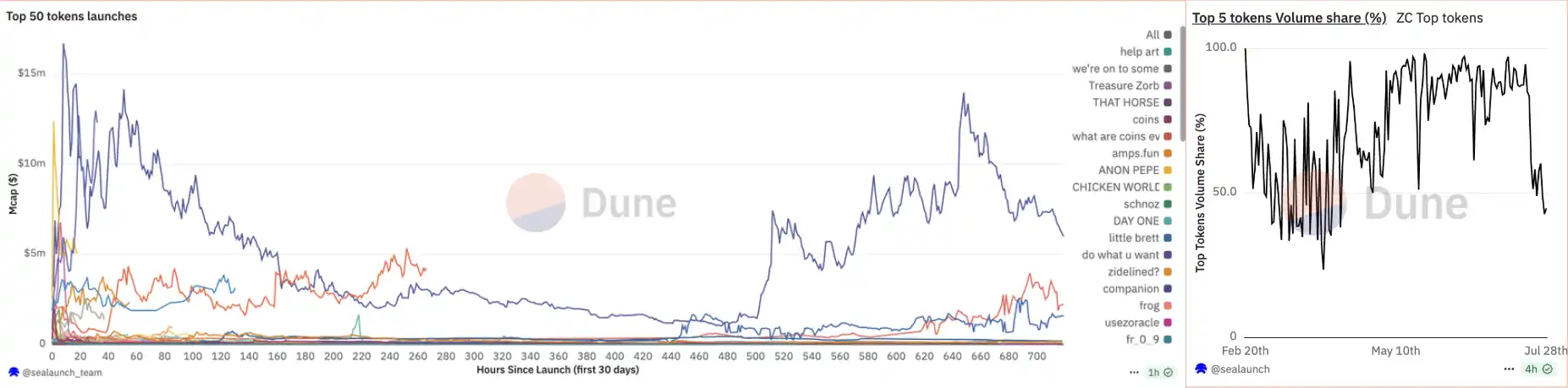

A total of 3.5 million contracts have been deployed on the Zora chain, of which 1.5 million are "content coin" contracts of the Zora App. However, the trading volume of the top 5 tokens has consistently accounted for over 60% of the market share, and on July 27, when the $ZORA token reached a new high, this data hit a new low (under the condition of over 500,000 trading volume). The ecosystem finally saw other content tokens generate "breakout effects," but in a sense, Zora's "graduation rate" is even lower than Pumpfun.

Left: Market cap of the top 50 tokens, right: Proportion of the top five tokens in the overall market cap, source: DUNE

Even though recent data shows significant growth, Zora's scale is still far smaller than mainstream social media. The daily active users in the tens of thousands on Zora are mostly crypto users, lacking distribution channels aimed at the general public. Data comparisons indicate that Zora's user scale and stickiness are far from those of impactful social platforms. The establishment of "creator fundamentals" requires a large user base and sustained attention, which is precisely the bottleneck faced by Zora and the content coin ecosystem; at this stage, its "fundamentals" are not solid enough.

Source: BlockBeats

Despite ongoing criticism, the on-chain content economy still presents unique opportunities. Firstly, the transparent revenue-sharing mechanism on-chain can automatically distribute earnings to creators, partners, and community members through smart contracts, reducing platform cuts and thereby increasing creator income. For example, data shows that 54% of the platform's revenue on Zora is directly allocated to creators. In Web2, monetizing IP has always required complex channels; issuing personal tokens or limited content coins can not only establish closer economic ties with fans but also directly raise funds for creative projects.

However, this also requires clearer governance and rights design; otherwise, it risks touching on legal issues related to unregistered securities. In the long run, building a decentralized social platform with a social relationship graph and content discovery algorithms is key to forming a true on-chain content ecosystem. Currently, platforms like Zora are lacking in distribution capabilities. Mable Jiang, founder of the social protocol Trend, expressed understanding of Jesse's original intention in the discussion and agreed with Toly's criticism. Just recently, she launched a "similar" product to Zora on Solana called Trend, pointing out several key points:

Most content has no value. In today's world of generative AI with almost zero-cost content creation, the vast majority of content lacks scarcity and lasting value. Many trending posts, even if published by well-known IPs, go unsold.

The lack of distribution and social graphs makes it difficult for content on Zora to be discovered and generate value.

Certain content does have commemorative value, such as documenting historical events or artistic moments; these types of content tokens may have long-term "weight." However, this is rare, and most content coins will not generate transactions, which is also a significant reason for the lack of value in most content coins.

Wool comes from sheep; is there a creator economy on the blockchain?

The original poster sterlingcrispin mentioned the incentives for content creation and the issue of content distribution in further discussions with Jesse. He stated, "Through the binary decision of buying/selling and market interaction, buyers and sellers can express their beliefs about asset value at any time, but this may not be the best way to express beliefs about the value of content creators."

He further stated, "The second-order effects and human behavior over the past decade show that this mechanism often evolves into highly destructive zero-sum PvP games. Especially low liquidity AMMs (referring to Bonding Curves) with exponential price curves, which are suitable for large-scale mature markets with tens of millions or even billions in liquidity, rather than small creator scenarios. Most tokens in the market are almost 'shitcoins.' Focusing solely on theoretical paper gains is an idealistic mindset from an ivory tower; the real issue is that we must confront real human behavior."

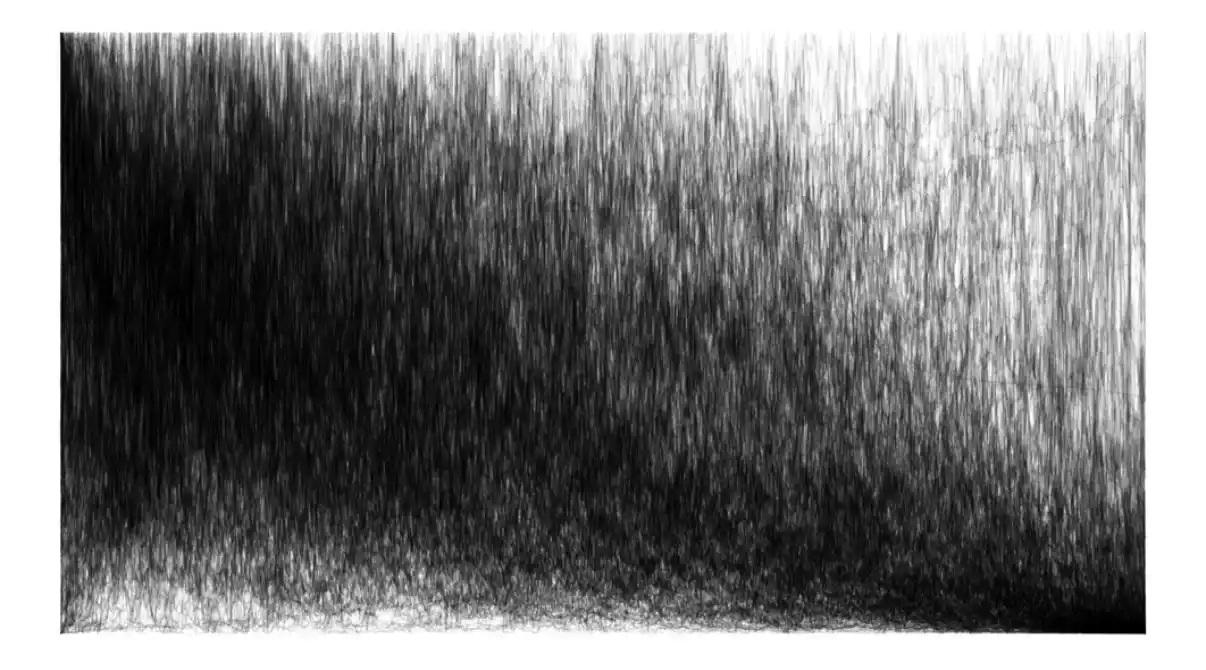

The volatility chart of the top 1000 ERC20 tokens by trading volume in AMM. From the chart, it can be seen that the parts with the largest market cap fluctuations (the darker the color, the more volatile) are increasingly lower in market cap (the author believes this chart is almost a piece of realist art for crypto traders), source: Sterlingcrispin

Zagabond, the founder of the well-known NFT project Azuki, commented on this event, "When someone points out that certain tokens lack fundamental value, we shouldn't be angry. It's okay because in many industries, cultural/perceived value has become more valuable than fundamental value, such as luxury brands, intellectual property/collectibles, meme coins, artworks, etc. Tokenization is merely the financial infrastructure that captures this value."

It seems no one has more authority on this matter than Azuki. In fact, although the community criticized the multiple "Azuki sub-series" releases that led to a price crash (before the NFT bull market faded), Azuki has never stopped seeking IP pathways for NFTs. Unlike the physical products of Little Penguins and the games of BAYC, Azuki chose the most challenging path—creating animation.

Azuki animation, source: Azuki official YouTube

The animation produced by Azuki in Japan is actually of quite high quality, reaching a level of breakout success. Coupled with collaborations with many IP derivative brands that are still striving today, after a long journey of IP construction, these "fundamentals" did not save Azuki's floor price. Without commercial logic to support it, sometimes value can be a more elusive thing, while price is something users can tangibly touch.

Azuki Mahjong, source: FrameBeans

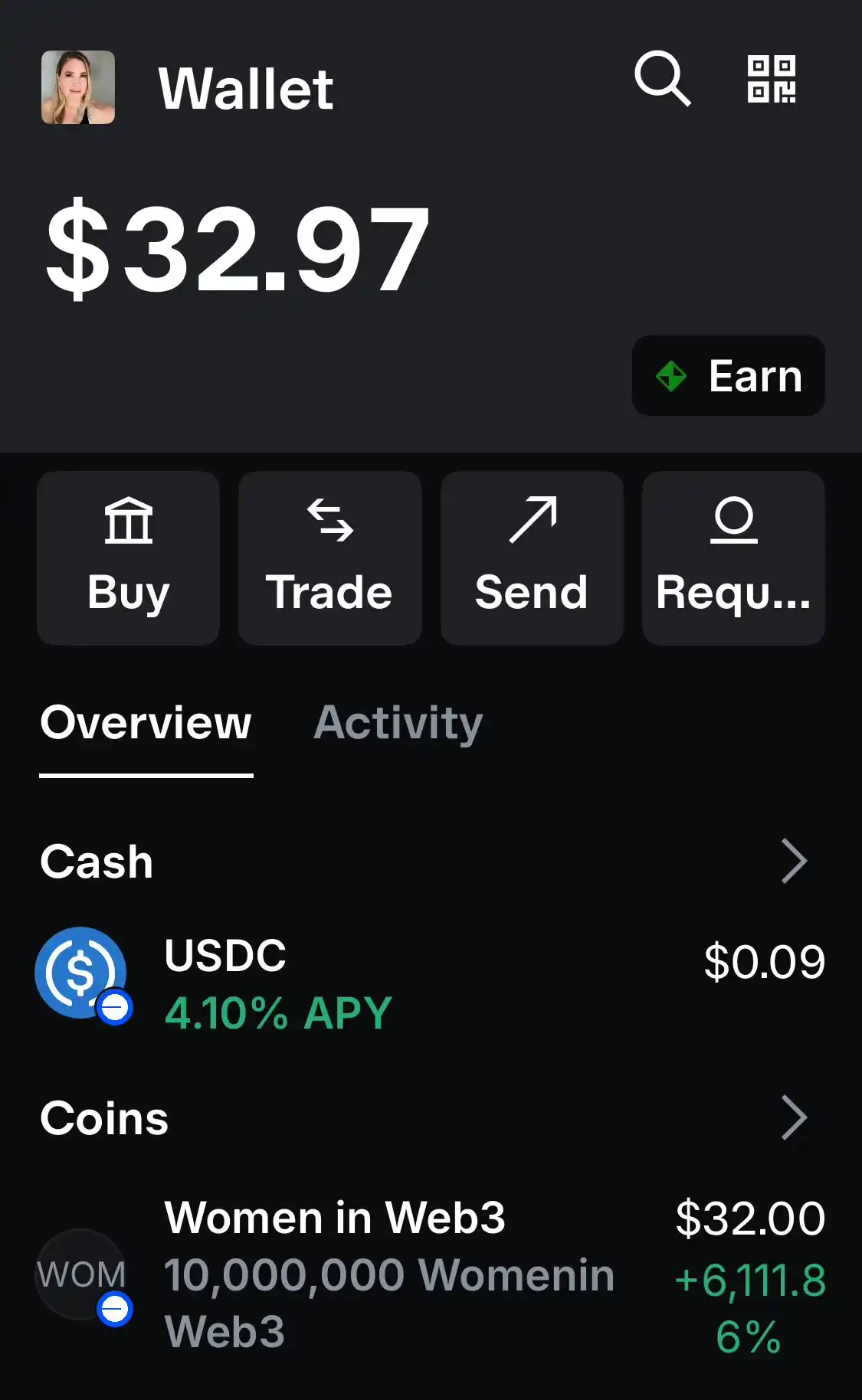

In a sense, this is rather a "destruction" of creators' work. Some in the community bluntly stated that this model would make creators more inclined to "please" token buyers rather than focus on the creation itself. Brookejlacey, who has 300,000 TikTok followers, mentioned the confusion she encountered while using BaseApp regarding the ability to earn money. Recently, discussions about making money on BaseApp have frequently appeared on Twitter, and they actually achieved this through "being tipped" and "tokenization similar to Zora."

As a TikTok creator, Brooke stated that she earned $65 by posting a video titled "Women in Web3" on BaseApp, "but that wasn't income paid like a creator; it was money I got by selling tokens. My wallet balance was about $185 at its peak, but as people started selling, I could only withdraw $65 before the liquidity pool was exhausted. Is that support? They aren't tipping me; they're speculating on a token with my name on it. And to get the money, I had to personally 'dump' it."

In fact, such reward mechanism products are like a "Pandora's box" for creators, on one hand, their "creative credit," and on the other hand, the "earnings" that fluctuate by dozens of points or even dozens of times. Traditional centralized social media has long extended a complete creator ecosystem. For example, on X, which Crypto users are most familiar with, starting from November 2024, X began sharing 25% of the platform's Premium revenue with members. Some mid-tier influencers can earn hundreds of dollars each month, while a few top users can earn thousands of dollars. In contrast, X's incentives are more sustainable and stable, potentially more attractive to long-term creators. So how will creators and their underlying ecosystems choose?

Source: BlockBeats

Content Value and the Luxury Effect—Solana's Revisionism

Just as Toly exploded with the statement, "Memecoins and NFTs are digital garbage with no intrinsic value. It's like loot boxes in mobile games. People spend $150 billion a year on mobile games," he emphasized that the value of these assets is not determined by the so-called "content itself," but is similar to random boxes in games—players pay to receive random rewards, a gameplay criticized for encouraging addictive consumption. The "random rewards" in Crypto are determined by market trading and the liquidity of market makers.

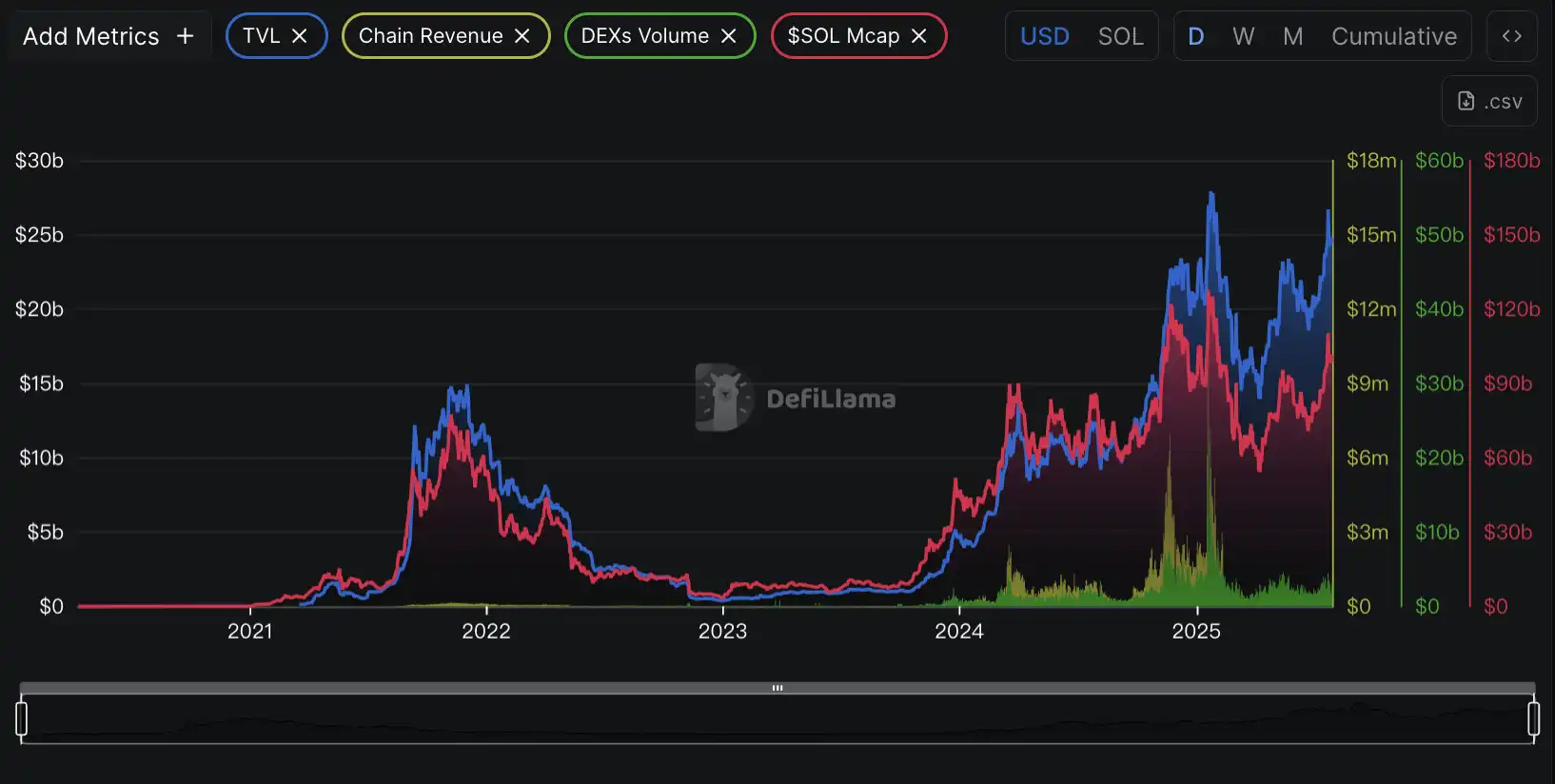

Well-known KOL @thecryptoskanda pointed out Toly's thoughts, stating, "On the surface, he criticizes Memes and NFTs as digital garbage, but in reality, he acknowledges that Solana relies on speculation and on-chain liquidity, with value priced by the AMM market. The core logic is still gambling rather than so-called content fundamentals. Toly is no longer telling the Silicon Valley-style 'content value story,' but is focusing on finding a more stable holding logic for SOL than the simple Meme market, namely maintaining demand through on-chain market making. Solana has entered a stage of revisionism."

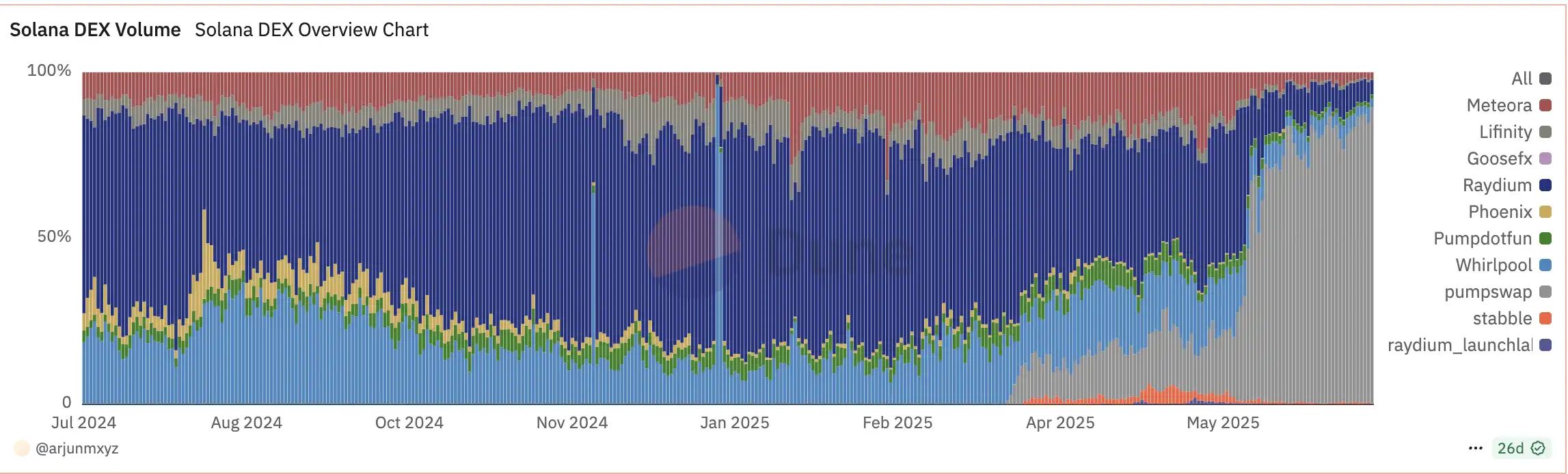

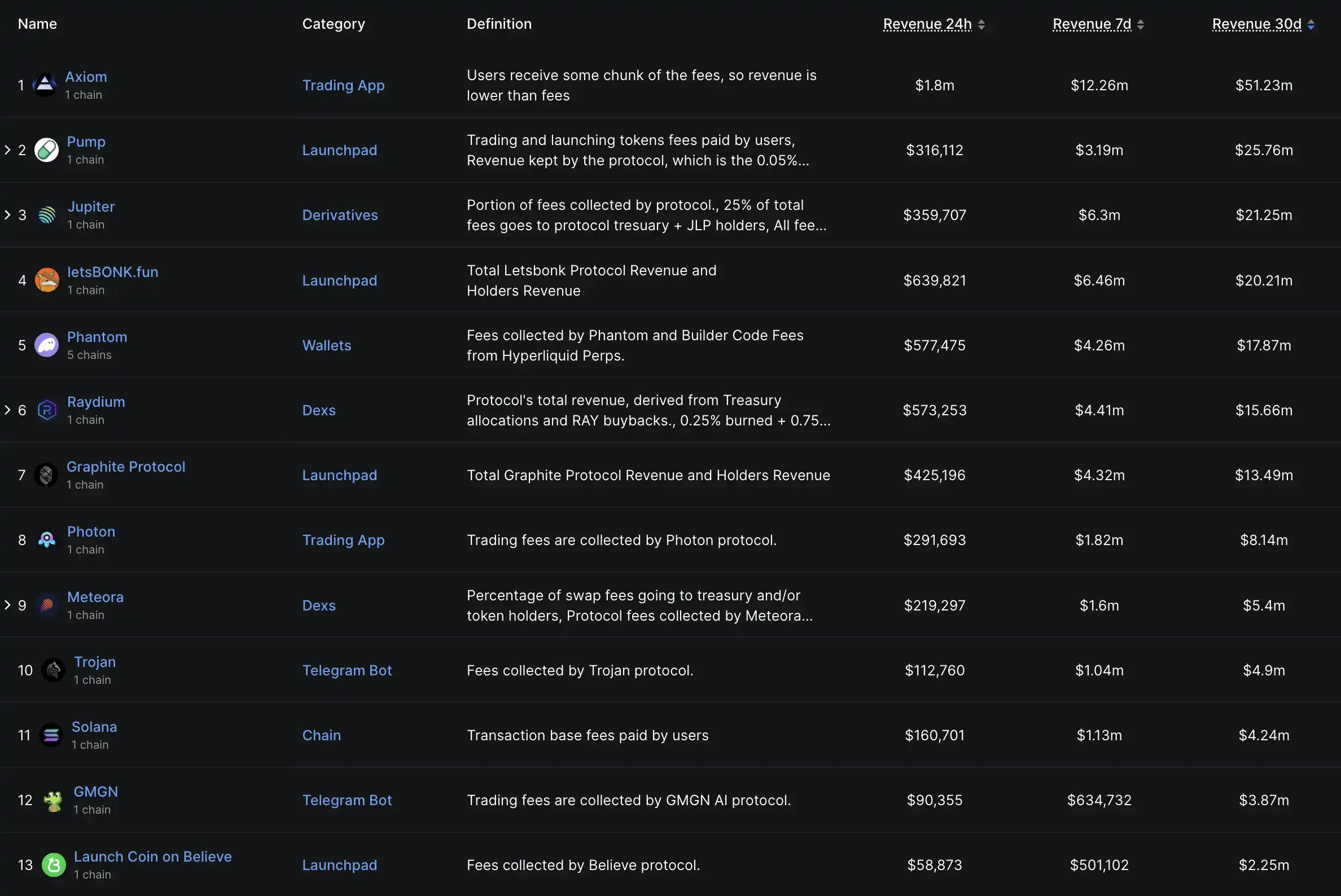

Over 80% of Solana's trading volume benefits from the activity of Memecoins, source: DUNE

The top 10 (even 20) revenue rankings in the Solana ecosystem are almost entirely occupied by the Memecoin ecosystem, source: Defillma

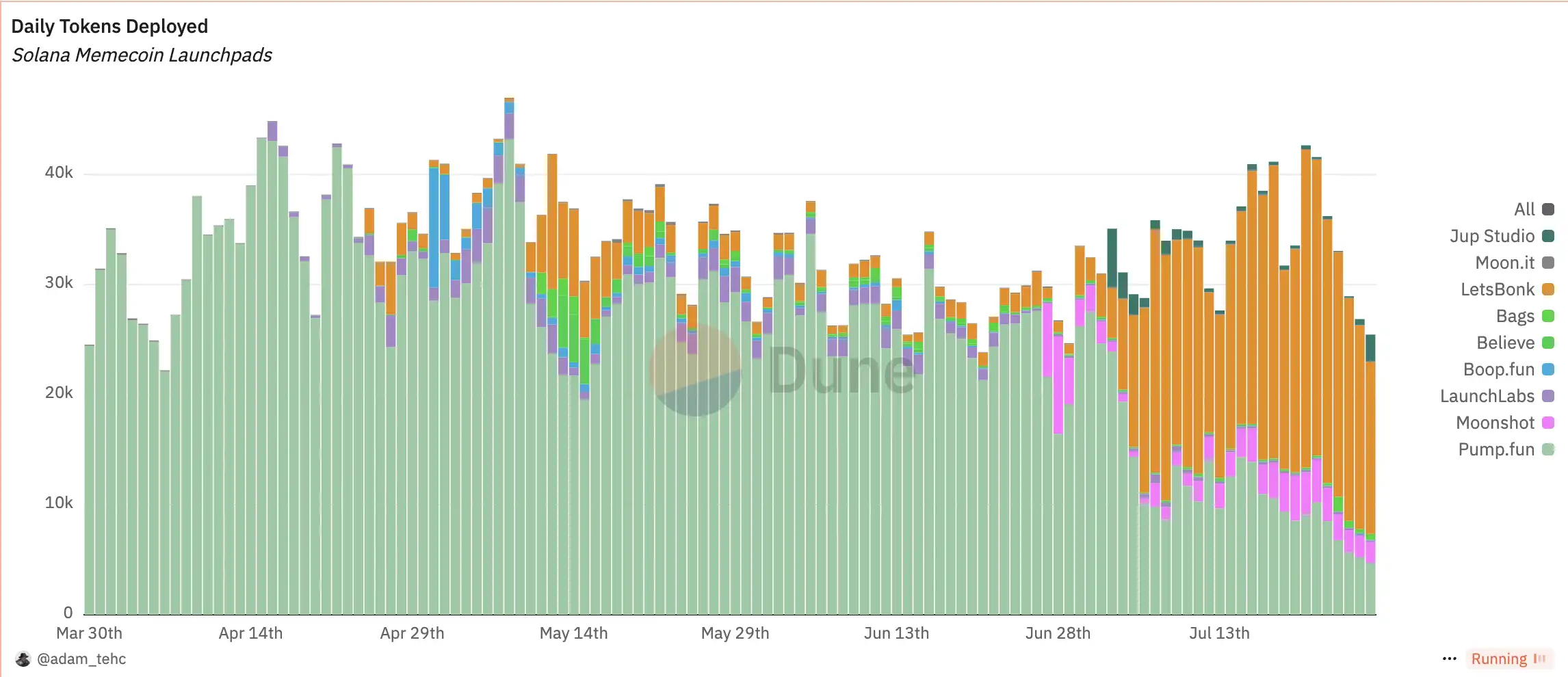

Although Solana's "casino concept" is deeply ingrained, their problems have also emerged. The market sees an average of 20,000 to 30,000 new tokens added daily, making it increasingly difficult to attract attention, as the overall market cap of these Memecoins continues to decline. @thecryptoskanda further analyzed that Solana has adopted a shifting strategy, first uniting the OG community and institutional forces to suppress "the continuous sale of SOL" by Pump.fun, and attempting to establish a more controllable and long-term stable market-making system (LetsBonk) to avoid the uncontrollable "high seas gambling" driven by market sentiment. Collaborating with Kraken on stock coins aims to shift speculative trading from old platforms to new sub-accounts, continuously providing a "get-rich-quick opportunity" for a small number of people while stabilizing the majority of users and maintaining the financial stability of the SOL system.

Daily token deployment ratios of major launch platforms on Solana, source: Dune

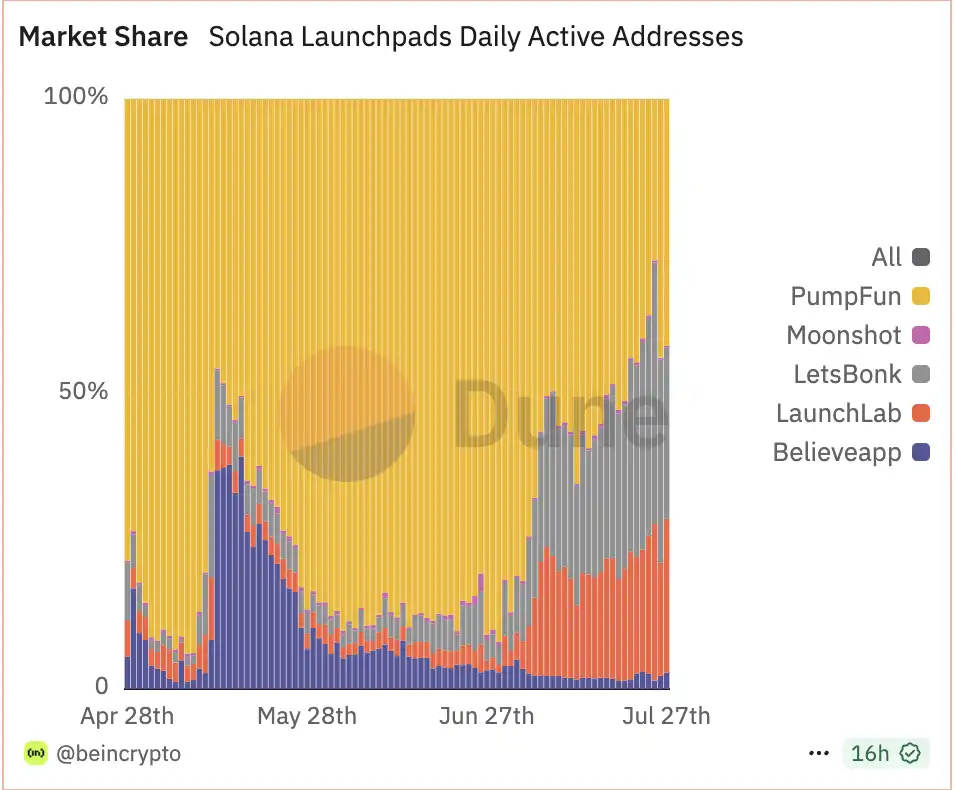

However, the shifting strategy has not been smooth sailing; both internally and externally, they have encountered significant "bottlenecks." Internally, while successfully pushing the BONK ecosystem team to capture market share exceeding Pumpfun, it is merely a cost-cutting measure, as its positioning is still Memecoins. The true significance of launching sub-accounts should be the "ICM" and "stock coin concept" they mentioned earlier, but results have been unsatisfactory. The leading platform of ICM, Believe, has seen its market share continuously decline, and with the emergence of multiple "SCAM startups," the market merely views it as a variant of Memecoins.

Market share of launch platforms, source: Dune

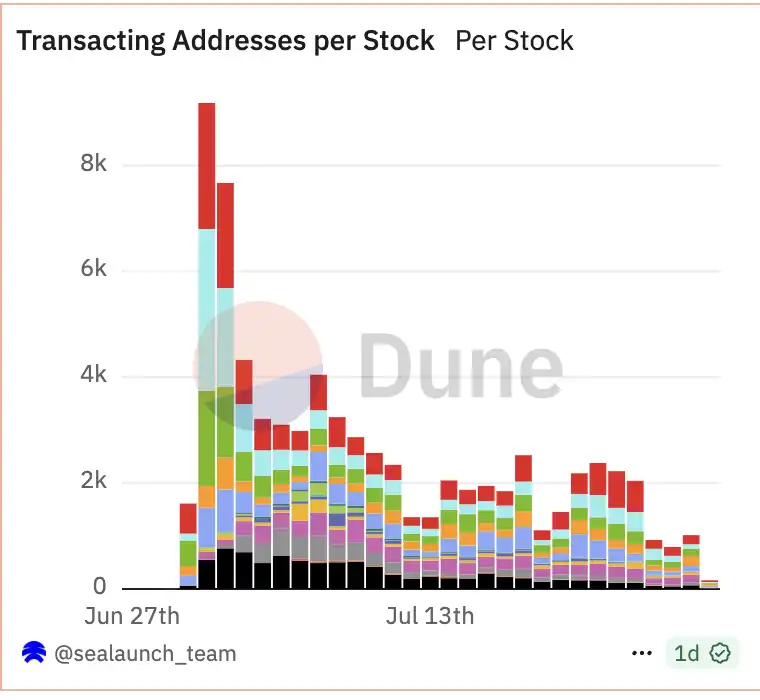

The on-chain US stock concept only sparked heated discussions in the first few days of issuance, but the actual number of participants was very few. In the past week, the total number of addresses participating in all on-chain US stocks combined was just over a thousand. The total trading volume accumulated over the past month was only about $75 million.

xStock trading address count, source: Dune

Additionally, @thecryptoskanda mentioned that the biggest competitor to Solana is not Base but Binance. He believes Binance is a USDT-based casino, while Solana is an SOL-based casino, and the two are in direct competition. Binance siphons off SOL liquidity through mechanisms like Alpha and refuses to list Solana Memecoins on spot/contract trading, forcing Solana to accelerate the construction of its own closed-loop market.

Source: Defillma

On one hand, there are internal troubles, and on the other hand, external threats. As more and more coin-stock companies and ETFs choose to reserve Solana through deeply on-chain binding, one aspect is the interest income from its yield-generating financial products, while the other is maintaining the "fundamentals" of the coin price. Regardless of which, Solana has reached a bifurcation point where it needs to accelerate its search for a way out.

They are not arguing about the fundamentals of content and Memecoins, but rather the fundamentals of Crypto at this stage.

The debate between Base and the co-founder of Solana regarding "content coins" reflects a clash of two ideas in the crypto space. One side hopes to capture the value of the attention economy through tokenization, providing creators with new sources of income; the other side is wary of speculation and marketing gimmicks, believing that tokens lacking cash flow and utility cannot be considered "fundamental investments."

From existing data and academic research, most content coins and meme coins exhibit strong Veblen good characteristics, with their value depending on social recognition and emotional spillover rather than intrinsic returns. Platforms like Zora have iterated on the trading methods for on-chain content, but their user base is hundreds of times smaller than that of mainstream social platforms, and the ecosystem remains confined within the crypto circle. Therefore, the fundamentals of content largely remain a vision that needs to address numerous issues such as "attracting and retaining a large audience," "recognition of IP rights and ecosystem merchants," and "defining regulatory frameworks."

In the absence of mature conditions, content coins and meme coins are still primarily speculative or collectible, with their emotional spillover resembling that of luxury goods or trendy brands. For creators, exploring on-chain tools to build community economies is understandable, but they still need to grasp scarcity, value commitment, and long-term credibility to avoid becoming a fleeting traffic game.

In this era, the supply of content is infinite, but attention is scarce.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。