Original Author: Joel Khalili, Wired

Image Source: WIRED Editorial / Getty Images

Editor’s Note: The highly anticipated pump.fun platform token PUMP launched on July 15, briefly rising to around $0.007 before entering a downward trend. The public sale price of $0.004 did not effectively halt the decline, and today PUMP has fallen below $0.003, severely impacting investor confidence in PUMP. Although the public sale of PUMP explicitly prohibits participation from U.S. users, it has not prevented U.S. meme players from suffering losses in meme trading. The well-known law firm Burwick Law, which has initiated multiple lawsuits regarding meme coin investments, announced yesterday that it is expanding its lawsuit against the Pump platform to include the Solana Foundation, Solana Labs, and Jito in the list of defendants.

Additionally, the "average age" of the Pump.fun team has become a hot topic of discussion in the crypto community. According to a previous report by The New York Times, Pump.fun is headquartered in London, UK, and is led by three entrepreneurs in their early twenties: Noah Tweedale, Alon Cohen, and Dylan Kerler. The three have registered a physical company—Baton Corporation, with Noah Tweedale serving as CEO, and all three are directors of the company. They met in Oxford, UK, and have years of experience trading meme coins like Dogecoin.

This is an article from WIRED in April of this year, which may help readers understand the Pump.fun platform and the people behind it.

Pump.Fun, the world's largest Memecoin factory, allows anyone to create their own cryptocurrency. However, years before the platform launched, a person sharing the name of co-founder Dylan Kerler had already made a small fortune by issuing and selling his own tokens.

According to WIRED's investigation, an individual named Dylan Kerler issued eight tokens in 2017. At that time, Pump.Fun co-founder Dylan Kerler was only 16 years old. Two of the tokens—eBitcoinCash and EthereumCash—gained attention on crypto forums, but subsequently plummeted in price, with investors accusing the developers of conducting a rug pull.

According to analysis by blockchain security company CertiK, the developer using the name Dylan Kerler earned as much as $75,000 in cryptocurrency from the sales of eBitcoinCash and EthereumCash in 2017—estimated to be worth around $400,000 at today’s coin prices.

"They quickly cashed out after waiting for market share and prices to rise," said Wang Tielei, Chief Security Officer of CertiK. "We strongly suspect that EthereumCash was designed as a tool for a rug pull by the developer."

The purpose of Pump.Fun, according to its co-founders, is to protect investors from unethical actors by standardizing the token issuance process. However, there is evidence that Dylan Kerler was precisely the type of developer the platform aims to guard against.

As of the time of publication, neither Pump.Fun nor Dylan Kerler has responded to multiple requests for comment.

The Rise of Pump.Fun and Its Mysterious Founders

Pump.Fun was founded in January 2024 by Noah Tweedale, Alon Cohen, and Dylan Kerler, three entrepreneurs in their early twenties. The platform quickly became the preferred incubator and trading venue for Memecoins.

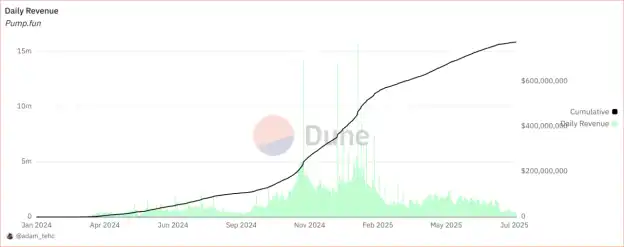

These cryptocurrencies are highly volatile and primarily created for speculation. According to third-party statistics, in just 15 months, Pump.Fun has generated over $600 million in revenue through a 1% trading commission.

The three co-founders rarely disclose their identities, locations, or company structure. Tweedale stated in a WIRED interview last year that this anonymity is for "personal safety" reasons, to prevent the massive crypto assets managed by Pump.Fun from attracting ransom or attacks.

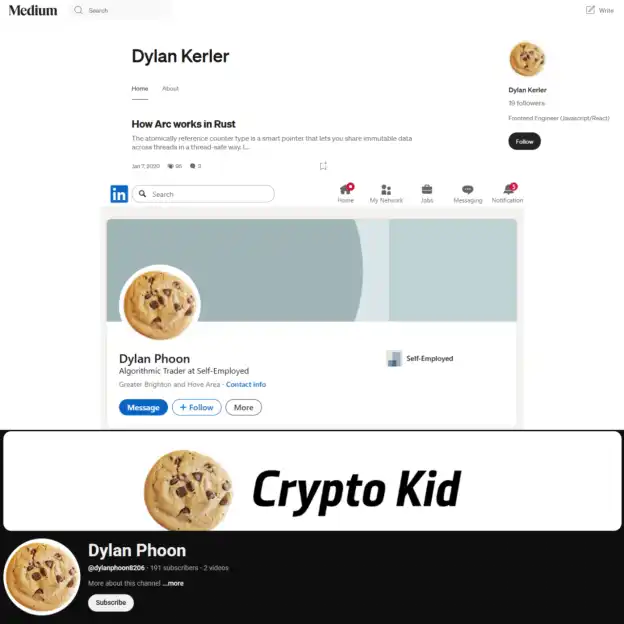

Among the three, public information about Kerler is the scarcest. Aside from being listed as a director in documents from the UK Companies House, he has almost no public association with Pump.Fun. Tweedale has indicated to WIRED that Kerler is responsible for leading the development team in writing the platform's code and feature iterations. Apart from a X (formerly Twitter) account named @outdoteth, Kerler has virtually no digital footprint.

However, a series of "digital clues" left in corners of the internet such as GitHub, YouTube, LinkedIn, and Medium still link this name to the suspected rug pull operations of eBitcoinCash and EthereumCash.

Digital Footprint: Tracing Early Token Promotions

In 2017, the tokens eBitcoinCash and EthereumCash were initially promoted by two accounts on the crypto forum BitcoinTalk: DOMAINBROKER and ninjagod, both belonging to the same user. According to a forum post, after the DOMAINBROKER account was "suspected to be hacked," the user began communicating with investors under the ninjagod identity.

In a forum post promoting eBitcoinCash, DOMAINBROKER provided an email address containing Dylan Kerler's name, referring to it as a "personal email"; while in another EthereumCash thread initiated by ninjagod, several forum users directly referred to Dylan Kerler as the developer of the project.

At the same time, multiple clues indicate that Pump.Fun co-founder Dylan Kerler and the developers of eBitcoinCash and EthereumCash were in the same area—the latter had previously stated in an old Telegram group that he was located in Brighton, UK.

Voter registration records reviewed by WIRED show that Kerler was still registered at an address in the Brighton and Hove area at least in 2024. When a reporter visited that address on April 15, a resident who responded via intercom refused to disclose their identity but stated that Kerler "no longer lives here," indirectly confirming the accuracy of the voter registration.

Company registration documents show that a physical company under Pump.Fun was registered at the same property in Brighton and Hove. This address is also shared by two other companies, both of which list 62-year-old Kee Fatt Phoon as a director. Additionally, Phoon is also registered as a voter at that address.

Alias and Connections: Is Dylan Kerler Also Dylan Phoon?

Dylan Kerler appears to have used the alias "Dylan Phoon," a surname that matches Kee Fatt Phoon, suggesting a possible familial relationship.

Until recently, a GitHub account using the nickname "outdoteth" still retained an old code repository that included a Gmail address named Dylan Phoon; the avatar used for that email also appears on a Medium account named DylanKerler1, as well as on LinkedIn and YouTube accounts under the name Dylan Phoon.

The aforementioned YouTube account uploaded a video about the cryptocurrency Skycoin. Although the project was created by others, its project logo also appeared in ninjagod's BitcoinTalk account, which can be seen as an indirect clue linking the two to the same person.

Another YouTube account named @dylankerler4130 had published a video about the "Equis" project, which promoted itself as "revolutionizing the gambling industry." Equis was also promoted by ninjagod on BitcoinTalk, and its code is identical to that of eBitcoinCash and EthereumCash. (The project did not generate investor interest on the forum.)

In summary, the two names used by Pump.Fun co-founder—Dylan Kerler and Dylan Phoon—can both be traced back to accounts that promoted EthereumCash and eBitcoinCash on BitcoinTalk.

ICO Bubble and Early Rug Pull Patterns

eBitcoinCash and EthereumCash were both launched during the peak of the ICO craze by a developer using the name Dylan Kerler. During that time, hundreds of token projects raised billions of dollars from investors through the ICO model. ICOs were popular among crypto startups because they did not require equity dilution.

Conducting an ICO typically involves a three-step process: deploying a contract on the Ethereum network to mint tokens, outlining the project vision on a website, and soliciting investments. Wang stated, "Many projects are just a white paper and a website with a countdown timer—it's a very low barrier to entry."

Analysts point out that while some projects funded through ICOs (like Ethereum) are still operational, most ICOs were manipulated, exaggerated, or outright fraudulent, ultimately leading to tighter regulations. Many developers exaggerated the utility of their projects, manipulated prices to create hype, and even fabricated return rates.

"Developers aggressively promoted the fantasy of high returns," said Nicolai Søndergaard, a research analyst at blockchain analytics firm Nansen. "This is the source of FOMO psychology."

The noise of the ICO craze led many gullible investors to chase profits with little due diligence, a phenomenon reminiscent of today's behavior of investing in dubious meme coins. "The meme craze has many similarities to ICOs," Søndergaard noted, "It's very easy to sell a story to the public and then quickly cash out."

The Hype and Collapse of EthereumCash

A developer using the alias Dylan Kerler began promoting his most popular token—EthereumCash—in early October 2017.

The developer followed the standard script: minting tokens on Ethereum, building a website, and promoting it on BitcoinTalk, Twitter, and Telegram. To generate hype, they distributed tokens for free through so-called "airdrops" and promised to release a white paper. At that time, a white paper was seen as a symbol of legitimacy and could drive prices up.

Søndergaard pointed out, "The release of a white paper can significantly enhance attractiveness. Even just the promise to release one is enough to stir market sentiment."

Screenshots of the project's now-deleted website circulating on Telegram revealed how it was marketed to potential investors. The page claimed, "We are committed to making the transition from fiat to cryptocurrency as smooth as possible while maintaining integrity and a high-end atmosphere (original wording retained)." The page also displayed an image of an EthereumCash bank card claimed to be usable for physical purchases.

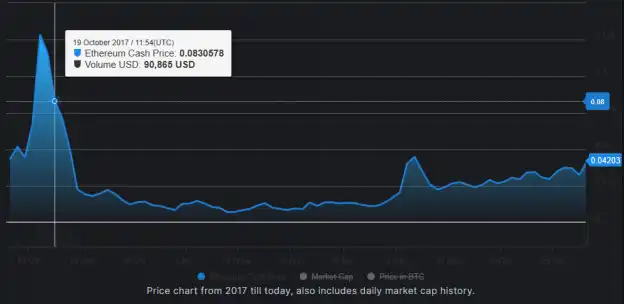

A document obtained by WIRED showed that within just a few days, hundreds of people had registered to participate in the EthereumCash airdrop. Meanwhile, discussions on the BitcoinTalk forum were lively. One user wrote, "Let's spread the word and get more people to notice this excellent token." By October 19, EthereumCash's market cap had risen to about $1.3 million.

But just as early investors were filled with anticipation, the developer named Dylan Kerler began secretly dumping tokens.

CertiK's analysis showed that just days after the token's creation, Dylan Kerler distributed millions of EthereumCash to wallets under his control. One wallet starting with 0x7f3E2 was subsequently used to sell large amounts of tokens on the market.

Between October 19 and 21, the 0x7f3E2 wallet sold hundreds of batches of EthereumCash on the peer-to-peer trading platform EtherDelta. These sales coincided with a catastrophic price drop of the asset, which fell by 87.9%.

Panic began to spread on Telegram and BitcoinTalk. One user, perhaps trying to find some humor in the situation, began referring to the token as "ECRASH." Others accused the developer of being fully responsible. Another Telegram user who participated in the EthereumCash airdrop told WIRED, "Everyone is very angry." "I think this is the first time I've experienced a rug pull."

The highly anticipated white paper also never materialized, and ultimately, the developer named Dylan Kerler vanished from BitcoinTalk posts and Telegram groups. Just days earlier, he had written, "I can assure everyone that the project is making great progress."

On October 20 and 21, the developer's wallet withdrew a total of 240 Ethereum (ETH) from EtherDelta, amounting to approximately $75,000 at the time. After each withdrawal, these ETH were immediately transferred to another wallet address (0xc8ae1), which were then dispersed into three wallets: 0x7EAbb, 0x31728, and 0x952F3. Ultimately, these ETH were transferred to accounts on centralized exchanges such as Binance, Bity, and the now-defunct Cryptopia—platforms typically used to convert cryptocurrencies into fiat.

WIRED identified at least 20 wallets used by the developer claiming to be Dylan Kerler, which were employed to issue, airdrop, or sell eBitcoinCash and EthereumCash, or to transfer related revenues to centralized exchanges.

"The effect of this layered handling is to obscure the flow of funds," Søndergaard said, "If you have nothing to hide, there’s really no need to do this. It’s inherently suspicious."

Although some investors still harbored fantasies of a return—on October 24, someone even joked "I smell the scent of a white paper"—all signs had long indicated the eventual outcome.

In a BitcoinTalk post from early October, a developer wrote: "This will be like a Pump and Dump, a round of hype and sell-off, where early investors can recoup their costs. I'm sorry to be so blunt, but that's the reality."

Faster than Wealth Creation is Forgetting

To this day, the frenzy of Pump.Fun has not subsided. According to third-party statistics, its platform generates daily revenues of up to $1 million. The founders' wealth has skyrocketed, far surpassing the former eBitcoinCash and EthereumCash by several streets. While this "wealth creation machine" continues to operate, the contrary Rug Pulls are still ongoing, with little attention paid.

In November last year, a teenager went live on Pump.Fun and created and sold a token in just a few minutes, netting $30,000. He shouted "Holy fuck! Holy fuck!" while giving the camera the middle finger—perhaps this moment truly encapsulates the essence of this era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。