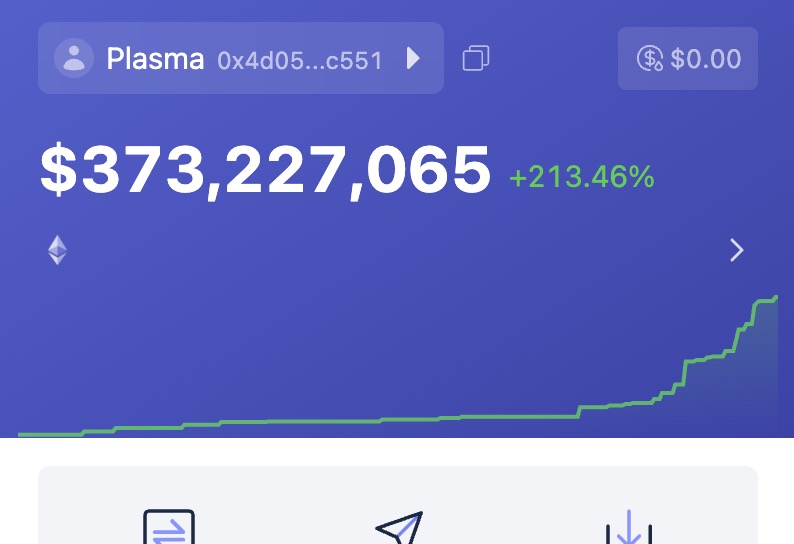

sale concluded. Final numbers are in

$320,000,000 is fighting to get a portion of $209,000

• $50,000,000 available to be purchased

• Just $209,000 was not purchased. Roughly 0.41%

• $373,000,000 total deposited, meaning 323,000,000 oversubscription

• x1545 oversubscribed capital

Assuming overcommitted funds are returned within 2 days, you can calculate the APR for overcommitments. Let's break it down:

- $10,000 overcommitment gets you $6.5 worth of tokens

- $9993.5 is refunded back to you

- considering most deposits were made in the last minute, let's use 3 days as lock to calculate APR

- $6.5 worth of tokens bought 130 XPL

- at 2B valuation, 130 XLP is worth $26

- So you started with $10,000, and now have $10019.8 (9993.8+26)

- This means $19.8 profit in 3 days. That's 24% APR

You can change both duration (2 days instead of 3, etc) and launch FDV (1B instead of 2B, 5B, etc).

Launch is in roughly 40 days. Refunds for overcommitments should be processed shortly. Upon launch, users get both their OG deposit back, and the XLP fully unlocked (except USA, 12-mo lock).

closely monitoring ⚡️

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。