Weekend Review of Ancient Whales Dumping Bitcoin Contracts

This time, the opening of positions came a week later. On Friday, it was reported again that the ancient whales holding $BTC had transferred their holdings, and this time it was a real sale, not just OTC but possibly even on exchanges, causing panic in the market, with BTC's price dropping to around $114,600 at its lowest.

At that moment, I immediately stated that the current macroeconomic situation, tariffs, and monetary policy had not changed, and the US stock market was still rising. This impact should be short-term. I had also opened long positions; I had a total of two orders, at $116,111 and $117,333, each for 0.5 BTC.

The average price was $116,730, and I also shared my logic multiple times, as the overall market situation was positive. Although BTC's sell-off increased, buying power was also correspondingly rising, and the inventory on exchanges was gradually decreasing, indicating that investors were willing to bet at this price.

Moreover, on Friday, I carefully observed that the support at $115,000 was very solid, so the probability of opening long positions for a rebound was quite high. To be cautious, I also placed a long order at $111,222, which is the liquidation point for this order, just in case.

The market trend unfolded as I expected; by Saturday, the price had already rebounded to around $117,000, and by Sunday, it stabilized near $118,300. Yesterday, I mentioned considering whether to close positions on Monday or Sunday night, as the uncertainties would increase on Monday.

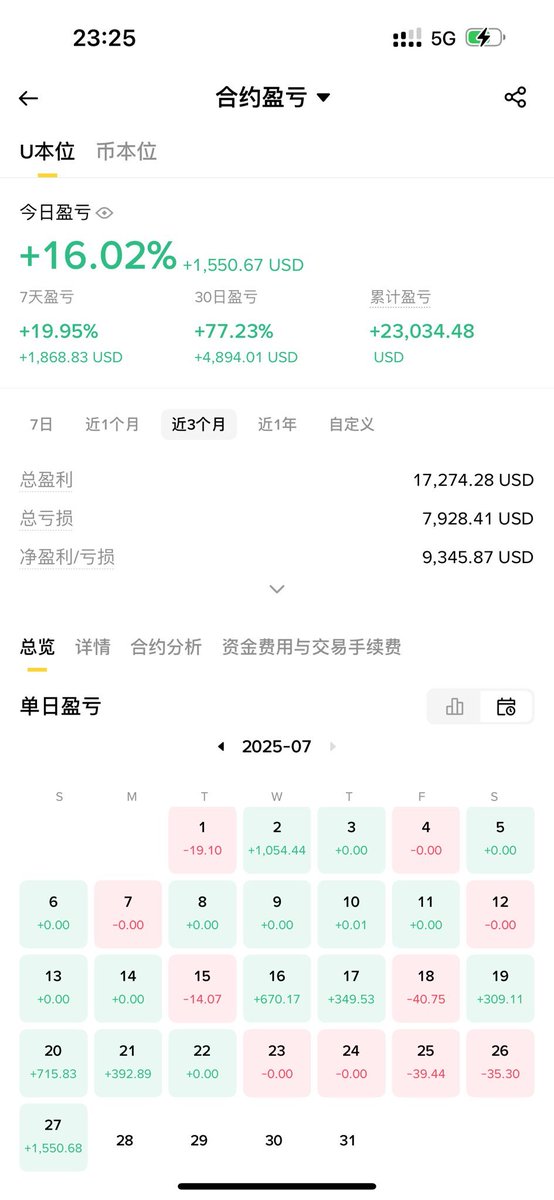

Considering that I was out and it was inconvenient to monitor the market and operate, it was safer to close all positions at $118,300. This trade earned me $1,610, approximately a 23% profit, which I am satisfied with. Next week, I will be betting on monetary policy, as both rises and falls are possible; I will take it step by step.

As of now, the total profit has exceeded $12,000, which is four times the previous $2,000 cost, taking four months, which is indeed slow, but accumulating little by little is also quite good.

All my positions are small, just to verify my judgment of the market, striving for unity of knowledge and action. Contract risks are significant, especially under high leverage; I am always prepared for a total loss when opening contract positions. One must be cautious when opening contracts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。