Source: CCTV. Program Official Website

Content organized by: Peter_Techub News

Last night, CCTV.com aired a report focusing on Trump, World Liberty Financial (WLFI), and topics related to stablecoins and cryptocurrencies, deeply analyzing how these events are reshaping the global financial landscape and revealing the opportunities and risks of cryptocurrencies. From Trump signing the "GENIUS Act" to the family's cryptocurrency business layout, and the dollar hegemony strategy behind stablecoins, CCTV.com presented this global monetary new war from an objective perspective. Below is an organization and interpretation of the report's content from the audience's viewpoint, taking you into the core of the cryptocurrency craze.

Focus 1: Trump Signs the "GENIUS Act," Stablecoins Receive Regulatory Endorsement

The primary highlight of the CCTV.com report is that U.S. President Trump signed the "GENIUS Act" (Guidance and Establishment of a National Innovation Act for U.S. Stablecoins). The bill was passed by the U.S. House of Representatives on July 17 (308 votes in favor, 122 against) and was signed into law by Trump the following day. The report specifically mentioned that Trump humorously referred to it as the "Genius Act," as the acronym "GENIUS" means "genius," and jokingly stated during the signing ceremony, "They named this bill after me!" This detail highlights Trump's emphasis on the bill and his personal style.

According to CCTV.com, the "GENIUS Act" establishes the first federal regulatory framework for stablecoins in the U.S., seen as a milestone for the crypto industry gaining official recognition. The bill requires stablecoin issuers to hold an equivalent amount of dollars or liquid assets like U.S. Treasury bonds for every dollar of stablecoin issued, and to disclose the reserve composition monthly while complying with anti-money laundering and sanctions requirements. This regulatory framework aims to ensure the stability of stablecoins, making them a reliable vehicle for the "digital dollar." The report predicts that the global stablecoin market size could grow from $260 billion to $2 trillion by 2028, helping the U.S. attract more crypto activities and solidify its dominant position in global digital finance.

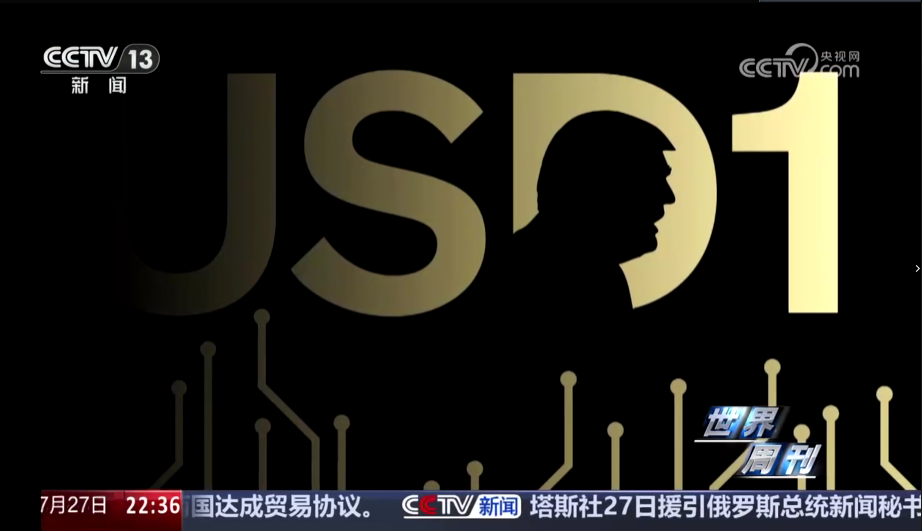

Focus 2: Trump Family and WLFI's Cryptocurrency Business Layout

CCTV.com also focused on the Trump family's business moves in the cryptocurrency field. According to the report, in January 2025, the Trump couple launched "Trump Coin" and "Melania Coin," profiting approximately $57.36 million through holding shares in World Liberty Financial (WLFI). WLFI is a cryptocurrency company established on March 31 of this year, which has raised $220 million and plans to go public. Its dollar-pegged stablecoin "USD One" aligns closely with the policy direction of the "GENIUS Act." The report cited Reuters, stating that the Trump family used cryptocurrency earnings to repay a $160 million loan for the Manhattan Trump Tower, demonstrating their deep involvement in the crypto market.

However, CCTV.com also pointed out that Trump's crypto investments have sparked controversy. Democrats questioned the potential conflict of interest related to a $200 million investment from Abu Dhabi, although the White House denied any issues, stating that Trump's assets are managed by a trust run by his children. This controversy reflects the complex intertwining of politics and business in the crypto field, raising concerns about transparency and regulation.

Focus 3: Stablecoins and the Digital New Chapter of Dollar Hegemony

CCTV.com analyzed the impact of stablecoins on the global financial landscape. The report noted that 95% of stablecoins are pegged to the dollar, with their reserve funds primarily invested in U.S. Treasury bonds. Against the backdrop of U.S. Treasury debt exceeding $36 trillion and a downgrade in credit ratings, stablecoins are seen as a "new engine" for demand for U.S. debt. CCTV.com described this mechanism as the "on-chain U.S. debt cycle": the Treasury issues bonds, stablecoin companies purchase Treasury bonds, users obtain stablecoins, and the Treasury receives funding. This model is considered a strategic tool for the U.S. to maintain dollar hegemony.

Trump stated in the report that stablecoins will ensure the dollar's dominant position as the global reserve currency. However, CCTV.com cited warnings from the Italian Finance Minister, indicating that dollar stablecoins could crowd out the euro, especially in countries with fragile financial systems, potentially leading to trust crises and bank run risks. The report also mentioned that the expansion of stablecoins could complicate global financial governance, presenting new challenges for the international monetary system.

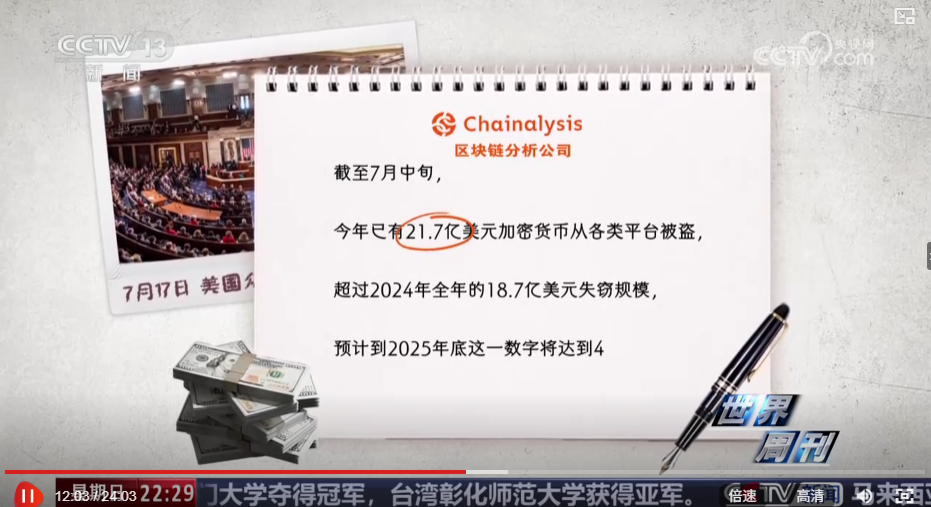

Focus 4: The Dark Side of Cryptocurrencies: Crime and Regulatory Loopholes

CCTV.com also focused on the security risks in the cryptocurrency market. Citing Chainalysis data, $2.17 billion worth of cryptocurrency had been stolen in the first half of 2025, with total losses expected to reach $4 billion for the year. The report detailed a case from September 2024: the FBI uncovered a $242 million Bitcoin theft case, where the criminal gang impersonated Google and Gemini staff to carry out "social engineering" scams, stealing 4,064 Bitcoins. Web3 detective ZackXBT tracked the criminals, revealing that they laundered money by purchasing luxury cars, mansions, and private jets, highlighting the complexity of crypto crime. The report pointed out that the surge in cryptocurrency crime coincides with the U.S. "greenlighting" the industry, and the lack of regulation in exchanges and the rampant growth of cryptocurrency types raise alarms for global financial security. This analysis reminds viewers that the innovative potential of cryptocurrencies coexists with regulatory gaps, necessitating stricter governance frameworks.

Focus 5: The Intrigue Behind Trump's Game with the Federal Reserve

Although not directly related to cryptocurrencies, the conflict between Trump and the Federal Reserve provides context for the cryptocurrency craze. The report stated that Trump publicly demanded the resignation of Chairman Powell due to budget overruns on the Federal Reserve headquarters renovation (from $270 million to $310 million), and even a fake resignation letter from Powell circulated online. CCTV.com analyzed that Trump is eager to lower interest rates to offset inflation caused by his tariff policies (with June CPI rising by 2.7%), but Powell emphasized the independence of the Federal Reserve.

Notably, CCTV.com mentioned that the "GENIUS Act" prohibits the Federal Reserve from issuing central bank digital currency, which somewhat undermines the Fed's minting authority. This indicates that the stablecoin strategy promoted by Trump may pose a challenge to the traditional monetary system. The report cited a warning from the Wall Street Journal that if Trump forces Powell to step down, it could trigger a collapse in the stock and bond markets, shaking the independence of the Federal Reserve.

Report Summary: Cryptocurrencies Open a New Chapter in the Currency War

CCTV.com's report presents the cryptocurrency craze and its concerns from an objective perspective. From Trump's "GENIUS Act" providing legitimacy to stablecoins, to WLFI's business layout, and the role of stablecoins in promoting dollar hegemony, cryptocurrencies are becoming a new battleground in global financial games. However, the surge in crime, regulatory loopholes, and risks of international monetary competition also cast a shadow over this craze. The report concluded that from the Bretton Woods system to petrodollars, and now to the "on-chain dollar," dollar hegemony is entering the 3.0 era. This currency war triggered by stablecoins not only tears open a gap for reform in the international financial order but also presents new challenges for global governance.

As an audience member, I am both excited about the innovative potential of cryptocurrencies and concerned about the risks they may bring. What are your thoughts on this cryptocurrency craze? Feel free to leave a comment and share!

_ (The above content is explained from the audience's perspective, based on the report aired by CCTV last night, focusing on Trump, WLFI, and stablecoins and other cryptocurrency topics.) _

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。